-

Posts

4,448 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Fancypants

-

-

On 02/07/2023 at 13:51, captainb said:

Doesn't make sense

You need 2X workers for each elderly that's a unsustainable model.

As if you import that 2x, they get old and you need 4x imported etc etc

Population chart can't rise ala 1960s forever

It is true that immigration only defers the population crash, it doesn't solve it. The children of migrants, raised in the UK, have a fertility rate much the same as those who have been here for generations.

-

5 minutes ago, Insane said:

Do immigrants not grow old themselves?

I know countries such as OZ have an age limit on people immigrating to the country. Do we ? I don't think I have ever heard of one. I do know that people have immigrated here and have then been able to send for their parents back home so we are bringing in old people as well as all growing old ourselves.

We are not producing enough young people of working age to support our ageing population, so we need to import them.

I have to say, immigrants sending for elderly parents is a new one on me. All around the world, the overwhelming majority of people who migrate are young.

-

It's quite simple, really. We need immigration in order to stop us from being overwhelmed by old people.

-

I did 11 years in Canary Wharf. I actually much prefer visiting it now than I did working there. It's impressive in its own way, but as was observed upthread, it lacks depth and soul, which does become very apparent after a prolonged period of schlepping in every day (not that many do anymore, evidently!)

I read a few months ago that vacancy rates there are much higher than in the City, which is in turn doing less well than the West End. Interesting what folk really value, when push comes to shove. Without Crossrail, they'd be really knackered now.

-

I couldn't see where the claim made in the thread title appears in the linked article. Can anyone help?

-

Saw this very well researched article, and naturally thought of my old pals here. A good examination of the long term historical drivers of where, what, and how much we build in the UK. Enjoy.

-

4 hours ago, Fancypants said:

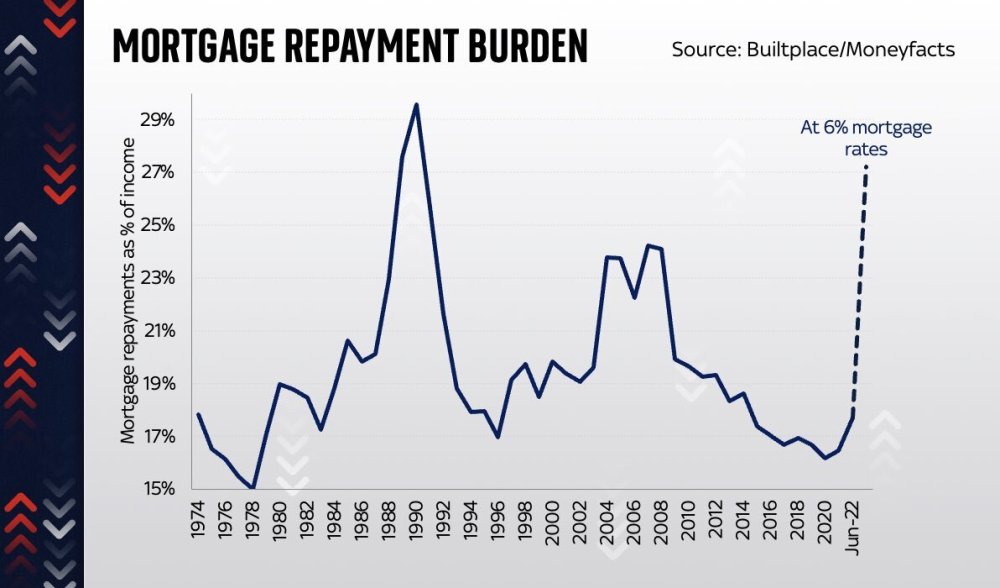

Now I'm sure there are plenty here who can point out what happened the last time the average burden approached 30%. But has anyone here got the skills and the time to synthesise this data with historic price data, to reveal where the tipping point might be irt nominal prices having positive or negative momentum? A cursory glance at this suggests it's around 25% - but I may be missing something...

Actually I think I need to revise that "tipping point" down a bit - I had forgotten that prices fell consistently through 2008.

Yes, there are other factors that affect this (there will be lagging effects, of course) but this is a pretty good proxy for determining what % we need to reach for the balloon to get punctured. TBQH this suggests it is well short of where we're headed...

-

-

Now I'm sure there are plenty here who can point out what happened the last time the average burden approached 30%. But has anyone here got the skills and the time to synthesise this data with historic price data, to reveal where the tipping point might be irt nominal prices having positive or negative momentum? A cursory glance at this suggests it's around 25% - but I may be missing something...

-

Pretty sure that if you examine the reporting from the early 90s crash you'll see that forecasts of falls were slow, late, and under-estimates until such time as things started to recover, and the forecasts were slow picking that up too.

As we're just at the beginning, I think it's a pretty safe bet that the falls will be bigger (and go on for longer) than predicted here. But it's an important part of establishing the new momentum to get the average punter to invert their expectations about what happens to house prices.

-

It's been so long since I've engaged with the personalities - was Boulger the one who was always very bullish back in the day, or the one who was occasionally sensible?

(either way, I agree that 10% is likely an under-estimate, barring some volte-face from the government very soon)

-

57 minutes ago, Staffsknot said:

Russian economists are even more optimistic...

Bit like when you cheered smuggling of Western luxuries via Kazakhstan for elites and claiming Corbynism...

Oh and that time you said India backs China over the Chinese war games off Taiwan and last week India said how unacceptable China's behaviour was.

Visionary Zug, visionary like Mystic Meg.

Well I don’t know about you, but I’m completely convinced by the optimism of un-named Russian economists.

-

On 24/08/2022 at 22:48, Staffsknot said:

God you talk a lot of crap Zug. You really have gone off with the fairies.

Strategic intelligence failure is pissing off Taiwan when you desperately need their semiconductors. But then China doesn't now there's rolling blackouts.

Anyhow back to facts - Russia is flogging off every asset it can dirt cheap - everything at discount and that's why the countries have dealt with it. They are saved only by high energy prices.

The largest Russian car manufacturer is halting production and seeking redundancies. Inflation is nearly 14%.

Soon the fridge will beat the TV in telling things how they are.

"How did you go bankrupt?" Bill asked...

"Two ways", Mike said... "gradually and then suddenly"

-

With immigration at record levels the "growth" in the UK population hasnt actually slowed down as a raw demographics suggests.

Its still running at roughly the same as in the 70s etc.

That's not the point though - we are importing humans to try and compensate for our own declining fertility. When those humans settle here, their own native-born children behave just like the rest of us, and have children at a low rate.

Meanwhile, fertility is coming down quite quickly all over the world, even in Bangladesh, Nigeria etc, and the pools of cheap labour start to shrink. Yes, there will be some disruption and more migration due to climate change - but its certain than global population will start to shrink much sooner than most people think. It's already baked in. And, in spite of the recent parochial trend in Western politics, capital is still global - money markets are international, even with Brexit we're a very very long way from autarchy. The course of future interest rates is largely a response to inflationary pressures worldwide, or - as we're starting to see - colossal deflationary pressures...

-

Interest rates will never go up? I do wonder. Given that we are much closer to "peak human" than most people imagine, it might be that markets are just reacting to this demographic reality. Rates do seem to have some sort of relationship with demographics, being highest in recent times when the boomers were booming all over the world: starting their own families, supporting relatively few old people, paying tax, buying houses, developing careers etc etc. Inflation was the problem then.

But for the foreseeable future, it's deflation. Once low birth rates set in (as they are all across the world) it's much harder to see where the prospects for "growth" (at least as we used to understand it) are. And so the value of the world's primary form of debt (i.e. money) turns down.

The debt bubble is imploding - it began in 2008, when the aggregated wisdom of financial markets first clocked what I'm describing here: that was the tipping point. Now we have central banks shovelling ever-increasing quantities of fiat into the vortex, but none of that can turn round the underlying driver: demographics.

-

Could we be enjoying a visit from Fungus Wilson?

Has he still not sold up to those wealthy overseas investors?

-

went for a butcher's at three 4/5 bed family homes nearby (pretty grubby area of North London with lots of stuff rented out to immigrant families) last week, and all three were landlords scaling back. A small sample size, sure - but it felt a bit significant. And this seemed like the most obvious thread to share it on.

-

-

Hey Bruce

Good question. I fancy that we'll see some selling, for sure. In fact, given that so much of the money blowing the London bubble has come from the BRICS or petro-nations, I'd be astounded if there wasn't a significant downward pressure exerted by recent market moves. The Chinese share index is just one part of that - falling commodity prices will squash interest from Russia, Arabia and SE Asia too.

In fact, I'm looking out of my office window at the moment wondering how much longer these cranes will be active.

I can't get my head around it.

We are now hearing, on the news channels, that Chinese investors have been buying stocks with borrowed money, using their homes as collateral (shades of US 1920s).

We have been hearing for many months that a lot of London property has been bought by Chinese investors. With borrowed money?

So, if the Chinese stock market continues to fall, will Chinese investors sell their London properties, buy more, or will it have no effect?

-

We're buying in zone 4, after years of resisting. But having just produced our third child, the lure of the extra bedroom and a garden got too much.

I'm not desperate to leave London, but I'd do it tomorrow if a good job opportunity came up. The main thing that's stopping me is my wife, who is London born and bred, hence simply cannot contemplate leaving. So I have to play the long game there...

-

A Victoria line extension isn't on the agenda and I think Haringey need spurs more than they let on. Always find it slightly bizarre that the new ground is only 200m away from enfield boundary,where Haringey have no influence.

Spurs also threatened to move to Enfield too, didn't they?

-

Pardon me, I have been getting my postcodes mixed up. Mind you, I'm more interested in N9 these days.

-

Spurs got some sweeteners to stay and to help them with the redevelopment though, didn't they? They were ready to bail on N15 and move to Stratford, which wouldn't have looked good post-riots and Olympics, especially as they planned to flatten the white elephant stadium that was already there.

I agree that their remaining won't have massively uplifting effects on Tottenham (see also Beswick), but if they'd left it would probably have had negative effects

-

Not too far away there is the Meridian Water development just getting underway, with the attendant improvement in rail services from Angel Road southwards. What with TfL taking over some of the other lines nearby, Crossrail2 in the offing, and even Ponders End in line for "regeneration" I'd say there is a clear direction of travel for the Lee Valley.

Of course, that's not to say that global macroeconomic conditions or political upheaval might not get in the way.

The unsayable truth about immigration is we simply don't have enough room at the inn

in House prices and the economy

Posted

Yes - the ageing, and shrinking of our population is pretty inevitable. Immigration just defers both.

And as fertility rates are falling all over the world, we will eventually run out of immigrants to bring here.