-

Posts

12,180 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Saving For a Space Ship

-

-

18 hours ago, debtlessmanc said:

London will need desalination for its water, the have already built one at Beckton. But desalination is energy intensive. I posted here for years that water and energy are going to be the limit on house building - a least in the south east.

QuoteBeckton desalination plant In 2010 the then Duke of Edinburgh beamed as he pulled back the royal blue curtain on a plaque to commemorate the opening of the £250m Beckton desalination plant in east London.

The plant, built in response to low reservoir levels in the mid-2000s and with considerable opposition from Ken Livingstone, then London mayor, was to provide a vital backup to supply in drought conditions for up to 400,000 households, taking water from the Thames and providing drinking water for homes and businesses.

Opponents urged the company to focus instead on water recycling and reducing leakage. However, it was argued that the site would provide resilience against increasing climatic uncertainty and, on becoming mayor in 2008, Boris Johnson withdrew his office’s opposition to the project.

Beckton desalination plant View image in fullscreen Despite the UK suffering a severe drought last year the Beckton desalination plant was out of action because of a carbon dioxide shortage.

More than a decade on, the plant, also known as the Thames Gateway water treatment works, has been labelled a “white elephant” by MPs.

Beckton has operated on just three occasions since it was opened. Its capacity has been downgraded, meaning it can only supply two-thirds of its planned 150m litres a day.

-

9 hours ago, shlomo said:

10,000 Chinese students x £40,000 a year. = £400 Million per year and that is just UCL

'up to £40,000 a year.'

-

9 hours ago, yodigo said:

They're the only way forward. South Korea going for it. EVs are basically a con to get to buy a car you don't need. They did that with diesel, told the sheeple it was the way forward (it wasn't, as was well known at the time by anyone who cared to look), then rolled back going on about all the pollution.

In January 2019, the Korean government expressed its vision to become a global leader in hydrogen vehicles and fuel cells by 2040

you are misinformed, mainly because of the amount of electricity wasted in producing hydrogen, you might as well use the elecricity to power ev's

Here are some reasons why electric cars are outselling hydrogen-powered ones:

- Cost: Electric vehicles tend to be cheaper than hydrogen-powered cars upfront. While the price of batteries for electric cars has come down significantly in recent years, the technology for hydrogen fuel cells is still expensive.

- Infrastructure: There are many more charging stations available for electric cars than there are hydrogen refueling stations. This makes it more convenient to own and operate an electric car.

- Range: The range of electric cars has been improving steadily in recent years, while the range of hydrogen-powered cars is typically shorter.

- Performance: Electric cars can offer very quick acceleration, while hydrogen-powered cars tend to have more modest performance.

- Fueling Speed: Refueling a hydrogen car can take several minutes, while charging an electric car can take anywhere from 30 minutes to several hours, depending on the charging station and the battery size. However, most electric car owners charge their cars at home overnight, so fueling time is less of a concern.

re your link ... estimates show ev' s outsell hydrogen cars in s korea by 33 to 1.

-

"Her head of dept at UCL had allegedly told her he was taking action because “in order to be commercially viable” the university’s courses 'need to retain a good reputation amongst future Chinese applicants'. The university has now announced that it will investigate the matter"

"UCL has the highest number of Chinese students in the UK, making up almost a quarter of its total student population. More than 10,000 Chinese students are at the university, typically paying two to three times the fees of home-grown students – up to £40,000 a year."

8:39 am · 10 Mar 2024 ·296 Views

FSU intervenes after UCL bans academic from China course to protect its "commercial interests"

-

6 minutes ago, NoHPCinTheUK said:

Nationalise the critical infrastructure is the only way to modernise them at this point.

The rentiers owning them have no interest upgrading them.

They only care about the dividend at the end of the quarter. Water, National grid, telcom, all should go back under government ownership as we have now reached the stage where no private money will even be spent on new projects.I am a free-market guy but for gods sake this is embarrassing.

+1

-

Capacity crunch on National Grid is delaying new homes in UK by years

Council leaders warn of ‘infrastructure crisis’ that will also affect green energy schemes and hinder growth

QuoteBuilding schemes for thousands of homes are on hold, while new projects face delays of up to four years in some parts of the UK because of a lengthening queue of developers waiting to be connected.

Those hoping to build new wind turbines, solar farms or micro-hydroelectric schemes face even longer waits after a deluge of new connection requests, many of them from speculative schemes.

Ministers have asked the National Infrastructure Commission (NIC) to investigate, but senior members of the District Councils’ Network (DCN), part of the Local Government Association, say the delays are slowing down the UK economy. Bridget Smith, the DCN’s vice-chair and leader of South Cambridgeshire district council, said: “Nationally, we’ve got an absolute crisis in all infrastructure.”

Plans by Michael Gove, the housing secretary, to build 150,000 homes in Cambridge to create a British Silicon Valley were already being hampered by lack of water, she said. “And where’s the power coming from? Something fundamental has to change.”

Susan Brown, the leader of Oxford city council, who is also a DCN vice-chair, said that 90 new homes in the Littlemore district had been meant to have heat pumps. “The National Grid basically said ‘we won’t have enough power to connect them’ so half the houses are going to have to have gas boilers instead – it’s so frustrating.”..

-

Quote

“The tsunami of Chinese electric vehicles is coming, and Europe is sleepwalking into an abyss”: my opening statement in “Made in Europe: from mine to electric vehicle”. A sentence that keeps reverberating in my head. A sentence triggering a razor-sharp analysis in today’s edition of

(thanks

for endorsing me): "BYD, the battering ram with which China wants to conquer the world”. In an earlier interview, I compared the BYD tsunami with the "Trojan horse" metaphor. This week we saw the Belgian bus company Van Hool throwing the towel in the ring, admitting defeat by the all-conquering Chinese electric buses. A decision that was catalyzed by the ingenious decision of the Flemish/Belgian public bus company

to order Chinese e-buses rather than “made in Europe” ones (well, they also have batteries from China, with CRMs refined in China). Connect the dots please The political world in Europe and Flanders/Belgium needs to wake up and start connecting the dots. We need to maintain our cleantech manufacturing industry in Europe; however, that also requires investing in the upstream part of the value chain: from mines, to refineries for lithium, cobalt, nickel, rare earths, to battery and REE-motor production, to final EV (& other cleantech) assembly. Without investments in the upstream part, so we can reach a full vertical integration, we will be obliterated by the Chinese juggernaut. In that respect, I was more than satisfied to see that

& #CARESTER have decided to join forces (rather than to battle it out with each other) in order to boost the refining and recycling of #rareearths for the EU magnet and e-motor industry. A story that was covered in

today (thanks for the interview

). Europe’s Mining Renaissance In our new documentary we stress the importance of taking care of the upstream part of the mine-to-EV value chain. On March 27 we will be premiering in Leuven (

). We invite policymakers to join the event, in order to be better informed about the need to invest in #responsiblemining & refining of CRMs & battery/motor production in Europe. It’s the only way to avoid the following list getting any longer: Ford Genk, Renault Vilvoorde, Van Hool Koningshooikt, (Audi Brussel?)…

-

20 hours ago, winkie said:

There are many gardens that are not used or cultivated......use a garden one person not interested in, grow food and give the owner a share of the produce.....win,win.

We share people's concreted front drives why not their fertile back gardens?

Landshare schemes https://www.permaculture.org.uk/practical-solutions/landshare-schemes

https://www.lendandtend.com https://www.theguardian.com/money/2011/sep/02/garden-sharing-growing-vegetables

https://www.incredibleedible.org.uk/news/incredible-garden-sharing-finding-more-space-to-grow/

-

onwards & upwards ...major Tesla uk expansion & new variation for Business van on Model Y

Tesla has released a video of their large Midlands (UK) delivery center.

https://www.linkedin.com/feed/update/urn:li:activity:7171444222636584960/

Tesla Takes on the French Commercial Vehicle Market with the Model Y ByTeslam 7 March 2024 https://tesla-mag.com/en/tesla-takes-on-the-french-commercial-vehicle-market-with-the-model-y/

-

On 19/02/2024 at 19:03, smash said:

HMRC caves to pressure on double cabs....

https://www.gov.uk/government/news/update-on-hmrc-double-cab-pick-up-guidance

Got to keep those WankPanzers rolling !

-

1 hour ago, wighty said:

It sold for £72,500 in 2007.

that was bad timing ....given 2008

-

-

Going to sell my lean to.... the blind ? - £110k in Prestatyn

comments - https://www.reddit.com/r/SpottedonRightmove/comments/1b5gy9i/going_to_sell_my_lean_to/

-

Why are U.S car dealerships lying about electric car demand?

https://www.youtube.com/watch?v=xgIGowL02yU

Chinese Tesla competitors getting desperate ....

BYD slashes new EV prices 30% as it creates EPIC EV price war in China - https://www.youtube.com/watch?v=th6pn6dojiI&t=3s

-

10 hours ago, Big Orange said:

But AI "art" image/video digital collages (with Sora admitedly looking spookily realistic, like good lucid dreams) still uses human creativity and essentially human produced images and human videos as a big crutch (and boils down to theft through the internet).

The article does not talk about image / art . perhaps humans still have an edge there I don't know. (thanks for all the tunes BTW )

the tests ..

QuoteThe three tests utilized were the Alternative Use Task, which asks participants to come up with creative uses for everyday objects like a rope or a fork; the Consequences Task, which invites participants to imagine possible outcomes of hypothetical situations, like "what if humans no longer needed sleep?"; and the Divergent Associations Task, which asks participants to generate 10 nouns that are as semantically distant as possible.

For instance, there is not much semantic distance between "dog" and "cat" while there is a great deal between words like "cat" and "ontology."

QuoteIn a recent study, 151 human participants were pitted against ChatGPT-4 in three tests designed to measure divergent thinking, which is considered to be an indicator of creative thought.

Divergent thinking is characterized by the ability to generate a unique solution to a question that does not have one expected solution, such as "What is the best way to avoid talking about politics with my parents?" In the study, GPT-4 provided more original and elaborate answers than the human participants.

The study, "The current state of artificial intelligence generative language models is more creative than humans on divergent thinking tasks," was published in Scientific Reports and authored by U of A Ph.D. students in psychological science Kent F. Hubert and Kim N. Awa, as well as Darya L. Zabelina, an assistant professor of psychological science at the U of A and director of the Mechanisms of Creative Cognition and Attention Lab.

The three tests utilized were the Alternative Use Task, which asks participants to come up with creative uses for everyday objects like a rope or a fork; the Consequences Task, which invites participants to imagine possible outcomes of hypothetical situations, like "what if humans no longer needed sleep?"; and the Divergent Associations Task, which asks participants to generate 10 nouns that are as semantically distant as possible. For instance, there is not much semantic distance between "dog" and "cat" while there is a great deal between words like "cat" and "ontology."

Answers were evaluated for the number of responses, length of response and semantic difference between words. Ultimately, the authors found that "Overall, GPT-4 was more original and elaborate than humans on each of the divergent thinking tasks, even when controlling for fluency of responses. In other words, GPT-4 demonstrated higher creative potential across an entire battery of divergent thinking tasks."

This finding does come with some caveats. The authors state, "It is important to note that the measures used in this study are all measures of creative potential, but the involvement in creative activities or achievements are another aspect of measuring a person's creativity." The purpose of the study was to examine human-level creative potential, not necessarily people who may have established creative credentials.

Hubert and Awa further note that "AI, unlike humans, does not have agency" and is "dependent on the assistance of a human user. Therefore, the creative potential of AI is in a constant state of stagnation unless prompted."

Also, the researchers did not evaluate the appropriateness of GPT-4 responses. So while the AI may have provided more responses and more original responses, human participants may have felt they were constrained by their responses needing to be grounded in the real world.

Awa also acknowledged that the human motivation to write elaborate answers may not have been high, and said there are additional questions about "how do you operationalize creativity? Can we really say that using these tests for humans is generalizable to different people? Is it assessing a broad array of creative thinking? So I think it has us critically examining what are the most popular measures of divergent thinking."

Whether the tests are perfect measures of human creative potential is not really the point. The point is that large language models are rapidly progressing and outperforming humans in ways they have not before. Whether they are a threat to replace human creativity remains to be seen.

For now, the authors continue to see "Moving forward, future possibilities of AI acting as a tool of inspiration, as an aid in a person's creative process or to overcome fixedness is promising."

More information: Kent F. Hubert et al, The current state of artificial intelligence generative language models is more creative than humans on divergent thinking tasks, Scientific Reports (2024). DOI: 10.1038/s41598-024-53303-w

-

windowless shower bedroom, anyone? £1550 a month in bristol !!

https://www.reddit.com/r/SpottedonRightmove/comments/1b3dsyt/windowless_shower_bedroom_anyone/

-

On 28/02/2024 at 14:07, PeanutButter said:

Even if she wanted to give up work, or juggle a family and a career, she said she could not afford to because the cost of housing is too high.

More than half the population live in or around the capital Seoul, which is where the vast majority of opportunities are, creating huge pressure on apartments and resources. Stella and her husband have been gradually pushed further and further away from the capital, into neighbouring provinces, and are still unable to buy their own place.

Seoul's birth rate has sunk to 0.55 - the lowest in the country.

Then there is the cost of private education. While unaffordable housing is a problem the world over, this is what makes Korea truly unique.

From the age of four, children are sent to an array of expensive extra-curricular classes - from maths and English, to music and Taekwondo.

The practice is so widespread that to opt out is seen as setting your child up to fail, an inconceivable notion in hyper-competitive Korea. This has made it the most expensive country in the world to raise a child.

A 2022 study found that only 2% of parents did not pay for private tuition, while 94% said it was a financial burden.

Even human 'creativity', oft used as a reason for alternative life choices for kids is being surpassed by AI..

AI outperforms humans in standardized tests of creative potential

https://techxplore.com/news/2024-03-ai-outperforms-humans-standardized-creative.html

-

Investigation launched into eight homebuilders after 'persistent under delivery' of new houses

https://news.sky.com/story/investigation-launched-into-eight-homebuilders-after-persistent-under-delivery-of-new-houses-13081345

-

Video

@mmpadellan · 8h "Breathtaking to watch Fox News'

Bret Baier repeatedly fact check deranged and befuddled grandpa trump as he tries to spin his election lies and conspiracy theories. "You lost the 2020 election." WOW."

-

Video

@mmpadellan · 8h "Breathtaking to watch Fox News'

Bret Baier repeatedly fact check deranged and befuddled grandpa trump as he tries to spin his election lies and conspiracy theories. "You lost the 2020 election." WOW."

-

It ain't over til the fat man sings..oh...

Liz can't turn around ...

-

Revealed: car industry was warned keyless vehicles vulnerable to theft a decade ago

Experts alerted motor trade to security risks of ‘smart key’ systems which have now fuelled highest level of car thefts for a decade

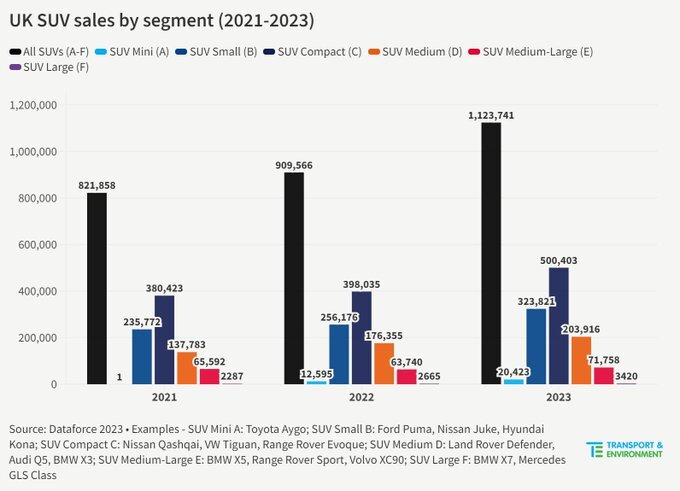

It's a Wankpanzer Tsunami ! no wonder the environments fluked

🚙🚙🚙In 2023, they broke the 1M mark and the trend has gone up and up over the past three years.

https://twitter.com/transenv_UK/status/1760939398944702775

-

Somebody Cloned Me in China... https://www.youtube.com/watch?v=3FQSFnZpsqw

QuoteIt is one thing to see funny deepfakes in Instagram Reels, and it is another to receive a message saying that your face has been reused for propaganda purposes in China...

It has been difficult to paint the picture of what's happening and I wanted to share this story with you — please stay informed as we enter the age of AI-generated content..

-

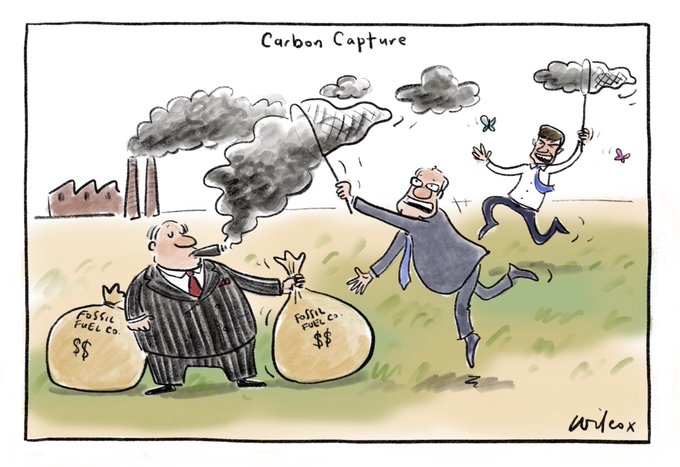

Carbon capture and storage, a fig leaf to produce more oil while greenwashing, has never worked: the most coherent CCS facility of them all, Equinor's Sleipner facility has been discharging, for 28 years, 25 times more CO2 than it sequestered

What will collapse next....

in House prices and the economy

Posted

'The lender’s shares fell as much as 45% at the market open and were trading down 38% at 77.2 pence as of 1:12 p.m. in London.'