pmf170170

-

Posts

181 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by pmf170170

-

-

On 18/12/2022 at 12:04, winkie said:

To add, if they want to put in a pre-payment meter, refuse it, do not accept a meter, nobody is forced to have a meter.......like nobody is forced to have a smart meter.

This is simply not true. I was listening to a phone in recently on the radio and a magistrate said that shevhas no choice but to grant the utility providers request to force the installation of a pre payment meter in most circumstances.

-

23 hours ago, Saving For a Space Ship said:

Renters pay council tax too and they have not benefited from Hpi

The landlord could pay the Council Tax. Problem is that it would just be added to the rent and those who currently qualify for financial support may be left worse off.

-

-

6 hours ago, Orb said:

I've worked out that buying the house in Hull for cash would be £150-£200 cheaper per month after taking everything into consideration (bills, council tax, maintenance money, insurance, internet, etc) than renting one room in a house in Northampton, as I'm currently doing.

Which begs the question... 'what are you waiting for?'

-

On 16/09/2022 at 20:55, fellow said:

Sales volumes are falling because inflation is rising.

nflation is rising because the £ is falling.

The £ is falling because our interest rates are lagging behind the Fed.

The Fed is considering a 1% rises next week so where is the logic in a smaller rise from the BOE if this happens, especially when the Government are planning a tax cutting fiscal stimulus the following day to boost the economy?

Surely the fiscal loosening needs to be balanced out wilh monetary tightening or you just get even more inflation,?

Really good to hear that increased energy costs are not primarily responsible for the inflatable. Those other expert economists clear know nothing. Idiots scare mongering.

-

3 hours ago, Mikhail Liebenstein said:

So I now have a more concentrated portfolio in a single active fund. Yes, it costs more per year, but the track record is good, particularly in up years for the market. It has held up well with the recent volatility too. It is definitely sees more swings, but over a 10 year window it will outperform any index tracker by a wide margin.

Are you happy to share the details of the fund manager? My workplace pension has an actively managed fund with a unit rate that is currently worth less than it was when the fund was constituted about 10 years ago. Incredible really. Many of the other available funds have alao had poor performance but the passive ones seem to be the most successful.

-

I recently had family visit the UK and they couldn't believe how cheap eating out in the UK is compared to where they live in California. Their comments stem from the fact that their incomes are much higher and the dollar is so strong at the moment. They sent me an image of the menu at a French restaurant that they eat at when back home. The prices definitely made the UK seem cheap although as we know, for anyone earning in Sterling, they are not. Eating out abroad for someone from the UK is becoming unaffordable.

With the cost of the inputs going through the roof though , the price increases have to be passed on. Eventually those who can afford them will relent and pay. Those that cannot afford them will contribute to the demand destruction that helps bring prices down.

Personally i have stopped going to pubs for food and now rarely go for a drink.

My local bakery makes some great savouries but they are getting to the price where they are now very much a treat. A family of 4 wanting a cornish roll each wouldn't get much change from £20. Add in a drink and you're breaking into another note.

These prices make house prices seem reasonable when measuring against food and drink.

-

The UK already levies an annual property tax. It's currently called Council Tax. It is primarily taxed based upon occupation but if unoccupied it is taxed based upon ownership. We have quite enough taxation without encouraging more.

-

3 hours ago, TheResponsibleHouseBuyer said:

So what we do? Print more? Cant give bailey any excuse to keep IRs low.

I think they will print more. Short term measure to keep everyone shut up again like furlough. Then it comes home to roost again in a few years.

Once the £ passes that $1 threshold, we are in deep shit. We import too much and our currency will be worthless.

I dont know who will reach the mark first, Us or the Euro.

Interesting to see what happens in the Italian elections and whether the results of that that brings down the EU project. Maybe might help the £ if the Euro goes first.

No. I would not advocate more QE. it's clear that the electric generators are profiteering and much as i hate to say it, i think that the least worst option is a windfall tax. Companies should not be making excessive profits on the back of despair.

-

1 hour ago, TheResponsibleHouseBuyer said:1 hour ago, TheResponsibleHouseBuyer said:

Its either take a small hit now, or postpone a serious economic disaster later when we run out of printy printy.

I don't see how what is coming over the horizon can be described as a small hit. Left unfettered it is going to devastate the economy. Decimation doesn't come close.

-

1 hour ago, Confusion of VIs said:

He

- effectively banned further rollout of onshore wind and solar by allowing a single objection to stymie projects.

- ended the existing schemes for home insulation, replacing them with a series of half baked schemes that saw a collapse in the number of homes being brought up to a good standard of insulation

- reduced the FiT for home solar to a level that caused a near collapse of the industry

- caved into the property developers (all donors to the tory party) and greatly reduced the insulation standards required for new builds resulting in nearly 2m properties built with, by modern standards, substandard insulation.

All in a disastrous set of policies.

Point 1 - maybe fair comment

Point 2 - people need to take responsibility for themselves. If insulation saves them money, then the home owner would be daft not to make the investment. I suspect that only loft insulation has a reasonable pay back. Floor insulation has terrible pay back given that heat rises.

Point 3. It was ridiculously generous and had to be scaled back. Investments should wash their own face.

Point 4. Part L of the Building Regulations are stringent. They have nit been relaxed and just get progressively more challenging to meet; particularly given the conflicting requirements to prevent interstitial condensation.

-

23 hours ago, FallingAwake said:

And their over-reliance on Russian gas 🤣

We'll see how well the EU are doing, during the winter, when Putin really turns off the taps.

They will be fine due to demand destruction and storage. Next Spring and summer will be a challenge to refill the storage sites though and Winter 2023 could be the real pinch point.

-

On 25/08/2022 at 14:37, Confusion of VIs said:

Yes we are heading into a recession, its already baked in and the only good thing about that is that it will weed out the weakest firms first.

Personally i suspect that ypu are being unduly optimistic. This has the hallmarks of a depression, certainly in Europe (inc the UK) with serious implications for companies that export into Europe.

Personally i feel that the cheerleaders for interest rate rises need to be very careful in what they wish for. Falling house prices will be irrelevant if no one can finance them.

-

On 25/08/2022 at 14:18, winkie said:

For a start, remove vat on fuel for businesses that pay it.......has got to happen, no brainer......make work pay.

This is a zero sum game as the business reclaims the VAT on its purchases. It then remits the VAT it charges its customers to the treasury.

-

On 22/08/2022 at 18:40, Confusion of VIs said:

Cameron's cutting the green crap is now costing us billions a year in increased energy costs, latest estimate is £13bn pa.

Cameron didn't cut 'the green crap' and the electric being produced by the renewables is the cheapest available by far. Unfortunately some short sighted official linled the output tl the gas price and whilst the energy is available, it is no more affordable than if it were produced using gas.

-

On 22/08/2022 at 16:07, henry the king said:

We are now seeing a rapid reversal of this, so 1997 prices could be coming back, and quickly.

If this happens we will see no new houses built because the cost of construction will exceed what they can be sold for.

-

28 minutes ago, Will! said:

It's a pay as you go scheme. The historic liabilities are paid for by what is paid in now and in the future. If the CS scheme is anything like my NHS DB scheme then it's moving (slowly, but it'll get there) to being able to vary contribution rates from year to year to cover however much is being paid out at that time.

What about the person who leaves the job. They still have the benefits increasing by the rate of inflation and compounding year on year.

-

6 minutes ago, Will! said:

CS pension contributions can be put up to match.

It is the historic liabilities which are the issue. Even if the schemes were to be closed to future acruals tomorrow, there is no cap on how the current liabilities can spiral. My old DB scheme had 5% protection before it was changed to career average and the inflation protection for new acruals was capped at just 2.5%.

-

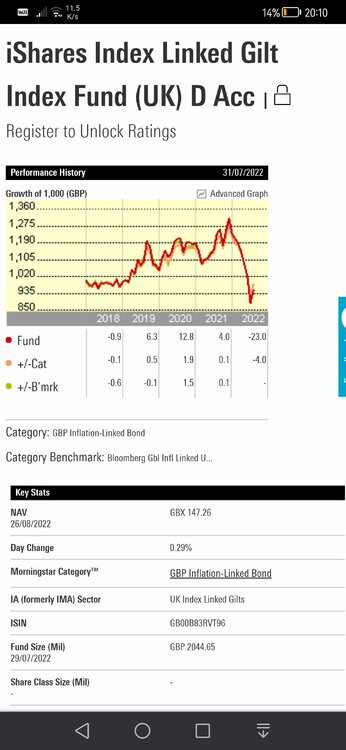

This is why index-linked bonds are crashing. And my pension provider classes these as low risk. Talk about misrepresentation.

-

11 hours ago, Up the spout said:

Government Debt to GDP in China is 69%. As the UK's is 85%, what is the word to describe 23% more than hyper 🤣

The UK figure does not include pension liabilities. Civil Service pensions are unlimited liability given the lack of inflation cap.

-

11 hours ago, dpg50000 said:

So presumably they should do this straight away?

I can't see a 25% drop either - am I looking at the wrong thing?

This is the chart!

-

1 hour ago, dpg50000 said:

Given that a good portion of the UK government debt is linked to inflation, can you advise how?

The price of index linked 10 yr gilts has fallen by about 25% so far this year. They are very senistive to interest rate rises. The Government could effectively buy these bonds and cut their debt by the circa 25%.

-

Sell, rent somewhere better and buy when prices fall back. I did this in 2007. I called the market right. I think that you have too but only time will tell. Until energy prices fall back i cant see any mainstream market for large or off gas mains properties.

-

On 14/07/2022 at 18:42, Roman Roady said:

22% near Bury Lancs

https://www.rightmove.co.uk/properties/121550957#/?channel=RES_BUY

Price Change History13/07/2022 Price changed from £975,000 to £900,000 13/06/2022 Price changed from £1,000,000 to £975,000 26/04/2022 Price changed from £1,150,000 to £1,000,000 25/03/2022 Initial entry found: £1,150,000 Lloks like a very desirable house and decent value. The current heating bills would be prohibitive for most though and it will be a very cold house during winter.

The Economist magazine Oct 2022 view

in House prices and the economy

Posted

Most of the article is behind a pay wall but the introduction which isn't makes it clear where they see house prices going and why.

https://www.economist.com/leaders/2022/10/20/a-global-house-price-slump-is-coming?utm_campaign=a.22holidayny_fy2223_q3_conversion-cb-dr_prospecting_global-global_auction_na&utm_medium=social-media.content.pd&utm_source=facebook-instagram&utm_content=conversion.content.non-subscriber.content_staticlinkad_np-houseprice-n-nov_na-na_article_na_na_na_na&utm_term=sa.lal-sub-5-int-currentevents-politics&utm_id=23851932273630064