-

Posts

519 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by hi5lo5

-

-

https://www.property118.com/landlords-union-slams-bbc-panorama-report/

Academic researcher and Landlord's opinion on BBC - No fault eviction episode.

-

https://www.mumsnet.com/Talk/property/3174006-House-valuation-help-please

Reality kicks in.

House valued at 450k in Aug 2017. Out on at 440k. Few viewings. Reduced to 415k after 12 weeks, end of Oct. Had about 6 viewings since but no offers. Phoned agent yesterday and asked bluntly, what price will we sell it at. Answer, try from £350/375k! Person from the same estate agency that originally suggested marketing it at 450k, with a view to attaining 425k.

I am dumbfounded, speechless, upset and frustrated. Our future projections were based around 400k minimum.

If you have experience of this industry, please can you comment as to how ludicrous you find this (or not!)

Thank you.450k - 350k in a year.

-

24 minutes ago, spyguy said:

And ...

If home ownership by the under 45 ha coolpased then home sales by the over 45 has collapsed too.

You really have to be careful hat UK housing becomes priceless - in the worse meaning of the word.

Isn't it the motive of any govt is to keep those prices up and eventually trigger some kind of tax(CGT/ IHT) on the unearned income?

-

https://www.propertytribes.com/re-mortgage-rate-offered-is-not-good-t-127633014.html

QuoteI currently own 6 BTLs and I want to re-mortgage just one of them.

However, the financial adviser I contacted suggested that I would get a much better rate if I re-financed my whole portfolio. The best rate he has found is 3.59% for a 5-year fixed term and extortionate fees to re-mortgage one property. I'm wondering if I should wait a while to see if lenders become more flexible.

I want to re-mortgage just one property that is currently with MX. He also mentioned that rents on a couple of my other properties are under market value so that may be an issue even though it doesn't apply to the property I want to re-finance.Has anyone else encountered similar problems? I thought this would be a great time to get a good rate but the opposite seems to be true.

Finally the PRA changes are having an effect on the leveraged muppets. End of TFS will push the rates further soon.

-

2 minutes ago, TonyJ said:

Even if a seller of a house down the road is forced to sell for a much lower price, don't you think a lot of other people will carry on telling themselves it was an anomaly that it doesn't apply to them? Some people will even tell themselves that their house is worth a LOT more than the similar one down the road because of something inconsequential like the 'beautiful' Dulux colours they chose.

Absolutely, these people can tell what they want. All along the accuracy of their house price prediction has been supported by lower IR rates, reckless govt policies and stupid monetary policies. None of the factors are going to support their theory in the near future. It will take a while for them to observe the shock when they see the valuation report whilst remortgaging.

-

29 minutes ago, TonyJ said:

Sounds pretty typical of the current market. But their monthly repayments are easy, so they are probably thinking there's no point in selling for anything less than the value a lottery win, if they don't have to.

Yes they don't need to sell as long as they meet their monthly repayments and keep the LTV, until a someone down the road forced to sell down the road on a lower price. You mentioned current market, But the market is dead at these prices. Anyways, its all about sentiment and the houses are not selling like unicorn poop.

-

https://www.mumsnet.com/Talk/property/3159713-Estate-Agent-lied-about-the-viewings

QuoteWe put our property in the market 2 weeks ago with the local estate agent and they set an open house date for last weekend. I called on Friday to check if everything is in place for the open house and was told that there are 3 viewers coming for the open house for viewing.

Finally on Saturday, the estate agent arrived and we went out, as the open house was only for 1hr, we were sitting in our car next few houses away for about 20mins. What we saw was that no viewers turned up for the viewing and the estate agent also locked the house and left in 20mins. -

8 hours ago, spyguy said:

SVR for BTL mortgages will be over 8% soon.

The current SVR offered by lenders are in the range of 4.5% - 5.99%. Most borrowers are able to service thier debt just because they are in a 2 year fixed discounted rate offered as low as 2.25% for a 75% LTV. My point is the 2.25% is offered all along, due to free money tap opened by BoE. To pay back the money to the BoE the banks has to raise capital elsewhere and there will be a cost. The minimum I suspect would be around 1.25 %(0.5% + LIBOR ).

-

4 hours ago, Longtermrenter said:

Great, judge not happy with no show, didn't even send a proper solicitor, just made himself look like a bigger prat than he already is.

Probably he doesn't have enough money to hire a decent lawyer.

-

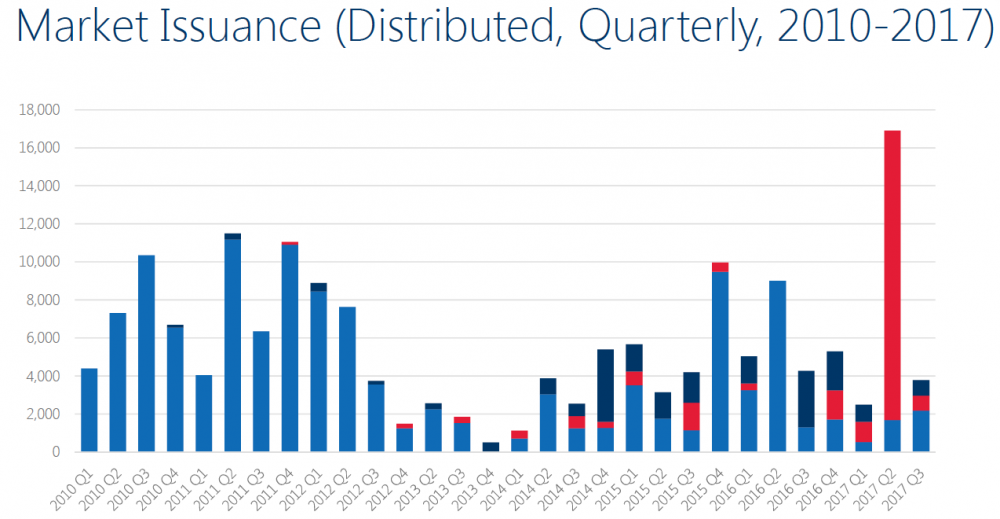

The scheduled payments have a direct impact on the securitization market. On Q2 17 there was a boat loads of BTL deals were issued by so called Challenger banks to meet the Q4 17 spike.

Up until now, these FLS repayments were done using the TFS drawings. When the TFS taps dries, issuance of RMBS starts to accelerate.

When there is a larger pool of new bonds, coupon payments is the key factor to attract the investors. A higher cost means the borrowers have to pay for it.

The beauty of it is most SE/ London BTL mortgages will not pass the new ICR test with a different lender. Those muppets will be mortgage prisoners with the existing lenders and the lenders can dictate the terms and may even force the borrowers to the SVR. Imagine a property bought in the peak of BTL lending at a teaser IO mortage of sub 2% would be pushed into a SVR of just over 5%. Along with this S24 will come in to play. Bring it on.

TL;DR. Banks need to raise funds from bonds and savers to meet the capital requirements whilst paying the BOE or they pay a LIBOR rate + some% to the BOE. This cost has to passed on to the borrowers. Without a base rate hike, the teaser discount rates will start disappearing.

-

49 minutes ago, Ah-so said:

Guy I know settled for over £70k with HMRC due to undeclared BTL income. Plenty have been drawing a healthy income.

Until HMRC finds out.

-

https://www.propertytribes.com/btl-where-figures-dont-stack-help-t-127632778.html

This is the one of the days many in this forum have been waiting for it. PRA is doing the magic.

Hi all,

I'm hoping someone may be able to offer some advice on this please.... We've seen a house in a particular area we'd like to buy as a long term investment where (unusually) we are not bothered about making a return as our intention would be to rent it to a family member at a slightly less than market rent so they can rent it for as long as they want and have complete surety of tenure. House is a 3 bed for around £260k and we'd be looking for a 75% LTV mortgage of £195k, although a LTV of 80% would be preferable..

My usual broker has come up with a TMW product which is a no fee five yr fix at 3.09% which would be easily affordable at £502pcm. As we have quite a few BTL mortgages TMW is possibly the only lender we can consider unless someone knows differently?

But, according to TMW criteria the minimum rent would have to be £195k x 5% x 1.45 = £14,137/yr or £1178pcm and the true market rent would probably be around £950pcm max. Therefore, assuming they do their due diligence and check on the rent returns for that area it seems likely that the maximum loan we would be able to borrow on that property would be around £160k which would mean us putting down £100k which is more than we either want to or can afford. Annoyingly, apparently if we were newbie LL's the factor TMW would apply would be £195k x 5% x 1.25 = £12187/yr or £1015pcm - this seems to me to be to be the wrong way round as we are therefore being penalised for being more experienced?

Can anybody think of another way we might be able to finance this or another lender who may be prepared to lend to us without such a high rent required?

Your input, as always will be appreciated - thanks.

-

4 hours ago, Beary McBearface said:

Not as a side note and directed not generally but specifically at you, TryingToWin - you're either lying by omission or just making stuff up (I still favour the latter view).

If he was adding a fourth property then he'd trip up on the portfolio lending rules in PRA SS13/16 and he wouldn't have access to the 1.79% rate you mentioned in your earlier post. Further, these ultra-low rate fixed rate deals currently in the market are not for incorporated BTL. 'Company' BTL rates from Paragon, who are hoovering up lots of this business, are more like 3.5%. Hence your earlier claim is guaranteed to be total nonsense unless your imaginary friend is applying for the new mortgage fraudulently. Anyway you choose to cut it, you're trolling.

You don't know enough to troll with any skill so give it a rest. I recommend that you quit posting as TryingToTroll, sorry, TryingToWin, read the forum more carefully for a while so that as you learn a little more you'll develop the knowledge you need to troll more competently and in about 6 months time sign up under a new name and try again.

Typical BTLer calculation. Trying to tell the world about how wise they are by investing in property. @TryingToWin your mate paid SDLT of £22k? How long you have to hold the property to get back the investment?

-

2 hours ago, Houdini said:

So btl loans are heading towards paragon and other second tier banks all of whom can just be closed down when they go belly up.

Paragon's Aggregate outstanding TFS drawings as at 30/09/2017 is £700 million.

-

http://forums.moneysavingexpert.com/showthread.php?t=5779893

Hi Everyone,

The question might be obvious to some of you but i couldn't find the information online. I have called HMRC a number of times and their line is always busy. I own a lease hold property which has been rented out to produce some income since 2016 April. So I need to pay rental income tax between 01/04/2016 - 31/03/2017.

I am filling my selfaccessment form at the moment and would like to know what can be included as rental income deduction/relief for tax payment purpose. I listed the items i know:- service charge, lease hold

- ground rent, lease hold

- Mortgage - interest only

- Any agency fee related, as it is managed by an agency.

I am currently renting a place to live in another city (other than the city where my owned property is). Can my monthly rental payment to another landlord be used to deduct my rental income?

I need to work out all expenses to see if it is more than £7500 to decide if I need to use rent-a-room scheme.

Thanks eveyrone in advance!

Dawei -

Forget about everything else. If your mate is higher rate payer, he will recover the fee he paid for SDLT(22k) in just under 4 years.

Indeed very sound investment.

If there is a correction in house price and can't meet the lenders requirement for a discounted rate( there won't be many if the TFS ends in Feb 2018) then good luck with a profit if 2k per year it will take 11 years to recover the SDLT.

-

4 hours ago, Mrs Bear said:

Just checked daughter's area again - OX3 - several empty HMOs just on the first page of zoopla.

Courtesy of their 'most reduced' feature, how about this? A 5 bed in fairly central Headington, originally on for £745k in Jul 2017, now 'offers over' £599,999!

Last sale, Aug 1999, £98,500! Methinks owner can afford to drop quite a bit more...

@30k annual rent you will be lucky to get 320k mortgage under PRA rules. So the price is max of £400k.

-

http://forums.moneysavingexpert.com/showthread.php?t=5776199

NHS worker MEWed £20k to "invest" in BTL. You can't go wrong on bricks. Can you?

-

Above two charts explains when and how the banks are planning to start the repayments on the helicopter money they received from BOE. By the looks of it the banks are offloading the BTL loans from thier book. Apr 2018 is critical for the BTL borrowers and lenders. The wiser LLs are remortgaging now to secure the sub 3% fixed for the next two years. However, there will be busy bond market for the rest of the year and the bond investors will start look at the Debt service ratio and price in the risk of tax implications. Suddenly all the BTL pools will be rated lower than AAA and returns has to match the risk.

There will be three way pressure on the banks. One side the banks will loose free flow of capital by end of Feb. On the other side the investors are ditching the bonds and borrowers are at the risk of default due to tax changes. The only way to come out of it is to keep more of thier loan pull in SVR or increase the cost of borrowing.

Wen need to remember that the PRA rules doesn't apply for remortgaging with the existing lender. What it means for the borrowers? The banks can refuse to remortgage applications and force the in to SVR or foreclosure. Double whammy for the borrowers, higher cost means higher tax bill and Lowe profit combined with falling prices.

-

Post belongs to Wrong thread moved to the right thread.

-

45 minutes ago, Smiley George said:

He's another conservative HPI stooge, who is so far out of touch with the current situation its not even funny. If he thinks £420k is an acceptable level for FTB average house price, then he is an idiot ...I wonder what it was when he bought a house?

Oh and he also didn't support the petition which Generation Rent created a couple of years ago on banning letting fees, his response is below, don't expect any HPC measures from this fool!

Good afternoon,

Thank you for contacting me about letting agent fees. I appreciate your concerns.

The government is committed to promoting a strong and thriving professional rented sector where tenants enjoy decent standards and receive a service that represents value for money.

The government does not believe that a blanket ban or cap on letting agent fees is the answer to tackling the rogue letting agents who exploit their customers by imposing inflated fees for their services. The government is committed to promoting a strong and thriving professional rented sector where tenants enjoy decent standards and receive a service that represents value for money. The evidence from Scotland, where letting agent fees have been banned, suggests the ban has led to higher rents.

The vast majority of letting agents provide a good service to tenants and landlords, and most fees charged reflect genuine business costs. However, the government has taken action to ensure full transparency of fees. Since 2015, letting agents and property managers have been required to display a full tariff of their fees prominently in their offices and on their websites, with a fine of up to £5,000 if they fail to comply. Such transparency will help to deter double charging by letting agents and enable both tenants and landlords to shop around, encouraging agents to offer competitive fees.

The government is currently reviewing whether to make client money protection mandatory for lettings agents and is committed to a wider review later this year to investigate the effectiveness of transparency measures and will consider whether more action needs to be taken. I hope this provides you with a degree of reassurance. I am afraid I do not, generally, sign EDM’s as they are expensive to administer and achieve little in practice.Infact people received similar response from then housing minister, Gavin Barewell just before the letting fees ban was announced. It doesn't matter how the minister think and view the current housing crisis. The more resistance for an HPC from them will have negative effect in thier own career. Joe public is coming to senses and their political career is hanging on balance. For example his predecessor Alok Sharma another NIMBY like Raab may not retain his safe Tory seat(Reading West) as it stands today. "Forever HPI" engraved on the walls of Westminster is starts to fade away for the Tory politicians eyes.

-

22 hours ago, houseface2000 said:

The banks can draw down all that extra cash injected into the Term for funding scheme and hold it. This will see them been able to offer cheap mortages for another 12-18 months. I imagine more brexit wobbles will make the bank come up with some other lending scheme at 0.1% even if rates go to 3%

The draw down period ends on 28th Feb 2018. Mostly building societies and Challenger banks actively participating in the scheme. Once the influx of free money stops they will be forced to look for funding to meet the capital requirements, this will lead to new worthless BTL RMBS's flooding the market.

-

3 minutes ago, iamnumerate said:

Did you see this bit

I am not quite sure how, if a LL owns a home he will rent it out to a tenant if it is repossessed someone else or the tenant will buy it.

They always think that the house will disappear when they sell it.

-

22 hours ago, spyguy said:

Small regional building society messing around in the wholesale market... full of high trained advisors cum sharks.... what could go wrong ??

The latest 18 months time 4.4k loan pool to 3.5k pool

and then the https://www.coventrybuildingsociety.co.uk/consumer/our-performance/treasury-services/mercia-no1-rmbs/agree.html

This deal is bit old.

Btl Scum Regrouping And On The Offensive. -- Merged

in House prices and the economy

Posted

I thought the HPC crowd is only 3 dozen numb skull anarchists. If he sees a noticeable traffic from hpc its because either poverty latter has a traffic in the range of low hundreds or there are so many people in this forum.