-

Posts

519 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by hi5lo5

-

-

3 hours ago, jiltedjen said:

i don't see interest rate rises. At worst case its back to 0.5% so basically irrelevant. And even then there will be loads of 'we are thinking of putting it back to 0.25%' to make sure people away that its not the sign of interest rates heading on an upwards direction.

Regardless of interest rates, S24 is going to be a big deal. But at the same time the HTB ISA's etc are slowly pumping to FTB's (like myself + and my partner). So personally i see slightly cheaper prices, a huge conversion of BTL to FTB, with FTB paying MMR restricted borrowing prices with HTB pumping. I also see rents increasing, but this is purely down to a short-term transition, as houses will take a long time to sell. I think the housing market will be a mess short to medium term (next 2-3 years), i know that the houses get sold to people, and don't disappear, but there will be a time lag, and thats going to be painful for renters. The choice will disappear also, not ever mug will be trying to rent out their houses anymore.

The dates and timing is a little harder to know for sure. There is a final payment date in January 2019, thats for the weakest of reductions of tax relief, but easily enough to sink thousands into bankruptcy. But there are loads of other mechanisms at play prior to this, the media for example will be ramping up about whats coming all through 2018. Banks will also see whats coming, and realise they suddenly no longer trump all other creditors when the HRMC come knocking.

We are already seeing banks crack down on BTL lending.

Basically whats important is:

1. BTL wont expand anymore in 2018

2. BTL will Shrink

3. prices will reduce slightly

4. short to medium term rents will increase

5. All those smug late to the party BTL morons will be toast

In my view the biggest threat for BTL is end of Term funding scheme. BOE publishes the details of the lending data of all the banking groups that participate in this scheme. Co incidentally all the "Challenger banks"(balls deep in BTL lending) appears to be the top beneficiaries of this scheme. I vaguely recall someone raising the point of the sales volume not matching the CML's Mortgage numbers. If investor is taxed more, normally they tend to save the cost by reducing the expenses in this case mortgage interest.

By Feb 2018 the scheme ends. Then the banks that drawn money out of this scheme has to find funds to repay the BOE. The banks has a choice of issuing covered bond or RMBS. Either the case there will be a cost for raising capital (0% now). This cost has to passed on to the borrowers , so no more cheap money to lend. When the term funding ends the IR for discounted rate (fixed 2 years) will be higher than what it is now.

The Muppets who borrowed at the peak (Mar 2016) to avoid SDLT surcharge will see thier 2 year fixed ending on mar 2018 and the lender gets a freedom to take advantage of the borrowers inability to meet the new PRA(ICR test) requirements to remortgage with another lender. On April 2018 those borrowers will be shell shocked when they 1 letter from thier accountant about the tax bill and an annual mortgage review from the lender. Most lenders allow the existing borrowers to switch to cheaper rate products for a cost of 2k average.

Note that the RMBS bond market is pretty much dried since the term funding. I wouldn't be surprised if the banks puts pressure on borrowers to keep the loan book to look nicer for the bond investors.

-

2 hours ago, Ballyk said:

The thing about S24 is that it only affect landlords who are BOTH leveraged AND higher rate taxpayers.

If you're a higher rate taxpayer with no debt on your rental property, then you are entirely unaffected. Similarly, if you are leveraged, but only a basic rate taxpayer, then you are completely untouched. The unfairness of this is often pointed out by leveraged landlords, who complain that rich landlords who have no mortgages are unaffected. But the answer is not to let up on S24, but to clamp down on the others in some other way.

That's not true at all. Those Muppets who are leveraged and basic rate payers would be hard hit when thier tax credits disappear.

-

2 hours ago, Bear Hug said:

Nice to hear "from the horse's mouth" that Reading lettings ARE slow!

It's interesting how the landlord, having lived there for many years, thinks that kitchen, bathroom, decoration etc are fine as they are. They don't look all that great to me at all. I assume it's the matter of him getting used to the place over the years and not seeing its flaws anymore, in addition to the typical landlords' greed.

If his valuation is to be believed, the yield is below 3%, although chances of that craphole (I am being positive about its mediocre state, so have not called it a shithole) selling for £317,000 Zoopla valuation are pretty close to nil.

On £850 rent pcm, in two years time the property is worth max of 160k.

Here is my calculations

850- 10% maintenance = 765

765 x 12 /5.5%/145% (PRA underwriting rules) =112k is the max you can borrow on 75% LTV.

-

-

17 minutes ago, Houdini said:

I think those cars will be handed back regardless. Most people coming off a PCP will be wanting to get another new car on PCP, and those that can't get a PCP deal won't be able to afford the balloon payment... The real question is how many people will still qualify for a PCP deal come January....

Not many I would say. The verified income of each borrower is not very high. They need to find a initial deposit of at least 10% of car value. Again where are we at the Unsecured lending?

-

2 hours ago, spyguy said:

To be honst, with equlaity of cars these days youd expect car sales to be falling.

On PCP. Ive jjust been commenting on a FB arugment about a car left outside someone house for 5days. Brand new mid range Audi. Popel were thinking its stolen. Someone confessed to owning it - but they did not live near where it hadd been *badly) parked.

Whcih up and coming go getter has this car I thoguht.

22 yo girl. Works in a chippy. Left as she could not put petrol in it. 500/m someone mentioned. Lives with parents.

I am not surprised. I happen to see one of the loan level data GM financial's ABS(of course AAA rated prime lending). PCP became mainstream on the Q1 of 2015 (at least on this pool) maturing in 36 months. Once the PCP ends the borrowers(average income £23k) are expected to make the average ballon payment of £5,500. I can't see the borrowers finding this money to make the ballon payment, remember we peaked unsecured lending couple of months back. Eventually all these cars will be handed back to the finance company and the dealers will need to hire nearby farmland for parking.

-

45 minutes ago, Bland Unsight said:

There are lots of them who aren't competing with anybody. Look at the state of this:

Source: DWP Research into mortgage borrowing and claiming Support for Mortgage Interest in retirement, August 2017

Notice how the number of under-50s, who have a bit of time to play with (and possibly stronger earnings), with proper 'naked' interest-only loans has fallen sharply since 2012 (presumably as they switch to repayment) but in the 50-59 late boomer cohort (can't go wrong with bricks and mortar, mate) you have an increase between 2012 and 2014. The number of these bozos has almost doubled since 2005.

(The boomers with their talk of feckless millennials need to stop drinking the Old Spice aftershave and inspect the beam in their own eye before boring on about avocado toast, or i-phones, or whatever form the latest piece of meaningless anecdotal idiocy they imagine to be the mote in the eye of the millennials.)

Thanks bland. That explains.

-

3 hours ago, Bland Unsight said:

A bit more speculation. There's no blip anywhere around the announcement of London Help-to-buy equity loans (announced November 2015 in the Autumn Statement). The property markets of London and the South East (which make up a big share of the entire UK market) may be being driven by speculation, unanchored to earnings, at levels that borrowers anchored to earnings can't even reach with the benefit of a 40% interest-free loan from the government. Not only is it fragile. It has a long way to fall.

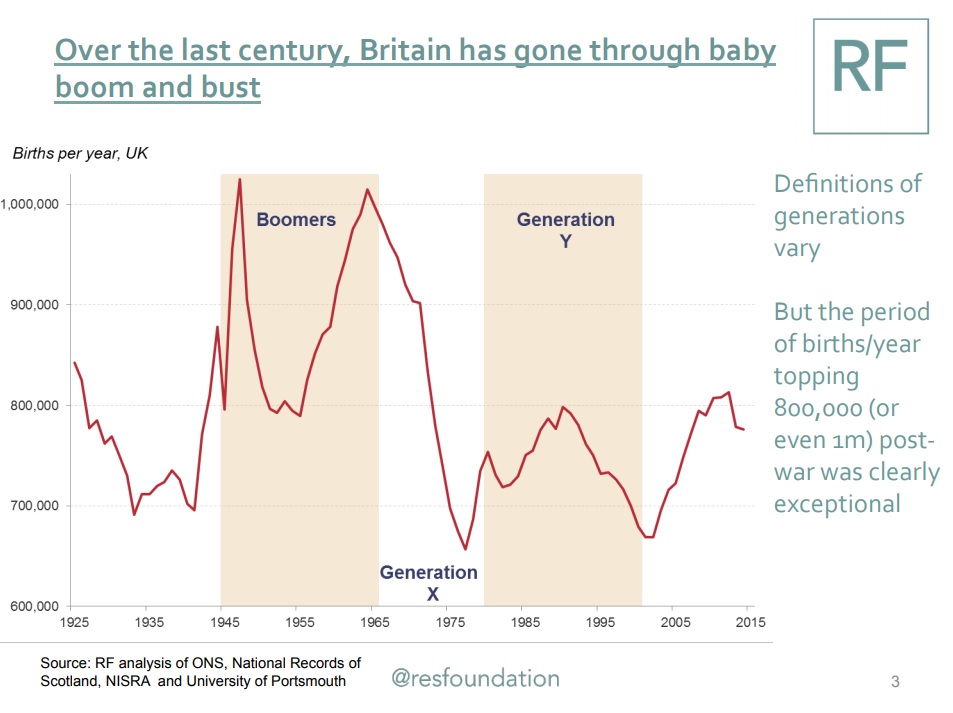

Also, as opposed to 2008, we're a decade further into the demographic turn as the boomers start to draw down on their accumulated wealth, including their housing wealth (the UK baby boom has two peaks, the middle of the entire cohort is, obvs, between those peaks at about 1955, turning 63 this year. The first peak are about 70 today).

Great post... But raises a different question. Obviously the cohort trying to downsize would be competing with the FTBers. Will that have a direct impact on prices of entry level homes?(hate to use the word ladder). Would the volume be sufficient enough to keep the wheel spinning?

-

17 minutes ago, Si1 said:

Surely not. But but former BoE committee member David Miles came up with somebody else's limited model results and proved that house prices should hit 15x earnings.

The yoof clearly need government props to help buy now whilst prices are still clearly affordable.

Yes..no doubt the prices are affordable. If thier model is any good, I am betting on Organ trading to be legal as most millennials have to sell organs to get on to the so called ladder.

-

Annual house price growth slows to 2.1%, from 2.9% in July

Modest 0.1% fall month-on-month

Stamp duty revenues rise to new highs

Lol...

http://www.nationwide.co.uk/~/media/MainSite/documents/about/house-price-index/2017/Aug_2017.pdf

-

-

14 minutes ago, rantnrave said:

A fall as per usual in the summer:

Mid-country hot-spots enjoy mini-boom in annual price growth

- Holiday season casts its usual shadow with price of property coming to market falling by 0.9% (-£2,758) this month

- Climate of stretched affordability and clouded political outlook continue to chill the annual rate of increase to a national average of just +3.1%

- Of the English counties exceeding the 3.1% average annual rise, over half are in the buoyant mid-regions of the country in contrast to only a quarter in the north and just a fifth in the south

- Eight counties are enjoying a mini-boom, with year-on-year rises of over twice the pace of the national average, and they are all in the middle band of the country

- Top three hottest markets: Northamptonshire (+9.1%), Derbyshire (+7.9%) and Norfolk (+7.4%)

There's some regional reports here too:

The big question of the hour is "Where is @TheCountOfNowhere"?

-

7 minutes ago, Lavalas said:

Ros Beck and Theresa May

https://m.facebook.com/groups/371572042862286?view=permalink&id=1648394658513345

Urgh

The issue HAS been bought to my attention from the politician translates to get yourself a better job. May can use Bland's dead horse meme.

-

-

7 hours ago, Wayward said:

This is all great for sentiment...but I will only celebrate when I see a change in my local market. mate just sold his house in a couple of days at new high at more than asking price...HPI 'business at usual' here in mid Hampshire I am afraid...I am keeping the faith but it is hard.

Ha.. I am seeing some changes in Reading. Chain's are breaking.

-

49 minutes ago, Habitationi Bulla said:

Fergus will have to start eating more of his houses to hide them, But failing that surely he is screwed in the next year????

Or is it a case if you own a few BTL mortgages you've got a problem, if you own 1000 the banks got a problem.

Nope... The bond holder has got the problem . It may very well be a bank.

-

18 minutes ago, Option5 said:

Nah, It's leasehold

Good.. to get in now.. you will get compensation. The new PPI. Free money

-

6 hours ago, spyguy said:

25k-35k (Losing tax credits).

Much more substantial than child benefit.

25k-35k is about 24%

So we have a whopping 85% of BTL properties will be affected by S24.

-

56 minutes ago, Bland Unsight said:

Making no apologies for repeating my own rubbish 'jokes' the problem with public domain data on BTL is that there is no decent public domain data on BTL.

Interesting rule of thumb analysis hi5lo5 and a sensible way of trying to extract some rule of thumb insight from the public domain data that does exist. Thanks for posting.

Worth noting that (as best as I understand matters) the Paragon SPVs are bells and whistles bankruptcy remote from Paragon; it's the people who bought the RMBS who carry the risk and should the SPVs fail it's the lenders to the SPVs (i.e. the RMBS bondholders) who will take the losses. Also worth bearing in mind that the Paragon portfolio is mostly likely unrepresentative in two ways compared to the average UK BTL mortgage. Firstly, the underwriting is probably a bit stricter (lower LTVs, higher ICRs) but also the concentration of the BTL Masters of the Universe (the 10+ portfolio guys) is probably greater in the Paragon book than it is in the stock of BTL mortgages as a whole. Taking on board those two points I think the merit of the rule of thumb analysis here is strengthened a little; the borrowers captured by these RMBS investor reports are, I would guess, more likely to be paying tax at 40% under Section 24 than the typical BTL landlord because they are more likely to be a portfolio landlord than someone drawn at random from, say, the Lloyds Bank BM Solutions book.

Been a while since I looked at one of these investor reports but IIRC some of them (all of them?) also report the pay rate on the loan book which will give you a feel for how many of these mortgages are stuck on bonkers late boom base rate plus bugger all tracker deals and how many have reverted to an SVR type rate.

Since the 2007 crash no one sells CDS for the RMBS. However all RMBS have class of shares and the junior most class(approx 5%) is subscribed by the SPV creator, the bank. Payout happens top to bottom and the event of default the junior class subscribers take the hit.

Lloyd's RMBS is tricky, because they securitize the these BTL loans along with the OO loans. Let me see if I can get Loan level data for those.

Unfortunately paragon doesn't report income data on the loan file. The income segmentation posted earlier comes from a building society RMBS, which I believe a close representation of a typical BTLers.

SVR is another variable that works against these idiots. If you look at the latest loan file of no.24 you can see that most of the loans reverting to SVR with in the next 6 months period.

-

20 hours ago, jiltedjen said:

First get everyone in a froth about stamp duty, really ratchet it up. Lots of news stories.

followed swiftly by capital gains on all houses, main residence or not. Grab the olds gains and a higher level than stamp duty costs.

There's gold in those hills.I agree. In the current political situation there is no way the Tories can remove SDLT, as this is will be seen as giving tax break for rich and also Treasury will find it hard with the shortfall. Thier only option now is either LVT which they don't have balls or CGT on all residence, again a vote losing policy.

-

20 minutes ago, Houdini said:

That's irrelevant as your typical btler won't know about S24 until they fill in their 2017-18 tax return in September 2018...

HMRC published a new form to capture rental income details for last year which BTlers will be filling next month. Anyone with half a brain would start wondering why HMRC is asking for these details.

The above breakdown was taken out from one the loan level data submitted to BOE . I was trying to gauge the level of damage S24 would do to wider market.

-

1 hour ago, spyguy said:

You cant really, without knowing about the distribution of mortgage holders tax position.

And I mean that as a BTL loan is much more risky post S24.

Btl is one ignored risk after another.

The original risk was made up rental values and ignored void periods. Never came up, just OOh, itll rent for 800/m on an EAs sayso.. Come 2007 and voids and non paying tenants go off the scale.

Now youve the big unknown of increasing tax liabilities.

Yes the tax position of the LL is missing. However I found the individual declared income in other RMBS. Here is the rough numbers.

>120k = 8%

100 - 120k = 3%( Loosing personal allowance)

60 - 100k = 15%

50 - 60k = 8% (Loosing child Benefit)

45 - 50k = 6%

35 - 45K = 21% (61% of BTL pushed to higher rates)

-

OK people... here is something for number crunchers

Especially @Bland Unsight @spyguy

I have been lately looking in to the RMBS.The uncrowned king of BTL lending "paragon" has a series of Bonds, you can access them here.

http://www.paragon-group.co.uk/investors/bond-investor-reporting

Here is what I found with my non existent excel skills. I wasn't sure to try this yet. I took the entire portfolio at the face value and tried to apple S24 rules and came up with the below figures. I know the error rate is high for cumulative sum. The model is simple

2016/2017 (Declared annual gross rental income - 10% ) - (Monthly Interest paid X 12) = profit

2017/2018 onwards Applied S24 on the Mortgage Interest paid. The loan level details are great if you want to run some numbers. There are couple of East midlands LL's with portfolio of 76 and 42. I presume one of them is Landlord whisperer.

Series 23 with 1729 mortgages , Gross yield : 5.99%, Net yield pre S24 is 1.74% post S24 0.86%

Num mortgages 1729 Total value 380,360,000.00 Mortgage 189,028,000.00 Monthly Yearly Rent collected 1,899,750.00 22,797,000.00 Interest paid 1,156,805.00 13,881,660.00 Post expenses -10% 1,709,775.00 20,517,300.00 Average Tax rate 30% 2016/2017 552,970.00 6,635,640.00 2017/2018 358,158.88 4,297,906.50 2018/2019 329,238.75 3,950,865.00 2019/2020 300,318.63 3,603,823.50 2020/2021 271,398.50 3,256,782.00 Series 24 is the latest

Num mortgages 1964 Total value 461,189,000.00 Mortgage 287,676,000.00 Monthly Yearly Rent collected 2,055,333.33 24,664,000.00 Interest paid 1,243,200.00 14,918,400.00 Post expenses -10% 1,849,800.00 22,197,600.00 Average Tax rate 30% 2016/2017 606,600.00 7,279,200.00 2017/2018 393,540.00 4,722,480.00 2018/2019 362,460.00 4,349,520.00 2019/2020 331,380.00 3,976,560.00 2020/2021 300,300.00 3,603,600.00 -

11 minutes ago, suresh786 said:

He and Labour had nothing to do? Morons.

Bang! RM -1.2% MoM, and London down the most in a decade

in House prices and the economy

Posted · Edited by hi5lo5

Spot on...

Here is the snap shot of TFS drawings as of 30 /Jun/ 2017. The items in bold has strong exposure to the BTL lending and their 0% on capital money is coming to end. The banks have to bear a cost usually around 1% to raise the capital. Ironically the TFS ending just before the end of 2 year fixes of mad gainz muppets who doubled down on Mar 2016. Now they will find themselves in between the rock and hard place. They can't move to a another lender as most will fail the PRA requirements. The current lenders is not in a position to offer the ultra low IR to keep the yield above zero. And don't forget the tax bill.

Aldermore : 946 million

Precise mortgages : 878 m

Coventry Building Society : 1 billion

Leeds Building Society : 650 million

LLoyds : 13 billion

Nationwide : 7.7 billion

Newcastle Building society : 146 mi

Nottingham building society : 275 mi

One Savings bank : 551 mi

Paragon Bank : 450 mi

Principality Building society : 400 mi

Paragon : 450 mi

RBS : 13 billion

Santander 7.5 b

Shawbrook bank : 510 mi

Skipton : 800 mi

Tesco : 800 mi

TSB : 4.5 b

Virgin : 4.9 bi

Westbrom : 256 mi