-

Posts

4,163 -

Joined

-

Last visited

About VeryMeanReversion

-

Rank

Newbie

Contact Methods

-

Website URL

http://

-

ICQ

0

Profile Information

-

Location

Kirstie's pie shop

Recent Profile Visitors

1,790 profile views

-

I've just evicted a lodger. Only tenants get extra Covid protection, not lodgers My Dad died during lockdown and the lodger had been there 15 years. So I moved in to be a resident landlord. I could then give the rental period (1 week) as notice. Lodger was an ex-con drug dealer and I found evidence that he was £10K behind in the rent and had borrowed money from Dad to pay his car insurance. No sign of anything behind paid back. All the money probably went on weed going by the smell in the lodgers room. I paid him his deposit and last months rent back to get him out. There was no sign that the rent had actually ever been paid but I needed him out of the house. I read up as much as I could about lodger/tenant differences and shelter/CAB advice to be sure that is was legal to get him out in a week. If he had refused to go, it would have been legal to change the locks and call the police to prevent re-entry, even during lockdown.

-

Number of middle renters doubles in a decade

VeryMeanReversion replied to Ah-so's topic in House prices and the economy

-

"Landlords are social parasites" Guardian

VeryMeanReversion replied to lostinessex's topic in House prices and the economy

parasite ˈparəsʌɪt/ noun 1. an organism which lives in or on another organism (its host) and benefits by deriving nutrients at the other's expense. --------------------------------------------------------------- Mortgage rules meant that landlords could use multiples of the rent to get larger mortgages than the renters could using income multiples. Landlords got to outbid the renters by using the renters income against them. The more houses that were used in this way, the worse it got. Those will little equity to start with are the worst hit. Only if their wages get really high can they achieve rental-escape-velocity to avoid the landlord parasites. I don't care if someone buys a lot of DVD players and tries to rent those out. It is different for housing due to being a limited supply of a basic need. -

Renter surge could throw Tories out of power

VeryMeanReversion replied to olde guto's topic in House prices and the economy

The political imperative for Corbynite labour is to import more labour voters and provide/subsidise houses for his supporters. If you want to earn enough of a wage so you can buy a family house within your own lifetime, you continue to be stuffed. Given that its the cost/availability of credit that is the major determinant of house prices, I think monetary policies far outweigh the differences in each parties housing policies. -

IMF warning on Global debt

VeryMeanReversion replied to “Nasty Piece of work”'s topic in House prices and the economy

Yum. -

The politics of high house prices

VeryMeanReversion replied to Si1's topic in House prices and the economy

It's a crazy system when this has become a rational course of action. I only realised this when I was made redundant many years ago with an STR fund in the bank so got nothing. If I get made redundant now, I will look poor (for benefits/credits purposes) despite having far more assets (house+SIPP ~£1M). -

Price per sq foot buying level

VeryMeanReversion replied to TheCountOfNowhere's topic in House prices and the economy

I sold in 2003 for £250/sqft then was looking for £200/sqft from 2003-2010 but couldn't find anything I liked in South Cambridgeshire. So in 2010, I went for a fixer-upper with large garden at £250/sqft then added ~70%to the size for £100/sqft. (did lots myself) Ended up at £200/sqft. Building costs seem to have gone up a lot since then, would expect a £150/sqft extension cost now. -

That's basically it for me. The only thing to stop it is for the lemmings to become debt-aware. I've noticed a few friends in their 50's are only now realising that the debt they are carrying means retirement will never happen.

-

FT Money Show Podcast

VeryMeanReversion replied to fuzzy_bear's topic in House prices and the economy

Muppet. (Sorry, couldn't resist. I did try.) -

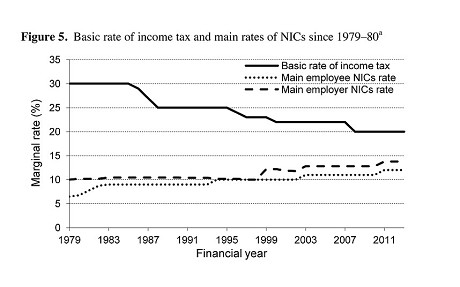

A couple of my favourite graphs below. You can see that as the the headline income tax rates fell over the years, NI just went up to compensate. Of course, BTL'rs and pensioners don't pay NI so their marginal rate stays in the 0-20% range. (Section 24 will move some BTL'rs up to 40% income tax but still no NI costs) Workers get the 32-60% range, particularly painful if then paying a large proportion of net income as rent to someone in the 0-20% marginal range. This EMTR graph actually understates marginal rate since it doesn't include employer NI which is effectively another worker tax avoidable via salary sacrifice. Personally, I salary sacrifice as much as I possibly can with the aim of living off the income (NI-free) asap. The tax system is simply encouraging me to become a pensioner as soon as possible.

-

I'm also keen on real assets or at least a claim on something real that is not likely to be confiscated. - One property with minimal leverage - Large cap boring divi payers with real assets. Energy/mining preferred when cheap. Some consumer oriented but not much. - Platinum - Classic car (not using it much after I noticed it was appreciating) The aim, as you put it, is to minimise getting stuffed. The only one I'm looking to increase is Platinum, seems cheap compared to Gold.