Search the Community

Showing results for tags 'house prices'.

-

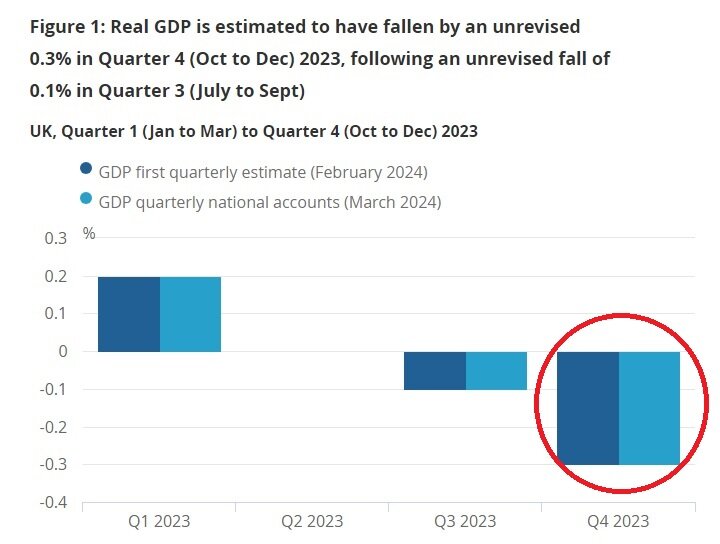

Unfortunately, I think things are even worse than the data shows and I would say that this also applies to the Euro Zone as they are not doing that well. Germany isn't doing that well economically and while the United States is a little different even though whenever Western countries are in a recession you can bet all of them are and I think it's only a matter of time until the US goes into recession if they are not already in one which would not surprise me just like they said in 2007 we are not in a recession but when the figures where revised in 2008 it showed that all through 2007 that they were actually in a recession. The GDP numbers in my opinion are worse than what is being publicized by the UK government and the statistics office because the way it's calculated is they add consumption, they add investment, they add government spending and they add exports minus imports so if your country is running a trade surplus that adds to the GDP if you're running a trade deficit it subtracts from the GDP. Government spending which they call government investment which is quite funny because governments don't save and governments don't invest what governments do is they extract wealth through taxation from the private sector and then most of the time they adjust the components of CPI which they use to deflate the GDP and what does deflating the GDP mean well even the government accept that they inflate the money supply and debase the currency so that makes GDP look better because people have to spend more money. So what they do is they are deflated by the CPI or some kind of GDP deflator but as we know the government made changes to the methodology for the CPI and yes it is a lot lower than it used to be not higher but they are always changing it to make it appear lower so they can tell you that inflation is low and the economy is growing but even with that change we're still getting a recession. The economy is a lot worse than some of the commentators on here are realizing but I know there are certain commentators on here who are really tuned into what is really going on. Unfortunately, there is no bounce back in the economy and in this year for most regions this is going to feed into negative house prices. Also into 2024-2025 we are going to see a major collapse in the financial system play out which will only make this downward spiral get even worse and unfortunately this is going to be brutal for many countries.

- 27 replies

-

- recession

- house prices

-

(and 1 more)

Tagged with:

-

So are Edinburgh house prices falling? I'm certainly seeing more fixed rates appear and it looks like there are a lot of properties sitting on the market for longer now. Or is it only this forum that's crashed? 😁

- 2 replies

-

- edinburgh

- house prices

-

(and 1 more)

Tagged with:

-

Hi - need advice on next house bid move. We bid 5% below the advertised asking and have been the highest bidders now for 4 weeks. The estate agent has now adjusted the advertised asking down to our offer thereby I assume to attract more interest and to disclose to any additional interested parties that there is a bid of the asking price. Given current house prices we are slightly miffed as we would have come in lower than the now current asking. Would you retract the offer and come in lower again? How would you react? Note that we believe our offer is a fair offer for the local market

-

This R4 programme is mostly about house prices and the effect they have had on areas of the UK since about 1980 http://www.bbc.co.uk/programmes/b09dxz1b 41 minutes Douglas Alexander comes across as a very reasonable and erudite person, now he is no longer an MP - a far cry from the swivel eyed lunatic I remember trying to push national identity cards during the Blair era.

-

It makes sense that mortgage debt is the main driver of house prices... However, is there a direct correlation between house building rates and house prices - has anybody ever attempted to put both on a graph, say in post war Britain, alongside house price inflation? It'd be interesting to see the interaction

-

Anna Powell Smith, a developer/data scientist, has created a plot of house prices per square metre, by combining Land Registry data with area data from Energy Performance of Buildings Data, see here: https://houseprices.anna.ps/ I think the Energy Performance data has only recently been made available, though I'm not 100% sure about that. It is at the following link, but you need to register: https://epc.opendatacommunities.org/ It should be possible to use the same idea to produce more accurate plots of price changes over time than is possible with the LR data alone.

- 6 replies

-

- data

- house prices

-

(and 1 more)

Tagged with:

-

There is a radio programme on Fivelive each week with Gabby Logan about buying houses. I have never listened to it but I have had the misfortune to listen to the endless promos for it on BBC Fivelive. Has anyone else listened to the promos - they are all about rising house prices, not too late to buy, property can only go up. I find it pretty disgusting. That's all I wanted to say really. Got that off my chest.

- 32 replies

-

The Guardian is reporting salaries by profession from ONS data https://www.theguardian.com/money/2016/oct/31/highest-paid-jobs-2016-ons-annual-survey-hours-earnings Take doctors, Median is £75k, 90th percentiles is £132k It is the 8th highest paid profession. The top is for financial traders / brokers - but too few reported to allow proper statistics. They had an average of £132k. The BoE are looking at mortgages multiples of 4.5 times... So median doctor can borrow £337k, top paid 10% of doctors can borrow £594k So how can house prices be where they are? Either mortgages are all much bigger than let on, or most people are committing tax fraud?

- 34 replies

-

- salaries

- house prices

-

(and 1 more)

Tagged with:

-

http://www.telegraph.co.uk/finance/personalfinance/borrowing/mortgages/12157842/Weve-got-80000-in-student-debt.-Can-we-borrow-100000-for-our-first-home.html Contains the classic line, Renting at a 6% yield. Not the worst and who knows maybe they might be able to find a cheaper rental? Maybe then it will feel like they are paying for a service and not like throwing money away!

- 42 replies

-

- debt

- house prices

-

(and 1 more)

Tagged with:

-

http://www.bbc.co.uk/news/uk-27360032 Viva Austeriteh! Viva the London real estate asset class! Viva Boris!

- 24 replies

-

- billionaires

- london

-

(and 3 more)

Tagged with:

-

http://www.telegraph.co.uk/finance/property/11700282/Mapped-How-much-has-your-house-price-moved-in-10-years.html Inflation adjusted prices over ten years aren't as high as I'd have thought for 90% of the country...

- 13 replies

-

- house prices

- inflation

-

(and 1 more)

Tagged with:

-

http://www.theguardian.com/society/2015/apr/28/uk-housing-crisis-in-breach-of-human-rights Word.

- 13 replies

-

- house prices

- rent

-

(and 4 more)

Tagged with:

-

The BBC has done several interesting news items on News 24 today - almost as if there is a theme on housing. Or perhaps they just stuck them all out on a sunny winter afternoon so that no one will notice. 1. New York now has 60,000 homeless people - a staggering 25,000 of whom are children. But the homeless are increasingly people who have jobs but who cannot afford to actually even rent, let alone buy, a property in NY. The income inequality between what people earn and what it costs to rent is the biggest in the US apparently. 2. Boulder, Colorado - similar to the above re the income inequality between what people earn and what it costs to rent buy. Boulder has become increasingly trendy with a huge influx of people from California, Hollywood types and Silicon Valley types, moving to the area. The town has loads going for it - it feels like a small town and, rare in the US, over the decades the town council has bought loads of land around the outskirts which are basiclaly now public parks. So it is a great place for people who enjoy outdoor activities. The recent drug legislation has also attracted more people with money to the area. But now people born and bred in the area are finding that they cannot afford to live in the town. More and more are now clubbing together to live in 'communes' but Boulder has a law where more than 3 unrelated people cannot live in the same house... so more and more Boulder-born people are finding that they have to break the law to live in their own town. 3. Baton Rouge, Louisiana, is an interesting 'Soylent Green' type scenario. One area of Baton Rouge, which is predominantly white, is lobbying to break away from Baton Rouge and become a new town called 'The City of St. George' - leaving the rest of Baton Rouge, which is mainly black, to fend for itself. Most of the taxes, which pay for the schools, libraries, etc, in Baton Rouge come from the predominantly white area and hence, although it was not openly mentioned, you got the impression that there is an undercurrent of why should we pay for everyone else.

- 20 replies

-

- house prices

- income inequality

-

(and 1 more)

Tagged with:

-

http://www.dailymail.co.uk/money/mortgageshome/article-2865295/Millions-younger-homeowners-struggle-ladder-two-years.html Post on the main blog and I can't comment there! So, just wanted to point out that Iibertas is really bad at maths! If the house you bought goes up by 10%, any larger house in the same area will also have gone up 10% (a greater amount). Buying a bigger house is more about saving, i.e, the amount you can save after servicing your debt or paying your rent. Yes, increase equity is a kind of saving, just as share price increases, increase my equity, but as I have already pointed out the larger house you want to buy will have gone up by more than that equity saving! So saving will have to make up the shortfall, unless you really want one of those IO mortgages! Oh BTW, there is no ladder (I really must get around to drawing that picture of the bamboos flying helicopters and home buyers jumping from rope to rope! Anyone who remembers the BBC4 show will know what I mean). Anyone else want to tell libby that basic maths is beyond him..... At least some of the posters on the article get it! And this is my fav so far! From a young homeowner....

-

Been keeping an eye on a house for 140k 2 months ago, it went down to 130k and then this week too 120k and I manged to buy it as a first time buyer for 115k with a 15% deposit. After years of low intrest rates I took the plunge. Even my parents neighbours have reduced there house from 140 to 125k this week because it has been up for a year. There is deals to be made as buyers wait till after the elcections but iam not delusioned to know that a storm is brewing. I just hope the 20% I saved can cover the loss I will make. Read more: http://www.thisismoney.co.uk/money/mortgageshome/article-2806165/Could-year-s-election-bag-bargain-home-Five-reasons-house-prices-slide.html#ixzz3H54emUus Follow us: @MailOnline on Twitter | DailyMail on Facebook

-

House prices: Have sellers missed the top of the property market?http://www.telegraph.co.uk/finance/economics/11081014/House-prices-Have-sellers-missed-the-top-of-the-property-market.html

- 19 replies

-

- house prices

- house

-

(and 2 more)

Tagged with:

-

It is basically an advert below for building your own home... and the advice for priced out people appears to be to build your own home on your parents' land... but the Shelter info about 29% of working adults in Wales unable to afford a home is interesting.

- 8 replies

-

- house prices

- wales

-

(and 1 more)

Tagged with:

-

First true sign of HPC. London asking prices drop 5.9% in a month! http://www.rightmove.co.uk/news/files/2014/08/august-2014.pdf

- 70 replies

-

- rightmove

- house prices

-

(and 4 more)

Tagged with:

-

....or is it just a lack of decent jobs? http://www.dailymail.co.uk/money/mortgageshome/article-2709948/House-prices-Doncaster-lower-today-TEN-years-ago.html