-

Posts

4,846 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Flat Bear

-

-

THIS THREAD WAS STARTED OVER 16 YEARS AGO

BUT IT IS AS TRUE TODAY AS IT EVER WAS.

On 01/07/2007 at 18:24, Flat Bear said:Looking at the 3 house price corrections since ww2 and the 3 corresponding GDP falls into negative GDP (recession)

House prices measured in terms of multiples of average salaries.

House price crash 1

Main features high inflationary period, The biggest and quickest GDP fall, with the highest pre bust GDP.

1972 After very steep increase in GDP and house prices, GDP peaks and starts to fall at some speed. (it takes less tan 20 months for gdp to fall from over 6% to -.5%.)

2.5 to 3 months later house prices hit a peak and start a dramatic change of direction shadowing the sudden change in the direction of GDP.

End of 1973 negative GDP entered into recession begins for the first time since WW2.

Very early in 1974 GDP troughs at around -.5%

late 1974 GDP starts to rise

early 1975 recession is pulled out of.

late 1975 house prices hit their trough for the cycle

Early 1978 GDP hits a peak (and starts a long decline see house price crash 2)

early in 1979 house prices hit a peak (and starts a decline see house price crash 2)

House price crash 2

started from the lowest GDP level, deepest GDP falls and recession, smallest falls in house prices.

Early in 1978 GDP starts its decline

early in 1979 House prices start their decline

early 1980 recession entered into

late 1980 recessionary trough reached at aroud -1% deepest recession.

mid 1981 recession pulled out of

very late 1981 house prices trough and during

late 1988 GDP hits a peak (before suddenly starting to fall see house price crash 3)

early 1989 house prices hit a peak (before suddenly starting to fall see house price crash 3)

House price crash 3

longest period for recovery of GDP back above 2% level, longest and lowest house price crash.

late 1988 GDP suddenly starts to fall

early 1989 house price suddenly start to fall

very early 1990 recession entered yet again

late 1990 recession hits its trough before stating a slow recovery.

early 1994 GDP hits a peak before starting a long plateau the longest period of relatively high growth (above 2%)

early 1995 house prices hit their trough stagnating for the year before starting a very long, slow at first ascent

...................................???????????????

What happens next?

Some interesting points

the magnitude of each boom is important in predicting each bust as well as the extremes and speeds of change but length of each boom seems extremely important.

The current boom has gone on about as long if not longer than the previous 3 put together!

In theory the boom in GDP should have ended long before now and its "dragging out" seems to be distorting house prices as well

No matter how benign the next bust in the economy house prices will suffer a longer downturn, even if GDP doesnt enter negative territory a deep correction would look inevitable.

House prices are starting at a much higher level than ever before whilst GDP at around its average of around 2.2 to 2.8%? this makes the biggest gap ever between these 2 factors.

I will be trying to find more information about the likely trend for GDP in the UK as far into the future as possible. If we see GDP fall below the 2% with further declines in growth likely I would suggest a house price correction would be underway soon after, I dont believe there would be a long delay this time.

Bottom line is there is always a slow down in HPI before a recession and there is always a recession that accompanies a fall in house prices. Depending on the depth of recession house prices will fall. There is a correlation every single time.

We have/will see nominal house price falls of around 5% by year end and this will indication we will go into recession.

Inflation has to be taken into account as it distorts everything and everything is in real terms.

On 01/07/2007 at 18:39, 29929BlackTuesday said:For heaven's sake - it's DEFINITE ...defiNIte FINITE with a 'de' before it.

I'm sorry about that - I've got it out of my system.

Plus I think you're being a little bit naughty with you're posting - coming over all Warren Buffet and GDP / blah blah with the hidden intention to dispirit the FTBs reading for the first time.

PRICES FOR HOUSES ARE COMING DOWN AND WILL CONTINUE. DO NOT BUY A HOUSE NOW - YOU WILL LOSE A LOT OF MONEY.

WAIT...

spelling errer.

This is why it is best not to give advice on your own assumptions alone like this @29929BlackTuesday idiot who shouts advice at first time buyers to not buy a house now (2007) as they will come down, no question about it. At the same time as berating me for getting posters to look at historic data and making a spelling mistake.

Maybe it would have been better if he actually read and took on board what I was saying or even some of what Andrew Farlow had been saying even if he disagreed with some or all of it. If they timed it exactly right and bought in 2009 they may have saved 10% but was this enough to put their lives on hold?

For what it's worth my advice today for FTB's is to not be too much in a rush and make absolutely sure they can afford the higher mortgage payments for a prolonged period. I would not advise not buying because people need to get on with their lives and no one can predict exactly what will happen to the economy or their lives.

It is true that nobody (possibly a select few in the know) could have predicted QE and ZIRP but there are always things that come out of left field.

-

On 01/08/2022 at 21:37, Flat Bear said:

When I opened this thread in 2014 I was trying to get feedback from others on the outlook with QE and ZIRP kicking in. There seemed to be a blinkered mindset that prices are too high so they must come down. I was trying to get answers to why this could have happened as I could not see any downward pressure at that time.

So in 2014, because of ZIRP and QE I was quite convinced that we would see continued HPI for the forseeable future. And we have every year since.

Some of the same posters who were arguing with me then that a crash was imminent (bearish) are now arguing with me that inflation is transitory and interest rates won't rise (bullish) They do not have any logical argument, again.

I am predicting house prices going year on year negative early 2023 and staying negative for a long time.You can call this a crash if you like.

PLEASE NOTE

THIS THREAD WAS STARTED A DECADE AGO

This was a thread I started nearly a decade ago now and as you can see from the content I was predicting a long period of HPI in the UK. I did not want this to happen as I thought it was a very bad thing for the people of this country and would destroy the lives of many people. BUT, I could not ignore the facts and they told me we would see HPI whether I liked it or not.

Today I see a situation where will have all the ingredients for a long and protacted period of house price deflation. I admit to thinking this would be a good thing and necessary, BUT I truely believe I am looking at, and baseing my judgment on the facts alone.

Like many of the bears back in early 2014 who were in denial you are in denial now. Their arguments were pure hopium and were based on gut feelings as you admit your reasoning is now.

Wake up and smell the coffee and get out of the matrix. Use your brain and not your heart, please. If you have any real reasoning then I for one will listen but stop all the hopium s##t.

If there is any particular reason you would like me to address for you I will oblige. Are you playing devil's advocate though?

-

1 hour ago, cdd said:

https://www.rightmove.co.uk/properties/139586174#/?channel=RES_BUY

Be interesting to see what happens here. This just came onto the market.

Sold in 2020 568k

Asking today 765k

How much has the property been improved over the last 3 years? How much was spent on it?

There was nothing in the description to say recent extensive improvements or similar.

It will be interesting to see what this does sell for if it eventually does. Tells me there are still a lot of people just trying it on. It will be the agents who will lose out as their "professionalism" comes into question by marketing unrealistic expectations.

Yes, please keep us informed as others have already asked for.

-

6 hours ago, The Angry Capitalist said:

Inflation is the increase of the currency/credit supply. Plain and simple.

Since QE post 2008 financial crisis the newly issued currency along with expanded credit has flowed into stocks, bonds and housing to name a few (and let's not forget the digital bus tokens that is crypto).

Like currencies, assets especially stocks are a claim on actual real resources.

The problem with assets inflated by currency creation is that they are not based on actual production or real growth in the economy.

Therefore, everyone who has benefited from rising prices in their portfolios cannot all cash out and make the true gains that their asset prices show.

It is mathematically impossible. If they all try to sell today or in the near future prices will plummet (as there will not be enough buyers to match sellers) and the first movers will only sell at a profit with the rest making real big losses.

The "wealth" is paper only and completely illusory.

Some (many?) have benefited and actually made real gains who have already profited from the QE era but the winners will always be minimal to the general population.

With that out of the way can that excess credit/currency be converted into real wealth and transferred to other assets and things therefore switching high prices from housing and stocks to something else?

Yes. If we do not get any major deflation.

But it is anyone's guess where that currency will flow to.

It will also depend on what the central banks and governments do.

With central banks currently not buying government debt and interest rates being set by the market there is no new currency creation via the BOE but banks could still increase new credit into the economy via mortgages and credit cards etc.

However, due to the amount of currency creation over the past decade many companies have come into existence that would not have otherwise in an interest rate set by the free market.

Therefore, as long as the interest rate is set by the market and not manipulated down via central banks buying government debt then soon many companies will go bankrupt.

This process will cause a high demand for credit/loans (as struggling zombie companies scramble for cash to survive) forcing interest rates up and banks to be extra cautious (they have already been moderately cautious since end of QE which is normal in a increasing interest rate environment after much money printing) as they know (it's their jobs to know) where the bodies are buried and so will be very stringent in their lending as it will become very high risk to lend out money in this new environment of zombie companies that are practically insolvent in a higher rate environment.

If the free market is allowed to solve this problem (as it should be and in fact this should have been left to solve the crisis of 2008) then we will have deflation which will bring back an equilibrium between the currency supply and national production of goods and services.

Prices will come down and wages will over time go back to a more healthy position where they will be more in proportion to the average house price etc.

The question to ask is how much deflation can the establishment (and the public) accept?

The answer to that question will give you a more precise way to predict how much of the inflation can be transferred to other assets.

My guess is some of the stock market, bond market and housing market ill gotten gains will go to fine art, gold and perhaps land before we have either major deflation or more money printing (whichever side you are on).

If we have no deflation and a return to money printing (and therefore lower interest rates) then watch out for a possible crack up boom.

But if we stay on the current deflation track then prices will come down in real and nominal terms.

The longer we stay on that track the more bankruptcies and defaults and stock market crashes we have as the free market unleashes its destruction on the irresponsible borrowers and entrepreneurs who have miscalculated from the money printing.

I think you are quite accurate in your thought process here and you are asking the right questions. Wouldn't it be good if Bailey could do the same?

4 hours ago, fellow said:To be fair to @Stewy we are now seeing deflation, just not the deflation he was looking for:

Halifax HPI

- 1.9% MoM

- 4.6% YoY

This is exactly the truth.

It could well be possible for the fall in house prices to mirror the rise in general consumer inflation. If it mirrors to a zero factor then we could see completely flat house prices with higher general inflation. If we see a factor greater than zero we will see falls in house prices. The bigger the factor the bigger the falls. In @Stewy world the factor could be less than zero, which it has been for many many years and HPI will be higher than general inflation. What is the current factor?

Anything is possible. The variables being: UK base rate, consumer inflation rate especially core inflation including wages, the amount of available credit and the actual need for housing. Basically supply and demand, as always.

-

2 hours ago, Sackboii said:

Is it going to stick like Zone 3 ? 😆

The thing is Bailey does not believe that inflation in asset prices can transfer to general inflation. THE CANTILLION EFFECT if you like.

I have had a discusion with @Timm on this Cantillion effect on another thread. Timm is very sceptical and does not believe it either. Timm does not pretend to be a top economist but Bailey does and gets over half a million a year, not counting bonus, to boot. Listen to any of his many interviews/statements, non of them make any sense and at the end he evades the question. Typical answers "well it may do this or it may do that, we just don't know" uses this quite often. He could bore the spots off a leopard and has a degree in waffling I believe

Interesting on his take a few year ago that he will keep negative interest rates in the arsenal and they will use it when needed "and they will be needed at some point" with a little chuckle.

Unsure about @Stewy I think he may well be winding you up and is playing devil's advocate. On the other hand he could be a total nut case. I suggest that he does not really believe what he posts in any event. Maybe he is just very frightened?

-

32 minutes ago, fellow said:

He's been saying this for about a year and a half.

As a number of us have been saying and realised over 2 years ago Bailey has an emotional attachment to the "new phenonomen" of ultra low interest rates forever. I will dig up one of his speeches where he scoffs at the idea of interest rates going above 3.5% ever again.

Somehow or other he has come to believe his own retoric.

He made an attempt several months ago where he tried to take on the market and the pound went into freefall along with the Euro which ended up below parity for a short period. I just knew he had not learnt his lesson although I think the ECB have had a shock and will do what it takes.

After this ultra dovish speech I would expect the pound to become into increasing pressure against the dollar and euro and most other currencies with the exception of the ruble.

He will actually make it worse for UK interest rates which will have to go even higher for even longer.

In the end he will have to raise whether he likes it or not.

He is making this stance now as he realises this is a pivatal point and when we see base rates get to and exceed that 6% mark the inevitable asset price crash along with a nasty recession taking place.

The fact is he has no power, no power at all, in the face of this oncoming pressure. if he does try to tighten up the money supply, which he must anyway, it will make things even worse.

Bailey has no credibility at all now and the only thing he can do is a @Stewy and we all know how that will turn out.

-

1 hour ago, 70PC said:

Leave the dark side, join us. There is plenty more in the article.

"Instead, the war has exposed the flaws in Putin’s system: the corruption and waste of the arms industries and supply chains, the drunkenness and depravity of the troops, the cruelty and cowardice of the elites. Russians notice that these elites protect their own, leaving the sons of workers and muzhiki (peasants) to be treated as cannon fodder. Whereas Zelensky has cracked down on draft-dodgers, Putin has conspicuously failed to do so."

"The Russians are losing their war on Ukraine. They just don’t know it yet. Many armchair generals ignore that fact. Putin is stronger than ever, they say. Even if his invasion failed to conquer Ukraine, the crushing burden of war cannot be sustained indefinitely by its defenders, we are told. And even if they do hold out, the Western democracies are already tiring of their role in providing military and financial lifelines to Kyiv while sanctioning Russia."

"The Russians are losing their war on Ukraine. They just don’t know it yet.

This is where I am in total disagreement.

The Russian's are losing the war in Ukraine (and outside). This is obvious to all. I do not believe there is anyone with reasonable inteligence who would think this was not the case. Does anyone know of anyone, without a vested interest, that truely believes Russia will prevail? Thought not.

-

On 21/08/2023 at 19:40, Flat Bear said:

I would suggest that drone and other attacks on Russia itself will increase as well as strategic attacks on Russian infastructure. The advances on the "front" will continue to be slow and deliberate. In the short term at least until Ukraine decides the west has given all it will and only then will they make a real counteroffensive move.

This does seem to be the Ukrainian tactic now. I think it was always going to be the case that the Ukrainians were going to take the fight to within Russia itself, they have to. By now there would be thousands of special forces type troops, partisan groups and dedicated saboteurs within Russia itself ready for activation and instructions. This is the biggest country in the world extremely sparsely populated where all the troops are busy defending borders or engage in a special operation that has gone on longer than expected. They could not have really done anything much to date due to the political situation of using NATO weaponry inside, or targeting, within Russian borders. It seems with drone technology and by using surprise raids they will be causing increasingly high damage to not just the military and logistical capabilities of Russia but also hit the Russian economy which already is in a very bad place.

Initially there will be plenty of rich military picking but I would suggest within a few more weeks we will see attacks on purely economic targets, administrative centres and more general infastructures such as oil depos, rail infastructure, factories etc etc etc. There is so much to choose from and I do not see how the Russians will be able to defend them all.

Edited to add

"Unexpected" fires and explodsions will suddenly break out in factories, oil depos, Road and rail centres etc etc. The Russians will deny it and they will gaslight with the most stupid of excuses even when it is really obvious. Mark my words.

-

On 31/08/2023 at 22:49, Up the spout said:

I'm not sure why you fascist dictator-loving, useful idiots post videos of other fascist dictator-loving, useful idiots here - nobody is watching them or reading your (plural your) long posts of lies and dissemination. You're obviously useless at it and are just further entrenching views that are polar and correct.

That is an actual dose of reality for you.

Yes

This is exactly the way it is. Anyone with any sense at all can see it.

These trolls are terrible at their jobs and they are a laughing stock. DO NOT LET THEIR STUPIDITY GET TO YOU. Sorry to shout.

On 01/09/2023 at 00:06, DarkHorseWaits-NoMore said:See what I mean @Up the spout?

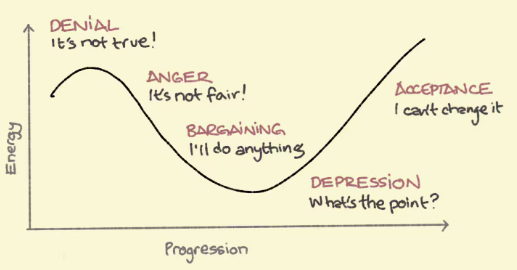

This troll has got it exactly the wrong way round. Many of these trolls are already past the BARGAINING stage "ill do anything" as they realize nobody wants to negotiate with them on any terms short of them getting completely out of all Ukrainian territory and paying all reparations as well as bringing all those responsible for war crimes to be punished. They are in the DEPRESSION stage, "what's the point"? of continuing with this increasingly ridiculous Russian propaganda. They are just about to enter the ACCEPTANCE stage "We can't change it" time, where they realize Russia has finished and it is just a matter of what will become of this failed state. There is not much longer to go, trust me.

The fog of war might have blinded them but the fog is lifting and everything is getting clearer albeit slowly so far.

6 hours ago, Grayphil said:Yes, I wonder how long the BRICS will pretend to be friends, looks like China sees some easier opportunities than invading Taiwan.

The Russian-Chinese border is the most heavily guarded border on the planet. How many of the elite Russian troops have been sent to Ukraine from there?

Chinese/Russian relations are all but certain to deteriorate very soon.

-

19 hours ago, henry the king said:

Rates are now higher for longer. They might drop a bit or rise a bit. But we are back to normal. The era of 0% rates and QE is over. They wrongly thought there was no negative consequences. They were wrong. So they will now be careful about 0% rates and QE again.

This will correct house prices vs earnings. The only question is how much is in real terms vs nominal terms. Prices will come down and are coming down. There is nothing to debate really beyond how much will be in real vs nominal terms. End of free money will bring down house prices vs earnings as it already has a lot.

A post I agree with.

How much will end up being nominal and when will we see the bottom? Is a question many posters would like to know. You can not time the market and it is best not to try.

-

On 23/08/2023 at 14:47, Stewy said:

5.3% to 4.9% is almost half a point rate cut getting baked in. I think we need to be careful of wishful thinking.

I think we need to be careful of wishful thinking.

LOL

-

56 minutes ago, staintunerider said:

Seems to me the market is finally saying no to ZIRP & QE, what took it so long ?

Guests like Alistair Macleod, Wolf Richter, Prof Steve Keane on the Keiser Report mentioned several times where were the Bond Vigilantes...?

The inflation numbers are and were utter rubbish always , whatever they say you can add a good chunk on...

So real BoE rates vs current inflation measured or real are really negative rates.....

I'm really try to get my head around why they blew the housing bubble if most of the lent into existence stayed in the housing market....was it for the builders and banks their chums ?

Also in a major correction what happens to the newly created money ?

Surely it cannot be destroyed because only repayment of the debt destroys the money, a correction is a whole different thing....but from my understanding back in the 90's debtors either soldiered on or capitulated and most were unpursuable for any loss by the lender but i think it did affect them financially via credit rating...

Am i right in presuming if the lender wrote off the losses that would destroy the lent into existence money ? Seems logical...

where were the Bond Vigilantes...?

They were not needed because there was so much QE and there was an unwritten agreement that the banks would purchase the bonds on very good terms. When they did not, last year, the BOE bought the bonds directly. Different matter entirely when Bonds are introduced to the real market again.

Am i right in presuming if the lender wrote off the losses that would destroy the lent into existence money ? Seems logical...

This is where there are real world consequences of QE. The bad debt still needs to be balanced against the credit entry. The banks will be liable for the loss and this is where we could see bank collapses. The only question is how much debt will any particular bank have? They have been more strenuously stress tested this time I believe?

-

9 hours ago, clarkey said:

Cyberattack by our friends in the east?

Will be interesting to find out the reason. I would think your guess might be right.

-

On 26/08/2023 at 12:15, staintunerider said:

So watched this....

1) When the wheels come off again just more of the same ? (Which is number one pick for the CB's and Govts)

2) Or does the inflationary nature of this now on top of the current inflation mean the Bond Market won;t let them ?

3) Or do they hope to combat inflation so they have the option to do number 1 for when the wheels come off again....

Market dictated interest rates for me everytime will that ever happen again I wonder ?

Thank you @staintunerider for this YouTube video. It is very appreciated by me at least.

It tells in a very simplistic way the short history of current Fiat money and the recent experiment with QE. It is very good, excellently put together.

I would like to know if their is anyone that did not realize this was the situation or disagrees with any of it?

I have "assumed" that everyone commenting on this and similar threads understood everything that was on the video in economic terms, although there were a couple of historic facts I admit to not knowing. So when I get replies to my posts on QE, Fiat money, how money is created, inflationary and deflationary forces these posters understand all the information on the video inside out. But is this the case?

To try and answer your quite difficult and very important questions on your next post

If Flat Bear is correct...persistent inflation this is going to be a long fight.....so property has to fall

What if there is a Global system shock before the inflation fight is done ?

Will the Bond market let them get away with the same old tired bodge fix....maybe if inflation is contained but what if its not ?

We have already seen some Global system shocks. I think we still have a lot more to come primarily from China when we eventually see the fallout from the Chinese economic implosion.

The Bond market(s) is a difficult one but I would suggest when we see tightening up of that money supply and capital becoming more expensive then Bonds must fall or do I mean rise? (I get mixed up with this) What I mean is people/institutions will want more for investing in these Bonds.

You are correct in that I do see this as a long fight. Also a very painful one.

There are quite a number of posters who call themselves "Bears" BUT they say they believe inflation will be very short lived and interest rates will pivot and reverse very soon. There are a number who thought prices would fall quite dramatically by 5% to 10% from mid 2022 to mid 2023 and they were going to buy come what may in June/July/August 2023.

There are a very few that do see it as I do and believe we are at the start of a long Bear market in the Property market.

I was of the opposite opinion when I left posting on the forum in October 2014 as I believed we would continue to see HPI until something changed. With increasing QE and ZIRP getting to the stage of going negative I could see no hope for any correction. I started to see the early signs of changes in late 2000 early 2021 and realized we were at the end of the era it was just no one seemed to have noticed. Started posting back in June 2021 when I read a couple of very insightful threads from such posters as sausages (changed his name a few times now) who could also see the looming inflation threats ahead. I was predicting then that we would see a correction in house prices amongst other things starting in 2022/23 but I always seem to get the timing wrong.

One thing I must not forget. "Bubbles get much bigger and they last for much longer than Flat Bear predicts"

Is this the "everything" bubble?

-

On 21/06/2023 at 00:13, Flat Bear said:

Will Russia run out of money within a few months at its current expenditure?

On 21/06/2023 at 18:36, Flat Bear said:It is difficult to find any source 100% unbiased, that is always true.

But I take it you disagree and think that Russia will get into 2024 (if they don't get heavily defeated in Ukraine) without any major financial problems?

Looking at the situation as detached as I can I think Russia is under tremendous economic difficulties and I think it will be this that will eventually bring Putins Russia down.

This Joe Blogs believes that Russia will have problems within 3 to 6 months so not too long to see if he is correct or if you are correct.

I don't know how to set a reminder to recheck our posts but I promise to try and come back to it at Christmas time this year if I can remember.

On 21/06/2023 at 18:56, DarkHorseWaits-NoMore said:Yes ok, I don't think we'll forget such an event happening.

Some put the figure on the conflict only costing Russia ~3% of GDP, which seems pretty efficient if true. The sanctions have been a joke, when most of the EU is purchasing re-badged Russian gas and oil via places like India and the middle east.Being British, you expect Sky/BBC/Channel4 to be more objective about Covid/Vaccines/Lybia/Syria/Ukraine etc.. Sadly, they are just not reporting beyond the narratives or just remaining silent on so many topics. The truth twisting and memory holing of recent history is very disturbing.

Well 2 months have passed and Russia has not collapsed yet. Just 4 more months to go and @DarkHorseWaits-NoMore will be right and Joe Bloggs will be wrong.

I will update in 4 months time to congratulate one of them.

Edited to add

@DarkHorseWaits-NoMore believes it possible that Russias expenditure on this special operation is just 3%???? Who is he kidding? The spend much more than this in peace time. We spend (UK) 3% and our economy is now over twice the size of the Russian economy. 2021 "OFFICIALLY" 4.08% of GDP. Looking at some of the very poor low quality and antiquated equipment it could be possible I suppose?

I read a report that stated that the war in Ukraine was costing Rusia over 30% of GDP. i will try and find it.

-

The Collapse of Russia. What happens next?

We are getting closer to this actually happening.

There is already a lot of confusion and Putin is starting to lose his grip.

Expect anything to happen any day from now on. People and countries could well make their move.

-

On 24/08/2023 at 22:24, satsuma said:

My main concern today is that with Russia breaking up who will move in? China will take Manchuria back, Japan will fight China for the islands. The yanks will want Siberia. Europe will fart about thinking about ethics and get nothing. Russian warlords will take the rest.

Yes, what happens to Russia afterwards

I jumped the gun and started a thread on it some time ago. Just below this one I THINK.

15 hours ago, 70PC said:👍👍👍

Tokmak is a long way in.

This will be a major milestone.

It seems Ukraine are making very steady progress along the front lines and if the figures are anywhere near acurate Russia can not last out much longer. Parity of both tanks and artillary has been past and each day the Ukrainian strength grows and the Russians weaken so it will get easier and easier from here on in. The Ukrainians are patient and underestimating advances etc.

The reason they are underestimating their success is to keep the arms rolling in and giving them time to carry out their own agenda of long range attacks on Russian bases and attacks deep into Russia itself, which has become a priority. Russia is a very very big and sparsly populated country. How many military bases have Ukraine and other partisans set up throughout Russia? A relatively small base just 200 miles from Moscow could see nightly drone attacks on Moscow itself. Fighting from within Russia itself in smaller groups could well see major destruction of what was once considered unpenetratable military bases and centres. The Ukrainians will have to go this one alone for political reasons. Hitting the Russians on their soft underbelly could be the answer and they won't like it.

-

7 hours ago, BorrowToLeech said:

That’s interesting but, to be clear, I wasn’t expressing my opinion. People like to misrepresent the views of HPC members for various reasons, so I just wanted to point out that plenty of people think inflation will fall a bit and rates might also fall a bit, or at least not rise much, and these aren’t brave challenges to the forum consensus or anything like that. Forum consensus can be wrong, obviously, but it’s much more moderate than people like to make out.

This is a very good observation.

I am a lot more bearish on the UK housing market than most others at this time because I see much bigger problems with inflation and interest rates going much higher than most believe possible together with a period of stagflation.

I see falls YOY of 5% at the end of this year (nominal) and even bigger falls 2024/25 as interest rates go up. 25% nominal fall by 2025/26 and real falls of over 50% by 2027/28 As you can see I am expecting high inflation.

Others have said there will be falls similar but don't think base rates will get above 5.5%? If interest don't rise then what do they think will drive these falls? So they are extremely moderate on interest rates, inflation and the economy but think we will see falling house prices (crash) This is not logical.

I did a topic a long time ago about house price falls and the recessionary factor which showed that every single time there is a house price correction (crash) there has been a recession. I would need to look back and see which comes first the slow down or house price falls. At some point fairly soon the economy will slow down, I have already felt the affects already. It seems to be a very steady slowdown this time in contrast to 2008/9 which was very rapid.

-

2 minutes ago, Flat Bear said:

Hello Timm

This is not a post to annoy you but I think this is a very important topic and I am trying to clarify it in my own head.

I would suggest that most of the "money" in existence in the UK is ofset against assets.

Would you agree with this?

So for individuals this will be mainly in the form of their houses

ONS figures all according to ONS data

52% of household wealth is in housing (12.3 trillion 2021)

The other 48% is mainly made up of of other financial assets such as loans, insurance, pensions, stocks and shares etc etc etc with a very small percentage 1 or 2% in cash at bank or physical cash in hand.

50% of ALL bank lending goes into mortgages for housing.

Banks see houses as fixed type appreciating assets and each dwelling is constantly updated with a "value" in currency £GBP.

On a banks balance sheet they will have a debit entry for a mortgage and on the other side a credit entry. These will be set against an asset (house) that has been valued at a safe margin above the mortgage amount. This entry has a value as it is a debt obligation.

When the mortgage is paid off over a period the asset is the owned by the freeholder and the Credit and Debit entries disappear. In essence the freeholder pays the BOE base rate, or more pecisely the rate the bank can obtain it and the margin the bank put on for profit and administration. Because there is so much money in the system QE originally used to prop up the balance sheets there is more than enough supply to need to use savers money, although if rates continue to rise just a couple more percent this will change dramatically.

If, for some reason the freeholder defaults ie can not pay the full amount back to the bank and is unable to service the debt the bank will lose the difference between the amount they can get from the freeholder and the mortgage amount. If this difference is high and they have a number of these they will be in serious trouble as the losses will be real.

We are told there will not be a problem this time as there has been vigorous stress tests.

BUT from what I understand a fall of 15% to 20% in house prices alongside a deep recession would see a situation with many banks in real trouble.

The collapse in the Chinese property market must have an affect on western banks. We are told it is only around 33 trillion USD which is massive but the banks can cope with it. I do not know if I believe this.

So what I am saying is the banks see houses purely as amounts in £GDP and any rise or fall in prices makes a very big difference. So you could say they are a store of money for them or you could use different words.

I have not really tied it to inflation.

So.

House prices have shot up for 15 years plus with people taking on bigger and bigger mortgages.

ZIRP introduced so although the mortgages got bigger the actual amount people actually paid in interest every month was around the same as when rates were normal so there was very little or no inflation (the amount people actually had to pay to service their mortgage) This would add very little to overall inflation and there was little demand for wage increases.

We have now seen the end of ZIRP and we are heading back to normal. Interest rates have already risen over 500% and interest only mortgages have more than quadrupled. This is the biggest outgoing for a sizeable proportion of the population and will push up individual inflation rates by over 100% in many cases. This has knock on affects and at some point people will demand more and more money, wages need to go up and quickly, rents will need to rise to a point where people will demand more and more money. The government can not subsidize everyone and businesses that survive will be pushing prices up as their cost go up. Everything gets very very very expensive very quickly.

High interest rates is the only cure for inflation BUT ironically because of QE and ZIRP will actually produce a massive surge in inflation for a long time to come.

-

On 24/08/2023 at 18:09, Timm said:

I think I see where you are going with this, but I will answer as honestly as possibe:

No, because it is not universally accepted, but it may perform some of the functions of money if you are reliable and I trust you.

- A medium of exchange. Yes.

- A standard of deferred payment. Yes.

- A store of wealth. Potentially - unless your circumstances change.

- A measure of value. By proxy: Yes.

- Fungability Generally speaking: No.

Generally, and for (most of?) history, yes.

PS. The UK mint do not print their own notes - De La Rue do.

If it is good enough, then it will function as money.

Until you take it to the bank.

Generally, yes.

You know what £10 means. It means you can swap your £10 for £10.

As per the answer above - probably.

As per its relative value - no.

"Sort of" is right - what is gold worth?

What is it worth if you invade South America and steal lots and lots of gold?

There are no guaranteed stores of wealth. That's why monarchs have royal guards and barns have cats.

But housing is generally a better store of wealth than fiat and generally has value as a place to live etc.

Value, wealth and money are not the same thing. I don't think that is controversial.

Not all assets are created as equal, and not all retain their value as well as others.

The rich people I know, spend their wealth around and are particularly keen on potential.

Most of their holdings would be classed as assets rather than money - I concede that.

As an aside, by wife's grandmother lost a LOT of money in Barings. If she had not, I probably would not have met my wife.

In terms of the second part, yes - to some extent. But like keeping grain in a barn, its value is likely to fall over time.

I don't think you have demonstrated the first part. Assets have value, some more than others. But the value is dependant on their yield and what someone will give you for them when you want to divest yourself of the asset. The value is not fixed, because you could have an unusually good harvest or a bad tenant. There might be a boom or a recession.

This has been a useful thought experiment, because it has made me realise that the point I was trying to make is not that assets are not stores of money (which they are not), or even stores of value or wealth (which they can be). The point I was trying to make is that they are not stores of inflation. Just because banker Bob paid £1M pounds for a house last year, does not mean that he will be able to sell it for the same price next year. That depends on many things, but mainly on what happens between when he buys and when he sells and not what happened before he bought.

Phew.

Hello Timm

This is not a post to annoy you but I think this is a very important topic and I am trying to clarify it in my own head.

I would suggest that most of the "money" in existence in the UK is ofset against assets.

Would you agree with this?

So for individuals this will be mainly in the form of their houses

ONS figures all according to ONS data

52% of household wealth is in housing (12.3 trillion 2021)

The other 48% is mainly made up of of other financial assets such as loans, insurance, pensions, stocks and shares etc etc etc with a very small percentage 1 or 2% in cash at bank or physical cash in hand.

50% of ALL bank lending goes into mortgages for housing.

Banks see houses as fixed type appreciating assets and each dwelling is constantly updated with a "value" in currency £GBP.

On a banks balance sheet they will have a debit entry for a mortgage and on the other side a credit entry. These will be set against an asset (house) that has been valued at a safe margin above the mortgage amount. This entry has a value as it is a debt obligation.

When the mortgage is paid off over a period the asset is the owned by the freeholder and the Credit and Debit entries disappear. In essence the freeholder pays the BOE base rate, or more pecisely the rate the bank can obtain it and the margin the bank put on for profit and administration. Because there is so much money in the system QE originally used to prop up the balance sheets there is more than enough supply to need to use savers money, although if rates continue to rise just a couple more percent this will change dramatically.

If, for some reason the freeholder defaults ie can not pay the full amount back to the bank and is unable to service the debt the bank will lose the difference between the amount they can get from the freeholder and the mortgage amount. If this difference is high and they have a number of these they will be in serious trouble as the losses will be real.

We are told there will not be a problem this time as there has been vigorous stress tests.

BUT from what I understand a fall of 15% to 20% in house prices alongside a deep recession would see a situation with many banks in real trouble.

The collapse in the Chinese property market must have an affect on western banks. We are told it is only around 33 billion USD which is massive but the banks can cope with it. I do not know if I believe this.

So what I am saying is the banks see houses purely as amounts in £GDP and any rise or fall in prices makes a very big difference. So you could say they are a store of money for them or you could use different words.

edited to change 33 trillion to billion

-

16 hours ago, staintunerider said:

Blimey do they really ? I don;t think anyone else does except big mortgage holders and they are just hoping..

I'm not disagreeing with you just shocked if thats what the BoE think....and Bailey imo isnt even worth mimimum wage...just a poser in an expensive suit....

Yes. This was exactly what the BOE thought and was the concensus back just 12 short months ago when I raised that post. This thread is a year old.

-

7 hours ago, Timm said:

I don't think money can be hidden in assets.

Fiat money can only be stored in accounts - even notes are promises / claims, as are gilts.

There is no money stored in a house that can be unlocked and released - the money passed from the purchaser to the vendor at the point of purchase. The buyer now has a house, not the money. Perhaps, they could sell it for the same price, but that would need a buyer who already had the money, or a mortgage (new money creation).

I accept that I may be starting down the same road that scottbeard appears to be travelling, but as you both know, I am quick to accept when I am wrong / ignorant and in this case I don't think I am.

You are going back to fundamentals which is a good thing to question.

If I write you an IOU for £10 is this money?

If you have a £10 note printed by the UK mint is this money?

If you have a £10 note forged by a master forger is this money?

If you had equivalent of £!0 in a Argentinian bank notes is this money?

All above are promisory notes and are arbitory amounts £10. What does £!0 actualy mean? Will it mean the same thing next year?

The system before the 1970s (USA) was gold backed and before that other precious comodities as well as salt backed and as such had a sort of intrinsic value.

You could turn your answer around and say real money ie wealth can only be stored in assets and not in an arbitory currency which is based on the credibility of the provider alone.

So assets have real intinsic value where as fiat money does not and is only arbitory wealth.

Rich people keep their wealth in assets and not arbitory currencies as they realize currencies are only arbitory.

So money can be kept in assets, but can real wealth be kept in fiat money?

-

9 hours ago, PeanutButter said:

Unlike most of the posters on this forum I have a lot of time for King. Much of what he has said in the past I think was very acurate.

BUT on this he is talking nonsense.

Why does he think the BOE are raising rates? Because they want to? Nope. Because they want inflation to come down? Nope. Because they think it is politically correct? Nope.

No, Mr King they are raising by the bare minimum to support the currency and thus the economy. We are totally in the hands of the FED and we need to get our base rate some way above theirs quickly to prevent a collapse of sterling. He should know this and probably is just ignoring it.

-

6 hours ago, scottbeard said:

Thank you @Flat Bear for taking the time to write all that.

I think for the first time I actually understand where you are coming from. If I can summarise: QE is inflationary - but that inflation has been "hidden" (as it were) by ZIRP in asset prices, and is only finding its way into goods, services and wages now that interest rates are coming back to normal.

This explains why you think we can have 10%+pa inflation even without any new money being created (which is what essentially I had regarded as impossible) - the money has ALREADY been created, it just has been used on assets and not goods and services.

I'm still not sure that I am totally on board with it - as I said in an earlier post, new money can indeed be used to bid up asset prices, but somewhere along the line for every buyer of an asset there is a seller, and those sellers will have got more money, and they will not always have used it to buy more assets. So I don't think ALL the inflation is "hidden" in that way. As I said, we 'should' have had a massive deflation from 2008-11 as the crazy credit boom of 2002-2007 unwound. So to a large degree I still think that much of the early QE was "used up" in that way.

However, the unnecessary 2021 QE I think has done exactly what you say - suddenly in 2021 everything from antiques to houses to Bitcoin went on a crazy boom, which is now unwinding. So I think in summary you have a point, but the magnitude of the effect you describe is lower than you think.

Yes.

That is exactly what I believe is the case.

I was talking about this for the last several years and was and am sure we would see major consequences.

There is still so much capital and money still available to be loaned out. I have just opened 2 letters, one telling me I am able to take a loan of up to 1 million, in the smaller print it gives an interest rate of 7.9% and the other letter from my card provider was a pre authorized loan for £18,000 at 8.6%. Which companies or individuals are going to take up such offers? They would have to be in serious trouble to want to pay these rates of interest rates unless the business model and likely return were fantastic. Two years ago I was offered the same at below 1% interest. So I think the banks and other lenders are in a sort of denial as borrowing will shrink at the same time as a massive growth in defaults.

Many other posters have also said that we need a very long deep recession to get this situation and inflation under control and they are right there is no other real way.

All the debt that people and Government holds needs to be addressed. There are only 3 ways this can happen:

1. Continue to service the debt.

2. Sell the assets where possible and pay off the debt.

3. Default on the debt.

1 is the option the Government and BOE are following. Kicking the can down the road type thing, but whilst the debt is still on the balance sheet then it is a credit. Government still holds A1 credit rating and most mortgages are on very low loan to value so are safe. It is only when this debt can not be serviced such as when interest rates go up we see major trouble. Government understands this and are trying to inflate that debt away through inflation of the currency. If they can keep interest rates as low as possible at the same time as real inflation is very high then the debt actually gets sustantially lower over time and the bigger the differential the more it devalues that debt. Trouble is the debt is just too big and real world events have put a spanner in the works.

2 is the more sensible option for individuals and Government but is very painful. It will shrink the economy for Government and individuals sense of net worth. Many will be caught in the trap of thinking they can ride out this temporary period of high interest rates and falling asset prices and everything will be back to "normal" next year. Where they leave it too long they will be forced into option 3

3 We are entering a period where we will see more companies default (go into liquidation) as well as individuals. Goverments will have to tighten up completely on spending with the public sector starved of resources. Taxes will increase and as a result of all this the economy will take a nose dive. Inflation will steal wealth from all of us as this all unwinds. Until there is enough erosion of the currency to make the real value of the debt serviceable which could take a long time.

I honestly believe the Government is using inflation to lower the real value of the debt. So expect "higher than expected" inflation for a long time to come as QE is unwound.

Consuming More & More Resources Is Finished

in House prices and the economy

Posted

When my father was born there was less than 2 billion people on the planet (1922). It was only just over 100 years earlier the world population got to the 1 billion milestone.When my father died there was just under 7 billion on the planet (2010). 3 and a half times the population when he was born.

When I was born there was less than 3 billion people on the plate (1958). There is now 8.1 billion people, plus or minus one or two, on the way to 3 times the number when I was born.

As time goes on and the population rises each individual has demanded more and more resources, so far the planet has provided BUT there has to be a time in the not too distant future when something has to give. Will the planet start warming up? (I don't believe this is an issue yet dispite some predictions) Will it suddenly cool down? (lots of reason why this might happen) Will there be enough food for at least some of us? Will the levels of co2 go down thus starving the plants which in turn stops producing oxygen? There are so, so many things that will be a result we just don't know yet.

Question such as how many people can the world actually support even for a short time frame? Good news is for the younger people is we are likely to see this point reach sometime in not too distant future. I personally think we could see 10 billion but there on up is anybodies guess. We will see 10 billion in around 20 years, maybe just over, so I should be alive to see this milestone.

According to research how many people can the planet sustain long term? The answer seems to be a consensus of 3 billion, with the "ideal" population being as low as 100 million up to 3 billion.

The amount of resources each individual demands is also growing so there will be shortages of resources going forward and future wars will be in the pursuit of resources. As always the strongest survive as they must. Forget about saving the planet, save yourself.