-

Posts

4,163 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by VeryMeanReversion

-

-

On 11/05/2018 at 13:37, iamnumerate said:

I disagree with 95-05 as being good affordability changed massively in that time, what you could buy on 3x average wage in 2005 was nothing compared to 95 or 98.

I would say 95-98 or 99 good

98 or 99 - 04 bad

04-08 very bad

08-11 bad

11-onwards very bad again !!!

My favourite chart.

I bought in 1997 (green), sold in 2003 (orange), bought in 2010 (yellow).

-

On 4/17/2018 at 3:04 PM, Errol said:

I don't see how a landlord is a parasite. They own something and rent it to people. No different from owning and renting anything else.

parasiteˈparəsʌɪt/noun-

1.an organism which lives in or on another organism (its host) and benefits by deriving nutrients at the other's expense.

---------------------------------------------------------------

Mortgage rules meant that landlords could use multiples of the rent to get larger mortgages than the renters could using income multiples. Landlords got to outbid the renters by using the renters income against them.

The more houses that were used in this way, the worse it got.

Those will little equity to start with are the worst hit. Only if their wages get really high can they achieve rental-escape-velocity to avoid the landlord parasites.

I don't care if someone buys a lot of DVD players and tries to rent those out. It is different for housing due to being a limited supply of a basic need.

-

-

17 hours ago, Lurkerbelow said:

I really don't get those who keep pushing the line that Labour will do nothing about the UK's housing mess, as political parties exist to represent the interests of their voters, its what they do. Its why we got help to buy and the triple lock, its why in the 2000's when politics was totally boomer dominated NuLabour also ramped house prices up the wazoo. Now the politically imperative for Corbynite labour is to build build build and for prices to fall fall fall. That it aligns with Corbyn's social justice warrior ethos is just a bonus.

The political imperative for Corbynite labour is to import more labour voters and provide/subsidise houses for his supporters.

If you want to earn enough of a wage so you can buy a family house within your own lifetime, you continue to be stuffed.

Given that its the cost/availability of credit that is the major determinant of house prices, I think monetary policies far outweigh the differences in each parties housing policies.

-

15 hours ago, Social Justice League said:

Money is worthless. It's the human mind that gives it 'value'.

What is £1 million worth to a wild boar or a mountain goat?

Yum.

-

33 minutes ago, Si1 said:

Hitherto spare cash has gone into pensions so as not to prejudice potential benefits claims should we need it whilst only I worked.

It's a crazy system when this has become a rational course of action.

I only realised this when I was made redundant many years ago with an STR fund in the bank so got nothing. If I get made redundant now, I will look poor (for benefits/credits purposes) despite having far more assets (house+SIPP ~£1M).

-

1 hour ago, TheCountOfNowhere said:

What pricfe per sq foot would entice everyone else to buy ?

I sold in 2003 for £250/sqft then was looking for £200/sqft from 2003-2010 but couldn't find anything I liked in South Cambridgeshire.

So in 2010, I went for a fixer-upper with large garden at £250/sqft then added ~70%to the size for £100/sqft. (did lots myself)

Ended up at £200/sqft.

Building costs seem to have gone up a lot since then, would expect a £150/sqft extension cost now.

-

10 hours ago, whome_yesyou said:

The only way for prices to fall is a true tightening of credit IMO. If you make easy money available, then the masses will always take it like lemmings.

That's basically it for me.

The only thing to stop it is for the lemmings to become debt-aware. I've noticed a few friends in their 50's are only now realising that the debt they are carrying means retirement will never happen.

-

15 hours ago, Dorkins said:

Indeed. I think the smoothest way to do it would be over the course of a Parliament or so to cut NI to zero and put the difference onto income tax.

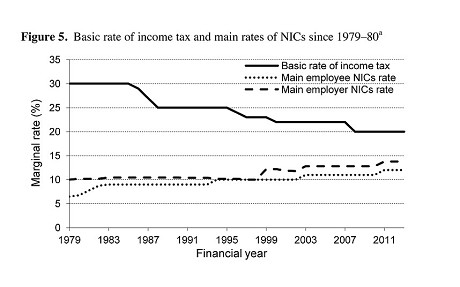

This is a bit out of date but it shows how it has been moving in the other direction. The powers that be know that income tax is the one that gets the headlines.

-

Muppet.

(Sorry, couldn't resist. I did try.)

-

A couple of my favourite graphs below.

You can see that as the the headline income tax rates fell over the years, NI just went up to compensate. Of course, BTL'rs and pensioners don't pay NI so their marginal rate stays in the 0-20% range. (Section 24 will move some BTL'rs up to 40% income tax but still no NI costs)

Workers get the 32-60% range, particularly painful if then paying a large proportion of net income as rent to someone in the 0-20% marginal range.

This EMTR graph actually understates marginal rate since it doesn't include employer NI which is effectively another worker tax avoidable via salary sacrifice.

Personally, I salary sacrifice as much as I possibly can with the aim of living off the income (NI-free) asap. The tax system is simply encouraging me to become a pensioner as soon as possible.

-

16 hours ago, reddog said:

-had my eye on a "show room condition" 1990s Mazda Rx7, great condition and high price, but was on sale for well over a year

I've got one of the last Rx7's, an unmodified series 8 RS. So much lighter than modern cars and with 300bhp, it can certainly shift. Its held its value over the last 11 years, even though I've been using it ~3K miles a year.

Pic here with its little brother (240bhp rotary mx5)

-

1 hour ago, TheCountOfNowhere said:

Are you happy for it to be confiscated to [pay for your end of life care or taxes at 80% ?

That's whats going to happen I expect.

If used for end-of-life care then I would consider it spent rather than confiscated.

If pensions were taxed at 80%, I would not be happy.

-

51 minutes ago, crouch said:

With Platinum I assume you will take delivery of the physical metal; I'm sure you're aware that the "paper" gold market is around 100 times the physical market and most of the contracts requiring delivery cannot be fulfilled and are not meant to be. I might buy gold but I would want a deposit receipt and would probably check that it is there - on the assumption that it would not be confiscated of course.

I can't have physical in my possession using a SIPP so I use an ETC. Supposed (!) to be 100% physically backed.

I looked at holding physical gold many years ago but without proper testing equipment, couldn't convince myself it would be real.

-

38 minutes ago, crouch said:

I think in an inflationary situation you just have to invest in "real assets" - and I include equities here because there is a backing of some sort in real assets. Whether it's gold, property or a Porsche Turbo is a matter of taste but some sort of claim over the real assets has to be the key. You might still get stuffed but a lot less than holding cash which is what I'm doing at the moment and have been for some years.

I'm also keen on real assets or at least a claim on something real that is not likely to be confiscated.

- One property with minimal leverage

- Large cap boring divi payers with real assets. Energy/mining preferred when cheap. Some consumer oriented but not much.

- Platinum

- Classic car (not using it much after I noticed it was appreciating)The aim, as you put it, is to minimise getting stuffed.

The only one I'm looking to increase is Platinum, seems cheap compared to Gold.

-

2 hours ago, Social Justice League said:

A country ran for the benefit of banks.

Shocking and an act of treason imo.

According to an Iplayer Radio 4 series on the history of debt, the banks were originally granted licences so our past Kings could issue debt. Our currency was just a note that could be used to pay off the kings debt.

So rather than treason, the Royals started it with the banks.

Bend over serf....

-

On 10/15/2017 at 10:25 AM, Ah-so said:

Take the £10k pay rise and put the entire lot in your pension, saving £4k in tax and it will allow you to retire that little bit earlier.

Use salary sacrifice, get the company NI savings and your NI saving and get over £11K instead.

-

On 10/15/2017 at 7:56 AM, regprentice said:

From that point onwards (up and over £70k) every £10k you can get out of your employer equates to a very low amount after tax. I was looking at £10k to go from £52k to £62k, less my pension deductionss at 15%, tax at 40%, ni at 1% , student loan deduction at 9% and losing my £1.8k per annum child benefit for 2 kids. That would leave me with less than £2.5k out of that original £10k. I've no idea how anyone with other deductions (ie child maintenance payments set at 20% of gross salary per child iirc) summons up the will to earn anything over £50k and take home as little at 10% of their gross.

I did the same calculations a few years ago. Since then, everything over £50K goes into SIPP via salary sacrifice. I turned down an offer of a more senior job with a 25% pay rise this year when I realised I wasn't going to see much of it for the extra hours/stress/commute. I couldn't even get the extra into a SIPP as I would hit other limits and the company didn't do salary sacrifice.

The funny thing I found is that the owner of my current company and the other company both take most of their income as divis, using their spouse as well so they had no idea how much tax their employees pay. Their tax rates were far smaller than mine.

When the 40% income tax band threshold moves up to £50K in a couple of years, this jump in marginal rate is going to look even steeper.

The aim is now to work less hours and make use of HMRC approved share schemes with 10% tax rates instead.

-

For A-level economics, I was taught that fractional reserve was the method used.

Then someone on here many years ago explained how the commercial banks created money.

Then someone on here a few years later very convincingly explained how only the central bank could do it.

Then someone on here this year pointed me towards the BoE paper that very clearly says how the commercial banks do it.

The above explanation of Central creates M0, commercial banks create M1 seems to be the best description.

No wonder I get confused.... nurse! nurse! Time for my medication.

-

12 minutes ago, dougless said:

I almost feel sorry for them.....

They are just hoarders of first-time buyer properties. Every one they bought made it harder for everyone else. When they go bankrupt, I hope they end up renting from the next parasite up the housing food chain.

-

>we chose to set up our own company as a Letting Agency

Yet couldn't resist getting into BTL (highly leveraged speculation) directly.

> we have a profit from our portfolio of buy to let properties

we have a profit from our hoard of buy to let properties

> hard earned money

Rentier loot

>we have to pay 32.5% on every dividend we take. How can this be fair.

Tenants pay 20/40% PAYE and 12% National insurance and have to work for it. How can this be fair?

>we are normal hard working people

Nope, just middlemen between the banks and the tenants. Just collect commission and do as little work as possible.

>How can it be in this country, that a loyal proud British couple can work hard for their country, then set up a business to better themselves and their family whilst at the same time genuinely help thousands of tenants and landlords, but be forced through no fault of their own be pushed into bankruptcy by an evil, uncaring greedy tax scheme.

They may have worked hard in the past but now want to be parasites on those working .

It's their highly leveraged BTL speculations that will make them bankrupt, not the lettings agency.

-

On 10/17/2017 at 2:09 PM, Midlifemum said:

In this article about house prices, there is a comment about the UK being on the brink of social collapse because of the cost of housing

I think people get angriest when things (they think they have) are taken from them, rather than not being able to get them in the first place.

e.g

- That DB pension we promised you is now worthless

- That state pension we promised you is now worthless

- Lost your job? We are coming for whatever equity is left in your house

- Sorry, no more tax credit income for you

- Sorry, we don't do IVA's any more. Hand over all your stuff.

I struggle to see how a system of ever-expanding debt works in a population where the average age has gone past the peak-income/productivity years (~40).

-

6 hours ago, Parkwell said:

Carney is just another spineless management speaking conman. He only has to paper over the cracks for another 2 years and then he can go get another high paying job where he does eff all about major problems for a term. He has zero plans to rock the boat. A steady hidden decline suits him fine, then it can explode when he's clear of the blast.

I've worked with a few people like that in previous management roles. They know what is really going on but see the people they are talking to as simple objects to be manipulated. They are also excellent at manipulating their own boss.

I had an interview a few months ago, got offered the job but recognised all the characteristics of the above in the VP there so turned it down.

-

3 minutes ago, Hullabaloo82 said:

Where I live the Council has an active policy of not contesting planning applications unless it is absolutely cut and dried. Reason? Lost a court case a couple of years ago, forked out a few mil and are now risk averse.

Result? Thousands more house? Nope. A handful of executive houses and a shit load of land banking? Correctamundo.

Market failure.

Those with deep pockets get to outspend the council in court, no suprise. Any market failure is due to the planning system where only those with big £ (or "influence") get to manipulate the system. Individuals simply can't take the risk.

I've had my fights with the planners, going to appeals etc and got nowhere trying to do something sensible. Neighbours, parish council and local MP tried to help but I got nowhere playing by the rules. I found that permitted development loopholes were the only way to get anything done for an individual without risking big court costs.

The planning system is the failure. So as I said before, getting councils to build only works if they give themselves permission that a private company or individual would not have got.

I don't think the builders are that interesting in land banking for its own sake (just ensuring a pipeline of future work). They make money on house sales but more importantly, when the planning permission is gained. They don't gain as much just sitting on it.

-

14 hours ago, Saving For a Space Ship said:

The private sector has failed. Only councils can be trusted to build the homes we need

Private sector is profit driven within the planning laws. They seem to be doing what private businesses are supposed to do.

Planning laws keep supply low, credit keeps demand high.

Your suggestion only works if councils give themselves planning permission that would not have been granted to private companies.

Illegal evictions of lodgers or not? Extortion by new landlord.

in House prices and the economy

Posted

I've just evicted a lodger. Only tenants get extra Covid protection, not lodgers

My Dad died during lockdown and the lodger had been there 15 years. So I moved in to be a resident landlord. I could then give the rental period (1 week) as notice.

Lodger was an ex-con drug dealer and I found evidence that he was £10K behind in the rent and had borrowed money from Dad to pay his car insurance. No sign of anything behind paid back. All the money probably went on weed going by the smell in the lodgers room.

I paid him his deposit and last months rent back to get him out. There was no sign that the rent had actually ever been paid but I needed him out of the house.

I read up as much as I could about lodger/tenant differences and shelter/CAB advice to be sure that is was legal to get him out in a week. If he had refused to go, it would have been legal to change the locks and call the police to prevent re-entry, even during lockdown.