tep1

-

Posts

305 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by tep1

-

-

1 hour ago, Gigantic Purple Slug said:

No, they can't.

They can print as much as

the marketstheir Elite Cronies will let them print, which for the UK, is pretty much the same as the US and the EU (in proportion to the size of their relative economies).FTFY

-

43 minutes ago, anonguest said:

I've nver been. So please enlighten us. A few quick and simple bullet point style summary of issues/factors will suffice.

Ta!

My impressions were infrastructure investment was poor outside of Bucharest. In Timisoara there is some beautiful architecture but a visible lack of funding to keep on top of maintenance. Residential areas although lived in, still look like building sites. You could visibly see it is one of the poorer EU nations. They do get tornados. One had hit 12 months prior to my business trip and it still looked like there was a lot of cleaning up to do.

That aside the people are lovely and welcoming.

-

I believe those companies and individuals seeking furlough should be jointly responsible for paying back those costs via additional taxation on future earnings.

-

If you've ever been to romania you realise why property is relatively cheap.

-

I like how they us the word BOOM rather than hyperinflation!

-

21 minutes ago, MonsieurCopperCrutch said:

No they’ll keep printing.

Yep, absolute madness.

-

10 hours ago, captainb said:

If you really want to minimise for tax the trick is:

Buy property A live in it until you can afford property B.

Sell property A into company. No CGT or stamp payable below 500k at the moment.

Buy property B. Repeat although set up a new sub company each time called prop B sub. Although now 3% stamp is due on any sales as you own multiple house, but avoid s24 etc

When you come to sell,you sell each sub company shares not the property itself to an investor. Hence you don't pay resi stamp duty as the buyer as you are selling shares not property. If you sell to an individual to live in just sell the property.

As for the mortgage current rates for 75% LTV on a 2 year fix are a lofty 1.75%. People still do it despite of s24 complications because of

Are you for real? I suggest you speak with an accountant on your grand idea and see how far that gets you. You cannot just transfer an asset to a limit company without a buy sell which means 1) the ltd co will still incur 3% stamp duty costs even below the 500k threshold 2) the ltd co will need funds to purchase the property either via a business loan or capital investment.

Shares issued on creation of the company is usually £1 since the company is deemed no value at time of creation. As a director you can personally invest more or seek a loan to fund capital but this would need to be returned at some point by the company. Which means the company requires an income ( i.e. rent) and therefore taxable on profits.

Lastly, you presume future buyers would want to buy shares in this ltd co. Good luck with that!

-

On 09/04/2021 at 17:27, TheCountOfNowhere said:

Un-ashamed copy from somewhere else. Pretty much what people here have been saying for a decade:

Includes-

soft default via inflation inbound,

the time for monetary reform was 08-too late now,

Big Kahuna inescapable.

Next crisis will question the validity of money.

Since 2000,each $1 of GDP growth has been funded by $3 of debt

Worlds average person is getting poorer

https://surplusenergyeconomics.wordpress.com/2021/03/24/193-nothing-for-money/

#193. Nothing for money

Posted on March 24, 2021THE LOOMING FINANCIAL CRASH IN FOUR PICTURES

In the light of recent events, it’s hardly surprising that financial collapse has become an increasingly popular subject of debate.

There seems to be a dawning awareness that the economic crisis caused by the coronavirus pandemic has loaded the system for inflation, because the support given to incomes has boosted demand at a time when the supply of goods and services has slumped. Meanwhile, markets in general – and Wall Street in particular – have taken on some truly bizarre characteristics, suggestive, perhaps, of the frenzied dying days of a bull market.

Those of us who understand the economy as an energy system have long known that an event far larger than the global financial crisis (GFC) is inescapable. Indeed, ‘GFC II’ was hard-wired into the system from the moment when the authorities decided to prevent market forces working through to their logical conclusions.

If markets had been left to their own devices back in 2008-09, what would – and arguably should – have happened was that those who had taken on excessive risk would have paid the price in widespread defaults, whilst asset prices would have corrected back to levels preceding the debt binge which had started a decade before the GFC.

It’s ironic that we hear so much talk of “re-set” nowadays, even though the only real opportunity for resetting the financial system came – and went – more than ten years ago. Promises of a post-pandemic reset are proof– if proof were needed – that ‘hype springs eternal’.

Properly understood, all that covid-19 has really done is to accelerate our advance along a pre-determined road to crisis.

There are two big differences between the coming crisis and its predecessor. First, whilst 2008-09 was caused by reckless credit expansion, the coming crash will be a product of far more dangerous monetaryadventurism. Second, a crisis previously confined largely to the banking sector will this time extend to the validity of money itself.

The best way to understand the looming crisis is to recognise that the financial system, and the economy itself, are distinct (though related) entities. The ‘real’ or material economy of goods and services is a product of the use of energy. The financial system acts as a proxy for the energy economy, and consists of monetary ‘claims’ on the economic output of today and tomorrow.

If finance and the economy diverge, so that a gap is created between the two, the restoration of equilibrium must involve the destruction of the ‘value’ represented by ‘excess claims’.

Our current predicament is that there now exists, not so much a gap, as a chasm between the material economy and the financial system. The emergence and scale of this chasm can best be depicted as a series of “wedges” that have been inserted between financial claims and underlying economic prosperity.

The debt wedge

The best place to start is with debt, which customarily – though mistakenly – is measured by reference to GDP.

Between 1999 and 2019, world GDP increased by 95%. Expressed in constant international dollars (converted from other currencies on the PPP – purchasing power parity – convention), this means that GDP grew by $66 trillion.

Over the same period, though, debt expanded by 177%, or $197tn. Put another way, this means that each dollar of reported “growth” was accompanied by $3 of net new borrowing.

As the first set of charts illustrates, what happened was that a “wedge” was inserted between debt and GDP.

This was a product of deliberate policy. The predominant belief, back in the 1990s, was that economic growth could be furthered by “de-regulation”, which included relaxing rules that, hitherto, had limited the rate at which debt could expand.

At the same time, the process of globalisation created its own pressures for credit expansion. Essentially, the aim was to out-source production to lower-cost EM (emerging market) economies whilst maintaining (and preferably increasing) Western consumption.

This divergence between production and consumption created a gap that could only be bridged by making credit ever easier to obtain.

An even more important factor then in play was an economic deceleration known as “secular stagnation”. The real reason for this deceleration was a relentless rise in the Energy Cost of Energy (ECoE). But this causation wasn’t understood. Instead, policymakers thought that the hard-to-explain deterioration in economic growth could be ‘fixed’ by making credit easier to obtain.

This in turn meant that monetary stimulus, hitherto used for the perfectly reasonable purpose of smoothing out economic cycles, would now become a permanent feature of economic policy.

It seems to have been assumed that excessive debt was something that the economy could somehow “grow out of”, much as youngsters grow out of childhood ailments.

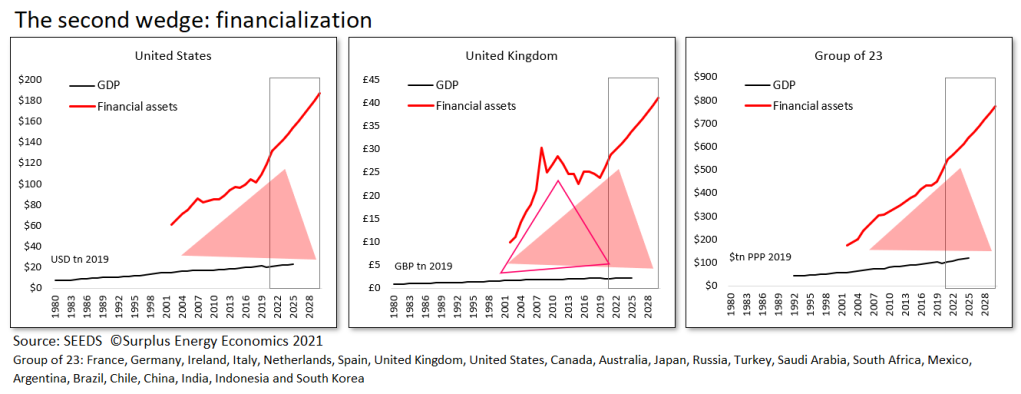

Financialization – the second wedge

Debt is only one component of financial commitments. There are many other forms of monetary obligation, even without moving into the realms of assumed (rather than formal) commitments such as pensions expectations.

A broader measure, that of financial assets, gives us a better grasp of the extent to which the economy has been financialized. For the most part, these “assets” are the counterparts of liabilities elsewhere in the system, much as banking sector “assets” correspond to the liabilities of borrowers.

Financial assets data isn’t available for all economies, but the right-hand chart below shows the aggregates for twenty-three countries which, between them, account for three-quarters of the world economy.

What this illustrates is that the “wedge” inserted between debt and GDP is part of a much bigger wedge that has been driven between the financial system itself and the economy.

Comparing 2019 with 2002 (the earliest year for which the data is available), the financial assets of these 23 countries increased by 158%, or $275tn, whilst their aggregated GDPs grew by only $44tn, or 77%.

On this basis, financial assets increased by $6.20 for each dollar of reported “growth”.

It’s a simplification, but a reasonable one, to say that, for these economies, each dollar of growth between 2002 and 2019 was accompanied, not just by net new debt of $2.70, but by a further $3.50 of additional financial commitments.

What this really means, in layman’s terms, is that debt escalation has been accompanied by a broader – and faster – financialization of the economy. Essentially, ever more of the activity recorded as economic ‘output’ is really nothing more than moving money around.

This is represented in the aggregates by relentless increases in the scale of interconnected assets and liabilities.

The risk, of course, is that failure in one part of the financialised system triggers a cascade of failures throughout the structure.

The third wedge – the ‘let’s pretend’ economy

By convention, both debt and broader financial commitments are measured against GDP. This would be reasonable if GDP was an accurate representation of the ability of the economy to carry these burdens.

Unfortunately, it is not.

Over the period between 1999 and 2019, trend GDP “growth” of 3.2% was a function of annual borrowing which averaged 9.6% of GDP. The mechanism is that we pour credit into the economy, count the spending of this money as economic “activity”, and tell ourselves that we can ‘grow out of’ our escalating debt burden.

As well as funding purchases of goods and services which could not have been afforded without it, relentless credit expansion also inflates the prices of assets, and this in turn inflates the apparent ‘value’ of all asset-related activities.

The SEEDS economic model strips out this credit effect, a process which reveals that underlying growth in the world economy averaged just 1.4% – rather than 3.2% – between 1999 and 2019. Accordingly, underlying or ‘clean’ output – which SEEDS calls ‘C-GDP’- is now very far below reported GDP. If net credit expansion were to cease, rates of “growth” would fall to barely 1%, and even that baseline rate is eroding. If we were, for any reason, to try to reduce aggregate debt, GDP would fall back towards the much lower level of C-GDP.

Neither is credit-injection the only major distortion in the story that we tell ourselves about economic output. More important still, ECoE – in its role as a prior call on output – is continuing to rise. Incorporating ECoE into the equation reveals that prosperity has stopped growing, whilst the number of people between whom aggregate prosperity is shared is continuing to increase.

In essence, this means that the world’s average person is getting poorer. This happened in most Western countries well before the GFC, and the EM economies have now reached their equivalent point of deterioration.

What began as “secular stagnation” has now become involuntary de-growth.

We can’t make this hard reality go away by pouring ever more and ever cheaper liquidity into the system. All that monetary loosening really does is to create financial ‘claims’ that the economy cannot meet.

The combined effects of credit manipulation and rising ECoEs form the third wedge – the one that divides economic reality from comforting self-delusion.

The fourth wedge – the quantum of instability

With the reality of flat-lining output and deteriorating prosperity understood, all that remains is to use this knowledge to recalibrate the relationship between a faltering economy and an escalating burden of financial obligations.

Even the ‘fourth wedge’, pictured below, excludes assumed (though not guaranteed) commitments, of which by far the largest is the provision of pensions.

The final set of charts compares debt and broader financial commitments with underlying prosperity. These charts reveal the drastic widening of the chasm between prosperity and the forward promises that the prosperity of the future is supposed to be able to meet. In SEEDS parlance, we are confronted by a massive crisis of ‘excess claims’ on the economy.

With these equations laid bare, we are entitled to wonder whether decision-makers are in blissful ignorance of this reality, or whether they have at least an inkling of what’s really happening and are simply nursing Micawber-like hopes that ‘something will turn up’. Based on the 2008-09 precedent, we can be pretty sure that the “soft default’ of inflation will play a starring role in the coming drama.

The question of ‘how much do they know?’ must be left to readers to decide. The same applies to quite how soon you think this situation is going to unravel, and whether you want to label what’s coming as a ‘crisis’ or a ‘collapse’.

The system is ****ed.

How do people protect themselves

Is it deflation, buy a house, invest what cash you have

or,

buy a house with the biggest monster sized mortgage you've ever seen and get a free house, like the boomers did.

It's one or the other, either way.

It's now a massive gamble either way but given the action of the bankers, the actions of the tories I cant see it going any other way now but straight to inflation.

Any sensible comments welcome.

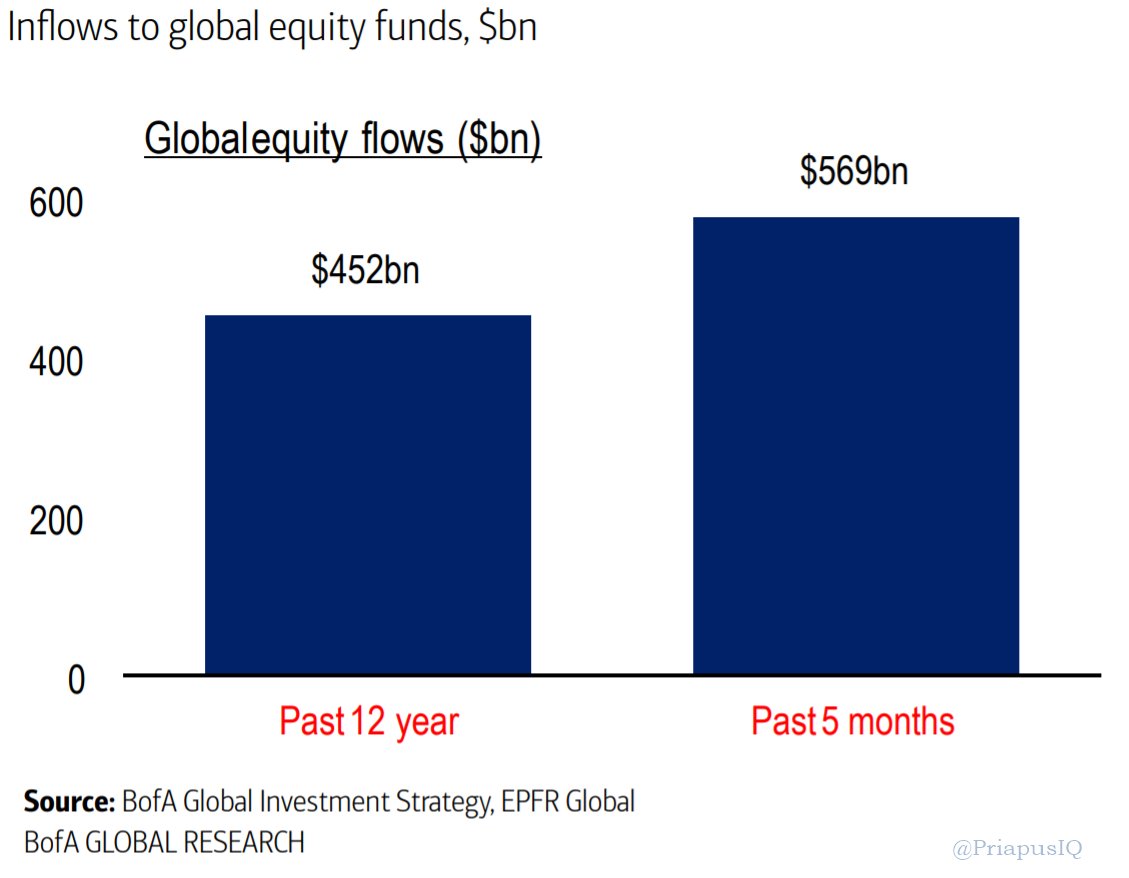

The inflow of stocks in the last 5 months suggests market makers believe we are headed for more inflation or possibly a new greener market economy with far reaching return on investment.

-

On 09/04/2021 at 21:07, Social Justice League said:

IR's at 10% will be the norn once more. Everyone will see when the smoke and mirrors clear.

Sorry SJL I cannot see IRs moving to 10% in my lifetime. I agree it would create far more affordable housing but unfortunately far less market investment. Rightly or wrongly, there is a desire for the economy to evolve investments into future greener technology. Private Individual investors should be at the heart of this. A stark change in interest rates would create economic sea change pushing investors to hold cash for safer returns via saving accounts. We would still have the same societal divisions as we do today, since most high to loan mortgage holders would be trapped in negative equity.

I would prefer interest rates move closer to 2-3% in the short to medium term and money supply (private debt) brought under control. Limiting the power of banks to create money would make house prices more affordable for vast majority and without the consequential impacts to investment markets. Like it or lump it we still need the latter since it encourages competition and growth in GDP.

-

Maybe I am being cynical but it sounds like an ideal way to siphon more tax payers cash without checks and balances for cronyism. Those workers being undocumented masks any proper paper trail.

-

2 minutes ago, Rachel88 said:

Yes. I've not mentioned this yet. But my bf is really good at voices so he phoned up in the afternoon and asked to see it he said he was a cash buyer and she said she would get back to him.

Your boyfriend is Steve Coogan? 😄

-

18 minutes ago, TheCountOfNowhere said:

FTFY

+1 the usual market ramp, followed by a quiet retrospective downgrade

-

4 minutes ago, MonsieurCopperCrutch said:

Not so sure about that as I told the EA we would a cash buyer but they still refused us a viewing.

Get yourself a buying agent and let them do the legwork. They can source properties that don't go to market in the usual way and can work a negotiation strategy in your best interests.

But if you ask me you're mad to buy in a frenzy. You're jumping into the arms of satan! 😈 Good luck with that.

-

Just now, MonsieurCopperCrutch said:

Similar situation here. House popped up on Rightmove last Thursday of the type that we are looking for. Emailed the agent immediately for a copy of the HR. Read it then phoneed agent on Friday late afternoon to arrange a viewing. Sorry all viewings now closed and the house is going to closing bids tomorrow at noon. The house ticks a lot of my wifes boxes but no way I'm putting in an offer without viewing it.

Its the largest investment you'll make in your lifetime. I would at least want to view it twice and mull over it for at least a week before offering a fraction of my bitcoin.

You want to see the turkeys in Oz. They crowd on auction day to have a competitive bidding war against shillers.

-

8 minutes ago, Rachel88 said:

I think I was quite polite to say I had to listen to lie after lie after lie.

We are desperate it's been 2 years of offers and being out bid etc.

I bet you're an estate agent. 😁

Haha it would make my life more interesting if i were an EA. I would be giving away properties at least 15% below asking.

I've been there myself. Just saying, there's no point pushing water uphill; if it happens it happens. But make sure your offer is in writing. They have a legal right to do the same. The vendors are most likely to take advice of offers from the EA, regardless if you make contact with them directly. Putting a letter through the door may encourage the vendors to prioritise you. Let them know your family situation and why you want their home. You need to convince the vendor and usually the EA that you are the right person. Things like no chain, finance sorted or cash buyer works.

The EA is incentivised to get a number of offers to find the best price. That may take some time. Now they have your offer they can tell other prospective buyers they have offers already and push for a bidding war. To catch a thief you need to think like a thief!

-

14 minutes ago, Rachel88 said:

Hi

So you all know I've been trying to buy a house since the beginning of the pandemic.

Well today I've snapped at an estate agent.

Here's the story. A house came up for sale at 7 pm last night. I emailed straight away with all my contact details to ask to view it. At 9.03am this morning I phoned and asked to view it. The estate agent said I couldn't see it as they dont have the keys and will phone me back.

I told my bff and he said he will phone. He then phoned 30 minutes later to be told there are no more appointments available.

So I said to him, hang on, how can there be no appointments left? I couldn't even get one.

So I said to my bf, can I just offer the money without seeing it. Now we have seen properties before and really you are just looking at rooms, you cant test the gas or even flush a chain on a viewing. Anyway he said yes. (I know people advise against this but honestly I'll be modernising it all anyway and I'd still be paying for a structural surveyor)

So I emailed my offer and then phone to make sure they got the email.

I said I know the house is popular but i will offer the asking price without seeing it, which will hopefully prevent others being messed around. I also said if they owners feel like they want more for it, then let me know how much they want.

Well, the estate agent refused to pass on the offer, saying they wanted it to be a fair viewing for everyone. So i said "you wont even give me a viewing!!!". To which the 'Director' said "you are not helping yourself in buying this property" so I said "what's that supposed to mean?" And she said "just because we dont want to sell you the property". And slammed the phone down on me.

Can you believe it! I was furious

So I emailed in and said by law, all offers should be passed on to the vendor. And that this is correct under the Property Ombudsman code and practice.

So then I got an email to say they would pass on my offer. And I've not heard anything back to say if the vendor has accepted or rejected.

I'm fumming. Lol

Anyone got any advice?

Honestly, your strategy reeks of desperation. What is your urgency to move or more importantly own when we have a biggest shortage of housing stock coming to market due to covid?

Not knowing your situation and if you are desperate to land something ASAP, then usually a timed offer above asking price does the trick.

Reading the narrative though, I say you may have blown it. Try not to let your emotions drive your negotiation strategy.

-

14 minutes ago, Si1 said:

When they need to sell the debt back to combat inflation.

Or quietly cancel aided by subterfuge. BoE is just an extension of Whitehall.

-

2 minutes ago, TheCountOfNowhere said:

When the tories have sold their housing portfolios.

Does make you wonder whether their plans to incentivise home ownership is purely to dump their rental stock at the top of the market! The ramping has gone an extra mile of recent bating the young with FOMO. Its like a last chance saloon for the Tories; almost like they know what's coming!

-

As of November 2020, the MPC has announced QE purchases totalling £895 billion, equivalent to over 40% of annual UK GDP. The vast majority of these purchases have been of UK government debt.

At what point does the BoE say enough crack for the addict and instead opts for the blunt interest rate rise to do the job?

-

I think its coming and I hope it arrives sooner rather than later. There is a definite "europhia" about which signals the top. A lot of this has been provoked by continual government intervention and investors running to protect their savings. House owners, crypto and tech stock holders will suffer the most in the next downturn in my opinion.

-

4 hours ago, Bruce Banner said:

After working for many years, not all retirees are skint. Many have both pensions and savings.

Why would I not wish to pay money to a landlord as, for most of those ten years, I was getting double that amount in interest on the money that I didn't have tied up in a house.

Opportunity cost.

Although I am vast number years off my retirement I've drawn a similar conclusion for now also. But each to their own as they say.

-

On 03/04/2021 at 18:05, Joshy said:

I have been patiently waiting for house prices to become "affordable". A good ten years. I the mean time I have been investing my money in shares. This is mainly because its so bad in a savings account. Nothing special or elegant, just FTSE/S&P500 and world trackers (etfs). It hasn't worked out too badly for me at all and I could lay down a really chunky deposit now if I ever found a property at a price I thought was fair!

Anyway I have come across this video that has really made me think a bit more about house price ownership. If you are thinking about things from a total potential returns basis you really may not be that worse off. Basically, if you can rent a property for below 5% of the total value you are better off renting.

Detail is in the video. But basically, taxes are approx 1%, maintenance is approx 1% and the opportunity cost of home ownership (foregoing greater returns in other investments by tying up equity and/money in interest payments) is about 3%.

Would be interested to know what others think about this?

https://m.youtube.com/watch?v=Uwl3-jBNEd4&t=370s

It works! I've rented for the last 15 years. Sold a home (before kids) and moved my savings into stocks 10 years ago. Continued to aggressively save across tax efficient investments like ISA and SIPPs. But I also have a taxable investment account as well. I started pretty poorly in the early days. Initially, during the first few years I netted only the equivalent of HPI/annum. But I have been extremely lucky since then. Experience teaches you, seeking value, hedging risk and holding, yields the best returns. I could buy a nice family home outright but based on experiences so far it is less likely to be financially sound. During the last taxable year I netted 8 times what I pay in rent. I also feel I've learned greater investment knowledge and socio-political awareness than if I wouldn't have and like to think I'm far less susceptible to BS.

House prices will become affordable again. They have to! But I am also prepared that they may never do so in my lifetime. We will all eventually die on the same capitalism treadmill. My best investment is to ensure I make the most of the life experiences while I can.

-

5 hours ago, TheCountOfNowhere said:

I've been watching the housing bubble for years now but the last 12 months has been beyond any sort of insanity I could imagine, the value of money has plummeted, not surprising when they can just magicked it out of thin air and set rates at 0%

Things were looking set for a real downward leg 12 months ago, now we are discussing houses selling like hot cakes, prices up 30% etc etc etc. A "Frenzy" FFS

All of which I am seeing with my own eyes so I cant really argue it's not happening, it is.

I have no idea what sort of future anyone thinks we have in the UK but I literally give up now, I've had enough, it's not good for anyone's mental health to be continually watching this madness. No point having a productive job, or savings or anything.

You will own nothing and they will tell you you are happy.

Maybe house prices will crash nominally, unlikely though now given what's going on, we literally have been robbed blind to keep the property owning establishment living in clover.

Interesting times but I think I'm done with this now.

I'll keep posting UK Property Lion on twitter every month/quarter if anyone is interested.

Take care.

@TheCountOfNowhere I follow Property Lion on twitter so I'm always interested in those informative market tweets! Its a shame twitter is a little restrictive in its reach. Only, reaching more people outside this board would make a greater impact.

A possible opportunity to refocus talent and energy on an informative "Property Lion" portal for those first home buyers looking to time the market and benefit from discounted properties?! Either-or, spend time in the garden enjoying the sunshine; mental health is far more important!

Like it or lump it, we are on the precipice of sea change in this country, brought on by the ruling class encroachments on rights, freedoms and privileges. We can change it but only as a collective force. Dinner calls, enjoy your time off!

-

1 hour ago, Arpeggio said:

+1. I watched the whole thing too. Matt Hancocks' nickname used to be "Disaster waiting to happen"

Deserves its own thread away from the distractions.

Are these people for real?

in House prices and the economy

Posted

I think I may find myself rejecting all major parties and voting green at the next election but it feels pointless without proportional representation.