MOP

-

Posts

5,016 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by MOP

-

-

Could someone tell me what the title of the article is? I can't open the link.

-

There was an old chap on that tried to do just that. Rigged up his shed to some home made explosive device. 2 weeks later, he'd forgotten all about it, went into his shed and blew a hug hole in his leg.

He forgot about the fact that he'd planted a bomb in his own shed?

-

we should open a book on who will be first to get banned and why.

Injun.

-

Link not working for me. Can you give me something I can google to find it?

-

Tut tut shame of you. You're actually hoping people with families get chucked out of their house so you can get one cheap?

Have you ever heard of karma?

You are nasty people. That's why you have f*** all.

There. Lesson in life over for today.

Hope you have a nice day flipping burgers tomorrow.

Why do you always assume people on here have f*ck all Sibs? I could probably buy your house twice over if I wanted (or even 3 times over in a couple of years time

).

). -

Markets Will 'Abruptly' Drop 25-50%: Strategist

Published: Friday, 14 Aug 2009 | 1:37 PM ET Text Size By: JeeYeon Park

Dan Deighan, founder of Deighan Financial Advisors, and Rob Stein, managing partner at Astor Asset Management, explained their positions on the economy and shared their market outlooks. (See their sector recommendations, below.)

Markets will drop 25 to 50 percent and it will happen abruptly, Deighan told CNBC.

“There’s no basic foundation for the run-up we’ve had, been far too rapid. It continues to run up on what’s normally considered bad news,†he said.

Deighan said in the past, Wall Street “shoved things down Main Street’s throat.†And now, he believes, "Washington" is trying to do the same. Main Street is slowly finding out "what’s going on with the banks, health care and the Federal Reserve’s moves" and they are “absolutely angry.â€

“None of this stuff is positive, and Americans are very angry in addition to being scared—a very dangerous combination,†he said.

In the meantime, Stein said he doesn’t expect a sharp drop in the markets, and predicts stocks will trade at the current levels for at least several months.

“I actually think we’re going nowhere,†said Stein. “These are going to be the levels that we trade at 5 percent around here for several months, if not for the rest of the year."

Stein said the economy is experiencing two types of recessions: the traditional inventory and unemployment recession, and another based on the credit crisis.

“The inventory/unemployment one is starting to abate and we’re starting to grow," he said. "I think the growth from this in 2010 will surprise everyone on the upside—and then when the credit crisis comes back again, it won’t be as doom and gloom.â€

http://www.cnbc.com/id/32417835

Warning: The video interview at the above link may make bulls cry.

-

Watch the video.

It's a fascinating discussion involving Elizabeth Warren, head of the Congessional Oversight Panel on the bailout money.

She says bank balance sheets are not transparent because toxic assets no longer have to be marked to market i.e. priced at market values. So they lie on balance sheets, overpriced and no one dares sell them, because the true asset values would be exposed.

Apart from that big problem coming our way, there is a wave of corporate mortgae defaults heading towards us, which will probably hit the medium sized US banks disproportionately.

http://www.zerohedge.com/article/elizabeth...-problem-coming

Two threads started on this last night, but it's worth repeating. Warren is at the coal face so she should know.

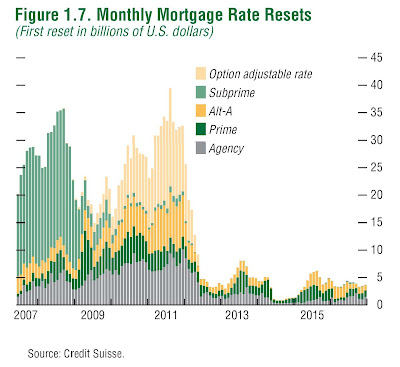

She seems to be suggesting that we are being lied to left, right and centre with all this mark to myth bullsh*t. Most of the banks are utterly fu*ked apart from maybe JPM and GS. I suspect it will start to become clear once the Option ARM, Alt-A, CRE and credit card defaults gather pace towards the end of this year.

2010 looking like carnage as she suggests.

-

-

Still nothing on Jordan then?

Still waiting for Citi to implode.

If I had to start a new thread every time Jordan goes down, I wouldn't be able to keep up.

I shall just concentrate on banks going down.

-

BB&T Said to Be Taking Colonial in Year’s Biggest Bank Failure

By David Mildenberg

Aug. 14 (Bloomberg) -- BB&T Corp., the North Carolina lender that bought back a $3.1 billion stake from the U.S. government, is taking over offices and deposits of Colonial BancGroup Inc., according to a person familiar with the matter.

Colonial, Alabama’s second-largest bank, is being closed by regulators today, the person said, becoming the largest U.S. bank failure of 2009 after an expansion into Florida saddled the lender with more than $1.7 billion in soured real-estate loans.

Colonial said last month there was “substantial doubt†it could survive and on Aug. 7 said its warehouse mortgage-lending business is the target of a U.S. criminal probe. The Securities and Exchange Commission issued subpoenas for documents related to accounting for loan loss reserves and participation in the Troubled Asset Relief Program, the bank said.

A call to Colonial spokeswoman Merrie Tolbert wasn’t immediately returned. “The FDIC does not comment on open institutions,†agency spokesman David Barr said in an e-mail.

Regulators are closing banks at the fastest pace in 17 years amid mounting losses on real-estate loans in the worst economic crisis since the Great Depression. The FDIC is offering to share losses with buyers of failed banks, reviving a practice used during the U.S. savings-and-loan crisis in the late 1980s.

BB&T on June 17 redeemed preferred shares that had been sold to the U.S. Treasury under TARP, joining nine other banks permitted to quit the fund.

Second-Quarter Loss

Colonial posted a $606 million second-quarter loss, its fifth straight deficit, mostly because of soured loans to developers and home builders in Florida. A planned $300 million injection by an investor group collapsed and the bank hasn’t met capital requirements to qualify for money from TARP, the $700 billion U.S. bailout program for financial firms.

Colonial was founded in 1981 in Montgomery by Chief Executive Officer Bobby Lowder, who oversaw acquisitions in Florida, Georgia, Nevada and Texas, where economic growth outpaced Alabama. Lowder stepped down as chairman in January after failing to raise capital as required by regulators.

BB&T has declined 10 percent in the past year, compared with a 30 percent fall in the 24-member KBW Bank Index. Colonial has declined 94 percent.

Colonial shares did not open this morning in New York Stock Exchange composite trading.

To contact the reporter on this story: David Mildenberg in Charlotte at dmildenberg@bloomberg.net

http://www.bloomberg.com/apps/news?pid=206...id=aXsSaA6DJw_4

-

Don't tell me. It was unexpected. A complete surprise. No one could have foreseen it.

Indeed.

This is the "back to school" buying season in the U.S. but the consumer contraction just keeps on going.

-

Consumers' Mood Darkens Despite Hopes For Economy

Published: Friday, 14 Aug 2009 | 9:59 AM ET Text Size By: Reuters

U.S. consumer confidence fell in early August as a growing number of Americans fretted about their finances even though they expected the broader economy to improve, a survey showed Friday.

The Reuters/University of Michigan Surveys of Consumers said its preliminary reading of the index of confidence for August fell to 63.2 from 66.0 in July. This was below economists' median expectation of a reading of 68.5, according to a Reuters poll.

The index of consumer expectations fell to 62.1 in early August, its lowest reading since March and down from 63.2 in July.

"Consumers reported much less favorable assessments of their personal finances even as they were more likely to expect improved conditions in the national economy," the Reuters/University of Michigan Surveys of Consumers said in a statement.

The fewest consumers in the survey's sixty-year history reported improved finances, with many citing job losses, shorter working hours and smaller wage gains, said the survey.

http://www.cnbc.com/id/32416061

Not good news when consumption is the engine of the U.S. economy.

-

More bad consumer news coming out of the US today.

DOW 9277.12 -121.07 -1.29%

NASDAQ 1979.35 -30.00 -1.49%

S&P 500 998.78 -13.95 -1.38%

-

I think the answer is oui and ja.

Our hapless bunch have been Xeroxing the money to keep the property ponzi going and banks up.

How did the continentals manage to do it without QEasying and persecuting savers? Yet our lot are too dumb to manage it.

Here we had to tear up the rule book and encourage more reckless debt taking, reducing the spending power of the prudent, just to bail out the feckless.

Blanchflower, King and the whole lot of them - F**ing amateurs. And I say that even if the French/German figures are a blip. USELESS HERE, BoE = utterly US£L£SS.

[hangs head in shame]

If you consider just how low we went towards the end of 08/start of 09, it's no suprise that we should see some improvement. Getting anywhere near 07 again is a very different matter.

-

Art Cashin is floor operations manager for UBS and he talks utter shite aswell. What part of 'Art Cashin' do you not understand?. As an extra, what part of 'CNBC report eh?' do you not understand? With dumb idiots like you about, with nothing to come back on except a pathetic ''Which part of "Deutsche Bank Chief Economist" did you not understand?'', no wonder the UK has gone to the dogs

If you are of the ilk who will swallow the garbage of a two bob bit economist, you need help

Who let you out for the day.

I know who Art Cashin is and he's a tw@t, but this article is not about Art Cashin or CNBC, it's about

Deutsche Bank Chief Economist Norbert Walter

-

CNBC report eh? Even that weird gimp Brown is more accurate in his predictions, and he himself, is a laughing stock.

With CNBCs art cashins style reports, they can never ever be taken seriously.

Which part of "Deutsche Bank Chief Economist" did you not understand?

-

I'm sure the stimulus packages will keep things on the up through until the second half of 2010 at the earliest. Early 2011 at the latest.

I don't think so. Elizabeth Warren is overseeing the US "Emergency Economic Stabilization Act" and has just lifted the lid on the true state of the US banks. It's not pretty. She expects the next wave to hit the banks in early 2010 when the heavy loses from the Option-ARM/ALt-A/CRE defaults start to kick in.

http://www.msnbc.msn.com/id/22425001/vp/32385463#32385463

If the banks are still under water now, how will they cope when this all kicks off in early 2010?

-

‘The World Is in Trouble’: Deutsche Bank Chief Economist

Published: Wednesday, 12 Aug 2009 | 9:55 PM ET Text Size By: CNBC.com

The global economy still faces turmoil as government try to figure out how to move out of fiscal rescue packages, which could lead to another two downturns, Deutsche Bank Chief Economist Norbert Walter said Thursday.

In addition, nervousness on the part of major dollar holders could pressure the greenback and lead to a very worrying 2010, Walter said.

Norbert said recently in research notes “the world is in trouble.â€

“I believe that the rescue packages brought on have been so costly for so many governments that the exit from this fiscal policy will be very painful, very painful indeed,†he said. “Some of us are already talking about a W-shaped recovery. I’d probably talk about a triple-U-shaped recovery because there are so many stumbling blocks here to get out of this.â€

“There are a few countries that have not dismissed people, they had a dramatic drop in their sales but they kept on people because they believed the recession would be very shallow,†Walter said. “They now have to fire people. That will increase unemployment and they therefore, of course, may be endangering retail sales in some countries.â€

If Australia hikes rates in September or October, markets “will certainly shiver†and cause zig-zagging at the bottom of the recession, Walter said.

And while the White House struggles with issues like health care and puts a fiscal policy exit strategy on the back burner, there are big concerns of about the direction of the U.S. dollar.

“I’m deeply worried about the worries of those investors who have invested a lot, really a lot into the dollar†like the Chinese, Japanese, Arabs and Russians, he said.

“If they have second thoughts about the quality of this currency then the dollar is bound to weaken†which means higher long-term interest rates for a country where government debt is approaching 100 percent of gross domestic product, he said.

If that happens, “2010 could be a worrisome year for all of us,†he said.

http://www.cnbc.com/id/32396144

Video interview at the above link.

This ties in well with the Elizabeth Warren revelations about the true state of the US banks.

-

"Potentially 50-60% default rates on commercial mortgages through 2010-11"

!

I started a thread on this last week.

About half of U.S. mortgages seen underwater by 2011By Al Yoon Al Yoon – Wed Aug 5, 5:12 pm ET

NEW YORK (Reuters) – The percentage of U.S. homeowners who owe more than their house is worth will nearly double to 48 percent in 2011 from 26 percent at the end of March, portending another blow to the housing market, Deutsche Bank said on Wednesday.

http://news.yahoo.com/s/nm/20090805/bs_nm/...ng_deutschebank

We have only seen the first wave of this crisis.

-

No, it's not.

http://www.msnbc.msn.com/id/22425001/vp/32385463#32385463

This is just the beginning.

-

Ah Yes! but it only takes quarter with +0.00001 % increase in GDP to end it. Then you need two more negative quarters to re-enter the recession, or is this classed as a new recession?

Officially it would probably be called a new recession but I would tend to just call it double dip recession like Roubini has.

It just shows how pointless the criteria is.

-

-

He fails to mention that GS got TARP funds, as well as billions more through the backdoor by rights issues from the publicly bailed out AIG. That along with their highly questionable practice front running of the market... GS are more like Al Capone claiming disability benefits...

-

so it will be down, but up in reality. reality being the measure.

xcojo has a point.

Nah. xcojo is just a dimwit.

Amazing German Machines Lead Europe Out Of Recession

in House prices and the economy

Posted