-

Posts

5,156 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by InternationalRockSuperstar

-

-

Soup isn't £10 a tin because it's (not yet) illegal to buy a bunch of vegetables and knock up a batch without 'panning permission'.

...

spot on.

-

What Would Be A Decent Average Price Of A Uk Home

simple:

the cost of assembly.

-

7 miles - say each way - 14 miles, 5 days a week - 70 miles. MPG of efficient car - 35mpg - 2 gallons a week, £500 odd pounds a year. Paying £40,000 ( UK price would be same as US most likely) you'd never get your money back even with free electricity.

All electric (accepting restrictions) or a combined unit way cheaper than this is needed to make economic sense.

exactly.

and any good diesel engine will get you 55 mpg+

-

US Fed To Announce More Qe

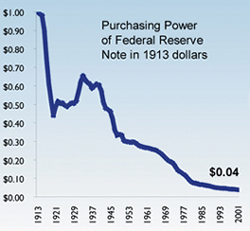

might as well finish what they started:

-

...

So if you want to put a mansion in a field go ahead, but if that increases the value of the field from £50k to £0.5m you pay £450k to the council.

...

why pay the council £450k? you don't owe them anything.

...

As it is getting that sort of planning permission is like winning the lottery, why not make it fair.

...

only way to make it fair is to get rid of it.

-

Where Are The Bond Vigilantes....

Bond Vigilantes are powerless when the Fed is monetising whatever debt the vigilantes aren't buying.

http://www.chrismartenson.com/blog/fed-buys-last-weeks-treasury-auction/23880

The Fed Buys Last Week's Treasury NotesThursday, 6 August 2009

...

Good grief! Just last week, when the auction results were announced it was trumpeted to great fanfare that there was "more than sufficient" bid-to-cover, "strong demand" and all the rest.

And now it turns out that 47% (!) of the bonds that were taken by the primary dealers in that auction have been quietly bought by the Fed and permanently secreted to its balance sheet.

...

-

...

the monetisation of a bond simply recognises the fact the free market has already monetised it.

...

nope, it recognises that the gov't can't fund itself by its usual extortion methods (tax etc).

and the free market has not 'already monetised' the debt, otherwise bonds would be priced exactly as legal tender, which they are obviously not (they generally trade at a discount - and they'd have much more of a discount right now if it weren't for QE).

besides, legal tender laws prohibit the actual process of monetisation from being performed by anyone except the seignior (the BoE in sterling's case).

...

havnig said that, you are right - there is no point to QE - it won't work. But it won't create hyperinflation either.

...

there is a point in QE - it allows the gov't to 'technically' pay its bills that it would otherwise have had to default on by now.

and what are you saying will not cause hyperinflation? an ever increasing national debt that all ends up being monetised?

-

Recovery Locked In As Pound Approaches 1.60

I see your GBP predictions are every bit as shite as your gold predictions!

I see your GBP predictions are every bit as shite as your gold predictions!1 GBP =

1.45973

It hit a high of 1.476 earlier today.

I am massively short on sterling (CABLE bet) and started to get slightly nervous.

-

...

That means government bonds are almost as money-like as base money.

...

[facepalm]

if gov't bonds were really that much like base money, then there would be no point in the BoE creating hundreds of billions of pounds of base money (i.e. QE) to purchase gov't bonds!

-

Some on here do not believe in deflation. Or, to put it another way, the "cycle" is not really a cycle at all but a one-way inflationary track.

-

Gov. Arnold Schwarzenegger today proclaimed a state of emergency in Kern County, where wildfires this week have destroyed about 25 homes and continue to burn.

Says nothing about running out of cash.

if you pause the video in your link at 31 seconds, you'll see the worst FIRE HYDRANT FAIL ever:

-

And in no way does the 2009/2010 spike look like that of the 1980s, no siree.

-

so it will fall tomorrow as well?

it will remain low until after the options have expired.

-

Sterling Soars As Gold Slumps

gold pretty much always falls on options expiry days (like today).

gold pretty much always falls on options expiry days (like today).edit: it's tomorrow actually

-

a must watch for all

from now on I'm only putting 100% pure glucose syrup on my porridge.

-

didn't something like this happen before - when the LBMA tried to maintain the $35 ounce fix. How did that play out?

yes, the London Gold Pool. it played-out like this:

http://www.gold-eagle.com/editorials_01/judge052101.html

...World Gold Crisis

On Friday March 8th, London sold 100 ton of gold at market, up from around 5 ton on a normal day. The following Sunday evening, the pool released the statement "the London Gold Pool re-affirm their determination to support the pool at a fixed price of $35 per oz". Fed chairman William McChesney-Martin announced the US would defend the $35 per oz gold price "down to the last ingot". That week the London Gold Pool continued to fight the free market process and defend $35.20 gold. By midweek it had emergency airlifted several planeloads of gold from the US to London to meet demand. On Wednesday the London market sold 175 ton, 30 times its normal daily turnover, and by Thursday demand exceeded 225 tons.

That evening emergency meetings were held in Buckingham Palace, with the Queen subsequently declaring Friday 15th March a "bank holiday". Roy Jenkins, Chancellor of the Exchequer, announced that the decision to close the gold market had been taken "upon the request of the United States".

Two-tier Market

The London gold market remained closed for two weeks, during which time the London Gold Pool was officially disbanded. During that two weeks, Zurich and French markets continued to trade with open market prices for gold exceeding $44 per oz (up 25% from London's official price of $35.20 per oz).

A fortnight later, an official "two-tiered" price was announced to the world, where the official price of $35.20 would remain for central banks dealings, while the free market could find its own price, the London market re-opening again on the 1st April.

...

-

bring back the bicycle highways!

http://www.lowtechmagazine.com/2009/10/get-rid-of-cars-ride-a-bicycle.html

-

Virtually unnoticed, the yield on long dated pan-European sovereign debt has slipped below that on equities.

...

which probably simply means that the central banks are using more of their freshly printed cash to buy sovereign debt than to buy equities.

-

please vote for my idea on property tax

er, no thanx.

taxation is extortion under threat of incarceration.

the tax man will simply use his position to line his own pockets - same as in any other tax system.

-

Or HP may just be a bunch of c*nts

instead of blaming the thieving leaching c*nts that have made this country uncompetitive - you are blaming a group of private investors who are simply trying to avoid having their capital stolen.

-

What does this idiot from the union expect?

Permies are more expensive than contractors/temps. They are also less flexible in terms of being able to fire and hire as workload goes up or down.

trouble is that it is not so easy to fire politicos, banksters and all the other state chartered cartels.

their costs are a HUGE overhead on the expense of doing in business in the UK.

frankly, it's no wonder companies are choosing to scale down their business activity in this country.

-

Rbs Prepares Bank For State Exit In 2011 - Report

as if.

-

Buy inflation linked bonds just like the BoE pension fund is 100% in.

the UK government does not issue any inflation linked bonds.

they issue index linked bonds.

index < inflation

-

When was the last time that the UK defaulted?

well the UK gov't is constantly partially defaulting on its debt by inflation

When was the last time that sterling fell against sterling?

what use is a pile of queen headed paper if it won't buy you anything?

Chinese Lead Race To Devalue Their Currency

in House prices and the economy

Posted

1 euro = 1 pound = 1 dollar = 1 yuan

and a million of any of them to buy a packet of crisps.