-

Posts

6,627 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by _w_

-

-

Lots of it coming from central bank incontinence.

That's not quite true though is it? I reckon the agent is just repeating a mantra he doesn't understand, liquidity has only benefited banks and didn't translate in wage rises or more loans to the public. So no impact whatsoever on rental market.

-

has anyone else noticed david camerons hair going silver grey after such a short time in office.

that tells you a lot.

Have a heart. All that corrupting and destruction of democratic and social values does take you down.

-

Met and old acquanintance at the w/e.He's a lettings manager for a firm in a nice bit of Nottingham. he told me the following.

1 rents were bouyant and voids low through to september.dropped off a cliff of late with a more properties hitting the market on his patch.rents are dropping and noone's moving.Said last year tenants were moving in up to Christmas 2010,says it's already dead.

2 told me that other agents were cutting their fees to 5%-6% to win business off him.he basically said (he charges 10%)that he couldn't see how they'd break even at that level.seemed outraged/surprised.I merely pointed out this was a foretaste of the next five to ten years and to get used to it..

Nice guy,sounds like it's about to get nasty in their world what with shrinking volume/prices in the resi sales side

Can't imagine there's a great deal of symapthy out there for him.

Fancy that! Sky high prices reduce demand. Who would have thought...

Some agents now beginning to cold call us (prospective tenants) in sunny Fulham. We told them to call us back when prices are reasonnable.

-

Maybe only 20%, http://www.globalres...xt=va&aid=12003

Seems the Rothies love a Chinese Takeway http://www.edmond-de...ina-110311.aspx

Correct!! My wrong, thanks for the correction.

-

Mario Nobody, Greek guy that was a central banker and have no idea who he is called, referendums that "scare the market".

Has anyone else noticed that Europe is currently in the midst of a financial Coup D'Etat?

There are no tanks yet, but two regime changes with two puppets installed both of whom serve allegiance to Brussels. There has been no blood but the "Markets" have threatened bloodshed if their will is not obeyed.

The economy will tank if Europe is not saved? Really..... After all its in such great shape after 5 years of integration.

This looks like a decleration of war to me. Thankfully it is a war fought between foreign powers.

Give me power over a nations finances and I care not who makes the laws, for I will control them

Nathaniel Rothschild 1886

There is one precedent worthy of consideration I think, the successful ostracising of Austria by the EU when one if its extreme right parties came to power.

That these are coups I think is undeniable. The Austrian precedent indicate that this may be an EU 'political' coup if one can say such thing rather than a coup by the bankers.

-

What is an investment banker nowadays? My guess is they're now salesmen for the banks' funds working on comission, does anyone know?

-

Either that or you could argue it stopped us getting our act together earlier.

Or even now.

With 40% of our GDP consisting of finance real estate and construction we should have collapsed by now. Just imagine what's left when you remove puclic sector activities.

The fact that we haven't gives the now very powerful speculators and related government handlers room to argue that the situation is sustainable. So they are still printing causing further harm rather than start tackling the structural damage than has been done to our economy.

-

What's the answer?

In my opinion it's a no brainer. If it hadn't been for North Sea oil we'd be poorer than Greece by now. Being a petro-state for a while has hidden a lot of problems.

-

“This is a dangerous phase,” Neil MacKinnon, global macro strategist at VTB Capital in London and a former U.K. Treasury official, told Bloomberg Television’s “On the Move” with Francine Lacqua today. “All of a sudden, we’re talking about the future of monetary union in its current format.”

I don't think Europe ever stopped talking about a two speed Europe in the last ten years. But this is now so unexpected.

I don't think Europe ever stopped talking about a two speed Europe in the last ten years. But this is now so unexpected.

-

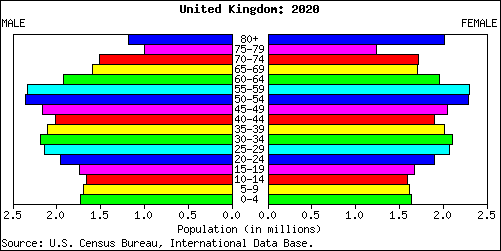

Someone want to tell me how house prices can rise with these demographics

There's one thing I'm noticing that will compound the problem: more and more people in their early forties are downsizing or selling 'assets' as they see their future employment prospects to be very dim because of their age. They're not waiting to reach their mid fifities anymore.

But I agree with Injin that this only works in real term, the formerly independent BOE can always print the pound to oblivion to keep those nominal prices up.

-

http://www.zerohedge...cb-intervention

ECB acting "illegally" or is this part of it's remit?

I think ZH is narking up the wrong tree. Italy's own banks and CB is where they should look. That's how Italy has always managed to finance its deficits.

-

http://www.boursier....77.html?sitemap

Soc Gen have today annonced a 2.8 billion profit for the first 9 months of 2011

As usual the French Banking Experts have got it all wrong here on the houseprices .UK

If it annoys you when some people tell you these banks are insolvent you could do worse than read this article from beginning to end. These banks make stupendous bonus generating profits right until they go bust. There is no mystery there.

http://www.bloomberg...efine-risk.html

Financial Alchemy Foils Capital Rules in Europe

Banks in Europe are undercutting regulators' demands that they boost capital by declaring assets they hold less risky today than they were yesterday. Banco Santander SA (SAN), Spain's largest lender, and Banco Bilbao Vizcaya Argentaria SA (BBVA), the second-biggest, say they can go halfway to adding 13.6 billion euros ($18.8 billion) of capital by changing how they calculate risk-weightings, the probability of default lenders assign to loans, mortgages and derivatives. The practice, known as "risk-weighted asset optimization," allows banks to boost capital ratios without cutting lending, selling assets or tapping shareholders.

Regulators in Europe, seeking to stem the region's sovereign-debt crisis, ordered banks last month to increase core capital to 9 percent of risk-weighted assets by the end of June. Lenders, facing a 106 billion-euro shortfall, are reluctant to plug the gap by cutting dividends or bonuses and are struggling to sell assets or raise cash in rights offerings. Politicians are trying to stop banks from the alternative, cutting back lending, because it could trigger a recession.

"By allowing sophisticated banks to do their own modeling, we are allowing the poacher to participate in being the game- keeper," said Adrian Blundell-Wignall, deputy director of the Organization for Economic Cooperation and Development's financial and enterprise affairs division in Paris. "That risks making core capital ratios useless."

Commerzbank, Lloyds

Spanish banks aren't alone in using the practice. Unione di Banche Italiane SCPA (UBI), Italy's fourth-biggest bank, said it will change its risk-weighting model instead of turning to investors for the 1.5 billion euros regulators say it needs. Commerzbank AG (CBK), Germany's second-biggest lender, said it will do the same. Lloyds Banking Group Plc (LLOY), Britain's biggest mortgage lender, and HSBC Holdings Plc (HSBA), Europe's largest bank, both said they cut risk-weighted assets by changing the model.

"It's probably not the highest-quality way to move to the 9 percent ratio," said Neil Smith, a bank analyst at West LB in Dusseldorf, Germany. "Maybe a more convincing way would be to use the same models and reduce the risk of your assets."

European firms, governed by Basel II rules, use their own models to decide how much capital to hold based on an assessment of how likely assets are to default and the riskiness of counterparties. The riskier the asset, the heavier weighting it is assigned and the more capital a bank is required to allocate. The weighting affects the profitability of trading and investing in those assets for the bank.

'Gray Area'

While firms submit their models to national regulators once a year, they don't have to disclose them publicly, and risk- weightings for the same assets vary among banks, regulators and analysts say.

"There are potentially significant differences in how different banks calculate RWA," Daragh Quinn, an analyst at Nomura Holdings Inc. in London, said in a telephone interview. "It's a very gray area."

The Basel Committee on Banking Supervision, which has set its own capital standards for banks worldwide independent of those laid out by the European Banking Authority, said in September it planned to review how lenders apply weightings to make sure "the outcomes of the new rules are consistent in practice across banks and jurisdictions."

That may mean publicly identifying lenders that game the rules, said a person with knowledge of the committee's talks who declined to be identified because the discussions are private. A spokesman for the Basel committee declined to comment.

'Anti-American'

Most U.S. banks are governed by Basel I rules, which assign standardized weightings to broad classes of assets, since the U.S. never adopted the second round of regulations.

The proportion of risk-weighted assets to total assets at European banks is half that of American banks, according to an April 6 Barclays Capital report written by analysts Simon Samuels and Mike Harrison. JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon in September described the Basel III rules, which give banks until 2019 to increase their core capital ratio to 9.5 percent of risk-weighted assets, as "anti-American."

Vikram Pandit, chief executive officer of Citigroup Inc. has called for banks to publish details of their risk-weightings on a quarterly basis. At a speech to the Bretton Woods Committee in Washington in September, he said weightings should also be "benchmarked" to ensure consistency across the industry.

Under Basel III, which maintains the same risk-weighting methodology as Basel II, all lenders will be required to use their own models to assess the riskiness of assets and therefore how much capital they need to hold.

"As you move to Basel III, these issues will become more ubiquitous, not less," the OECD's Blundell-Wignall said. "The core Tier 1 ratio is a ratio of two meaningless numbers, which itself is a meaningless number because banks can alter the ratio themselves. Basel III does absolutely nothing to address that."

'Naïve' Methodology

Sheila Bair, who stepped down as chairman of the Federal Deposit Insurance Corp. in June, has called Europe's adoption of risk-weighting "naive." The Washington-based regulator guarantees most consumers' deposits in U.S. banks.

"It is in a bank manager's interest to say his assets have low risk, because it enables the bank to maximize leverage and return on equity, which in turn can lead to bigger pay and bonuses," Bair wrote in Fortune magazine on Nov. 2. "Indeed, even during the Great Recession, as delinquencies and defaults increased, most European banks were saying their assets were becoming safer."

Some regulators, including Bair, have pushed for a leverage ratio that would require lenders to hold a fixed amount of capital against total assets.

One reason there's a difference between risk-weighted assets and total assets is that some securities, such as certain sovereign bonds, carry a zero risk-weighting, requiring banks to hold no capital.

'Gaming the System'

"A basic leverage ratio would be rougher, but it takes away the risk of gaming the system," said Stephany Griffith- Jones, an economist and lecturer in financial markets at Columbia University in New York. "We need to move away from outsourcing regulation of the banks to the banks."

European bank stocks have tumbled 31 percent this year, valuing firms at 62 percent of tangible book value. By contrast, U.S. lenders, measured by the 24-company KBW Bank Index (BKX), have fallen 22 percent, valuing banks at 73 percent of book value.

Banco Santander, based in Madrid, and BBVA in Bilbao said they're justified in adjusting risk-weightings because Spanish regulators have held them to higher standards than elsewhere.

Spanish banks have an average ratio of risk-weighted assets to total assets of 52 percent compared with 32 percent for U.K. banks, 31 percent for French and Benelux banks and 35 percent for German banks, analysts at Keefe, Bruyette & Woods Inc., wrote in an Oct. 26 report. A higher figure suggests a riskier balance sheet or a more conservative approach to risk-weighting.

'Relative Discrimination'

"There's a bias that penalizes the Spanish banks -- it's a situation of relative discrimination," Luis de Guindos, a former deputy finance minister, said at a Nov. 4 conference. "If it's fair and suitable, investors won't see it badly."

Santander said it planned to increase capital by 4 billion euros by optimizing risk-weighted assets and internal models. BBVA said the total effect of revising its model was expected to be 2.1 billion euros of additional capital.

"Santander's core capital exceeds that of any of its continental banking competitors," a spokesman for the bank, who asked not to be identified by name in line with company policy, said in a phone interview.

Paul Tobin, a Madrid-based spokesman at BBVA, said the bank is "catching up with practices that are common elsewhere in Europe." After making the changes, he said, "BBVA will still be one of the banks with the highest, if not the one with the highest, density of RWAs among large European banks."

'Less Faith'

Commerzbank Chief Financial Officer Eric Strutz said that adjusting the risk model was only one of four options being considered by the bank.

The lender needs "to look at models where our RWAs are higher than others because of market conditions," Strutz said on a conference call with reporters Nov. 3. "Commerzbank is more at the upper end compared with other banks."

UBI, based in Bergamo, Italy, said on Oct. 27 it's confident of meeting the 9 percent target by converting debt, shedding assets and "the progressive changeover" to an "advanced" risk model.

Spokesmen for UBI and Commerzbank declined to comment, as did a representative of the EBA.

Investors are unlikely be satisfied by banks adjusting risk models to avoid raising capital, said Harrison, the Barclays analyst, who is based in London.

"Gaming RWAs isn't helpful, particularly if the objective is to convince the market to invest in banks again," Harrison said. "The risk is that it's counterproductive, because there is even less faith in what the banks are telling you."

To contact the reporter on this story: Liam Vaughan in London at lvaughan6@bloomberg.net

To contact the editor responsible for this story: Edward Evans at eevans3@bloomberg.net

-

Do we need a Big Fat Spanish thread yet?

It should go straight to France from Italy.

-

-

-

The debt is becoming mandatory though. Even now, you are loaded with debts that were accumulated by successive governments and on the hook for the trillions of debts our banks have accumulated for their own profit, £1.3 trillions explicitly and probably about £3 trillion implicitly. The way forward is towards debts that are imposed on us by law.

Sorry for carrying on with this theme as it's a bit OT, but this article shows what dangers we face. These people now control those who make our laws.

http://www.bloomberg...efine-risk.html

Financial Alchemy Foils Capital Rules in Europe

Banks in Europe are undercutting regulators' demands that they boost capital by declaring assets they hold less risky today than they were yesterday. Banco Santander SA (SAN), Spain's largest lender, and Banco Bilbao Vizcaya Argentaria SA (BBVA), the second-biggest, say they can go halfway to adding 13.6 billion euros ($18.8 billion) of capital by changing how they calculate risk-weightings, the probability of default lenders assign to loans, mortgages and derivatives. The practice, known as "risk-weighted asset optimization," allows banks to boost capital ratios without cutting lending, selling assets or tapping shareholders.

Regulators in Europe, seeking to stem the region's sovereign-debt crisis, ordered banks last month to increase core capital to 9 percent of risk-weighted assets by the end of June. Lenders, facing a 106 billion-euro shortfall, are reluctant to plug the gap by cutting dividends or bonuses and are struggling to sell assets or raise cash in rights offerings. Politicians are trying to stop banks from the alternative, cutting back lending, because it could trigger a recession.

"By allowing sophisticated banks to do their own modeling, we are allowing the poacher to participate in being the game- keeper," said Adrian Blundell-Wignall, deputy director of the Organization for Economic Cooperation and Development's financial and enterprise affairs division in Paris. "That risks making core capital ratios useless."

Commerzbank, Lloyds

Spanish banks aren't alone in using the practice. Unione di Banche Italiane SCPA (UBI), Italy's fourth-biggest bank, said it will change its risk-weighting model instead of turning to investors for the 1.5 billion euros regulators say it needs. Commerzbank AG (CBK), Germany's second-biggest lender, said it will do the same. Lloyds Banking Group Plc (LLOY), Britain's biggest mortgage lender, and HSBC Holdings Plc (HSBA), Europe's largest bank, both said they cut risk-weighted assets by changing the model.

"It's probably not the highest-quality way to move to the 9 percent ratio," said Neil Smith, a bank analyst at West LB in Dusseldorf, Germany. "Maybe a more convincing way would be to use the same models and reduce the risk of your assets."

European firms, governed by Basel II rules, use their own models to decide how much capital to hold based on an assessment of how likely assets are to default and the riskiness of counterparties. The riskier the asset, the heavier weighting it is assigned and the more capital a bank is required to allocate. The weighting affects the profitability of trading and investing in those assets for the bank.

'Gray Area'

While firms submit their models to national regulators once a year, they don't have to disclose them publicly, and risk- weightings for the same assets vary among banks, regulators and analysts say.

"There are potentially significant differences in how different banks calculate RWA," Daragh Quinn, an analyst at Nomura Holdings Inc. in London, said in a telephone interview. "It's a very gray area."

The Basel Committee on Banking Supervision, which has set its own capital standards for banks worldwide independent of those laid out by the European Banking Authority, said in September it planned to review how lenders apply weightings to make sure "the outcomes of the new rules are consistent in practice across banks and jurisdictions."

That may mean publicly identifying lenders that game the rules, said a person with knowledge of the committee's talks who declined to be identified because the discussions are private. A spokesman for the Basel committee declined to comment.

'Anti-American'

Most U.S. banks are governed by Basel I rules, which assign standardized weightings to broad classes of assets, since the U.S. never adopted the second round of regulations.

The proportion of risk-weighted assets to total assets at European banks is half that of American banks, according to an April 6 Barclays Capital report written by analysts Simon Samuels and Mike Harrison. JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon in September described the Basel III rules, which give banks until 2019 to increase their core capital ratio to 9.5 percent of risk-weighted assets, as "anti-American."

Vikram Pandit, chief executive officer of Citigroup Inc. has called for banks to publish details of their risk-weightings on a quarterly basis. At a speech to the Bretton Woods Committee in Washington in September, he said weightings should also be "benchmarked" to ensure consistency across the industry.

Under Basel III, which maintains the same risk-weighting methodology as Basel II, all lenders will be required to use their own models to assess the riskiness of assets and therefore how much capital they need to hold.

"As you move to Basel III, these issues will become more ubiquitous, not less," the OECD's Blundell-Wignall said. "The core Tier 1 ratio is a ratio of two meaningless numbers, which itself is a meaningless number because banks can alter the ratio themselves. Basel III does absolutely nothing to address that."

'Naïve' Methodology

Sheila Bair, who stepped down as chairman of the Federal Deposit Insurance Corp. in June, has called Europe's adoption of risk-weighting "naive." The Washington-based regulator guarantees most consumers' deposits in U.S. banks.

"It is in a bank manager's interest to say his assets have low risk, because it enables the bank to maximize leverage and return on equity, which in turn can lead to bigger pay and bonuses," Bair wrote in Fortune magazine on Nov. 2. "Indeed, even during the Great Recession, as delinquencies and defaults increased, most European banks were saying their assets were becoming safer."

Some regulators, including Bair, have pushed for a leverage ratio that would require lenders to hold a fixed amount of capital against total assets.

One reason there's a difference between risk-weighted assets and total assets is that some securities, such as certain sovereign bonds, carry a zero risk-weighting, requiring banks to hold no capital.

'Gaming the System'

"A basic leverage ratio would be rougher, but it takes away the risk of gaming the system," said Stephany Griffith- Jones, an economist and lecturer in financial markets at Columbia University in New York. "We need to move away from outsourcing regulation of the banks to the banks."

European bank stocks have tumbled 31 percent this year, valuing firms at 62 percent of tangible book value. By contrast, U.S. lenders, measured by the 24-company KBW Bank Index (BKX), have fallen 22 percent, valuing banks at 73 percent of book value.

Banco Santander, based in Madrid, and BBVA in Bilbao said they're justified in adjusting risk-weightings because Spanish regulators have held them to higher standards than elsewhere.

Spanish banks have an average ratio of risk-weighted assets to total assets of 52 percent compared with 32 percent for U.K. banks, 31 percent for French and Benelux banks and 35 percent for German banks, analysts at Keefe, Bruyette & Woods Inc., wrote in an Oct. 26 report. A higher figure suggests a riskier balance sheet or a more conservative approach to risk-weighting.

'Relative Discrimination'

"There's a bias that penalizes the Spanish banks -- it's a situation of relative discrimination," Luis de Guindos, a former deputy finance minister, said at a Nov. 4 conference. "If it's fair and suitable, investors won't see it badly."

Santander said it planned to increase capital by 4 billion euros by optimizing risk-weighted assets and internal models. BBVA said the total effect of revising its model was expected to be 2.1 billion euros of additional capital.

"Santander's core capital exceeds that of any of its continental banking competitors," a spokesman for the bank, who asked not to be identified by name in line with company policy, said in a phone interview.

Paul Tobin, a Madrid-based spokesman at BBVA, said the bank is "catching up with practices that are common elsewhere in Europe." After making the changes, he said, "BBVA will still be one of the banks with the highest, if not the one with the highest, density of RWAs among large European banks."

'Less Faith'

Commerzbank Chief Financial Officer Eric Strutz said that adjusting the risk model was only one of four options being considered by the bank.

The lender needs "to look at models where our RWAs are higher than others because of market conditions," Strutz said on a conference call with reporters Nov. 3. "Commerzbank is more at the upper end compared with other banks."

UBI, based in Bergamo, Italy, said on Oct. 27 it's confident of meeting the 9 percent target by converting debt, shedding assets and "the progressive changeover" to an "advanced" risk model.

Spokesmen for UBI and Commerzbank declined to comment, as did a representative of the EBA.

Investors are unlikely be satisfied by banks adjusting risk models to avoid raising capital, said Harrison, the Barclays analyst, who is based in London.

"Gaming RWAs isn't helpful, particularly if the objective is to convince the market to invest in banks again," Harrison said. "The risk is that it's counterproductive, because there is even less faith in what the banks are telling you."

To contact the reporter on this story: Liam Vaughan in London at lvaughan6@bloomberg.net

To contact the editor responsible for this story: Edward Evans at eevans3@bloomberg.net

-

I agree to an extent. Although it may be for medicines.

Possibly there is a better way to manage these things than stopping imports entirely once the trade credit insurers stop offering their product.

I agree, some balance is needed. Although, I wouldn't mind Greece being 100% forbidden from buying BMWs and French frigates for a while.

-

I know this is an argument which highlights the madness of continuing down the same path, but at the same time, it makes me very relieved to be debt free.

The debt is becoming mandatory though. Even now, you are loaded with debts that were accumulated by successive governments and on the hook for the trillions of debts our banks have accumulated for their own profit, £1.3 trillions explicitly and probably about £3 trillion implicitly. The way forward is towards debts that are imposed on us by law.

-

Look, after the "interest rates are above 7%...the world is going to end" panic, you have to prepare yourself for commentators to look at their bodies and find we haven't all died (yet). People will think everything is okay for several months as...nobody has died. But periodic episodes of "we're about to die" will keep resurfacing until something happens one way or the other.

My worry is that if commercial bankers are in charge, the credit bubble will be further inflated over the next ten twenty years. At some stage, when students carry £500k non dischargeable student debts at RPI + 4% and all other segments of the population have been subjected to similar debt peonage made mandatory by bank controlled governments, whatever happens won't be pretty. This is happening now, only this week a cabinet composed of bankers decided to end the BOE's short lived (and largely ineffectual) independence !

I think the next biggest issue will be the gumming up of trade between countries in the Eurozone as trade credit becomes impossible to secure - this is already happening.

Isn't that something to be welcome as an automatic stabilisation mechanism in a way? Non credit worthy borrowers are not allowed to spend?

-

Isn't possible to stop.

That's the real problem.

I'm starting to agree with you. The only guys who could have stopped it where the CBs IMO but it looks like they are losing this war.

-

That one is even worse. The amount of direct lending in Italy by French banks is amazing.

-

The germans have sold the rest of the continent stuff on tick at lunatic terms in order to capture the real assets when the inevitable default occurs.

At the end of the day, a debt peddler (France in the case of Italy) helps someone finance consumption they can't afford. Then the debtor can't pay his debts and the peddlers hold trillions of debts as assets on their books (their own 'savings') that are worthless. Stop the excesssive debt peddling and the situation becomes sustainable.

-

like a kind of united states of Europe catastrophe thingy

Spaghetti Euronese.

-

Where is that French thread when you need it?

It's getting confusing. Perhaps we should have one mega giant Europe thread?

Gold strategy in the current economy

in House prices and the economy

Posted