-

Posts

641 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by PrincessNutNut

-

Generation Without Pension

PrincessNutNut replied to MerchantNavy's topic in House prices and the economy

A broad mix of dividend paying multinational stock pays abot 7% above inflation annually over large timeframes. I've never understood the cash holding and drawdown logic for people who have large pots. Surely it's better to look at the pot beyond your own lifetime. Compounding really starts kicking off after a century. -

Generation Without Pension

PrincessNutNut replied to MerchantNavy's topic in House prices and the economy

In most cases, the correct thing to do is take the lump sum and invest it tax efficiently to generate much of the same you would have had inside the pension. Only now you've also got a six figure pot to access for emergencies or bucket list events. -

Depends on your outlook. If you're convinced that inflation is "transitory", then yes, anything above the 10y gilt looks reasonably attractively priced right now. But the calculated yields are based on inflation expectations. So the real return those gilts will see depends on the actual progression of inflation in the time until they hit maturity.

-

A normal yield curve: Western CB yield curves right now: This is saying that bond purchasers are willing to accept less return for longer term bonds, despite them carrying higher inbuilt risks, than short term bonds - signalling that there's low confidence in long term economic conditions. Practically what's more important is that the yield curve eventually normalises. That can happen by the short end lowering. Or the long end going up. Or put it in more tangible terms: The 5 year mortgage is only temporarily cheaper than the 2 year. Whichever way it plays out, you'll either be able to get cheaper mortgages when it normalises (increasing your purchasing power), or they'll get more expensive - which will drag prices down. Conversely, if you're re-mortgaging, jump on those 5 year fixes at 4% while they last.

-

Prices are set on the margins. If everyone used Copilot, they'd have to charge more, as there's just not electricity generation in the world to cover all the data centres needed. Maybe that's good for the graduates, they'd all earn vastly more building us power stations. But maybe not, after all we're meant to lower our carbon footprint, or else. Even very smart people are pretty dumb - the human brain is a marvel, but it's efficiency comes from cutting corners. Avoiding bias and emotion, and remembering things accurately aren't our strengths. And compared with computers, we're pretty bad a maths. But I agree with you in that this is the correct application of computers, to amplify the outstanding and extend our reach.

-

Gold strategy in the current economy

PrincessNutNut replied to Lepista's topic in House prices and the economy

https://www.ft.com/content/e42dd872-f550-47f0-b203-3420cf498fcf It's not widely reported, but this bit is critical: The national security package includes a provision that would allow Ukraine to use funds from seized Russian assets to fund the war effort. Most so called Russian assets are in the form of US Treasuries - which allows the US to decide this in the first place (being the counterparty that owes money). Bonds are meant to be risk free, that allows governments to borrow cheaply. The US has just told the rest of the world that they're not - there's a counterparty risk. If they don't like what you're doing, you lose your assets, and have them used against you. In other words: America has just declared it will default on its debt to Russia. If you're China, or India (enter major Western government bond buyer of your choice), what's the message you take away here? -

I'm not too worried about outside interference, for me the error is in the method. There is no absolute truth, and reading several conflicting interpretations about a topic is exactly how you become informed about it. Skipping that step is the fastest way to Dunning Kruger - and there's too much of that already. I don't think I am. See above. You assume there's something new required ("research") in order to make the correct decision. Most of the time that's not accurate. Most places decisions are made are overwhelmed with information. It's the cutting out of bullsh*t and focussing on what matters that is the key skill, I think. The best people in the world are experts at simplifying complexity.

-

That's fair enough, and I'm not disputing that there are legitimate uses for these things in some areas. You may learn faster, but it is correct what you're learning? More importantly, are you able to distinguish what is correct from what isn't? And decisions aren't knowledge. A good manager has a good team feeding relevant information to come to good conclusions. A bad one doesn't.

-

My point was that the technology was available prior to chatbots, not that chatbots aren't chatbots. A 10 minute conversation with an LLM in a field you know intimately should change that point of view.

-

Auto-typing and language recognition have been available for some time, there's little "AI" here, other that it's wrapped up in a chatbot which makes it more accessible. Sure, but you were once a graduate. And by doing these tasks you added experience, and these tasks are now really easy to you. A chatbot query uses 10x the energy a google search does. Look at the forecast energy demand for data centres - which is a direct consequence of your very assumption. Machines tend to be convenient. I just don't see the big picture working at the scale most listed companies are forecasting this to develop.

-

First-time buyers face toughest test for 70 years

PrincessNutNut replied to Stewy's topic in House prices and the economy

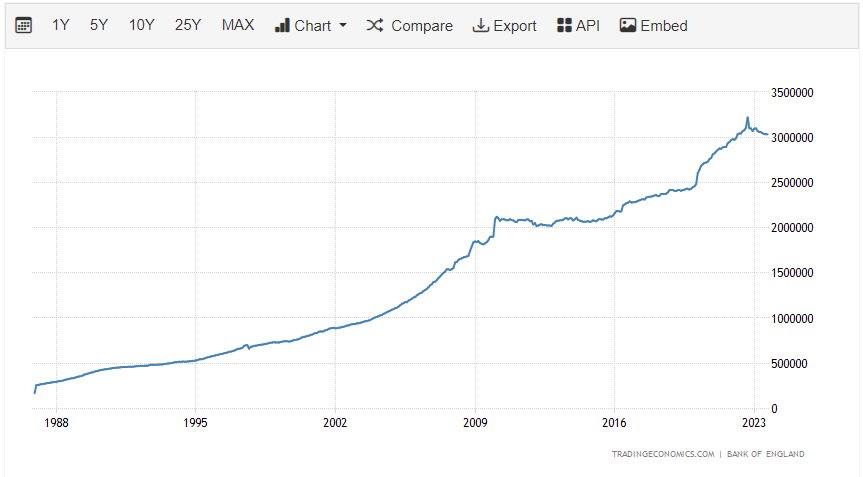

It's the affordability of debt that drives house prices. Earnings factor into that, but are not the whole equation. -

I don't think AI is on track to enabling much you couldn't have automated anyway in the past 20 years. We have simple stuff done by humans, because some humans aren't capable of complex stuff. If you replace them with a machine that has 100x their energy draw to do the same thing (and transferring from chemical to electrical energy), how does that fit in with climate goals?

-

Ah, but no one has considered the energy required again... Unfortunately. The worst of them appear to be "learning" their expertise by use of ChatGPT - which is tantamount to learning to read books backwards.

-

Gold strategy in the current economy

PrincessNutNut replied to Lepista's topic in House prices and the economy

Eyes on the bond market again. The US voted through the bill to give the Ukraine the assets "frozen" from Russia. The question is now: Are there enough Western buyers for Western government debt? In my view this could in hindsight prove as significant as the decision to de-peg the USD from gold in 1971. -

Gold strategy in the current economy

PrincessNutNut replied to Lepista's topic in House prices and the economy

Critically, gold has detached from long term bonds in correlation. The US have messed with the price signal to rule all price signals (fossil fuels, as energy is the master resource) since 2022. Good luck draining the Strategic Gold (insert commodity of choice) Reserves. -

Homes England: the govt gravy train

PrincessNutNut replied to Freki's topic in House prices and the economy

Just make it a simple exercise: Establish areas where building is permitted, and then make planning permission a confirmation that all relevant rules are upheld - like permitted development. Abolish the current nonsense where council workers and local retirees are arbitrarily awarding (or mostly not doing so) permissions to build, based on their opinions about "local character". -

Sky News - election in new year

PrincessNutNut replied to petetong's topic in House prices and the economy

We will see how long deficit spending can continue in a recessionary environment. And do the Brits ever really despise enough to bother doing something about it? -

Let's wait for the first sign that inflation isn't going straight for 2%.

-

Sky News - election in new year

PrincessNutNut replied to petetong's topic in House prices and the economy

Damage limitation? - They've just announced the last bung a (any) government is going to be able to afford for a while. Which will buy them some goodwill. - Reshuffling (i.e. distancing from the right) may buy some points with the moderates - But the biggest factor will be voter turnout. If they hold it in a cold, rainy time of the year, a lot of people won't be arsed to leave the house. It's not like any other parties are inspiring. Meaning the hardcore voters can swing things their way a little. Their aim will be to ensure Labour doesn't achieve an absolute majority, but is forced into a coalition with Lib Dem (and maybe Green?) heading into recession, with no money available to spend. (And if Green is involved, forced into batsh*t energy policy) Two (three?) birds with one stone. -

The world has changed

PrincessNutNut replied to NoHPCinTheUK's topic in House prices and the economy

If it isn't, the name is a lie. The source temperature determines whether the source for these units is a source of heat or not. The aggregates create heat by electric heaters. And the colder the source, the higher the electricity draw. -

Rishi Sunak: The time has come to cut tax

PrincessNutNut replied to fellow's topic in House prices and the economy

The deficit is smaller than our massive target. Let's spend some more! -

The world has changed

PrincessNutNut replied to NoHPCinTheUK's topic in House prices and the economy

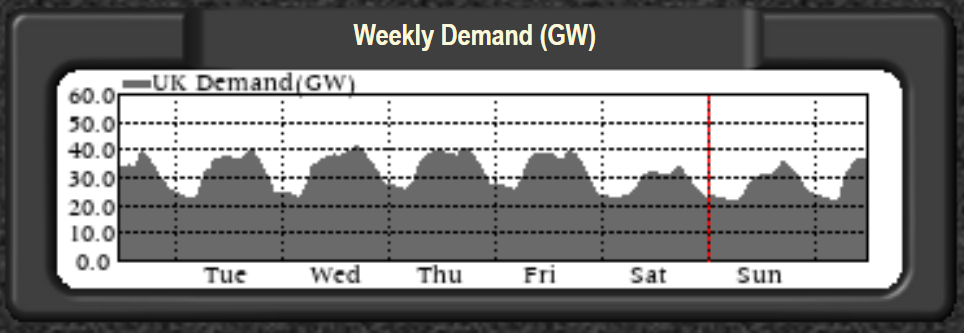

You can only shut each factory down once. 1. Weekends are outliers (also shows how little manufacturing we now do, a paltry 10GW peak demand difference from Saturdays to weekdays) 2. The grid balances supply and demand. Just because the infrastructure supports the exchange of 40GW doesn't mean the current supply is able to deliver 40GW on average. Nor does it mean that there's 10GW spare on weekends or 15 GW at night. Those aren't being produced. And if they were, they would be gas and coal powered. The point is that shifting from burning gas or oil as a source of heat, you're putting in place an electric heater. The source in the name is for the source of air. Not the source of heat. If it's cold outside, the source air is cold and requires heating. While we can debate the merits of its efficiency, it's clearly going to draw electricity that is currently not required. -

The world has changed

PrincessNutNut replied to NoHPCinTheUK's topic in House prices and the economy

In case anyone missed it: The max strike price for CfDs for offshore wind was increased by 66% this morning in the UK. £73/MWh is equivalent to £124.10 per barrel of oil (or $148.92 USD, for those wanting a quick reference against Brent). Edit: Of course CfDs are set at 2012 prices, which makes this £100.5/MWh in today's money... 😇