MissOnAccomplished

New Members-

Posts

47 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by MissOnAccomplished

-

I do not believe the availability of ‘non recourse’ lending has much explanatory power for difference between US and UK. 1) non recourse lending applies in only 12 states (including much of the west) 2) in practice, in the UK and the non-recourse states, lenders do not pursue other assets of borrowers in default because most residential borrowers in default do not have significant ‘other assets’. Savings and investments are held by individuals who have low (or zero) mortgage liabilities.

-

Creating price is indeces is very hard. The official statistics definitely do take into account the way in which products of one era are ‘better’ than a prior period e.g. pixels, storage capacity, comfort in cars, size of tv’s. But where changes in technology is more major - e.g. switch from film to digital - how does one define the modern version as equivalent to the past? Is it cost of taking a single picture? Cost of providing an hour’s entertainment taking pictures? Also, to be useful as an index, we necessarily need to consider the total cost of a bundle of goods and services. But an increase of product A relative to product B generally causes consumption of B to increase, relative to consumption of A. Maybe even inducing a complete substitution. So how should you determine the relative quantities of A and B actually consumed to determine the overall cost of the bundle? Consumption in the past or consumption at new prices?

-

Do a little dance, it's 0.5

MissOnAccomplished replied to Gawdon Bwown's topic in House prices and the economy

I haven’t checked your figures, but the principle demonstrated is certainly correct. When interest rates are low, the bulk of the payment in a repayment mortgage goes towards reducing the principal outstanding, and so interest rate changes make little difference to the amount that can be covered by the repayments. when interest rates are higher (say above 10%) the interest element of the payments is almost all of it, and so changes in interest rate have a greater impact on the amount of the loan that can be covered. -

Examples of big & multiple drops

MissOnAccomplished replied to user not found's topic in House prices and the economy

It’s always good to see reductions, but I wonder whether this 40% reduction is because the house is now being offered as 2 lots; the total asking price is still 800k. Perhaps the prior price was for both lots together. -

Examples of big & multiple drops

MissOnAccomplished replied to user not found's topic in House prices and the economy

Interesting to see that RM includes a fairly detailed surveyor's report on the house. I am guessing this is a 'Scottish thing' not just a voluntary act by the vendor. I sem to recall seeing something many, many years ago that 'offers' are binding far more quickly in Scotland than E&W so you avoid the weeks/months (years) long SSTC status on sales. -

Coronavirus - potential Black Swan?

MissOnAccomplished replied to LetsBuild's topic in House prices and the economy

My interpretation of what this paper says is that the excess risk of COVID-19 is pretty constant, irrespective of age. That is young people are less likely to die, in general, and young people are less likely to die as a result of COVID-19 - in the same proportion. Whether this 'constant-across-age-groups' excess risk warrants restrictions on what we do, where we go etc, to reduce the impact of the disease, I leave to further discussion. -

I am not sure about HPC now

MissOnAccomplished replied to NoHPCinTheUK's topic in House prices and the economy

Umm - the US is already109k deaths WITH the lockdown in place (as of 5th June. Current figures at: https://www.nytimes.com/interactive/2020/us/coronavirus-us-cases.html) . The disease is now becoming more prevalent in the areas away from the coasts so 150-200k seems likely. And probably more since the population is not behaving as it has done for the past two months. It is not all clear that an estimate of 1.2m without lockdown was wildly wrong. -

Examples of big & multiple drops

MissOnAccomplished replied to user not found's topic in House prices and the economy

Zoopla is good in that includes price history on the page. But I prefer RightMove's presentation of photos and floorplans. -

A very sad tale here about someone unable to sell their 'very fairly' priced house. Apparently there are not just SDLT implications but also, Capital Gains tax too. I was disappointed to read some of the 'top comments' on the article. They appear to written by plebs who demonstrate a lack of sympathy for their betters. https://www.telegraph.co.uk/tax/capital-gains/13m-grand-designs-style-dream-build-now-40000-stamp-duty-nightmare/?li_source=LI&li_medium=li-recommendation-widget

-

Examples of big & multiple drops

MissOnAccomplished replied to user not found's topic in House prices and the economy

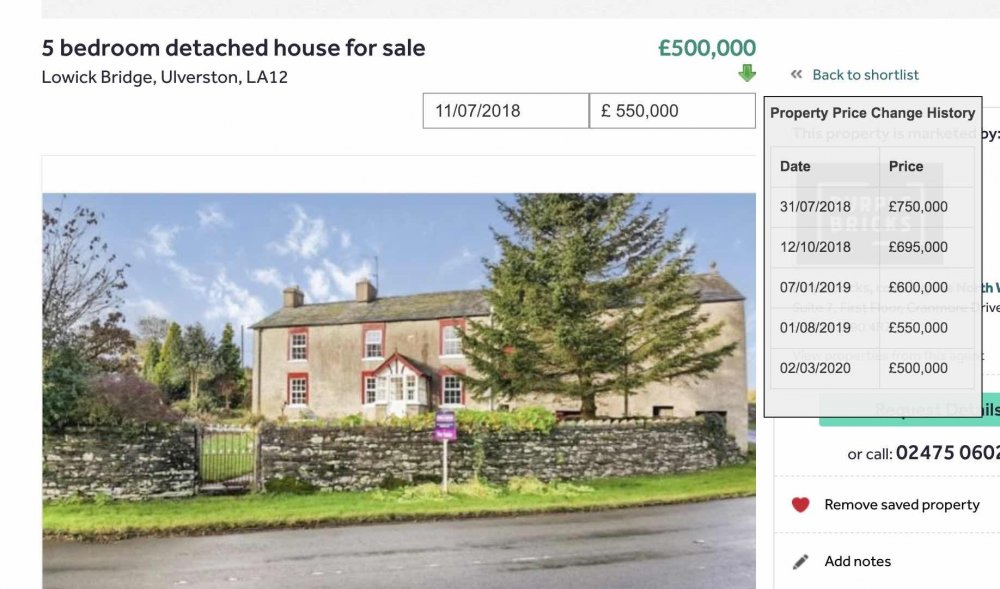

Here is a nice one. 33% down and counting. Still overpriced - unless it includes the MG in the shed. https://www.rightmove.co.uk/property-for-sale/property-55328661.html -

Why do some people have no savings?

MissOnAccomplished replied to shlomo's topic in House prices and the economy

+1 -

I wish you good luck with this. At present, it seems that the initial reviews of properties are being made by those most trustworthy of people - estate agents. From what I can see, every property commented upon is a fantastic bargain! I wonder to what extent you will be able to protect yourself against those who feel properties are way overvalued 'overdoing' their criticism - and thereby leaving you potentially exposed to legal claims by vendors (and their agents).My understanding that previous authors of widgets removed the ability of users to comment on properties for sale because of this fear. I think it should be possible to make polite criticisms of asking prices, without being accused of slander. I hope the extension can survive.

-

Under US GAAP, companies have more flexibility in choosing an assumed rate of return for the purpose of computing the effect of pension costs in the income statement. In effect they can assume a 'reasonable rate of return' based on the portfolio of assets held. As you note, this rate might be up to 8%. Under IFRS (and hence applies to UK public companies) companies can only use the discount rate that is used to measure the pension obligation as the assumed rate of return on pension assets. However, under both IFRS and US GAAP, the pension obligation in the balance sheet is computed using the interest rate on long term corporate bonds - which again, as you note, is likely of the order of 2% - 3% on both sides of the pond. So in computing the extent to which pension obligations are over/underfunded conditional on the assets held by the pension trustees (which are included at approximate market value), US and UK figures are comparable. (And yes - pension accounting is very odd.)

-

What is most impressive/encouraging is the sea of red on the first page of the listings

-

"The star initially took out a mortgage with the bank Coutts, and then went onto transform the Surrey pad with new facilities such as a hi-tech gym, a dreamy walk-in wardrobe, and a terrace overlooking the idyllic gardens." Maybe she overpaid at about 900 in 2009 and then spent another 300+ doing 'improvements'. Such expenditure might have been worth while if she were going to live there a good long time to get the benefit, but anyone else is likely to value them at 0.

-

Starting to view & make offers again

MissOnAccomplished replied to 2rocketman's topic in House prices and the economy

Isn't it annoying when (newspaper) articles do not have a clear 'publication date' . It's only when you read down to discover this was about 2004 onwards! -

We do tax turnover. That is exactly what VAT is. Of course, much of Sainsbury's output is zero-rated, and so we do not tax that part. But Ebay charges VAT on its commissions collected from UK customers, FB on its UK advertising revenue etc. Who bears the tax is another question though. If the demand for what the US tech companies are selling does not shift because of the higher price, then the tax is indeed borne by the customer. But if that is the case, why are they not charging their customers more? Therefore, is it not reasonable to conclude that at least in part, VAT is borne by suppliers?

-

Mumsnet Debt Junkies

MissOnAccomplished replied to hurlerontheditch's topic in House prices and the economy

I think you are too pessimistic, nome. I haven't done detailed statistical analysis, but it seems to me that most recent replies are from those reporting (boasting) how much they paid less than asking price. And some healthy discounts being reported - up to 20%. The more that it can be seen as 'normal' that transaction prices are 20% lower than asking prices, the better. -

Apologies - hit the wrong button - why can one not edit posts? ******* agreed. Am additional reason: final salary schemes make sense when you expect to work for the same employer throughout your working life (or are, at least, part of the same pension scheme) but if this is not the case, younger workers are likely better off with DC schemes . It is not difficult to show that if one assumes: 1) real rate of return of 3% (as was available for many, many decades) 2) contributions from age 20 to 65 3) life expectancy of 20 years after retirement 4) pension to be 67.5% of final salary for 45 years of contributions (i.e. 1.5% for every year of service) 5) no growth in salary in real terms then the scheme can be funded with contributions (employee and employer combined) at approximately 12% of salary However, to fund an extra year of pension benefit (1.5%) for an employee who is just about to retire is clearly greater than the cost to fund an extra year of benefit for an employee who is only 25. (the cost is approximately 23% of salary for the 65 year old and 5% for the rookie.) In effect, the young are subsidizing the old (what a surprise!) Such subsidies might be acceptable if the young can be certain that they themselves wil still be within the scheme at age 65, and hence will benefit. In recent decades (maybe starting in the 1970's) such lifetime employment prospects are unlikely and it was economically beneficial for young employees to take part in DC schemes where the same overall contribution (the 12% of salary) could, in effect, be paid into a portable scheme. Furthermore, if folks (1) get big promotions shortly before retiring - e.g. military/police - or (2) work boatloads of overtime - e.g. some firemen and other unionized jobs - to jack up final salary without there having been a commensurate increase in contributions, then the 12% funding level will likely prove to have been inadequate.

-

agreed. Am additional reason: final salary schemes make sense when you expect to work for the same employer throughout your working life (or are, at least, part of the same pension scheme). It is not difficult to show that if one assumes: 1) real rate of return of 3% (as was available for many, many decades) 2) contributions from age 20 to 65 contributions to the scheme (employee and employer combined) are fixed at at a constant percentage of salary, then contributions of approximately 12% of salary

-

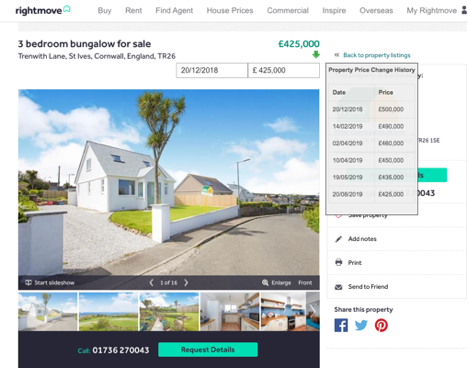

Examples of big & multiple drops

MissOnAccomplished replied to user not found's topic in House prices and the economy

Sorry about quality of picture - should be: Price Change History 20/08/2019 Price Changed: £435,000 £425,000 18/05/2019 Price Changed: £450,000 £435,000 11/04/2019 Price Changed: £460,000 £450,000 07/04/2019 Price Changed: £490,000 £460,000 14/02/2019 Price Changed: £500,000 £490,000 21/12/2018 Initial entry found. -

Examples of big & multiple drops

MissOnAccomplished replied to user not found's topic in House prices and the economy

Oh dear, what a shame, how sad. This one was purchased for 357.5 in Feb 2018. ( https://www.rightmove.co.uk/house-prices/detailMatching.html?prop=46109550&sale=6791509&country=england ) It is true that it now looks better than it did - though they have not even changed the kitchen sink. 18 months' interest, insurance, renovation costs, legal fees, and I suspect the profits on which they had grand designs will be smaller than anticipated. https://www.rightmove.co.uk/property-for-sale/property-69106585.html -

And even these statistics are pointless. E.g. GDP per capita in Ireland is high because of a few tech comapnies - including Apple - running their non-US operations through a holding company that is treated as part of the Irisih economy. Huge profits are recognized in the Irish subsidiary (rather than in France, Australia, Japan) because the taxes payable by the (e.g.) Apple Group of comapnies is lower thatn they would be if profits (and hence contributions to GDP) were recognized in the countries where the final consumer sale occurred. However, the impact of these profits recorded by Apple Ireland is negligible on the overall welfare of the people living in Ireland. I seem to recall that using a metric such as "Gross National Product per capita" might be better - but I suspect that measure has its own problems too.