nero120

Members-

Posts

2,725 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by nero120

-

22/04/2024 - The exact moment the housing bubble burst

nero120 replied to fellow's topic in House prices and the economy

Err, has any forum thread on the internet ever not ended up as a sh1t show? -

He's also confusing HPI as a result of "inflation" when actually it's classic speculation driving increased asset prices as a result of the declining cost of credit. He's just clutching at whatever straw he can grab hold of, just like some of the other VIs/trolls on this forum. And to be honest, this crap has gone on so long that you can't really blame them! However, it doesn't change the fact that they will be dragged down to oblivion as they have tied themselves to the mast (physically and emotionally) of a rapidly sinking ship.

-

Why do you think that is mate? Think hard! 🤔

-

Russia to grow faster than all advanced economies says IMF

nero120 replied to shlomo's topic in House prices and the economy

https://www.telegraph.co.uk/news/2024/04/23/ukraine-has-only-six-months-left/ BAHAHAHA!!!! Oh would you look at that! Despite all the UK establishment chode-smokers infesting this board attacking any suggestion that Russia was actually a formidable adversary that should not be underestimated, even the Telegraph's chief neo-con chode-smoker sociopath admits that, despite every junk article he's written during the course of this war, Russia are actually a formidable adversary that should not be underestimated and Ukraine are now F*CKED. So unexpected!! So unpredictable!! How could this have happened!! Who could have known!! SURROUNDED BY F*CKING MORONS. -

You might think so, but sadly that would be stunningly ignorant. You see, if the price of an asset has been bid up far beyond it's residual value due to abundant cheap credit, when the cost of credit rises it has the effect of removing liquidity from the market, this prices fall. High inflation = higher interest rates = property prices continue to tumble until they find their residual value, or perhaps even lower for the real bilge that most wouldn't be caught dead in. So sorry.

-

Gold strategy in the current economy

nero120 replied to Lepista's topic in House prices and the economy

Agreed. -

Gold strategy in the current economy

nero120 replied to Lepista's topic in House prices and the economy

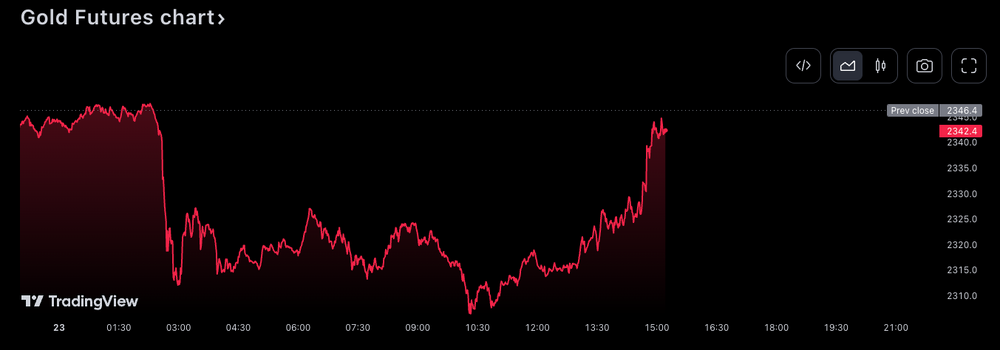

Note the telltale 3am globex monkeyhammer, classic BIS/CB attempt to smash the gold futures price as low as possible taking advantage of thin volume. But, it's already recovered! Sorry b(w)ankers! -

Gold strategy in the current economy

nero120 replied to Lepista's topic in House prices and the economy

Everything is awesome! -

HPC forum mortgage brokers vs the market

nero120 replied to NoHPCinTheUK's topic in House prices and the economy

HAHA!!! Keep dreaming timmy, hold on to those dreams tight!! -

HPC forum mortgage brokers vs the market

nero120 replied to NoHPCinTheUK's topic in House prices and the economy

Clearly business can't be great, they have far too much time on their hands if they're posting hundreds of posts here a week! VI HPC daily/weekly post count is a good indicator of market sentiment/activity!! -

Rightmove asking prices April 2024 +1.1% MoM +1.7% YoY

nero120 replied to fellow's topic in House prices and the economy

Yet all the evidence speaks to the contrary. Thick-as-sh1t sellers might be as deluded as ever asking for stupid, undeserved amounts, but numbers of actual transactions are bumping along all time lows whilst real wages continue to sink lower and credit gets tighter. Even in St Albans (one of the most affluent and desirable places to live in the country) I can see houses are not selling for what they were 1-2 years ago. Admittedly, the British establishment and their little robot-sheep flock are doing their best not to admit any of this, and indeed fight it, but the tide is inexorably rising and you're all starting to drown... -

Gold strategy in the current economy

nero120 replied to Lepista's topic in House prices and the economy

They are really trying to hammer gold down in the futures market! I think though there are just too many fundamentals pushing the price higher. All this will do is allow the recent big physical buyers (CBs/SWFs/FOs/etc) to load up on cheaper physical gold... or perhaps that's the idea...? The US is just borrowing insane amounts of money, 10 year treasury auctions are going to get more and more difficult as there just aren't the buyers out there for such a large supply at these yields. More and more are simply going to opt to store their reserves in physical gold. -

Rightmove asking prices April 2024 +1.1% MoM +1.7% YoY

nero120 replied to fellow's topic in House prices and the economy

Was it ever in any doubt?! -

Gold strategy in the current economy

nero120 replied to Lepista's topic in House prices and the economy

Yet "digital gold" is up! Funny that! Prob many more shorts losing money in silver, they had to schwack the price. Won't stop it moving higher though, they best use this opportunity to cover. -

Rightmove asking prices April 2024 +1.1% MoM +1.7% YoY

nero120 replied to fellow's topic in House prices and the economy

Asking prices increase, number of sales continues to drop... -

Sorry that deserves another one of these: I work in tech, it's my bread and butter, and whenever I hear any layman talk about how life changing LLMs are I'm just .

-

Russia to grow faster than all advanced economies says IMF

nero120 replied to shlomo's topic in House prices and the economy

Exactly, a senile, pedophile for a president keeping his broken economy propped up by borrowing $1 TRILLION every 100 DAYS, is a sgn of strength in clown world! 🤡 Russia and China are going to collapse any day now! Whatever they say is just lies! We tell the truth!