Dorkins

-

Posts

16,517 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Dorkins

-

-

-

-

30 minutes ago, andrewwk said:

Fair, but I speculate that the distribution of those paypackets has become more unequal in spread i.e. more dual income households and a skew towards those income brackets where households are more likely to be homeowners.

Subtle changes like there being both more dual income and more zero income working age households does not seem like something that could hold the price of all properties at double the historic ratio to average wages for long.

-

13 minutes ago, andrewwk said:

fine, but it is unlikely to revert in the medium term, so the house price to income ratio will remain elevated above historic levels.

UK employment rate across all working age adults is in the 70-75% range, same range it has bounced around in for the last 50+ years apart from the early 1980s recession. There has been no significant increase in the number of wage packets being taken home:

-

37 minutes ago, TerryBoi said:

This is his Churchill moment.

1951-1955 Churchill premiership where he made housebuilding his main domestic policy objective and tasked his housing minister (future PM Harold Macmillan) with building 300k houses a year for a population about a third smaller than today's?

The equivalent housebuilding target today (per capita adjusted) would be about 420k houses per year.

-

'Look we know it's tough right now, but to get through it together we need all you wageslaves to work just a bit harder this year for just a bit less real money while paying just a bit more tax. Better times are just around the corner, a couple of years max, we definitely won't be saying the exact same thing next year.'

-

Assume an average household consists of a couple who between them will produce 70 full years of averagely waged labour in a lifetime.

The taxman will take about 30 of those years so 40 years of wage labour remaining.

These 40 years need to pay for absolutely everything for an 80-odd year lifespan: housing, food, clothing and other manufactured goods, transport, utilities, leisure etc. Say housing gets a 20% share i.e. 8 years of wage labour

But not all of those 8 years can be capitalised straight into the house price. Some are needed for rental costs before buying, some on maintenance/renovation, some on mortgage interest, some on transaction costs. Say that takes about half of it, leaves you with 4 years of gross wage labour that can be capitalised into the house price.

-

16 hours ago, Frugal Git said:

Full time minimum wage is nearly 20k per year these days, so more like £1500 per month after tax.

Think about it this way, a couple with no kids and one of them working min wage and the other doing sweet FA would bring in £3500 p/m net under such a scheme. Better yet they could both work 1/2 hours, and take home even more thanks to not exceeding their personal allowances. Either way, it would probably be highly inflationary.

That's why you need a high LVT to fund the UBI, it sucks the inflation back out of the system. Net result is efficient use of land, stable lower income households which are not scrabbling around to make ends meet and high incentives to work and earn more because there is no poverty trap due to means-tested benefits.

-

Last house we lived in was a 1910ish terraced house, could easily hear the neighbours through the living room wall. When we first moved in there was a couple with kids and the father used to lose his temper and shout a lot. After a few years the neighbouring house was sold and a 30ish couple moved in, they used to shag in the living room quite frequently and she made a lot of enthusiastic noises.

You can soundproof walls to some extent, best thing is to frame out a completely separate wall a few inches into the room but you do lose space doing that.

-

34 minutes ago, Si1 said:

Employers are saying we have a college or uni graduate who's great at writing pointless humanities essays but can't use a spreadsheet or apply some basic stats. There's a difference between useful and useless education.

For most adults the line between useful and useless education lies roughly on the primary to secondary education border. About 15% are worth training up in academic-type subjects.

If 'humanities brain' types want to learn to use a spreadsheet they could just watch a Youtube video, it's how the rest of us teach ourselves things.

-

2 minutes ago, winkie said:

some kids love math subjects, connected closely with science subjects.......others are better at English, languages, history......

I'm increasingly convinced that there is no such thing as actually having a brain which is good at humanities subjects, it's just a coping strategy for being bad at maths. What kind of problem is humanities brain particularly good at solving? None that I can tell.

-

Sunak: "Right now, just half of all 16-year-olds study any maths at all. Yet in a world where data is everywhere and statistics underpin every job, our children's jobs will require more analytical skills than ever before."

If you're not already functionally numerate at age 16 then you are not going to be capable of performing a job that requires solid numeracy. An extra 2 years of maths lessons is not going to change that.

The jobs involving handling data/statistics/analytical skills will still be done by the people who were already numerate at age 16, same as now.

So what is the marginal gain here?

-

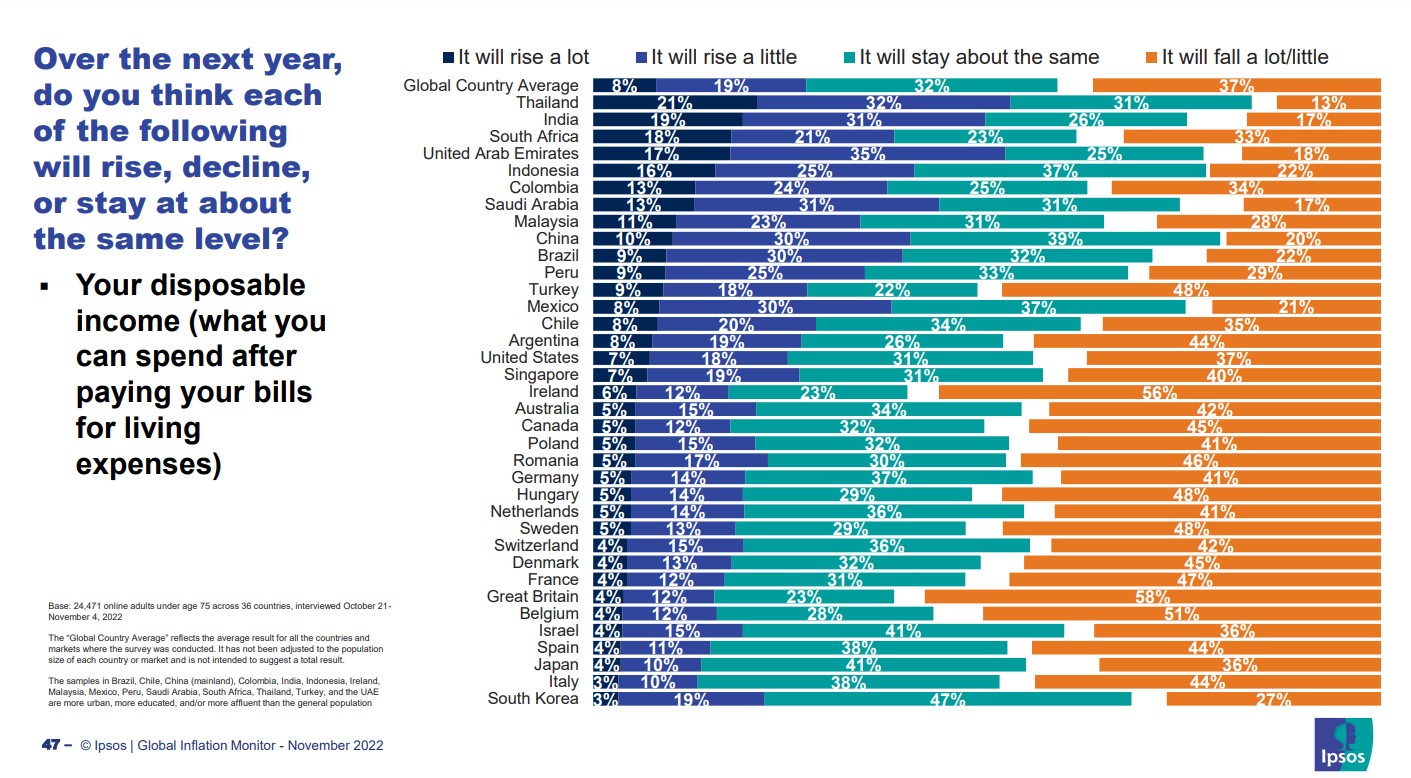

UK citizens more pessimistic about 2023 disposable income change than any other country surveyed:

-

1 hour ago, mynamehere said:

Sounds sensible, but it should obviously be extended to anyone with a second home

It does apply to anybody with a second home in that area, not just English people. The headline is just Daily Mail clickbait.

-

On 22/11/2022 at 21:26, scottbeard said:

Whereas burning energy day and night and risking people's lives digging up gold, only to re-bury it again in a bank vault, does...?

About half of gold dug up goes into making jewelry and another 10% to industrial applications

-

5 hours ago, Bear Goggles said:

I reckon people like the guy in the article will end up voting LibDem unless or until the Tories boot out the headbangers.

You're probably right, trouble is the LibDems are even more NIMBY than the Tories and these Millennial/GenZ Tories are engaged enough in politics to know that.

Maybe if Labour get in at the next election they will start building lots of homes in blue/yellow constituencies in SE England. Why not? It's not like Labour have seats to lose there.

The same logic should have applied over the last 12 years: build lots of housing in Labour-voting urban areas where Millennials/GenZ disproportionately live. Why not? It's not like the Tories had seats to lose there. Still, they didn't do that, and it's too late now.

-

3 hours ago, Peter Hun said:

My Tesla short is finally above water.

Let's hope I can get xN times my investment... Musk has totally screwed up.

It's amazing how similar the BTCUSD and Tesla share price curves are. BTCUSD peaked in November 2021, Tesla shares peaked in November 2021. Now BTCUSD is back to November 2020 prices and Tesla shares are back to November 2020 prices.

-

Ironically freezing the 40% tax threshold might actually reduce tax income relative to letting it rise with inflation or nominal wage growth. People might be willing to pay basic rate income tax + NI to get the money now, but tell them they can either pay 42% to have it now or chuck it into a pension and keep it all and they may well choose the latter.

This is especially true when every year before the budget the government starts briefing that they are 'looking at' the 40% pension relief. People might start to think 'well if they're going to take it away I'd best use it while I can'.

-

45 minutes ago, Dyson Fury said:

Genuinely surprising how little extra tax some of these measures raise:

And the effect: to completely crush the ambition and aspiration of many middle earners. Anybody near £50K will pay 40% marginal rate on any income increase. Why bother with longer hours, asking for a pay rise, applying for promotion, going for a new job with more responsibility?

The Treasury seem completely uninterested in the knock-on effects that their very high marginal tax rates on wage income might have. Taxing literally any other economic activity at a marginal rate of >60% would be unimaginable but when it's turning up to work, sure why not.

-

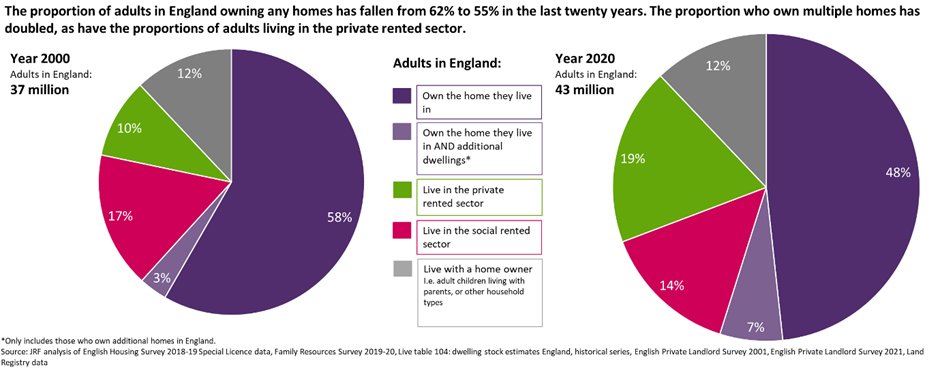

Amazing statistic below: half of all working age adults in the UK are renters

-

8 hours ago, Depressedpedro said:

What happens when everyone contracts their spending to afford those mortgage costs like you suggest?

Why would everyone contract their spending in response to a rise in mortgage costs when only 35% of households owe a mortgage?

-

Marginal tax rates on labour are already very high in the UK, almost 50% of the marginal cost of employing somebody on a salary of over £50k is going to the state if you include employer NI. Over £100k there's a fairly wide tax band in which the state is taking 2/3rds of the marginal cost of employing somebody.

Tax relief on pension contributions is the main mechanism available to employees in these 50%-67% tax bands to get their marginal tax rates back down to the point where they are keeping at least half of what they earn.

-

1 hour ago, joeda0 said:

I put this here as well to fight misinformation. Just posted it in another thread, but belongs here really.

https://www.measuringworth.com/datasets/ukearncpi/

1989 - 1995, last inflation and high bank rates induced HPC:

1989 - 1995, retail price change: 29%

1989 - 1995, nominal wage change: 37%If there is 10% food, gas and everything inflation, there will be ~10% wage inflation - even if rates are 15%, like in those years.

Pick any two years from the chart above to compare prices and nominal wages, the % difference between prices are vaguely the same as the % difference in nominal wages. As soon as there is inflation it rolls through wages quite fast.

Exactly as it happens now.

The 1980s-90s were typical of post-WW2 Britain in that in most years real wages rose.

Real wages now are back at the level they were at 15 years ago and are falling pretty quickly. Clearly we are not in a typical post-WW2 economic situation.

-

8 minutes ago, winkie said:

Sure, but you can't use a retirement visa to move to Spain if your income is coming from work (remote or otherwise).

Amazing news: Mortgage approvals CRASH

in House prices and the economy

Posted

I suspect inflation in the cost of non-housing goods and services will have absorbed most/all/more than all of those wage increases.