-

Posts

626 -

Joined

-

Last visited

About PrincessNutNut

-

Rank

Newbie

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

-

Gold strategy in the current economy

PrincessNutNut replied to Lepista's topic in House prices and the economy

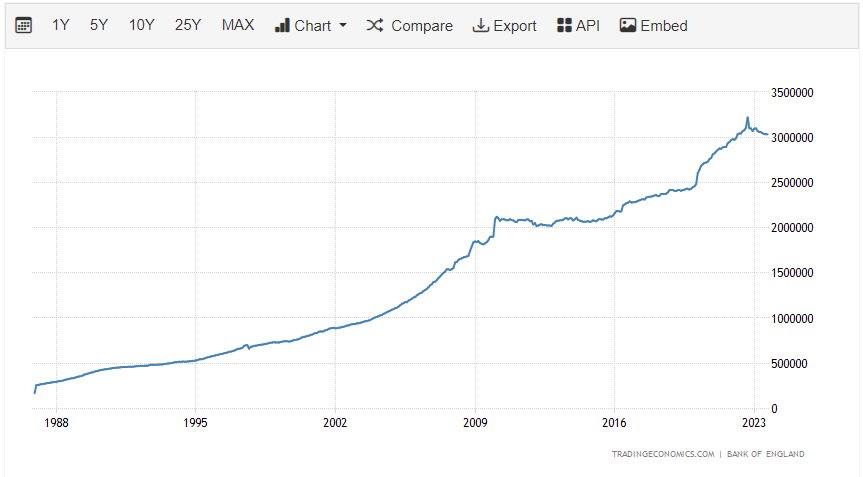

Critically, gold has detached from long term bonds in correlation. The US have messed with the price signal to rule all price signals (fossil fuels, as energy is the master resource) since 2022. Good luck draining the Strategic Gold (insert commodity of choice) Reserves. -

Homes England: the govt gravy train

PrincessNutNut replied to Freki's topic in House prices and the economy

Just make it a simple exercise: Establish areas where building is permitted, and then make planning permission a confirmation that all relevant rules are upheld - like permitted development. Abolish the current nonsense where council workers and local retirees are arbitrarily awarding (or mostly not doing so) permissions to build, based on their opinions about "local character". -

Sky News - election in new year

PrincessNutNut replied to petetong's topic in House prices and the economy

We will see how long deficit spending can continue in a recessionary environment. And do the Brits ever really despise enough to bother doing something about it? -

Let's wait for the first sign that inflation isn't going straight for 2%.

-

Sky News - election in new year

PrincessNutNut replied to petetong's topic in House prices and the economy

Damage limitation? - They've just announced the last bung a (any) government is going to be able to afford for a while. Which will buy them some goodwill. - Reshuffling (i.e. distancing from the right) may buy some points with the moderates - But the biggest factor will be voter turnout. If they hold it in a cold, rainy time of the year, a lot of people won't be arsed to leave the house. It's not like any other parties are inspiring. Meaning the hardcore voters can swing things their way a little. Their aim will be to ensure Labour doesn't achieve an absolute majority, but is forced into a coalition with Lib Dem (and maybe Green?) heading into recession, with no money available to spend. (And if Green is involved, forced into batsh*t energy policy) Two (three?) birds with one stone. -

The world has changed

PrincessNutNut replied to NoHPCinTheUK's topic in House prices and the economy

If it isn't, the name is a lie. The source temperature determines whether the source for these units is a source of heat or not. The aggregates create heat by electric heaters. And the colder the source, the higher the electricity draw. -

Rishi Sunak: The time has come to cut tax

PrincessNutNut replied to fellow's topic in House prices and the economy

The deficit is smaller than our massive target. Let's spend some more! -

The world has changed

PrincessNutNut replied to NoHPCinTheUK's topic in House prices and the economy

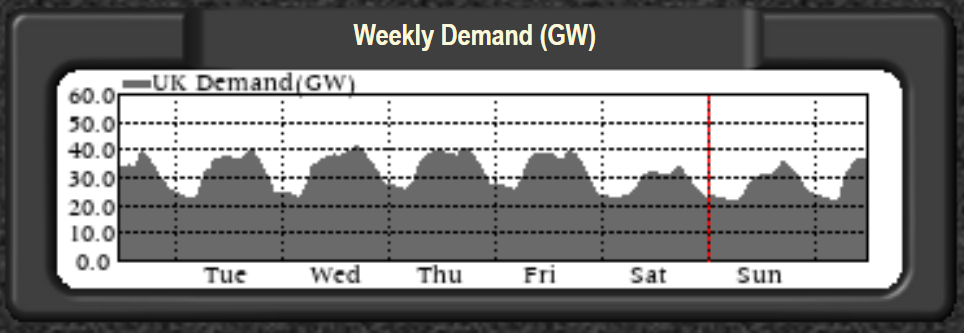

You can only shut each factory down once. 1. Weekends are outliers (also shows how little manufacturing we now do, a paltry 10GW peak demand difference from Saturdays to weekdays) 2. The grid balances supply and demand. Just because the infrastructure supports the exchange of 40GW doesn't mean the current supply is able to deliver 40GW on average. Nor does it mean that there's 10GW spare on weekends or 15 GW at night. Those aren't being produced. And if they were, they would be gas and coal powered. The point is that shifting from burning gas or oil as a source of heat, you're putting in place an electric heater. The source in the name is for the source of air. Not the source of heat. If it's cold outside, the source air is cold and requires heating. While we can debate the merits of its efficiency, it's clearly going to draw electricity that is currently not required. -

The world has changed

PrincessNutNut replied to NoHPCinTheUK's topic in House prices and the economy

In case anyone missed it: The max strike price for CfDs for offshore wind was increased by 66% this morning in the UK. £73/MWh is equivalent to £124.10 per barrel of oil (or $148.92 USD, for those wanting a quick reference against Brent). Edit: Of course CfDs are set at 2012 prices, which makes this £100.5/MWh in today's money... 😇 -

The world has changed

PrincessNutNut replied to NoHPCinTheUK's topic in House prices and the economy

Per household/appliance perhaps. I'd expect that to be offset by both population growth (i.e. more households) and shift in consumption (more appliances, especially computers). Below supposedly stems from DECC data. -

CPI reported 15th Nov 2023 4.6% YoY

PrincessNutNut replied to Timm's topic in House prices and the economy

Back to the statistics - October was likely to come in lower than the months preceding, with it's high rate and strong rate of change. From now on the base effect works the other way - something to bear in mind. -

The world has changed

PrincessNutNut replied to NoHPCinTheUK's topic in House prices and the economy

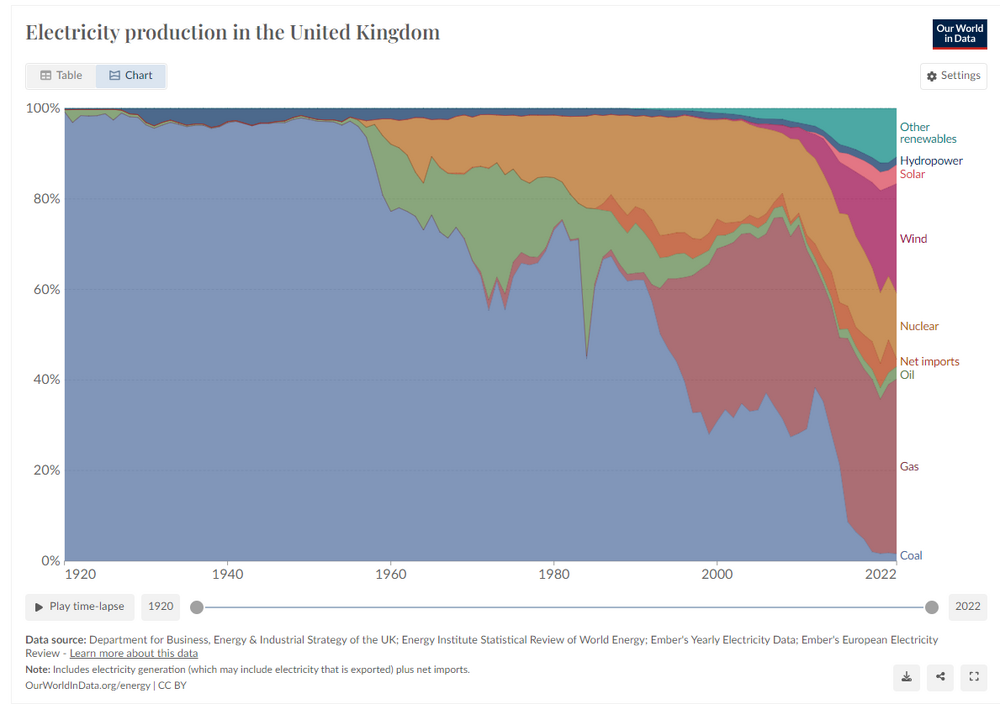

Total UK energy demand is falling due to offshoring of manufacturing. Electricity as a share of primary energy is on a steady rise, and you'll see an acceleration in the graph since the middle of the last decade. Below shows @kzb's assessment broadly right. If you include biomass (which is less climate friendly than most of this list) in "renewables", you're looking at roughly 40% of electricity being produced by renewables, with electricity making up around 15% of total primary energy demand. So around 6% of the UK's energy needs are met by renewables. To make the future work, we need this chart to be around 60% nuclear, with 40% made up of a healthy mix of renewables backed by gas (until another ad hoc baseload generator can be found that will power the dark and windless periods (maybe nuclear, maybe batteries?)). And in the meantime, electricity needs to make up the vast majority of primary energy demand, let's say 90%. In this scenario, current renewable output needs to grow sixfold. The nuclear fleet would have to grow by a factor of 50+ (at least). -

The world has changed

PrincessNutNut replied to NoHPCinTheUK's topic in House prices and the economy

Has something changed since last winter? Other than bailing out of renewables companies that aren't making money at record energy prices? https://www.nytimes.com/2023/11/14/business/germany-siemens-energy-green-projects.html