-

Posts

1,101 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by sharpe

-

-

http://uk.biz.yahoo.com/30092010/389/currency-war-mean-fx-investors.html

What does a currency war mean for FX investors?

By Kathleen "Kath" Brooks, Director of Research UK, Forex.comWhen he warned of “international currency wars” earlier this week, Brazilian finance minister Guido Mantega coined a phrase that could become the main FX theme for the rest of the year. He said interventions and devaluations were a problem for Brazil’s competitiveness. As a big exporter of raw materials, no wonder he is worrying about the strength of the currency. The Brazilian real has appreciated the most against the dollar versus a basket of developed and developing currencies since the start of 2009.We have heard this argument before: when US authorities complain about China keeping the Yuan pegged to the dollar generating massive fiscal imbalances between the two nations. But the argument has now widened and even the US could be blamed for trying to keep the dollar weak. Japan and the Swiss authorities have directly intervened in their currencies in recent months, while the Federal Reserve and Bank of England are toying with the idea of further monetary stimulus to boost their flagging economies. Both actions tend to lead to currency depreciation.As demand contracts and oversupply/overcapicity looms the winner will be the most competetive.

The US appear to have been driving up the Euro to disable Germany and the Japs have been trying the same with everyone else to get back in the game.

Who wins? The one who buys the most, of course.

The UK has won - plain and simple we are the winners. These putz's have no idea how to play the game, it takes years of pissing away generations of hard work on coke, hookers and over priced house to win.

-

I was watching a rather lightweight program on the '80s last night with Tebbit putting forward the normal arguments about why Thatcher closed the mines. In theory, her ideology should have meant that she'd have let the banks go to the wall afaict.

Any thoughts?

If you described Thatcher as the "Banker's Whore" you would be about right.

Check what she did to the reserve ratios in England:

Country 1968 1978 1988 1998

United Kingdom 20.5 15.9 5.0 3.1

http://en.wikipedia.org/wiki/Reserve_requirement

Greatest money printer in UK history.

-

Unlike a lot of the rest of economics there is a wealth of data on demographics, which makes it possible to test out some of the arguments currently being discussed in the media. There have been a number of articles in the press discussing the changing shape of demographics and how this impacts our economy.

One of the theories is that the increasing proportion of the population in the age group 50-69 is having an impact on the saving behaviour. As this group are naturally hoping to save for retirement, a rise in their number would suggest more savers looking for a yield on their savings. With a higher demand for savings and a higher demand for bonds, property etc… we would expect prices to rise and yields to fall. This theory is used to explain the rise in asset prices and fall in yields seen in the UK, US and Japan.

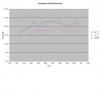

I have taken demographic data for the UK, US and Japan from www.mortality.org. The following chart shows the proportion of the population between 50-69.

For the UK this proportion rose from 1922 until 1940; after which it has stayed between 20 and 23%. The US has shown a similar pattern with a slightly lower blip during the Second World War and a slightly higher rise after 1990.

Japan has had a different pattern of a constantly rising proportion only peaking in 2006.

Interpretation

It seems difficult to me to see how the banking crisis or current low yields in the UK are due to demographics. In the UK the proportion of population between 50 and 69 was highest between 1965 and 1975 and yet interest rates ran well into double digits in this period.

If we can dismiss demographics as a significant impact on yields in the UK – is it then credible to discuss it in other nations?

Some other factor aside demographics must be impacting the yields in the UK. I would contend it is this factor (or factors) that should be explored rather than focusing on demograhics.

-

Unlike a lot of the rest of economics there is a wealth of data on demographics, which makes it possible to test out some of the arguments currently being discussed in the media. There have been a number of articles in the press discussing the changing shape of demographics and how this impacts our economy.

One of the theories is that the increasing proportion of the population in the age group 50-69 is having an impact on the saving behaviour. As this group are naturally hoping to save for retirement, a rise in their number would suggest more savers looking for a yield on their savings. With a higher demand for savings and a higher demand for bonds, property etc… we would expect prices to rise and yields to fall. This theory is used to explain the rise in asset prices and fall in yields seen in the UK, US and Japan.

I have taken demographic data for the UK, US and Japan from www.mortality.org. The following chart shows the proportion of the population between 50-69.

For the UK this proportion rose from 1922 until 1940; after which it has stayed between 20 and 23%. The US has shown a similar pattern with a slightly lower blip during the Second World War and a slightly higher rise after 1990.

Japan has had a different pattern of a constantly rising proportion only peaking in 2006.

Interpretation

It seems difficult to me to see how the banking crisis or current low yields in the UK are due to demographics. In the UK the proportion of population between 50 and 69 was highest between 1965 and 1975 and yet interest rates ran well into double digits in this period.

If we can dismiss demographics as a significant impact on yields in the UK – is it then credible to discuss it in other nations?

Some other factor aside demographics must be impacting the yields in the UK. I would contend it is this factor (or factors) that should be explored rather than focusing on demograhics.

-

There is a massive issue here. Unless there is a failsafe way of deaths being reported to those that are paying pensions, then we will get fraud.

If you get fraud, then there is no way that the system can be allowed to continue. Private companies offering pensions will lose money from the fraud. No one will want to save for a pension, knowing that their returns will be reduced by fraudsters, if this cant be stopped. Private pensions become a thing of the past. The only ones wanting to use such a system will be doing so knowing that they will be committing fraud of some sort. They might even be able to bring forward some income by selling the rights to a fraudulent pension to someone else, stranger things have happened.

The taxpayer though, is the one that will lose most over this.

The only way I can think of stopping this nonsense as far as the taxpayer is concerned, is to give every person claiming the state pension, a lump sum upon retirement. Then let them get an annuity of blow the dough I say, but that is the end of the states involvement. That might lead to incredible hard luck stories of those who lost it or spent it on something heartbreaking, but the state needs to stand firm, no more money.

I think most of the fraud has been stopped in UK insurers after people realised the scale of the issue some serious time was put into tracking it. I think the UK government does something similar with state pensions - obviously more difficult if people live abroad.

-

Dear All

I added this post below to the "baby bomer fraud" thread and enjoyed writing it so much (sad) that I thought I would share it as a new thread.

After I wrote it I recalled the recent case of the 2 scouser women who tried to smuggle their dead pensioner Dad onto a flight to Germany and were arrested and charged (he was born in Germany). Their defence was, allegedly, that it would have been cheaper to fly his body there as a passenger than in the hold, for burial - but I would wager that they simply wanted to bury him secretly there/register hi death there and keep claiming his UK pension - which are now paid into bank accounts, for which they almost certainly would have the ATM card and pin number.....so before you start planning to export your dead grandad so you can keep keeping his pension, read my post about the massive hidden problem with Dead Johnny Commonwealth Immigrant Foreigner Pensioners and weep. We really are a soft touch and it is only going to get worse:

Post-mortem pension fraud by greedy relations is already costing the UK millions each year. When I worked in UKBA we used to have officers based mainly in the indian sub-continent who would spend some of their weekly work issuing visas and the other part driving up into remote hill villages etc to check on the recipients of UK pensions (some years back it became possible for pension cash to be collected at commonwealth post offices, to cater for the growing band of UK immigrants from the 1950s on who were returning to their countries of birth to live a high life on the UK pension).

In many cases it was found that the pension recipient was dead - usually the family would be as evasive as the in the Japanese case, sometimes even borrowing another daft old git from the village to pretend to be the person. But generally these countries have proper death records, thanks to their British Empire style civil services, hence death certificates could be found by the officers and pensions stopped. Of course there is no chance of any prosecution against family members being successful - trouble is that now it is impossible for such officers to head up into the Pakistani hills and return alive, so the list of remarkably alive 100 years plus British pensioners residing in those hills will grow and grow and grow....at our expense.

This is the next problem for us - the massive waves of immigrants from the 50s, 60s and 70s are now returning home and will quite rightly claim their state pensions - in almost all cases we will never know when they are dead. Eventually such countries will get computerised central death records - but then the families will simply bribe the local doctor or hospital or funeral director to keep quiet and not notify the death or burial. We have not got a chance! Send in the drones perhaps to spy on funerals????

PS - IF THERE IS A DAILY MAIL JOURNALIST READING THIS, IT IS A STORY YOUR LARGELY INSANE READERS WILL ENJOY BEING HORRIFIED BY SO COME ON AND GET STUCK IN!

This is certainly not limited to foreigners. In the UK about 5 or 6 years ago insurers started comparing the pension book to a UK database of recorded deaths (contrasting with their previous approach of having policyholder deaths reported to them).

Some companies had about 5 percent of policyholders as being dead who had been receiving pensions. So on say a 10 billion reserve that is 500 million set aside for people already dead.

Some of this was likely due to joint pensions where the spouse just forgot to mention it. A lot was potentially fraud.

I imagine it is even more difficult with foreigners.

Increasing fraud is possibly due to a dis enfranchisement of the population. Bankers commit massive fraud on a wide scale which is sanctioned by government approval using tax payers money. Small wonder normal do it.

There is such a thing as society.

-

Can anyone recommend a general economics book?

Nothing too basic, but then nothing massive and dull .... if that's possible.

thanks

I would agree with the Henry Hazlit tip.

Also "The Mystery of Banking" Rothbard.

"Monetary Regimes and inflation" Bernholz is worth a read

-

Anyone Recieved a letter from HMRC Yet??

Regarding underpayment or overpayment of tax through PAYE?

The guy opposite me at work got one. Apparently 7.5 grand a year with respect to the last 4 years - so 30 grand. He was a bit down hearted.

-

BoE is creating 'greenspan put' type of impression for UK home owners. Can't really see why VAR rates will be a timebomb either, if the government/Boe wishes, they can keep rates low forever (and take administrative measures to sort out inflation, or worse, let inflation runs).

To control an economy the government just need to control Quantity of money (which they have more control) and Velocity of money (which it has less control but interest rate is just a tool to control this). Before I get flamed, HP will go down if the product of Quantiy of money and velocity of money goes down. Interest rate is just a side show (to affect the V).

In fact, Fixed rate can also be a time bomb if cost of living rises and economy continue to be weak. Fixed rates tend to come in with fixed term contract

with penalty as well - so, a significant cost to exist.

Do low interest rates encourage borrowing and so raise quantity of money?

-

If I recall correctly the US military and govt commissioned (and were alarmed by) the Hirsch Report back in early 2005. Which is about when I started to get worried about the issue to.

Are there any smart people in the army? As the price rises many new sources become available. The germans were converting coal into gasoline during world war 2. I understand this becomes economic at around 200 dollars a barrel. There is still a lot of coal...

-

So, someone please remind me again why people think there will be decent sized nomimal falls in House prices in places like London, that don't seem to be going down much any more.

I'm starting to believe that the BoE can hold interest rates down low for another five years, gilts markets don't seem to mind now. I think we'll see some more cost push inflation. But wages won't be going up and people will be getting poorer. And under a low interest rate regime, them slashing the public sector won't have that much affect.

Thoughts, opinions?

Is the UK government massively supporting house prices? Any falls would be as a result of failure by the government to prop up prices.

If housing fell say 30-50 percent (what is needed for a sustainable market) would that wipe out most of the assets on the banks balance sheets and put the UK is deep trouble again.

My big guess is interest rates will stay low and inflation will go high (10 percent plus) and house prices will not fall much nominally. Which for someone in a 2 bed rented cottage with one child and another planned is a grim prospect of not being able to buy without a hugh risk (risk the government fails and house prices do collapse (as in US, ireland)).

-

Buy into UK Coal ??????????

Did see a story about a lot more open cast sites will have to be opened in the next FEW years to meet energy demands for the UK.

I did about 3 years ago - it is down about 90 percent.

They have some long term fixed deal on coal prices which means buying into UK coal is effectively buying into commerical property. (Though do not quote me...)

-

Is anyone really in any doubt that they are going to print it up and hand it out?

Come on....

No doubt there - mainly because they already started printing.

Are public sector pensions now linked to cpi rather than rpi? That has likely reduced that liability significantly. They are printing and also cutting. The pound is holding up well which shows someone has confidence in what is currently being done.

-

And yet the premise is basically sound - $4.5 trillion in new debt and that for central banks to issue that kind of funny money is just way too suspect. It actually leads to the logical conclusion of monetary contraction - which no-one on HPC or in that clip actually believes or wants to believe.

Is that right? The BoE has printed 200 billion pounds directly.

If that goes through the banking system which has about 5 percent fractional reserve you get a multiplier of 20. Is that is about 4 trillion pounds by the BoE alone?

-

Hi. I need to raise somecash so now seems like a good time to sell some of my coin collection. Has anyone sold to coininvestdirect.com before? They seem to offer fair prices but looking through their FAQs there is this bit that puts me off - "Following the fixing of price we will ask you to send the items immediately to the receiving office in Germany where they will be checked by one of our experts. Postage and risk have to be covered by you. We will supply you with the address once the price has been fixed"

I'm only selling a couple of 1oz coins but I'd still rather not have to send them abroad. Would anyone be able to put my mind at ease that this is ok or recommend another dealer to sell to who offers good prices? Might consider ebay if not.

I will buy them - pm me if you are selling

-

those are stil positive (or at least not negative) coupons. the negative yields are for people buying in the secondary market - I'm pretty sure that is the case. No US government debt has ever paid a negative coupon - your article says that the 0 coupon on 4 week bills was the lowest ever.

Coupon value has nothing to do with yield. You do not need a negative coupon to get a negative yield.

If redemption is 100, with a 1 year bond, if the coupon is 100 you still have a negative yield if the price is 500.

In the article above the government got free money - people knowingly accepted a small loss.

-

those are stil positive (or at least not negative) coupons. the negative yields are for people buying in the secondary market - I'm pretty sure that is the case. No US government debt has ever paid a negative coupon - your article says that the 0 coupon on 4 week bills was the lowest ever.

Coupon value has nothing to do with yield. You do not need a negative coupon to get a negative yield.

If redemption is 100, with a 1 year bond, if the coupon is 100 you still have a negative yield if the price is 500.

In the article above the government got free money - people knowingly accepted a small loss.

-

OK guys

get ready this the big one,

its just round the corner now

FTSE falling, DOW down.

its all happening.

Remember this: http://www.bloomberg.com/apps/news?pid=newsarchive&sid=azLmks3BmQm4

Just be glad you ignored that advice, as bond prices have risen significantly since that utterly guff advice.

-

I don't think that has ever happened. Not in the primary market. Traders can correct me if I am wrong.

http://www.bloomberg.com/apps/news?sid=aOGXsWKEI6F4&pid=newsarchive

Treasury Bills Trade at Negative Rates as Haven Demand Surges

Dec. 9 (Bloomberg) -- Treasuries rose, pushing rates on the three-month bill negative for the first time, as investors gravitate toward the safety of U.S. government debt amid the worst financial crisis since the Great Depression.

The Treasury sold $27 billion of three-month bills yesterday at a discount rate of 0.005 percent, the lowest since it starting auctioning the securities in 1929. The U.S. also sold $30 billion of four-week bills today at zero percent for the first time since it began selling the debt in 2001.

“It’s the year-end factor,” said Chris Ahrens, an interest-rate strategist in Greenwich, Connecticut, at UBS Securities LLC, one of the 17 primary dealers that trade directly with the Federal Reserve. “Everyone wants to be in bills going into year-end. Buy now while the opportunity is still there.”

The benchmark 10-year note’s yield tumbled 11 basis points, or 0.11 percentage point, to 2.63 percent at 4:48 p.m. in New York, according to BGCantor Market Data. The 3.75 percent security due in November 2018 gained 31/32, or $9.69 per $1,000 face amount, to 109 23/32. The yield touched 2.505 percent on Dec. 5, the lowest level since at least 1962, when the Fed’s daily records began.

The two-year note’s yield fell 10 basis points to 0.84 percent. It dropped to a record low of 0.77 percent on Dec. 5.

If you invested $1 million in three-month bills at today’s negative discount rate of 0.01 percent, for a price of 100.002556, at maturity you would receive the par value for a loss of $25.56.

‘Horrible Year’

Indirect bidders, a group that includes foreign central banks, bought 47.2 percent of the four-week bills, compared with 31.7 percent in the prior auction. Primary dealers bought 52.1 percent, while direct bidders such as individual investors purchased 0.7 percent.

“It’s been such a horrible year people want to show they have the good stuff on their balance sheets, not the bad stuff, but with yields already so low it pushes these even lower,” said Theodore Ake, the head of Treasury trading in New York at Mizuho Securities USA Inc., another primary dealer.

The rate on four-week bills peaked at 5.175 percent on Jan. 29, 2007. The government began issuing the four-week bills in July 2001, according to Stephen Meyerhardt, a spokesman for the Bureau of Public Debt in Washington. The bills are intended to reduce the government’s reliance on irregularly issued cash management bills.

Meyerhardt wasn’t aware of the three-month bill ever trading at a negative rate before.

Housing Slump

Treasuries of all maturities have returned 11.4 percent this year, according to Merrill Lynch & Co.’s U.S. Treasury Master Index. That compares with a 39 percent loss in the Standard & Poor’s 500 Index, including reinvested dividends.

Bonds have surged as the U.S. housing slump pushed up the cost of credit globally, causing equity markets to tumble. The world’s biggest financial companies incurred almost $1 trillion in writedowns and credit losses since the start of last year, helping push the major economies into recession.

Treasuries rallied today as stocks snapped a two-day winning streak after companies from FedEx Corp. to Danaher Corp. forecast earnings that disappointed investors as the deepening recession crimps sales. The S&P 500 lost 2.3 percent.

‘The Bottom Line’

“The bottom line is there’s still a good amount of cash on the sidelines, and people are trying to figure out how they want to allocate that capital,” said Richard Bryant, a trader of 30- year bonds at primary dealer Citigroup Global Markets Inc. “The answer is still Treasuries for a lot of people.”

The National Association of Realtors’ index of signed purchase agreements, or pending home resales, fell a less-than- forecast 0.7 percent to 88.9 from a revised 89.5 in September, according to a report from the group today in Washington.

Futures contracts on the Chicago Board of Trade show 100 percent odds t the Fed will lower its 1 percent target rate on overnight loans between banks to 0.25 percent on Dec. 16. The probability was 38 percent a week ago.

Rate predictions based on the futures are not considered as accurate as they once were because the central bank hasn’t sought to bring the daily effect rate to the level of its target.

Mutual Funds

Money-market mutual funds that buy mostly Treasuries are starting to turn away new investors as the record low yields pull down returns for shareholders and squeeze managers’ fees.

At least three Treasury money-market funds run by JPMorgan Chase & Co., Evergreen Investments and Allegiant Asset Management recently stopped taking outside cash, according to Web site notices and regulatory filings. Barring new customers protects returns for investors already in the funds because managers don’t have to buy as many new Treasuries with yields lower than current holdings. Higher fund yields also prop up management fees.

The record low borrowing costs for the Treasury Department may turn out to benefit President-elect Barack Obama as he faces a widening budget deficit while pledging to embark on the biggest U.S. public works plan since the 1950s to stimulate the economy.

The U.S. is headed toward $1.5 trillion in debt sales as the budget deficit approaches $1 trillion in the 2009 fiscal year according to Bank of America Corp. The deficit this year was $455 billion.

The Treasury will sell $28 billion of three-year notes tomorrow and $16 billion of 10-year notes the following day. The $44 billion total is about $3 billion more than expected by Wrightson ICAP LLC.

-

it can work like this. The government offers a 1 year bond for 1000. It pays a small amount of coupons too - say 50 in coupons. The issue is oversubscribed and there are not any left. Due to a flight to risk, the value of the bond rises to 1100. I'm risk averse, so I buy the bond in the secodary market. Now if I hold this bond to maturity I will only get 1050 back at the end of the term. I lose 50. That is a negative nominal rate on a bond held to maturity. And it has happened previously.

This does not represent free money for gov. They still pay 50 in coupons. However if this keeps happening the price of new issues will get bid up. The more this happens the flatten the yield curve gets where buyers get in at any maturity they can for essentially no yield. Then buyers in the secondary market will take losses.

Unless the government then specifies that certain maturities will pay negative coupons the whole curve would flatten. However assuming deflation is going on (which seems reasonable in this scenario, the government would need to more or less destroy the money they receive in nagative coupons to keep the base money supply in line with oustanding credit in the broad money supply, because if they don't the interbank rate will stay at zero and the yield curve will stay flat.

I understood during the credit crunch for 3 month t-bills people paid say 101 to get back 100 in 3 months time.

If this happens in the secondary market for longer term bonds, it would also happen in the primary market, you can get negative yield simply by having a higher purchase price - regardless of the coupon. So the government could issue a two year bond with 5 percent coupon and 100 par. If the purchase price was say 120 that is negative yield - even though the coupon is positive.

This is free money for the government - I am really wondering what the consequence of that is?

-

Popular belief has it that the Fed is intervening in the market to keep rates suppressed at the zero bound.

But in reality cutting Fed Funds rates is actually all about driving short-term rates in risk-free assets below where they would otherwise trade via market forces, so as to incentivise risk-taking. This process hence stimulates the economy.

However, once market forces push ‘real’ rates below a level where a central bank can easily incentivise risk-taking, a liquidity trap situation may come into the making.

That is to say, no matter how much zero-rated money you push into the system, no incentive exists to draw that money into riskier assets.

So how does that apply to where we are now?

As ever, one place to look for clues is in the yield curve. Below you find the current state of the US Treasury curve, the US swap curve and the US Treasury-inflation protected curve:

For one, there seems to be an obvious convergence point around the 11-month mark, where Tips get propped back into positive territory, Treasuries yields begin to bounce higher, and the swap rate comes off rapidly.

In which case, is that the point where the Fed’s interventions are possibly supporting rates from falling through the zero bound, rather than suppressing them lower?

And would market forces otherwise force them into negative or special status?

Well well well. First Bill Gross, now isabella K is starting go Sceptical. Who next, I wonder? Answers on a forum thread please.

are negative rates on bonds free money for the government? did yields on treasuries go negative briefly a couple of years ago.

could I ask why the government would be unhappy at free money from investors?

-

its not comparable. That was a mistake on my part. The velocity of bonds is comparable (7) to the velocity of money(2). The stock of bonds (800bn or whatever) is comparable to the stock of money (200bn base, 1.4tn broad)

no there is no reserve requirement. there is are just rules on capital ratios. Only china still uses reserve requirements.

no, but that doesn't mean they are not money. And from what I can see gilt velocity is much higher than for pounds.

Ok, that makes more sense to me.

http://www.federalreserve.gov/monetarypolicy/reservereq.htm I think some countries other than china use an explicit reserve requirement. Are capital ratios not an implicit reserve requirement, which incorporates the quality of assets backing those liabilities? You can estimate the reserves held across the industry; who knows what they are now, say 2%; then the money multiplier is 1/0.02.

Gilts have a different term to money; so if you have a long term liability like a pension or life insurance liability - you would buy gilts to match - not cash. In fact you can match your expected liabilities for life insurance and pensions extremely well with gilts. Cash would create a term mismatch as you would be at the mercy of short term interest rates - this would create a risk of not meeting your liabilities, so they are clearly not interchangeable

-

now that is the velocity of broad money - e.g. bank credit, about 2X for the last 15 years.

interesting that the velocity of gilts is considerably higher.

But I am still lost as to why the velocity is comparable to 1/(fractional reserve req)?

Money goes through the banking system and increases in volume by 1/fract reserve. This reduces the value of the money as its supply increases.

This does not happen for gilts.

-

well, to test my theory I need to show some effect of both increases net stock of bonds and increased velocity of bonds, that links both increased stocks and velocity of these to actual prices of real goods and other non financial assets.

I see what you are saying. If balances between 2 players net out with high frequency then base money movement is not required for many transactions. Base money would only move between two institutions when they had exceeded whatever bi-lateral credit has been extended between them.

Therefore while counterparty confidence is high many settlements simply won't show up in official velocity figures, but these settlements will affect prices (or rather, the perceived ability to easily make future settlements will affect real prices.

Could I repeat my question. Why is velocity comparable with the money multiplier? (By money multiplier I mean 1/(fractional reserve requirement)

Child Benefit To Be Scrapped For Higher Taxpayers

in House prices and the economy

Posted

It should be called child tax reduction; as anyone in this category is already paying a lot of tax. That tax reduction is now being removed and the most overburdened sector is paying more tax again