-

Posts

27,542 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by R K

-

-

-

You should still have 5% (or around that) in precious metals. Saying you 'don't fancy' gold is tantamount to saying you don't fancy insurance.

You don't buy gold because you 'fancy' it (or at least most people don't).

hopefully this wont turn into yet another gold thread.

Insurance is a rentier industry. It is a cost. A drag on performance. Far better to self-insure.

As I said, asset allocations are mostly irrelevant in any event.

-

Any thoughts about P2P within SIPP? Minor providers offer it but HL should be doing it later this year.

I'm now 75% equities and 25% cash in SIPP and want a better use for that cash over the long-term. I don't fancy bonds, gold, property.

The attractiveness of P2P is decent rates (with risk) and the money stays in the UK but is not going to the banks to be leveraged up into mortgages.

I dont understand the case for P2P at all.

Agree re gov bonds, gold. Cash I like as a hedge, to provide optionality & to mitigate equity volatility

In very long run asset allocation less important (almost irrelevant) compared to fees.

-

May as PM will set up a BREXIT department

She could get Gove or Boris to head it up.

May has more balls than Gove and Boris put together.

She reminds me of Thatcher. Right now this country needs her.

Not Boris

Emily Ashton @elashton 27m27 minutes ago

"Last time Boris did a deal with the Germans, he came back with three nearly new water cannons" - SLAPDOWN from Theresa May

41 retweets 31 likes -

How can May be favourite? She was a supporter of Remain (yeah, Home Secretary as well....). How is Brexit going to be managed by a supporter of Remain?

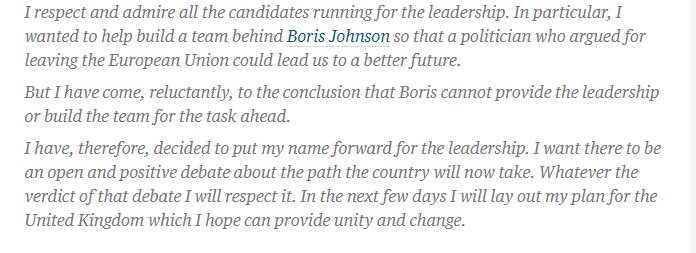

Boris is dead in the water.

Its already over. hes done.

May is next Tory leader & PM.

-

Graeme Wearden @graemewearden 5m5 minutes ago

Theresa May now odds-on to be next Tory leader on Betfair. Boris's odds are lengthening fast....

May

Merkel

Clinton

(& Adele)

-

Now Boris v Gove ....

GO ANDREA!!!

Buller v T0sser

Looks like May then.

-

-

Gove declares. Cant support Boris (after his Mail journo wife told him Dacre wants him to run)

So he will be Dacres man. Murdoch appears to have (at least) 2 horses in the race.

-

Spot on. 9 months in a row closed above 24/8 low. 100% +ve outcome on FTSE & SPX.

FTSE

http://stockcharts.com/h-sc/ui?s=%24FTSE&p=D&yr=1&mn=0&dy=0&id=p95104547928

SPX

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=1&mn=0&dy=0&id=p16813848788

11 months out of 11.

FTSE up 13.5% (plus divs) since Feb low

-

Sounds like the perfect job for a team comprising of a bunch of apprentice candidates and Kirstie and Phill from LLL

Tories should pick the next leader in an Apprentice style contest

Boris Theresa and Andrea selling fish from the back of a van would be a perfect test

-

Bank of England governor Mark Carney is to live broadcast a statement on Thursday to soothe any anxieties about the health of the financial markets in the wake of the vote for Brexit.

Slotted into the governor’s diary at the last moment, the speech is part of efforts by Threadneedle Street to reassure the public and investors following the historic vote on 23 June for the UK to leave the EU.

4pm, London time

-

Reading across a couple of articles in the Telegraph and FT, the UK is seriously short of trade negotiators. Whitehall has apparently lost two generations of potential knowledge in this area because trade talks have been left to EU negotiators since 1973.

In a gesture of goodwill (and because it is keen to forge a new trade relationship with the UK) New Zealand has reportedly offered the services of its top trade negotiators to the UK for post-Brexit deals.

http://www.ft.com/cms/s/0/5425dd4e-3dd0-11e6-8716-a4a71e8140b0.html#axzz4CGWn8ndF

how will he get into the country until Boris has sorted out the new points system?

Ive heard (true) govt actually only has 1 competent trade negotiator, but source believed that may be an exaggeration.

-

I don't want to do that but thanks!

I thought more of the FIRE plans discussed were to buy houses than rent. WICAO and rantnrave are buyers. Europbaron is renting.

Ok. My impression was WICAO rents with a view to buying with cash in Malta (or similar) when FIREd. But Im not especially concerned with individual stories rather general principles.

-

EU 27 press release

http://www.consilium.europa.eu/en/press/press-releases/2016/06/29-tusk-remarks-informal-meeting-27/

Good afternoon. Today 27 EU leaders discussed the consequences of the British referendum for Europe. It was a calm and serious discussion, as it is a serious moment in our common history. Certainly one issue is clear from our debate. Leaders are absolutely determined to remain united and work closely together as 27.

We reconfirmed that Britain's withdrawal from the European Union must be orderly and there will be no negotiations of any kind until the UK formally notifies its intention to withdraw. We hope to have the UK as a close partner in the future. It is up to the British government to notify the European Council of the UK intentions to withdraw from the EU. Leaders made it crystal clear today that access to the single market requires acceptance of all four freedoms, including the freedom of movement. There will be no single market "à la carte".

We also discussed the fact that too many people in Europe are unhappy with the current state of affairs and who expect us to do better. Many recalled that for decades Europe was bringing hope and that we have a responsibility to return to that.

As you know it was a first exchange of 27 leaders after the British referendum and so it would be too early to draw conclusions. This is why we have started a political reflection on the future of EU with 27 states and will meet on 16 September in Bratislava to continue talks. Thank you.

-

I can see how ignoring inflation allows living expense increase to be cancelled out by wage rises on these type of calculations. Though I think you would have to include some return on investment over 30 years to reduce your nominal yearly saving amount.

I agree that WICAO's £1m target cannot be achieved on average wages. The governbankment wouldn't allow it, too many people would be stopping work early and not paying enough tax.

No problem, I shall let you work out inflation adjusted & real investment return numbers.

But you will also have to escalate the number by house price increases too since these FIRE plans seem to involve renting rather than owning. Im not exactly sure why since over a 30 year period it would seem more sensible - to me - for a couple to simply take out a mortgage and pay it off, thus hedging out the housing risk entirely.

In fact I would go so far as to suggest that the best FIRE plan for a couple on average earnings is to buy a house in the first post-recession dip they encounter, save tax efficiently, ensure they have full state pension contribs & then simply enjoy their lives.

That would result in a couple having say an average price house mortgage free after 25-30 years (earlier if pay mtge down more rapidly), 2x state pension pots worth £8k each inflation linked or £250k each capitalised value at c 3% discount rate (more if rates are lower) = c £750,000 joint assets plus whatever savings/pensions are achieved as appropriate.

Who knows they may even get to buy an iphone or enjoy the occasional cup of coffee during the best 30 years of their life of penury.

-

Point taken. It does require exceptional (where exceptional meand deviating from the norm) effort in one way or another.

OK then, I'm guessing the thread's spirit shouldn't be totally all about financial independence but saving/investing in general too. What input would you have on that RK?

As I said in my original response to WICAOs opening posts Im not being critical at all of his FIRE plan. Simply that it is impossible for someone on average earnings to FIRE on a c £1,000,000 pot.

Lets keep it simple:- If FIRE = 10 years before NRD that allows approx 30 years to accumulate a nominal £1,000,000. Im going to wilfully ignore both inflation & nominal returns on wages, consumption & savings (for simplicity)

Thus £1,000,000 / 30 years = £33k pa savings. Since this is > average earnings it is axiomatically impossible.

That is all.

-

6 days in and NO article 50 invoked.

For all those people who said they wouldnt just ignore it....welcome to actual oppression

Why dont you start a new thread every day asking why article 50 hasnt been invoked

-

Operation #Bre-entry has already commenced.

Merkel sitting on her hands waiting.

Boris#/gove/hannan backtracking - admitting Brexit doesnt mean immigration numbers will necc. fall.

Civil Service high command kicking Article 50 into long grass.

Labour kicking out Corbyn

This is the reality of it.

etc etc

-

Volatility is usually a long term buying opp. Media "explanations" are irrelevant narrative.

40% mark downs were a gift.

Personally I am now waiting for a much deeper correction overall to load up over coming months. Im sceptical Friday was it & in any event spreads were too wide & liquidity too low.

-

Alex Dellal, the property expert who helped fund Chappell, was very impressive in his evidence session yesterday.

Only looked to be in is 20s but I cant recall anyone ever being so calm and capable in a committee session.

My thought was it was because he was being very honest & open. Something palpably lacking in most other respondents.

My other thought was just how much money is made trading prime London commercial property.

-

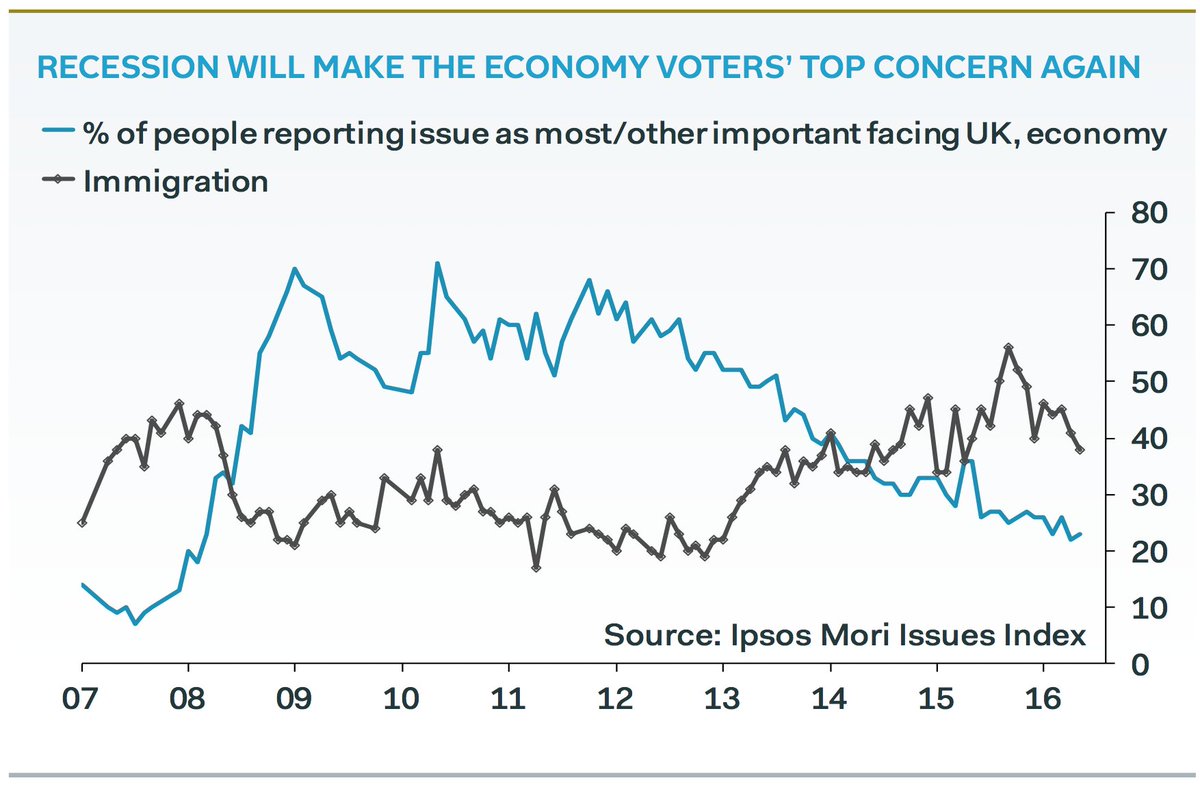

Nice graph. Any idea what caused the immigration to become much bigger issue in 2013? Is that a result of 2013 local election campaign?

Im not sure. Was it when Labour started to talk about it? ISIS? SYRIA?

-

Maybe but like i keep saying.... If the UK goes into a steep recession then the entire EU will also go into recession.Can the EU hold together with more austerity measures imposed, can the EU banks hold together, riots in Europe? We cannot predict any outcome of a referendum at this stage as the EU may be in a worse position than the UK.

I dont think so.

But then Ive been arguing for germany to be forced to change tack or be ejected from EZ for last 5 years.

Italy looks like potential proximate catalyst.

-

The EU won't compromise. But pub. opinion will change as economy falters. A 2nd ref would yield a different response

Brexit What Happens Next Thread ---multiple merged threads.

in House prices and the economy

Posted · Edited by R K

Boris interruptus