-

Posts

107 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by The Young and the Nestless

-

At the low end of the market in NW9 London, I would say it has not started: a 1 bed flat in Amelia House, Boulevard Drive, London NW9 Sold Jul 2008 for £178,950 https://www.zoopla.co.uk/property/flat-19/amelia-house/11-boulevard-drive/london/nw9-5jp/28509191 a 1 bed flat in Amelia House, Boulevard Drive, London NW9 Selling now for £320,000 https://www.zoopla.co.uk/for-sale/details/49505759 another for £299,500 https://www.winkworth.co.uk/properties/10623284/sales/amelia-house-11-boulevard-drive-london-nw9/HEN170292 a new build 1 bed flat in London NW9 (slightly larger) Selling now for £355,000 https://www.zoopla.co.uk/new-homes/details/49408231 another for £350,000 https://www.zoopla.co.uk/new-homes/details/40652696 an older-build 1 bed flat in Amber Court https://www.zoopla.co.uk/property/flat-4/amber-court/colindale-avenue/london/nw9-5et/17291641 Sold Sep 1996 for £44,000 Sold Nov 2000 for £86,000 Refurbished 1 bed flat in Amber Court now selling for £300,000: https://www.emoov.co.uk/property/1-bed-ground-floor-flat/london-nw9/2lv-jwjb/ It's possible the new build flats are more expensive than the slightly older flats because they are better quality / nicer architecture. Or it could be the influence of HTB. Also, strangely when the £250k stamp duty threshold existed for FTBs (people paid higher rates above £250k) the 1 bed flats there tended not to go over £250k often. So current FTBs are paying nothing in stamp duty, can have a massive bridging loan from the government, yet are paying more than 5 years ago when those incentives did not exist.

-

Prefab is back!

The Young and the Nestless replied to oatbake's topic in House prices and the economy

Using locally sourced raw materials perhaps: -

Spotted yet another petition out there on the twittersphere: https://www.change.org/p/theresa-may-mp-abolish-leasehold-strict-regulation-for-residential-managing-agents-be-introduced This petition appears to have 2,483 signatures already, which is still not that many given the number of people stuck with ludicrous new-build leasehold houses. Perhaps it is just that too many people who own property don't understand the difference?

-

- leasehold

- commonhold

-

(and 1 more)

Tagged with:

-

Okay... Some older studies concluded that there was no correlation between aid provided to a state and its stability. However, more recent studies have shown that it depends on the characteristics of the state (in what way the state is fragile: whether it has legitimacy, capacity to handle crises, good governance, lack of conflict, etc) and also the precise types of aid are being provided. The Fragile States Index uses 12 variables to evaluate fragility. This study explains some of the variables mentioned in the report above (though doesn't statistically show aid can help fragility). The next study does attempt to show a link between aid and terrorism reduction: Savun et al. (Final published version is available on sagepub.) Some selected quotes from Savun et al: The current UK government aid program in Somalia is an example of government attempting to target aid at some of those key variables mentioned above. Specific projects: Conflict Stability and Security Fund - Support to Elections, State Formation and Rule of Law Programmes in Somalia. [GB-1-205091] Somalia Stability Fund II Somalia Security and Justice Programme Somaliland Development Fund (SDF) Phase II Programme "To improve governance..." etc Back to Ethiopia, once again from the Fragile States Index report, you can see it is at risk because of certain elevated factors: The report also shows standard potential actions/questions to address C3 would be: some of which aid can assist with. The report also shows Ethiopia has improved economic indicators, but worsening fragility index, so certainly it is not just a case of providing money, it requires an amount of state reconciliation/reconstruction/reintegration as mentioned above. Notice the UK government's top priorities for Ethiopia don't seem to reflect the above situation: So I would say yes there is evidence aid can improve stability, but the specific risk indicators mentioned in the Fragile State Index need to be brought to light and targeted per country, and while there is evidence some of the UK aid projects are trying follow that heuristic, they should update aid projects to address emerging risks mentioned in the Fragile States Index report.

-

As an idea, it is without intellectual foundation. Though Jacob Rees-Mogg may have benefited from a great education and has a superficially likeable character, these populist ideas are nothing other than 'misattribution of cause' and policies which could make the problem worse. Redirecting money from aid to housing is wrong because the housing market is very distorted. The Tories certainly will not correct those distortions, as those distortions benefit so many of their supporters. It took George Osborne years to realise the distortive effects of BTL and begin to act upon it. As to Hammond/May and the 'do nothing' budget, and the 'do nothing' manifesto, how can anyone believe the Tories will ever tackle the real problems of: land hoarding, property cartels, BTL mortgages, removing HRA cap, foreign/tax-haven ownership, rent controls, right to buy, nimbyism, devaluation of currency, etc. Is Jacob Rees-Mogg willing to take on any of these problems? Or is taking food out of the mouths of starving Eithiopians a more acceptable solution? Even if money was redirected, putting that into the 'existing system' it would get swallowed up by property developer shareholders, unless it were to be combined with a central government housebuilding operation, which the Tory government are unlikely to deliver. If countries like the UK reduce foreign aid, and that stabilising force is removed from those countries, you could begin to see more civil wars, and later an increase in the refugee crisis which would later place an increased demand on our housing domestically.

-

Negative real terms interest rates are 'theft' (direct theft of the value of savings and salaries). Financial sector bailouts are 'theft', and actually discourage self regulation. Massive shoring-up of corporate balance sheets, again is 'theft'. Trickle-down of this 'monetary' expansion is almost non-existent. The part-time-libertarians, and very few financial/property sector shills are apparently the last dinosaurs who believe the above techniques are preferable options to spending ('fiscally') the same money in the real economy, on public services, on infrastructure, as money which will remain more available in the real economy. No mainstream economist still thinks the former 'monetary' options as the sole way forwards are the correct strategy! None. Not even the ones who invented the actual QE terminology. Not even the BoE's MPC who don't really understand the government's disinclination towards fiscal expansion. It's a choice, made by a small group of ill-informed politicians, and it's the wrong choice.

-

We are talking peanuts. Possibly some councils could add sprinklers to all their high-rises for less than a few million. Some of these flats may be rented out and making money. The paying tenants would want to live somewhere safe. Any business would borrow the money at the current crazy low rate and get it done. What's the problem here?

-

It is possible that "marketing speak" may have confused the designers, or that they simply tried to save £5000. Reynobond or Reynobond FR (Class B ) "Fire Retardent" Reynobond A2 (Class A2) "Non-combustible" Reynodual (Class A2) Reynolux (Class A1) "Incombustible" This PDF on the website carries the instructions: "As soon as the building is higher than the firefighters’ ladders, it has to be conceived with an incombustible material." Grenfell tower was 67m high and therefore should have used A1 class cladding according to the manufacturer's own statement above. (Though more than likely they meant to allow A2 'non-combustible' as well.) That was not a 'legal' requirement unfortunately. At the time of building the sprinkler system may have been unnecessary, but even without the re-clad problems, there would be no guarantee that some other incorrect maintenance wouldn't take place and accidentally 'reduce' the original fire rating of any flat. Thus a sprinkler system would serve as a 'failsafe' in those scenarios.

-

Post Your Favourite Charts Here

The Young and the Nestless replied to Confounded's topic in House prices and the economy

Noticed this chart on Sky news earlier -- OBR Household Savings Ratio chart shows a negative forecast: -

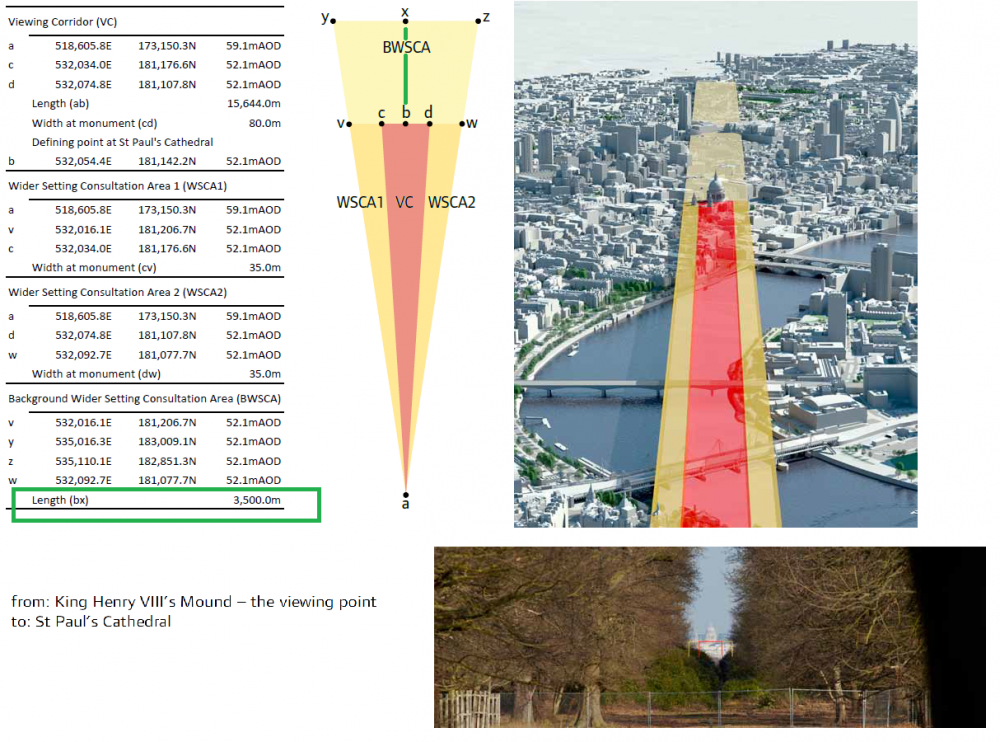

To be fair to the property developer... on this occasion they appear to have followed the rules correctly. From the Guardian: Reading part 3 of the LVMF it states the: Background Wider Setting Consultation Area (BWSCA) is 3.5km. (The new building is much further away than that, so there should be no problem...) Edit: perhaps there could be an adaptive camouflage solution/workaround to replace the current sky colour, paid for by Friends of Richmond Park? Something like these displays over the outside of the building:

-

Some things I noticed watching the Select Committee "Economy Committee" on iPlayer recently: Consisting of ex-MPC member Sir Charles Bean, and Austrian school economist Detlev Schlichter (possibly a future MPC hopeful) - who claims helicopter money doesn't work because if everyone gets it, it will make prices go up (i.e. like Help to Buy or any other scheme) he also says the only reason monetary expansion could work is if you give it to some people and not others (i.e. that QE was known to have distortive effects on the market). I think the debate shows us how far from a true science Economics really is... We already introduced inflationary money via Help to Buy, as this is one of areas where true competition cannot exist because land cannot be produced, therefore a distortion will definitely occur. If we limited how helicopter money could be issued, such as "Made in Britain" vouchers, then surely production would increase, and there would be some kind of real benefit to the manufacturing chain in the UK (once that prop is removed though we would revert to the previous low demand). Certainly the government should do a better job of supplying grants to real manufacturing businesses in the UK (we know that tooling and manufacturing equipment is a very expensive hurdle). Also they do not seem to understand it is very important how and where the monetary expansion occurs, i.e. who the money is issued to. If the BOE issues the monetary expansion as purchases of Apple bonds or McDonald's bonds, or stupid mortgage lending, or BTL mortgage lending, then this clearly has a very different effect on the shape of the economy than if you issued that money down the chain to people who could use it to buy British manufactured goods, or abolish homelessness, or making education free, or manufacturing tooling grants, or similar helpful injection. However, it seems the BOE is given free reign to 'invest' in bond purchases knowing they will definitely pay back with interest (unlike the "invisible" payback from helicopter money options). Also, zero time is given to discussing the debt-free money debate, or the interest-free debt-based money (i.e. Positive Money / Ben Dyson / Bill Still / zero interest greenbacks / etc). Also for some reason the three panellists (including Professor David Miles) refuse to say how the monetary expansion has distorted existing wealth, saying it hasn't distorted on class lines. Clearly, by their own explanations: the asset rich would get wealthier, and the asset poor would get poorer. They are economists, they should know this, yet they refuse to state it clearly back to the government when asked directly (as if they don't want a public admission of this on the record). It is fascinating that essentially a semi-layperson on the committee, Helen Goodman, asks the important questions. Then Charles Bean says that distribution of wealth issues need to be addressed by fiscal policy, or essentially "not our problem mate". Even Jacob Rees-Mogg questions the ludicrously low interest rates - he seems 'left' of the MPC, yet Schlichter claims he himself would not raise rates if he was placed on the MPC (up is down, down is up). The whole thing reminds me of the Noam Chomsky quote: "The smart way to keep people passive and obedient is to strictly limit the spectrum of acceptable opinion, but allow very lively debate within that spectrum." Here is the two plus hour discussion on iPlayer: http://www.bbc.co.uk/iplayer/episode/b08jrh7m/select-committees-economy-committee These are the experts, yet there are no real solutions or great ideas on the horizon. I wonder how different the discussion would be if they had a panel consisting of Steve Keen, Mark Blyth, etc, or would that require a "Real Economy Committee"? Would the committee then just temporarily humour any radical ideas, and settle to do nothing?

-

It's a shame that a crowd funded approach doesn't fit here: you would need to find a bank willing to assess and lend to 5,000 separate buyers, and release the funds in stages to landowner, architects, builders, utilities, etc. Has any bank ever done this? Also, councils are still HRA capped (though recently slightly extended), so Islington council would struggle to afford the entire project themselves. (Although it would be in their interest to have 5,000 extra council tax receipts, rather than investment units that take 8 years to sell...) Total cost including land, building, architects, utilities, surely wouldn't exceed 150k per flat? It seems that with the current system, the affordable land actually exists in this case, but the only group with the ability to build on a large scale is the corporate housebuilders who keep the housing unaffordable. The current government doesn't want to challenge the builders on their actual selling prices, because they see them as a 'free market' entity even though no other group competes with them on large scale building.

-

I don't really believe in the 'household' balancing the books analogy for a government with its own central bank, sorry. (Sidenote: this does not mean visible or stealth debasing of the currency is acceptable either.) I don't believe this either, it's a logical non-sequitur. Sorry. i.e. it would take other factors to 'crash' the economy.

-

I don't think we have exactly those same problems now- 1) The government will bail out any bank if necessary. 2) The rules for lending since 2008 became stricter. 3) The BOE has been stress testing banks. 4) All lenders should have cleaner lending books than they had ten years ago in 2007 (greatly reduced subprime borrowers). 5) The confidence and 'liquidity availability' problems of 2007-2008 should not apply to Northern Rock or others now (because of points 2, 3, 4 and 7). 6) Any theoretical crash would release pent-up demand, so lenders would still be in demand. 7) NRAM (the mortgages themselves) are still owned the government. 8) If the crash occurred back to 2008 prices, it would penalise those who over-valued their property since then, but all of those people would have been subject to stricter borrowing rules.

-

Just saw this video in my recommendations on Youtube: Apparently you can buy a house "in Tokyo" (34 minutes by train from the central district) for £240,000: It looks like they do have rules but fewer planning restrictions than we have here, in case you were wondering what might happen if we tried that approach here... Another Tokyo video - renting an 82 sq ft apartment - for £490 per month:

-

Yes that's a lot of energy in an IC petrol tank - and 2/3rds of it is wasted as heat, waste chemicals, noise, etc. Also no one is claiming the EV solution applies to every use case, just probably 90% of many people's everyday driving requirements. Those people will know the range and recharge speed and will be able to decide if it applies to their use case before they buy. It's not difficult to work out if it suits you. The general high/low energy density of each system is irrelevant. We are not adopting one solution or the other entirely as a human population. If it works for 90% of people's driving use cases, why would it be wrong for those 90% because of "low energy density"?

-

Probably because government is not 'paying' for Hinkley Point C to be built, but they are approving it, with a contract to purchase electricity from it at a very high price £92/MWh, but yes the taxpayer pays to store the waste. So technically we pay for it in higher bills (£30bn on our bills according to the NAO, which is estimated at up to £18 on an annual bill). As the £18bn is not coming out of the budget it allows the government figures to look better, and protects them against the rising cost of the £18bn project. Perhaps they could get an energy company to pay for a new 3GW wind project (multiple wind farms) as an alternative (for a third of the price) in a similar fashion. I don't know why they didn't keep the solar subsidy in place, probably to reduce the green charges on energy bills i.e. satisfy their voters? Also, the ability for a solar installation to cover a house and car electricity usage does not imply it does so in a cost effective way, I haven't done that calculation.

-

Another interesting question, I have just looked into this: This depends on the capability of your solar array (physical size and roof orientation etc) your house electric usage, and your annual mileage. It is possible to install a 10kW solar system on a house but it requires different paperwork (G59 vs G83 form), and probably an inspection from the DNO (Distributed Network Operator) so some installers stick to the 4kW systems for simplicity. Here is one example of a 10kW system. A similar system might generate around 8500kWh per year in UK conditions. If your house usage is very efficient at 5000kWh, then yes you should be able to run an electric car around 10,000 miles from the remaining 3500 kWh (this would require multiple battery storage to balance out the usage). Potentially if you have higher electric usage then you would need a larger solar system and more roof space. So yes it is 'possible' from a physics perspective if your roof is suitable and you have a low electricity usage.

-

What year was your brother in-law's leaf? You have prompted me to research the different Leaf versions: It looks like the 2011 Leaf AESC batteries were more degradable than the 2013 generation or latest 2016 generation. The 2011-era batteries had degradation depending on temperature, and speed of charging: 2011/2012 Nissan Leaf - 24 kWh AESC (LMO cells) sensitive to temperature and speed of charging. 2013 Nissan Leaf - 24 kWh AESC '2nd Gen' chemistry - - less sensitive to temperature or speed of charging (requires extra mounting kit to retro-fit to 2011 cars) see various links [1], [2], [3] 2016 Nissan Leaf - 30kWh AESC (NMC cells) less sensitive to temperature or speed of charging, 25% higher capacity, same physical volume, 21kg heavier. Not currently retrofittable to 2011-era Leaf (at time of posting). So the explanation would be, the taxi driver I linked above uses a 2013 Leaf with '2nd Gen' chemistry battery (which did 100,000 miles, with 1,750 rapid charges and 7000 L2 charges, with 100% charges every night, and remain at 98% of original capacity) ...and the 'staff car' test on Transport Evolved which you linked uses a 2011 era Leaf with the 1st gen chemistry only maintained 79% with 73,100 miles. The recent 30kWh battery (or future 40kWh battery) use latest chemistry and extra capacity, but the downside with the Nissan Leaf there is no battery capacity 'upgrade' available (yet) for 2011 era vehicles... Therefore there remains an advantage to buying a Renault/BMW/Tesla electric in that they offer future capacity and battery technology upgrades (whereas I am not sure why Nissan didn't build-in that upgrade-ability from the start). If Nissan enabled capacity upgrades for older vehicles that would certainly help confidence of purchase but perhaps they are worried the used marked would start to impact their new sales because the other components hold up well? Either way, it would need more cases to fully 'prove' capacity loss is not a problem on the latest Leaf, but so far it does look 'fixed' and makes the used 2014 Leafs selling for £7000 look like a bargain (if it suits your use case). Edit: Found some more data here, looks to be mostly 2011 vehicles with the degradation problem and a handful of 2013 vehicles with one bar loss in hot climates. Furthermore, the Panasonic batteries used in Toyota PHEVs and Teslas, and the Samsungs used in BMWs should all be technologically ahead of the AESC batteries.

-

Toyota Prius batteries from 10 years ago have outlasted their expected lifespan and mileage, and they were using older NiMH battery technologies. (In the unlikely event they didn't last their expected mileage lifespan, OR expected age lifespan, then they would have been replaced by the manufacturer for free.) More recent Li Ion batteries which go over their expected mileage life have found to be at 98% of original capacity after 100,000 miles. Actually it's thanks to the mobile phone technology battery improvements that means this is no longer an issue!