-

Posts

1,086 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Asheron

-

-

The main worry is that if silver does go up in price,ebay is the only outlet where you can sell it at a decent price.

I am currently selling all of my .999 silver and I am buying .925 sterling scrap silver as it is less hassle to sell.

I have reported people to ebay for selling fakes but they are not interested.

You are selling .999 silver for .925?

I don't see how that is a good idea?

-

“There is hardly an issue about which Germans as so united as they are by their desire to see America on its knees. It unites both the left and the right. Wherever they look, they see decay, a lack of culture and ignorance. “A perverse mixture of irresponsibility, greed, and religious zealotry”.

With a bit of luck, the specter across the Atlantic might even take care of itself. It can’t be ruled out.

When they are not shooting each other or being fried by dangling power lines then the Americans might simply pop. Two out of every three US citizens are overweight, or even obese! Every child in Germany knows the numbers.

For the über-watchful among us, the signs of the downfall are obvious. One must only take a look at the condition of the streets (every fourth bridge is crumbling!), or the entirely outdated power grid, to come to the conclusion that this country has its future behind it. A nation that has its utility lines hanging from poles in the street, instead of burying them in an orderly fashion underground, cannot really be taken seriously.

-

After being capped overnight during London trading at $1730 and $32.50, gold & silver have just been smacked down to pre-Obama victory levels of $31.50 and $1712.

View this morning’s weakness as a gift from the cartel, as both metals will be heading exponentially higher over the medium-long term as the Fed’s QE∞ policy has been rubber stamped by an American public re-electing Barack Obama.

Guns, ammo, and gold and silver sales have exploded throughout the country this morning in response to the election results as Americans contemplate another 4 years of an Obama Presidency with no concern for any voter approval.

As such, this morning’s weakness is a welcomed gift to PM stackers, and should be responded to professionally by STACKING THE SMACK!!!

Once again, $31.50 has held as support for silver:

While the cartel would like nothing more than to see gold stuffed back below $1700, they have their work cut out for them as $1700 is now strong support:

-

Gold prices have hit their highest level in two and a half weeks on the news that Obama has won a second term in the White House, and are heading for the longest positive streak in more than two months.

The precious metal soared to around $1,729 an ounce, its highest level since Oct 23. U.S. gold for December rose $3.70 to $1,718.70 an ounce.

Late Tuesday night, gold prices jumped up by $30 a troy ounce, and then increased even more as it became apparent that Mitt Romney had failed to defeat the incumbent president.

In total, gold prices are up $54, or 3.2 per cent, since the beginning of the week. They reached a high of $1,731.40 an ounce on Wednesday morning, before dropping back slightly.

Earlier this month gold reached an 11-month high above $1,795 an ounce, following the Federal Reserve’s announcement that it would commence a third round of so-called “quantitative easing.”

With control of the Senate remaining with the Democrats and control of the House staying with Republicans, the phony left/right political status quo has been maintained, meaning that gold is likely to make significant gains.

“Nothing will change with regard to the ultra-loose monetary policy of the Fed,” Commerzbank analyst Daniel Briesemann said.

The Fed announced two weeks ago that it planned to maintain $40 billion in monthly purchases of mortgage debt and to hold interest rates near zero until mid-2015.

The political dog and pony standoff between the Republicrats and the Democans means that averting some $600 billion in tax increases and spending cuts now also seems unlikely, leading many to warn of a “fiscal cliff” looming for the US economy.

Gold prices more than doubled during Obama’s first term in office. Experts believe the precious metal could make significant gains over the coming weeks and months.

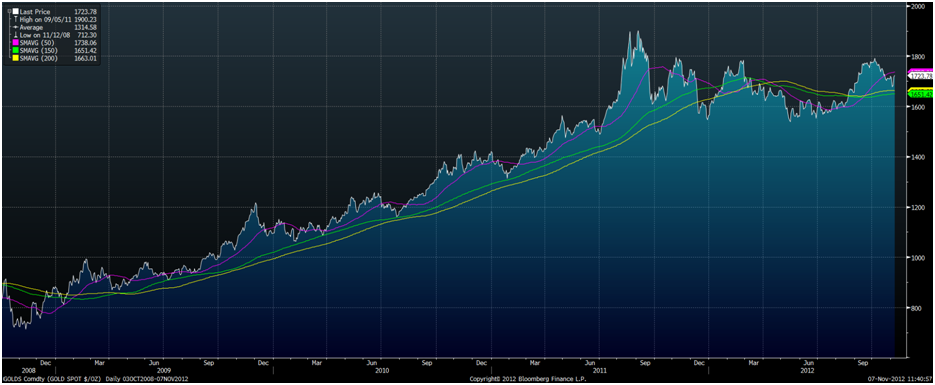

Gold in USD – Gold’s Performance in the First 4 Years of Obama’s Presidency

“The political gridlock in Washington has not gone away following the election, and this uncertainty has the potential of supporting the [precious] metals.” said Ole Hansen, head of commodity strategy at Saxo Bank.

Bayram Dincer of LGT Capital Management said that no change in loose Federal Reserve policy could see gold reach $1,800 an ounce by the end of 2012 and $1,900 by the end of the first half of 2013.

“We will see a continuation of the loose monetary policies pursued by the Fed and Chairman Bernanke, for the foreseeable future. Low interest rates and more quantitative easing all add up to favourable metal prices,” added David Govett, head of precious metals at Marex Spectron.

“The outcome of the U.S. election increases the probability that the ultra-expansionary monetary and fiscal policy will continue, which puts pressure on the U.S. dollar and gives buoyancy to commodity prices,” Eugen Weinberg, head of commodities research at Commerzbank also said today in a report.

Copper and silver also made gains on the Obama win, as did stocks and US Treasurys.

Written By: Steve Watson

Sources:

Reuters

Financial Times

Bloomberg

-

For a goldbug or silverfish, who also has an interest in and means to investing in Earth, there are many things to consider in regards to buying land. One of the first things many consider is whether or not to buy in the US or outside. For the purposes of this article, we will focus on real estate in the US. How we will judge its value is its proximity to active or potentially active silver mines.

http://silvervigilante.com/buying-real-estate-in-the-us-with-silver-in-mind/

-

Are Central Banks Overstating their Gold Holdings?

Romania has demanded for many years that Russia return its gold.

Last year, Venezuela demanded the return of 90 tons of gold from the Bank of England.

As everyone knows, the German high court ruled that Germany must audit its gold reserves held in foreign countries such as the U.S., England and France. And German inspectors will actually travel to the New York Federal Reserve Bank’s gold depository and the Bank of England to inspect their gold.

Germany will also repatriate 150 tons of gold in order to test it for purity.

Germany’s not the only country. As Zero Hedge notes (quoting Bloomberg):

Ecuador’s government wants the nation’s banks to repatriate about one third of their foreign holdings to support national growth, the head of the country’s tax agency said.

Carlos Carrasco, director of the tax agency known as the SRI, said today that Ecuador’s lenders could repatriate about $1.7 billion and still fulfill obligations to international clients. Carrasco spoke at a congressional hearing in Quito on a government proposal to raise taxes on banks to finance cash subsidies to the South American nation’s poor.

Some people in the Netherlands want their gold back as well.

Jim Willie says that the gold is gone.

The fact that CNBC head editor John Carney is arguing that it doesn’t matter whether or not the Fed has the gold does not exactly inspire confidence.

Gerald Celente notes:

It’s not only Germany (who’s gold is missing), it’s the United Sates, it’s all of the countries. Nobody knows what’s in Fort Knox. They won’t let anybody in. Where’s the gold in the United States? How come we can’t go in and look in Fort Knox?

How come the people can’t have a reading? How come we can’t look at it? How come politicians can’t get in there? How come no one can get in there? The gold does not exist. All this does is confirm what so many of us already know, “The Emperor has no gold.”

Egon von Greyerz – founder and managing partner at Matterhorn Asset Management – agrees:

There probably isn’t anywhere near the central bank gold (governments claim they possess).

Ron Paul has called for an audit of Fort Knox, based upon the suspicion by many that the gold was sold off years ago:

-

I love this video of Max Keiser

-

I originally thought Max Keiser had come to London as a Safe Haven.

Not for a front row seat

-

The real conclusion that must be internalized is that, while buying precious metals and other tangible assets can be an excellent way of exiting the fiat currency paradigm, we mustn’t forget that central bankers own the world’s gold. They have been in a position to accumulate for centuries, and through conniving and contrivance have ensured that their stashes are the biggest on the planet.

-

What about a Tax on having a second child?

It's coming.

-

Daily mail put I thought it was worth a link

How about we Quit the E.U dictatorship?

-

I just don't understand how anyone can get things like that approved by the council ? It's just weird.

-

Why would you hold silver?

#bonkers

What do you suggest ?

-

According to NetDania’s volume (which approximates volume from 5 separate sources and is not an exact indicator of volume data) 38,400 contracts, or 191.99 million ounces of paper silver (nearly a quarter of annual global silver production!) were dumped on the market in only 10 minutes between 8:30 and 8:40am EST upon the release of the NFP data.

-

No it's because houses are too expensive and no-one can sell their current house.

I know 4 people who have all had their houses on the market for over 1 year.

That's a lot of people considering I don't have a lot of friends

lol

lol -

Imagine you’re a businessman in Xian who needs some silly permit, and you have to grease a local bureaucrat. It would be untoward to deliver a suitcase full of cash… especially these days with all the internal scrutiny from the Bo Xilai incident.

So now what business people seem to be doing is minting solid gold business cards. When they want to bribe an official, they schedule a meeting, and hand them a business card or six. It’s so innocuous, nobody really notices.

For the bureaucrat, it’s much simpler to travel with a few ‘gold cards’ than cash. And Hong Kong is an easy place to store a collection of such cards… or even melt them down into other forms.

http://www.sovereignman.com/expat/gold-cards-are-the-new-bribe-in-china-9379/#ixzz2AstZuDfm

-

Crushed by financial sanctions and needing real money (gold) in order to purchase food and necessities, Iran yesterday banned the export of gold and gold coins from the country without a special license from the Iranian Central Bank.

The Iranian Customs department blamed the export ban on extreme fluctuations in Iran’s markets (i.e. hyperinflation of the Rial).

Any Iranians planning on fleeing the nation ahead of a Western attack with REAL NON HYPER-DEFLATING WEALTH better have held it in silver.

Iran has prohibited exports of gold and golden coins from the country, without the license issued by country’s Central Bank, Mehr reported.

http://www.silverdoctors.com/iran-prohibits-exports-of-gold-without-central-banks-license/

-

One week ago, when we reported the news that the Bundesbank had secretly pulled two thirds of its gold from London years ago, we said the following:

... Germany has done nothing wrong! It simply demanded a reclamation of what is rightfully Germany's to demand.

And here is the crux of the issue: in a globalized system, in which every sovereign is increasingly subjugated to the credit-creating power of the globalized "whole", one must leave all thoughts of sovereign independence at the door and embrace the "new world order." After all this is the only way that the globalized system can create the shadow cloud of infinite repoable liabilities, in which we currently all float light as a binary feather, which permits instantaeous capital flows and monetary fungibility, and which guarantees that there will be no sovereign bond issue failure as long as nobody dares to defect from the system in which all collateral is cross pledge and ultra-rehypothecated... for the greater good. Until the Buba secretly defected that is.

And this is the whole story. Because by doing what it has every right to do, the German Central Bank implicitly broke the cardinal rule of true modern monetary system (never to be confused with that socialist acronym fad MMT, MMR or some such comparable mumbo-jumbo). And the rule is that a sovereign can never put its own people above the global corporatist-cum-banking oligarchy, which needs to have access to all hard (and otherwise) assets at any given moment, on a moment's notice, as the system's explicit leverage at last check inclusive of the nearly $1 quadrillion in derivatives, is about 20 times greater than global GDP. This also happens to be the reason why the entire world is always at most a few keystrokes away from a complete monetary (and trade) paralysis, as the Lehman aftermath and the Reserve Fund breaking the buck so aptly showed.

We are confident that little if anything will be made of the Buba's action, because dwelling on it too much may expose just who the first country will be (or already has been) when the tide finally breaks, and when it will be every sovereign for themselves. Because at that point, which will come eventually, not only Buba, but every other bank, corporation, and individual will scramble to recover their own gold located in some vault in London, New York, or Paris, or at your friendly bank vault down the street, and instead will merely find a recently emptied storage room with humorously written I.O.U. letters in the place of 1 kilo gold bricks

It appears that the story, which has refused to go away, was not covered sufficiently fast, and precisely the worst case scenario - at least for the "asset-lite" status quo - is slowly but surely starting to materialize. From Bloomberg:

Ecuador’s government wants the nation’s banks to repatriate about one third of their foreign holdings to support national growth, the head of the country’s tax agency said.

Carlos Carrasco, director of the tax agency known as the SRI, said today that Ecuador’s lenders could repatriate about $1.7 billion and still fulfill obligations to international clients. Carrasco spoke at a congressional hearing in Quito on a government proposal to raise taxes on banks to finance cash subsidies to the South American nation’s poor.

So yesterday: Germany... today: Ecuador... tomorrow: the World?

Because while Ecuador, with its 26.3 tonnes of gold, may be small in the grand scheme of gold things, all it takes is for more and more banks to join the bandwagon and demand delivery in kind from official repositories (i.e., New York and London), and the myth that is the overcollateralization of hard money by central banks will promptly come to an abrupt, bitter and, likely, quite violent end.

-

I am planning on getting a self-investment ISA as I am sick to the teeth of low interest rate standard crap.

I wondered if anyone on here has any advice for a budding investor with regards to commodities and ETFs? I am particularly interested in commodities as I feel less afraid of them when compared to equities. I am considering going long gold, silver and natural gas and possibly shorting copper. What pitfalls should I avoid? Would I be better off buying some nice preference shares and chillaxing?

In general I would be interested in hearing how other small investors have planned their own ISAs in terms of allocation of funds and strategy.

Thanks in advance.

Sugar

-

Growth restored, all is well, printers have the weekend off.

********

This is Bull-Sh*t

-

Romania wants its gold treasure back from Russia, a recent Bullion Street article says. It’s another signal of the accelerating trend of countries to repatriate their gold—and another indication that the tide is turning toward gold and silver.

-

In his latest update, Greg Mannarino discusses the massive rise in commodities prices, and states that when the debt bubble finally bursts, commodities prices will skyrocket. Funds will pour from equities and bonds to the only safe havens remaining- commodities such as oil, gold, and silver.

Mannarino states that equities will deflate while commodities, particularly food will rise exponentially higher as fiat currency dies. Mannarino states that The Fed is in panic mode, and that Bernanke will begin QE4 before the end of the year. The coming free market correction will be devastating and shocking to average Americans as COMMODITIES GO TO THE MOON!

Investors must protect themselves by becoming their own Central Bank, and acquiring physical gold, silver, and long-term food supplies.

-

Today James Turk once again shocked King World News when he stated, “... in 1997 over (a stunning) 2,000 tons of gold moved out of Great Britain.” Turk added, “Now since Great Britain is not a gold miner, we know that gold had to come out of the Bank of England (where they store other countries gold), and it probably went into Zurich (Switzerland) for what’s called ‘leasing’ but I use the word ‘lending,’ or lending into the market.”

Turk added this stunning estimate, “At the time I had concluded that it was about 15,000 tons of gold which had actually been put into the market out of central bank vaults. This is approximately half of what central banks reported to own at the time.”

But first, here is what Turk had to say about his last interview titled, “The Entire German Gold Hoard Is Gone,” which has received an incredible amount of attention around the world: “Yes, it’s getting increasing attention, Eric, and rightly so. There has been a lot of deception about how much gold is really in central bank vaults.

The reason why there is this deception, if you look at a balance sheet of a central bank like the Bundesbank, Bank of Italy or the Bank of England, they basically say gold in the vault and gold out on loan, they show it as one line item. They call it, ‘gold and gold receivables.’

Anybody who understands generally accepted accounting principles knows that ‘cash’ is different from an ‘account receivable.’....

“But central banks ignore this reality of generally accepted accounting principles because the IMF allows them to perpetuate this deception.

So we don’t know how much gold is really in central bank vaults. But the general thinking from people who have looked into it is that it’s a lot less than what is presently reported. We actually know that the gold has moved out of central bank vaults. The Federal Reserve, up until recently, reported movements coming out of the Federal Reserve Bank of New York.

Back in 2003 I did a major report looking at customs information in Great Britain, and showed that in 1997 over (a stunning) 2,000 tons of gold moved out of Great Britain. It was gold being reported in a monetary form being moved out of Great Britain.

Now since Great Britain is not a gold miner, we know that gold had to come out of the Bank of England (where they store other countries gold), and it probably went into Zurich (Switzerland) for what’s called ‘leasing’ but I use the word ‘lending’ or lending into the market.

The gold is taken out of the vault, borrowed by bullion banks, and then gold fabricators melt it down, and disperse it throughout the globe in various forms of fabrication. It’s all documented and it’s a tremendous amount of gold. At the time I had concluded that it was about 15,000 tons of gold which had actually been put into the market out of central bank vaults. This is approximately half of what central banks reported to own at the time.”

-

Definitely a vote winner this one. Just what we need is another expense placed on the motorist. What with the high cost of petrol, parking charges road tax. No doubt it will ruin what is left of the economy. I don't know why I don't just go up to number 10 and hand them over my wallet. I agree that ht Tories are not a party of taxation. We just give it to their grabbing mates.

Why don't you buy an Electric Car ? the Toll roads are free if you have an electric car?

Stock Tips 11/11/12

in Investment in general

Posted · Edited by Asheron

Here are the most up to date stock tips I was sent. I don't own any of these personally...

As of the close Wednesday (7/11/12 )

We advise subscribers to consider the following LONG POSITIONS:

The first price is where we recommend buying, the second is the objective &

the third price is today's closing price.

Agnico Eagle...............(AEM)..............45.32.................79.00...................56.79

Goldcorp.......................(GG).................37.30.................64.00...................44.67

Newmont Mining...........(NEM).............47.20.................65.00....................48.74

Randgold.....................(GOLD)............120.09...............162.00.................112.78

Royal Gold....................(RGLD)..............89.94................121.00.................87.86

Buenaventura Mines......(BVN)..............39.65................52.00...................35.54

Freeport McMoran.........(FCX).............36.00.................58.00...................39.29

Pretium Resources........ (PVG)............15.29.................19.00...................13.31

Alexco Resources ..........(AXU)..........................................9.00....................3.91

Hellix Ventures..............(HLLXF)......................................3.00...............0.1700 cents

Abington Resources........(ABIZF)......................................1.00...............0.1300 cents

Coca Cola........................(KO).................39.62.................60.00..................36.72

Walmart............................(WMT).............73.85..................98.00..................73.11

Target...............................(TGT)................62.69.................67.00...................62.79

United Armour..................(UA).................57.35.................82.00...................52.86

Chevron.............................(CVX)..............112.62..............142.00................107.51

Exxon Mobile.....................(XOM)..............88.20................112.00................88.18

Kinder Morgan..................(KMP)...............81.16.................92.00.................82.31

3M....................................(MMM)................91.59................101.00................89.38

CBS..................................(CBS).................35.37................47.00.................34.00

Valero Energy...................(VLO)................30.73.................48.00.................29.39

Sherwin Williams..............(SHW)...............142.00..............185.00..............143.87

Campbell Soup.................(CPB)...............35.09.................47.00.................35.22

H.J. Heinz..........................(HNZ).................55.86.................78.00.................57.66

Dollar General...................(DG)..................50.07..................71.00.................47.98

Anheuser Busch................(BUD)................83.35..................92.00................82.17

Nike.....................................(NKE)................97.75.................120.00..............94.65

Eli Lilly.................................(LLY).................44.90..................56.00................48.18

Facebook............................(FB)..................22.62..................32.00................20.14

General Electric..................(GE)..................22.43..................33.00................21.13

Groupon...............................(GRPN)..............5.13....................15.00..............3.72

Seadrill.................................(SDRL)..............39.54.................53.00...............40.34

Marathon Petroleum............(MPC)...............53.37................71.00.................55.47

Phillips 66............................(PSX).................45.78.................67.00................49.51

Conoco Phillips....................(COP)................57.59.................76.00................56.77

As of the close Wednesday 7/11/12

We advise subscribers to consider the following SHORT POSITIONS:

The first price is where we recommend shorting, the second is the cover price &

the third is today's closing price.

Bank of America.................(BAC)..................7.72..................3.25.....................9.23

General Motors....................(GM)....................20.65................12.00..................25.03

Ford.......................................(F).......................9.34...................4.50....................11,06

Boston Beer..........................(SAM)................111.05..............74.00..................115.04

Molycorp................................(MCP).................12.92................5.00.....................8.97

Tyson Food...........................(TSN)...................15.82................6.00.....................17.02

Dean Foods...........................(DF).....................16.71...............8.00......................16.08

Research In Motion................(RIMM)...............7.80..................3.00.......................8.24

Netflix.......................................(NFLX)...............57.91................32.00....................77.60

McDonalds.............................(MCD).................87.15................71.00....................86.86

Hewlett Packard.....................(HPQ).................16.78................11.00....................13.69

Sears......................................(SHLD)................52.90.................36.00....................63.94

Harley Davidson.....................(HOG)..................42.42................28.00....................46.51

Dell............................................(DELL)...............9.33....................4.00......................9.16

Disclaimer: IF does NOT make a market in any of the above securities, nor does

IF have any incentive relationship with any of the listed companies. IF does NOT own any of the listed securities. All investors are encouraged to discuss all transactions with their financial advisors before making any purchases to be sure that all investments fit their financial objectives & goals. Investors should understand all risks associated with buying & selling securities as well as options transactions. Investors should abide by money management principals & never risk more than they can afford to lose.

There are No guarantees when investing in the stock markets.