-

Posts

519 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by hi5lo5

-

-

4 hours ago, mathschoc said:

Just had a chat with the landlady. According to her S24 is no big deal, she doesn't know how much she will be paying, tax will be filed next April inn2018, she will find out the bill then.

Not surprised by her and other landlord stupidity. This flat is her pension fund too.

Until the brown envelope from HMRC arrives.

-

Henry pryor's take on poverty latter's fallacy.

-

2 hours ago, Bland Unsight said:

In the shobolerant I refer to a punt that northshore took on the Tax Relief thread at inferring an ownership distribution for the BTL mortgages in the Lloyds book (and in doing so he highlighted a rather glaring error I had made).

We were looking at the chart in the Wallace & Rugg report on buy-to-let mortgage arrears. It's a chart I've posted a bunch of times already, but here it is again:

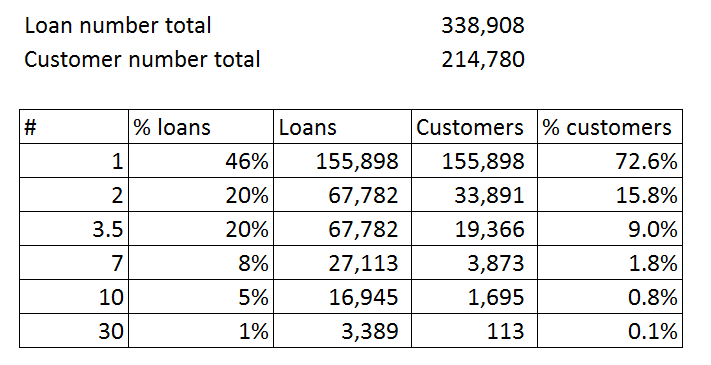

Northshore's punt on the distribution looked like this:

These numbers were offered as an attempt to fit the data and whilst the percentage of loans at a given portfolio size is solid for portfolios of one or two properties (it comes straight from the chart) because of the presentation of the other bins (e.g. "3-5 properties") you're really being forced to guess a little bit and you're just getting a feel for the numbers, not making a claim to confident knowledge. Also it's just one lender, and even though it is the biggest lender it was still only about 20% of the market at the time so you couldn't be sure it was representative of the market as a whole.

As also flagged a number of times on the forum, in December 2016 the CML issued a report they'd had produced by Scanlon and Whitehead, The Profile of UK Private Landlords.

That report gives the the same kind of data, but this time the presentation is a bit tighter. Also it's now a survey of landlords and not the data for just one lender.

Here's the key table:

The Scanlon/Whitehead report uses BTL to mean a landlord who has at least one leveraged property and non-BTL to mean a landlord who owns all their property outright. For this reason the numbers above don't tally with the non-BTL portfolio sizes in Figure 2 of the report because many of one or two BTL guys also have one or more unleveraged properties.

Now, if you know that there were 861 landlords with a mean number of houses encumbered by BTL mortgages of 2.12 then you know that there is a total of 1,825 houses with BTL mortgages in your sample. Then you can solve backward to work out what share of the houses the 10+ guys have. (I've then extrapolated forward show what these percentages mean when applied to the approximately 2 million BTL mortgages out there in the wild).

The most striking thing about that is that it implies that about 40% of all buy-to-let mortgages are going to be caught by the 4+ portfolio PRA SS13/16 credit underwriting rules which come into play on 30 September 2017.

As usual a chart helps:

Now I propose a round of "Spot the PovertyLater tw@ts"

Top job. Great insights. Just one brown envelope from HMRC followed by lenders demand.

-

Our good old Rachel on facebook

He did! Not much, admittedly. This incident is a pity as he talked a lot of sense.

Of course the label "Tenant Tax" is a publicity stunt. And a very good one to convey to the public and tenants that this tax WILL cause rents to rise.

All rents currently below market rates for affected LLs with decent long term tenants will rise. It's called capitalism. We all know that those of us with decent long term tenants deliberately chose, as good business decisions, not to raise rents as costs hadn't significantly increased. Now they have!

For those LLs unable to raise rents, who're highly geared, most likely within deprived areas, tenants will be evicted as houses are sold and repossessed. So, Mr. Pryor, this tax will affect highly geared LLs *and* tenants at the bottom end of the market. The poorest tenants.

I'm very disappointed at his over reaction, which seems only to be based on the campaign name. I thought he was quite impartial and intelligent!

What an utter toss, if All rates are below market rates then that is the market rate for f**k sake.

-

38 minutes ago, hotairmail said:

Half of all landlords didn't realise there was tax to pay in the first place, so maybe this has brought it to their attention.

EDIT: Does my daughter's landlord pay tax on a property in London, as a Chinese lady living in Canada?

There are two options for the LL, she can opt for self assessment by filling NRL1i form and hand it over to the tenant/LA to get the rent in full or the letting agent / tenant deducts the basic rate tax by law. If there is no LA involved in your daughter's and not deducting taxes she is breaching the law.

-

6 minutes ago, btd1981 said:

Bit of free financial advice: if you're finding a house 'hard to sell'...REDUCE THE ASKING PRICE.

Nope.. they won't listen. I am holding up to my advice "call insolvency practitioner" until Jan 2019.

-

3 hours ago, Bland Unsight said:

The last Muppet Commader to mock us and make out that he knew what he was doing is now in Malta praying that the taxman sees matters the same way as he does and that his lenders overlook or remain unaware of all the BICT jiggery-pokery.

At least Busta had the sense to do something other than pretend he could single-handedly buck the rental market (though the £2,000 book idea never really worked out).

Sell now, sell everything.

The YouTube video is hilarious. True representation of BTLers today. Full credit to Bland and other HPCers campaigned rigrously against the 118 crew in Twitter and other forums.

-

The word “troll” springs to mind… Unless of course we are under estimating him and he is after all a serious journalist/property expert/writer and the following is correct:

(1) Most landlords do not have mortgages

(2) The Residential Landlords Association is an obscure outfit that knows next to nothing about the PRS and landlords and tenantsI’m a member of the RLA but I work for the NLA and while they uphold the rights of landlords, this is NEVER at the expense of tenants, and while the RLA has slightly different policies and does things differently, in their objectives the two organisations are similar if not identical.

Someone is going to be banned from poverty later.

-

9 hours ago, Ah-so said:

Bland Unsight - great work vs 'Home Provider' on the Guardian article yesterday. I laughed when he said that you knew nothing about accountancy

Of course, he had the last laugh when he found out that you are a teacher (a teacher!) pushing 40 (40!) and renting (renting!). You must naturally be ashamed. How can you live with yourself being a mere teacher when a real man would have leveraged himself to the hilt and bought a load of crappy BTL flats.

And well done for finishing the work that that the OP on that thread could clearly not be bothered to do.

A lot of leveraged LLs are losing sleep as the S24 dates fast approaching. They have been writing ranty emails to their MPs and politicians to overturn the govt decision since it was announced. They should have sold some properties to rescue themselves from bankruptcy. As some one mentioned they aren't the sharpest tool in the box. They are still in the state of denial

Yesterday Vanessa of PT snubbed Henry Pryor on Twitter when he questioned the motive of tenant tax campaign.

Click bait

From the comments.

Simon BradburyHenry is suggesting the sensible and (in my view) totally sustainable contention that… “It is not a tenant tax & most landlords aren’t affected.”

This is a statement of FACT.

Of course people can debate the issue – but Henry is speaking the truth.

This “tenant tax” is about as much a tax on tenants as the “Poll tax” was a tax on Polish people!

-

9 hours ago, disenfranchised said:

I read that Guardian article and it sent me to this one:

"Landlords villified"

Top rated comment with 481 upvotes

"You're being villified because you're despicable parasites"

Back of the net!

Pretty much sums up the need of S24.

-

4 hours ago, InvestmentByker said:

Only partially, the game changer is the fact that the cost of change will be reduced significantly for the Tenant but remain (or even increase) for the Landlord. Cost of change is the primary mechanism for an incumbent supplier (Landlord) to maintain pricing power. The higher the cost of change, the less likely that an efficient market can operate. When the cost of change disappears - customers can ruthlessly shop around to drive down prices and increase service levels. Anyone in IT knows how important this principle is :-)

Where I live in Reading, moving house costs £700+ (Landlord Fees) plus a removal van (£50). Whenever I got an incremental rent rise of £50 the cost of change was too high for to justify this relatively small increase in cost. The same would apply whenever I saw a slightly cheaper or better house advertised in the neighbourhood

Although moving house is inconvenient, for the vast majority of renters it is only a weekends worth of work and a removal van.

Landlords might have real difficulty in even maintaining rent levels if this passes.

I concur, Reading EAs are rip off agents Romans, Haslams and Parkers are involved in price fixing. However I see a lots of properties for sale with tenants in situ.

-

41 minutes ago, Bland Unsight said:

Barry's not happy.

Don't hurt yourselves bayoneting that straw man, lads. And best of luck with that "serious Tenant backlash". Just a question of time now that slick Axe The Tenant Tax campaign is in gear.

Sine you mentioned, the campaign attracted over 1k views with 1 reply. Their intention was to reach out to warn their 1.4m chums who might go bankrupt. If they ever wanted the attention of greedy selfish pricks they should simply create a "House price crash" campaign. http://www.propertytribes.com/launch-of-axe-the-tenant-tax-awareness-week-t-127629047.html

Clearly Vanessa getting frustrated.

http://www.propertytribes.com/launch-of-axe-the-tenant-tax-awareness-week-t-127629047.html#pid286300

-

Did someone mentioned about BTLers crying foul for mortgage mis selling? Here it comes.

On another note.

Just spent 16 mins precisely watching the video of "Axe the tenant tax" awareness week campaign. Ironically had 3 mentions of "tenants" and repeated plea to reach out to the 1.4m+ LL's to help protect them from going bankrupt. Also, citing about the failed Irish attempts.

Even a person with pea sized brain will think this is not about "TENANTS" and ALL about "GREEDY SCUMS who doesn't want to give up the houses which they don't own and have their lifestyle funded by hard working tenants"

-

8 hours ago, Bland Unsight said:

Absolutely not. There is no lending here. The lending rules relate to when new mortgage contracts are written. All that is happening here is that the ownership of an existing loan is moving from one legal entity to another (ultimately from UKAR to Blackstone and Prudential).

Also as neither of these parties is a lending bank, these loans are now just assets sitting on their balance sheet; these mortgage books are going to be run-off. In the fullness of time they'll be redeemed and that will be the end of it*. Prudential will have regulatory capital requirements and therefore there must be some way in which they are forced to reflect that some assets are better than others but I do not know anything about how that process presently works for insurers. Blackstone are private equity so they'll be no regulatory capital requirement. They had some money to buy some stuff, they may have borrowed some money too, but the stuff now sits on their balance sheet and the people who provided the money to buy it (bondholders, shareholders - whatever) are taken to be grown-ups who are big enough and ugly enough to take their losses with the same sangfroid that they collect their winnings.

* This means that 8Year's earlier point though interesting is perhaps unlikely, because in order to make the borrowers an offer then can't refuse it seems you'd be creating a new mortgage contract? I will readily admit to being way out of my depth at this point. Time will tell, or rather the bleating on PropertyTribes and Property118 will tell, in the fullness of time.

Thanks.

-

22 minutes ago, 24 year mortgage 8itch said:

Yes I understand this. In the days of Paddles, I think we assumed margin calls would mean a fire sale. Nowadays I can't see a fire sale of any sort happening.

100k loans are transfered from Mortgage express and B&B. I wish the those loans include the loans of people who used Busta's BICT scam

-

-

3 hours ago, Bland Unsight said:

Now that is an interesting thought...

@Bland Unsight Just a question? Do the new buyers need to meet the PRA lending criteria?

-

Very intresting, a LA is trying to pass the liability to the LL.

http://www.propertytribes.com/worrying-liability-clause-t-127628996.html

-

I see lots of reductions in Reading mainly 1/2 bed flats, probably BTL's running for cover. Some of them were only listed in the last 10 days and had reductions. may be no interests from buyers and the LL's are sweating still kite flying prices.

The intresting one is this.

http://www.rightmove.co.uk/property-for-sale/property-58225198.html

29/03/2017, - Price changed: from '£349,950' to '£335,000'

21/03/2017, - Price changed: from '£359,950' to '£349,950'

09/03/2017, - Price changed: from '£375,000' to '£359,950'

-

I vaguely remember he houses lots of EE's. Now that he has alienated a few segemnts of people how is he going to cope up with the voids?

-

Great news.

For sure there will be more LL's would be finding themselves in a much more difficult situation than this.

It's all down to their inability to think the real reasons of why S24 was bought in the first place. Their only Moto have been hoard of few houses on debt and somehow invent a way to fund their lifestyle in LaLa land without doing anything.

In a few months I would see more poverty later posts crying foul for using Busta's Ponzi scheme.

-

"UK consumer credit slows less than expected, but mortgage approvals weak in February" - http://uk.reuters.com/article/uk-britain-lending-idUKKBN1700UQ

-

11 minutes ago, Bland Unsight said:

Also, this thread is a bit special - so here I feel it's totally OK to shoot first and ask questions later.

+1

You are right, we may get more of these trolls as S24 dates are nearing. It's pretty evident with a 90 page letter to the tenants.

-

33 minutes ago, PSP said:

Venger you have chosen to take my quotes out of context ! Select only certain quotes and paint an incorrect picture!

Just for for the record I am totally in favour of the S24 rule amateur landlords need to go !

The small BTL amateur landlord is history, rightly so , along with his 20 % deposit he has given to the banks !

Next My main fear is as recorded 16 million people who don't have a 100 pounds won't be buying property any time soon!

I cant believe you are so naive to think osbourne introduced this to help the little man get on the property ladder you are having a laugh with that one !

osbourne did so the little man will lose his deposit , banks can block sell properties on mass to the likes of the black rock investment company he works for the corporate institutions shaft the small man landlord and their big corporate friends clean up!

huge huge corporate landlords will appear (backed by investment companies like black rock ) to hoover up the coming bankrupt stock ! These properties won't be back on the market for 50 years !

These AE properties will probably never come back to the market !

You are are so naive !

Why do people buy property? People may come up with variety of reasons. But the core reason is to call a place home and raise a family. In the current rent market, renters are faced with insecurity about their homes. If LLs offer a long term tenancy most renters desire to own home may go down.

I am told that the LL's were prevented by their lenders from offering long term tenancy agreements.

If blackrock takes all these houses and manage to make a profit good luck with them. They might offer long term tenancies.

But will they bet on property? May be not .

I agree that not all renters can afford to buy or lining up to buy the BTLers property. But a correction could help a few to buy homes.

Halifax March 2017: 0.0%

in House prices and the economy

Posted

Interesting time for BTL clowns. Read about a BTL scum gloating about his ability to recover the cost of tax bill from the capital growth yesterday.

So No rent rises, No capital growth, potentially a negative one in few months. still they don't give up? Or it is the few clever ones cashing out whilst their bricks are worth something.