lowrentyieldmakessense(honest!)

-

Posts

4,893 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by lowrentyieldmakessense(honest!)

-

-

Unsure LRYMS if you're playing devil's advocate and that's the point. With with profits - you simply don't know. The insurance company decides what it wants to charge and keeps it implicit.

2 to 3% would be about right probably.

you should be sure

-

If returns are that bad, why are people so keen to buy on the open market and at prices over and above the providers redemption figure. Think about it!

they are keen because they are buying at a discount - because of the early surrender penalties - would they be buying were it not for this discount - i think not.

if you are going to sell you have got to think about what the likely returns are for you to continue with the policy compared against the cost of life cover, and investing the proceeds in something else and the likeley returns of that.

With asset allocations of some 40% equities, 40% bonds and the rest comm prop and cash - as I said the returns will be crap.If your endowment is invested as above - I would be worried about its likely returns given the state of the economy.

For the average person, an endowment can be an excellent LOW RISK LONG TERM product. I am thinking of buying a good traded policy (to mature in 4 years) whilst i ride out the hpc storm.what's the usual charges as a percentage of the fund in these endowment policies

-

your figures add up but only in certain markets can you rent a £260k property for as little as £700 a month.....

(yield to landlord of 3.23%)..........The only person i know renting like this is in a 3 bed detached house in rural Nottinghamshire...........and even there smaller properties yield 5%

thats what is happening

not in a rural area in a yorkshire town close to motorways etc - maybe there is more of a bubble where i am - buy to let just doesn't stack up in this area at the moment - i know - i've done it.

-

Well I do think owning is better than renting. When renting in the UK costs substantially less (say 40%+) than buying (IO vs. rent) then as I've said before, I'll join the bear camp. Until then, I believe that CG is on the cards.

Anectdotal

currently paying £700 per month rent. Property realistically worth 260-280k. If 260k on interest only at 5% is £1083.33 per month. discount of renting to buying 35.4% add on other costs of ownership would surely give you your 40% discount. Bring your tent.

PS only reason i am renting is because we are currently doing a house up that we have bought. If it was purely for financial reasons I would not buy at the moment as it so much cheaper to rent (this will eventually change unless it really is different this time). The reason we have bought is because I don't like living somewhere that i don't own (young family etc), this is just how i am.

-

So the questions are :

What is your view on the return i might get on that 5k investment in say 2008/9? Do you expect a bubble, mediocre returns or a loss?

If the value of the pound decreases through inflation, am I right in thinking that will just increase the £ value of my gold, and so I am therefore protected?

Is it in anyway possible (however unlikely) that I could lose ALL my £5k?

Apology again for taking up your time with a question which may be found by an evening of reading threads.

I just want a simple answer.

I think you need to do more of your own research before you invest in it, either that or find a good financial planner that knows about the economy - most financial advisors don't have a clue.

try reading the books, the dollar crisis and why its great for your investments and the empire of debt (just ordered this)

-

Pound down 12% against the dollar since January

Yen down 13% against the dollar since January

Euro down 14% against the dollar since January

Gold up 12% in dollars since January

if i new how to do it i would add a clip of a certain spandau ballet song at this point

-

Just look at the language*:

clapped-out

spin machine

coming home to roost

drink-now-pay-later binge

gloomiest

bottoms thrashed

British anxiety

increasingly fretful

eroding confidence

debt

insolvencies

court orders

repossessions

business failures

interest rates ..back up

taxes ...rise even further

fuel bills

pensions crisis

jump in unemployment

"black hole"

Brown's tub-thumpers

highest-ever ..personal insolvencies

no cigar.

running out fast

dressing up the UK's finances

peddle the fiction

run out of money

jammed up against a ceiling of credit-card limits

debt-financed boom

over-stretched

being ruined.

weight of ..debt

alarming reality

distressed debtors

terrifying last resort.

Soaring unsecured credit

spiral of debt

untenable situation

bankruptcies to double

bad news

shot to pieces

horrific pension-fund deficits

pensions mess

"fool's paradise".

ghastly

liabilities..£500billion.

infuriated

shabby stitch-up

mess

lack of ideas

fantasy world

easy credit

swapped their security

beach and booze in Benidorm

culprits

shopaholics.

blame and claim,

drowning in debt

profligate wasters

"loan abuse".

delicious irony

deliberately undermined

hand-outs, benefits, subsidies and credits

enormous client class

life-wrecking

revenge

One of these days that Jeff Randall is gonna get off the fence and tell us what he really thinks!

After such a bombastic, unrelenting, tirade, I can almost imagine shell-shocked, NuLab, spin-doctors disorientedly fumbling for their Motos to implore Mr Randall to cease fire: after all, it is Armistice Day!

______________________________________________________________

Could have been written by someone on here - was it TTRTR showing his true colours

-

Second that. I am by nature a lazy slob who would not get involved with anything like that and was dragged into it by my missus. I now do the recycling, fair trade, local produce shite and one you get into the habbit it's difficult to stop. I think it's a bit like using a seat belt. Maybe £50.00 fines are the answer.

some councils are reducing dustbin collections to two weekly rather than every week - but also providing a recycling collection service to try and encourage people to recycle.

-

Yes, you're right.... the current situation is unprecedented....as in all previous times of sustained low inflation and low IRs (all

before the 1970s) mortgage lending was very strictly rationed to a modest multiple of one person's salary.....This was when most women were married with children by their early 20s....

Throughout the 70s , 80s and 90s there were flash-in-the-pan periods of low inflation but never sustained enough to allow cheap long term (5, 10 and 20 year money ) loans to be available....or for lenders to be confident enough to lend large multiples.......

We are now therefore in uncharted territory..........Huge multiples combined with low IRs.....mean the debt isn't going to be eroded in the way it was in the 70s or 80s........but borrowers can lock into 10 year fixed deals at more or less current low IR level.....

too right

inflation isn't going to get people out of this mess - because we have global competition reducing wage inflation, commodities will probably continue increasing though.

don't know the answer to this - more responsible lending would help - mortgage and credit cards etc.

hope a few MP's read this thread and take some action.

-

Does anyone know what value is recorded with the LR in the case of the sale of a new build that comes with a "cash back" offer? Is it the price before or after the cash back? If before, does this not skew the figures ???

pretty sure its the sale price - before the cash back which is done as a gift. That is why the builders have been doing it.

-

The strength of sterling is heavily reliant on HPI. The world knows that HPI has been underpinning Gordon's "economic miracle" and until it shows signs of a significant correction sterling will remain strong. I am STR and almost 100% invested in US $ and my bet is that sterling and house prices will each depreciate by 20% over the coming 12 months. Why? Because the Fed will continue tightening making the $ more attrcative to investors and the US is not as dependent on HPI. As Al Greenspan said, the "froth" in the US house markets is confined to the coastal areas where significant corrections are expected and disregarded as economic disasters. Whereas the UK has universal HPI and is dependent upon further inflation to keep momentum going. Once the pyramid stops growing the house of cards collapses and everyone gets to buy a home at levels that are commensurate with earnings.

So your banking on the US$.

Short term you may be right but long term i think the US$ is gonna be worse than the £. Swiss Franks or Euros may be good though.

reason being US balance of payments problem and budget deficit.

just my opinion

-

-

I don't see it either...

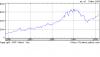

http://newsvote.bbc.co.uk/1/shared/fds/hi/...welve_month.stm

wood and trees come to mind

-

I want to thank evereyone who posted here in the last couple of days. Unfortunately... I had no access to web since Friday evening. Doh!

However, to couple of hundred thousand who were watching and the 100,000 who were listening IO think I got the message across - there are problems out there.

Thanks again.

hope it went well.

I'm sorry i missed it - if anyone has got the time to summarise what went off that would be great!

-

Perhaps people thought the Poll was a self cert mortage application form!?

classic

I`m a BTL`er and `earn` £800k per month minimum.

So there.

horace

Hmmm

now if you said that you have recently sold most of your portfolio I might have believed you.

-

talking about the pensions crisis - there'll be some other non (but really) govt bloke saying there isn't one.

There is and it'll be as big as the Housing Snake.

I would like your good Karma please

I'm a TV virgin...

If anyone says I look like an ugly Krusty Allcrap, I'll... well you better not. So there!

Wish me luck. I gather he's a rottweiller at 6 am.

Good luck

Be careful though you don't want people getting the idea that financial advisers know what they are talking about.

-

I think you first of all need to define "short term"

valid points but the problem is the concentration on short term profits (hours, days, weeks, months rather than years. will probably mean that in the long term we will be less well off. I haven't got a problem with business angels, VC etc investing in businesses and exiting within a few years and this should be encouraged.

I don't believe that governments are good at deciding which businesses are good for a country but I think they should be.

the most successfull start up businesses i know have been started by the owners putting up their own funds, spending less than what they earn and reinvesting their profits.

-

Paul

monday should be interesting - thanks for the pdf file

A chap was on TV today talking about living through it and living on just two bowls of bean soup a day for years afterwards, travelling on foot across America looking for work

was it david carradine

-

-

I have been watching the £ to $ rate very carefully as I was thinking of moving our cash into dollars and what I see is that every time there is a rumour of a cut in rates the pound falls and every time a more hawkish tone is adopted the pound rises. So in my simple world view this is a very clear link , in order to maintain the current exchange rate ( which is needed to avoid inflating imports ) we would need to track the US rates from here on in and they are going up up and away.

I should say I am not an economist or a financial expert, I know nothing about bonds or gilts I just monitor the situation closely and apply a bit of logic.

think twice about switching from £ to $. the dollar may rise in the short term (interest rates - unless we get some good decisions in the mpc) but long term i don't think the us dollar will be a good place to be unless they can get their balance of payments and trade balance sorted out.

-

Be careful what you wish for. The financial sector is a major pillar of the UK economy. Actually there is not much left...

yep thats the problem.

-

just a thought but does short term trading actually help economies grow - i don't think so - i don't know if there is a way that it could be stopped other than a few companies like refco going bust but i think that as a country we would be better off if investors invested for the long term, so that companies could also invest for the long term (plant and machinery, research and development etc) rather than trying to flip shares/ properties etc to make money.

-

How long can the ponzi schemes aka stock market/fiat money system continue?

A lot longer than you think.

instead of buying tins of tuna i've bought a printing press and i'm gonna start printing my own money - what you think i won't get away with it - USA have been doing so for years

-

she also had the ability to suck the chrome off a bumper or a grapefruit through a hosepipe.

Property Funds About To Become Isa - Able!

in House prices and the economy

Posted

Aberdeen Technology anyone?