-

Posts

853 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Radge

-

-

Do you have any independent figures to back this up Radge?

I was just going by the increase in the numbers of flats available on the rental market that CCC has been posting since the start of the current difficulties and the steady drop in rents demanded that my occasional perusals of Citylets have shown (and CCC's stats as well).

If you're a regular watcher of an area on ESPC and Citylets, you'll quite often see the same properties shifting regularly from the 'for sales' to the 'to lets' and back again.

-

Studying for 4-5 years, just to finish her first degree. There are a lot of rent cheques you know.

Indeed, but unless you're buying for cash, there's lot of 'rent cheques' to the bank over the first 4-5 yrs to rent the money. By my fag packet calculations you'd be out of pocket buying even if prices don't tank.

-

You do realise that there are many professional landlords who may have owned their property for 10+ years?

Yes, but in terms of numbers they pale into insignificance compared to the number of BTL'ers of the last 10 years and accidental landlords.

-

Small flats have only really just started to tank. I'd let the BTL sucker take the capital loss and thank my lucky stars with every rent cheque.

-

The only effect of raising the minimum wage is to ensure that those who aren't productive enough to justify the higher wage will be out of work.

So, again, why do you hate poor people and want to put them out of work?

So you wish the State to continue to subsidise shyte employers by topping up their 'employees' wages with benefits?

The minimum wage should be raised to a level where no benefits become payable to employees in full-time work. Anything else is State subsidy of half-paid employment.

-

Agreed ... and that's v. interesting in itself ... nobody's really taken issue with the words, but rather with the man

I think most of us just prefer not to learn about economics from one of these "Show me the greenbacks for the Lord!" con artists.

-

Fook me, let's keep HPC secular.

Have we not got enough to worry about unwinding the fairy stories of the last 40 years without bringing in 2,000 year old fairy stories as well?

There are enough interweb forums elsewhere for deluded god-botherers.

-

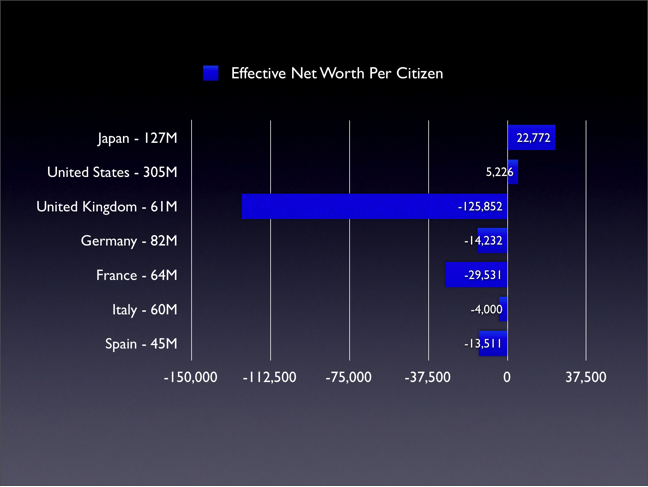

Yes, a wee bit of background on the graph from Dr B would be most welcome.

-

I found Dr Bubb's article fascinating but one graph in particular scared the socks off me and I thought it was worth focussing on in its own right:

If that graph is accurate, we really is fooked!

-

How's this for the 'Wow Factor'?

-

I think the bit the current crop of Kenseian chimps seem to have forgotten is that deficit spending only really works if it is used to invest in economic capacity and productive infrastructure, not simply to attempt to reflate destructive bubbles that should have blown years ago.

It strikes me that Broon is investing in sod-all other than perhaps his electoral chances, bonuses for the destroyers and blowing bubbles in the FTSE and house prices.

-

Of the assets insured, some £80bn are traditional loans, £55bn are consumer finance loans and there is a further £39bn each of derivatives and commercial property. Residential mortgages comprise £15bn of the total, with the remainder in leveraged finance, structured finance, bonds and lease and project finance.

Only the fecking treasury would trumpet the miniscule fees when we the taxpayer are insuring £189Bn at least a 1/3rd of which is utter shyte that's bound to blow up in our faces.

I hope Broon at least gets a fecking good job out of it if he can stay out of Carstairs long enough.

-

And folk wonder how we got into this mess? Beam me up for a shyte, Scotty!

And after 10 pages of this shyte, I still see nothing that would dissuade me from my original comment. Even on p8 or 9 there are chimps that think this guy "owns" an £80K flat!

-

Since HBoS are offering savers 0.5%, I bet they have a massive funding gap for any mortgages.

-

Not being a sponger off the State, I'll have to bow to your superior knowledge.

-

Sure I'm a bear. I'm not however blindly pessimistic in the way you are

So levering up 8 times to purchase an asset you expect to fall in value when the cost of the leverage can only go up is sensible? I think I should just have left this conversation when I referred the Hon Gent to my earlier comments.

-

1) Are you conveniently omiting his partner salary? You need to confirm that - Otherwise your argument is hogwash.

The wife has just had twins. Unless Mary Poppins is going to come along and look after the kids for nothing, either she is getting a shedload of Maternity Pay or we can start factoring childcare into the magic budget.

-

Where is this magic town where £80K flats command £500 rents, TCoN?

The estate agents are just doing what they do. The mortgage broker should be in jail!

-

Sure he'll struggle if he gets particularly unlucky, people always have. But a car for instance is hardly essential, boilers don't die particularly often and neither do people end up in hospital that regularly. He probably only needs to get through a few years before the mortgage is looking smaller. Most people are immediately fecked with real emergencies, that only makes him average. Ultimately if he were to end up a few months behind the lender likely wont repossess anyway so long as he can keep from getting further behind.

If he survives the early years he'll do ok. An STR on the other hand will be forced to gamble on one unstable asset or another or see his stash shrink in value by the day. There is danger for us all at the moment, those who do not act as well as those who do.

And you're a bear? If a bear sees borrowing 8 x income when IRs are at Disneyland all-time lows as sensible, I dread to even contemplate your finacial acumen when you turn bullish!

-

2/3rds of the debt is not going to be a business loan.....

You are the ones saying he'll have an emergency, I'm simply saying he has wriggle room in the short term

And if he has a real emergency, he's immediately fecked! Even without hols or i/o periods, he can't afford to carpet or furnish the big hoose. If his car needs tax / service / tyres, his wife and kids are on beans on toast for the month if they're lucky. Likewise if a tenant trashes the flat, either boiler goes, he crashes his car, his wife has to go into hospital or any other domestic emergency you care to mention. He is not even going to be able to save up a contingency fund to cover any of these all-too-likely exigencies.

Even without a real emergency, Let's say he takes an i/o holiday (on the residential element) for 2 months to cover a void. His income still doesn't cover his outgoings unless he starves his wife and kids and turns the heating off! It's not as if he's got the wiggle-room to build up a contingency fund when all's well (in his eyes). Never mind that there's only one direction for IRs to go and it ain't down!

He fails any stress test you care to apply.

-

I doubt you can for a business loan....like the one the guy should be taking out for the flat.

Exactly. Added to which, the estimates done so far have been on a £200K all-in residential mortgage. In actual fact, the BTL element for the flat will be more expensive.

HumanAction: Most mortgages allow limited hols or i/o periods. These would be something to keep in reserve in case of job-loss, ill-health etc. Not to set aside against exigencies like voids which will in all probability happen around every 2 years at least.

-

With new mortgages you can take holidays or make underpayments or just go IO for a while.....

I refer the Honourable Gentleman to the remarks I made some moments ago:

And folk wonder how we got into this mess? Beam me up for a shyte, Scotty!

-

TBH I don't see this as a massive risk on behalf of the buyer ( unemployment is the only real risk ).

If he has a 2 month void he'll have net income after mortgage of @ £393 pcm, 2 lots of CT to pay at @ £100 each property at least, so he's going to feed his family and all the rest on @ £193 pcm for those 2 months?

I'll wager he's up the creek before the year's out.

-

not sure about that , he certainly is £200K in debt but you have to take to account he also still owes a house which is worth 70K, rented, likely to go up in price in the long run, if he can afford the repayments why worrying?

And folk wonder how we got into this mess? Beam me up for a shyte, Scotty!

He did own a flat valued at £80K. He no longer has the deeds - he has £10K equity in that flat, the bank to all intents and purposes owns £70K of it. Worse still, if its value falls, it's his £10K that goes first!

I'd love to know what this wonder-town is where £80K flats generate £500pcm rental income. In Edinburgh, you can't buy a flat for less than @ £85K even in the worst ex-council estates - more likely £120K, but you can rent for as low as £430 pcm.

By my reckoning, with a following wind after tax, costs (excl. mortgage) and minimum voids, he'll be lucky to clear £400 pcm in rent, added to his £1,562 take-home pay less his £1,169 pcm repayment mortgage gives him £793 pcm to feed, clothe, heat, light, council tax, transport and entertain him, his wife and 2 kids and furnish his big new pile! Good luck to him, looks like a recipe for 25 yrs of misery to me.

Worse still, any void over a month and his cash-flow is fecked.

If he's on an I/O mortgage, then ultimately he's on the road to owning boogger-all!

The Nhs, Why Is It Underfunded ?

in House prices and the economy

Posted · Edited by Radge

A huge chunk of the £119Bn goes on paying for grossly overpriced PFI hospitals to cartels of HPC's favourite people, yep - the Bankers.

While I've never been a fan of PFI and have always regarded it as legalised defrauding of the public purse by the bankers, I suppose at least the public got the use of a school or hospital. Now they just demand and get the billions for nothing just by shouting that the sky is about to fall in!