The site that *correctly* predicted the 2008 crash!

Join 10,000’s discussing house prices right now…

@Conservatives failing/failed. pic.twitter.com/1cGtqYwrVb

— housepricecrash (@housepricecrash) May 7, 2024

Track what’s really moving UK house prices…

| Data Point | Latest Reading | 1 m/o change | 3 m/o change | 12 m/o change |

|---|---|---|---|---|

| Mortgage Approvals | 49,444 | -5161 | -120 | -13,735 |

| 5yr Fixed Mortgage Rate | 5.71 | 0.76 | 1.54 | 2.28 |

| M4 Growth (%) | -8.3 | 0.5 | 0.9 | -2.2 |

| GFK Index | -25 | 5 | 2 | 19 |

| Avg Real Weekly Earnings (£) | 515 | 4 | 7 | 5 |

| Score | – | 1 | 1 | -1 |

Latest: House Price Crash News

Tuesday, May 14 2024 Add a News Blog Article

2023 Q4 Inflation Adjusted House Prices

Real House Prices Fall Again

Still falling...

London is in negative territory (-0.8%) YoY

MoM sold prices down

On a seasonally adjusted basis, the average UK house price decreased by 0.5% in July 2023, following a month-on-month increase of 0.7% in June 2023.

Represents annual fall of c£14,600 on a typical home

"August sees further weakness in house prices"

“August saw a further softening in the annual rate of house price growth to -5.3%, from -3.8% in July, the weakest rate since July 2009. Prices fell by 0.8% over the month, after taking account of seasonal effects. “The softening is not surprising, given the extent of the rise in borrowing costs in recent months, which has resulted in activity in the housing market running well below pre-pandemic levels.

Further falls in house prices

Halifax HPI July '23

“Expectations of further Base Rate increases from the Bank of England were tempered by a better-than expected inflation report for June. However, while there have been recent signs of borrowing costs stabilising or even falling, they will likely remain much higher than homeowners have become used to over the last decade."

BOE report

Bank Rate increased to 5.25%

At its meeting ending on 2 August 2023, the MPC voted by a majority of 6–3 to increase Bank Rate by 0.25 percentage points, to 5.25%. Two members preferred to increase Bank Rate by 0.5 percentage points, to 5.5%, and one member preferred to maintain Bank Rate at 5%.

House prices further into negative territory

Nationwide HPI Jul 2023

Headlines: Monthly Index: 517.8 Monthly Change: -0.2% Annual Change: -3.8% Average Price (not seasonally adjusted) £260,828

No spring bounce in May ’23

Latest Land Registry Sold Prices

House prices fall 0.4% MoM when seasonally adjusted. (0.00% non S.A). London falling 1.2% MoM.

Real House Prices

House Price Crash Forum

Latest Topics

- Will Russia invade Ukraine and what happens if it escalates with NATO/US getting involved

Not only with the Ukrainian army ... "Ukraine sees signs Kharkiv front stab...

New golden age for British ship-building.

How many new hospitals built so far? https://www.bmj.com/content/381/bmj.p1...

Romance Scam

Texbook dangerous conman and urbane, high functioning psychopath, the Feds shoul...

New golden age for British ship-building.

...largely content free until orders are actually placed with a ship-builder. ...

Will Russia invade Ukraine and what happens if it escalates with NATO/US getting involved

Ukraine gets wrecked and arms manufacturers make out like bandits....

Reviews: Stop Getting Ripped Off

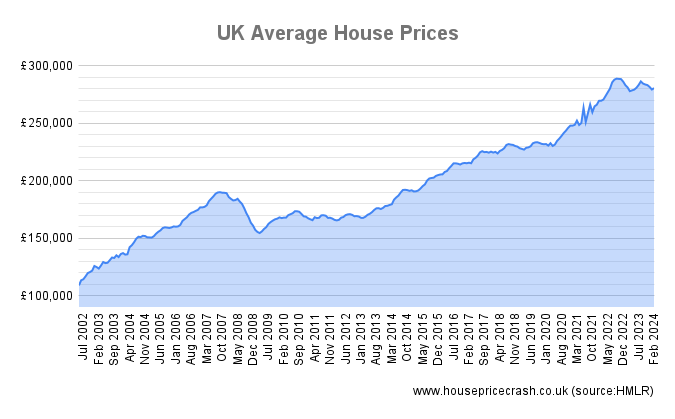

UK House Prices Graph

- The average price of a property in the UK was £281,000

- The annual price change for a property in the UK was -0.2%

- The monthly price change for a property in the UK was 0.4%

- The monthly index figure (January 2015 = 100) for the UK was 147.2

Source: Land Registry

UK House Price Index

| Source website | Period covered | Average house price | Monthly change (%) | Annual change (%) | Official releases |

|---|---|---|---|---|---|

| e.serv (prev LSL Acadata HPI) (England and Wales) | Mar 24 | £361,368 | |

|

Mar 2024 |

| Halifax House Price Index | Apr 24 | £288,949 | |

|

April 2024 |

| Office for National Statistics [O.N.S] | Jan 24 | £281,913 | |

|

Jan 2024 |

| Zoopla / Hometrack | Mar 24 | £264,500 |  0.00 0.00 |

|

Mar 2023 |

| HM Land Registry UK HPI | Feb 24 | £280,660 | |

|

Feb 2024 |

| Nationwide House Price Index | Apr 24 | £261,962 | |

|

April 2024 |

| Rightmove ‘Asking’ Price Index | Apr 24 | £372,324 | |

|

April 2024 |

House Price Predictions

If you have discovered other or revised predictions that you’d like added to this list then send an email to us with all the information for each column and also a link to a website that contains the information so that we can verify the data.

This table is now sorted by the date that the prediction was made.

| Source website | Analyst | Photo | Date prediction made | Amount predicted | Region | Time Period | Evidence | Notes |

|---|---|---|---|---|---|---|---|---|

| SP Rating | SP Rating | 2022 | Overvalued by 50% | UK | Not Stated |

”SP Rating has stated that London and the South East of England is overvalued by 50%. They further the statement by saying the rest of the UK is overvalued by 20%”

|