bearishonhouses

Members-

Posts

521 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by bearishonhouses

-

Note the increasing numbers of FTB having mortgages in excess of 30 years. As the length of the term of the mortgage increases, they become more sensitive to changes in interest rates. For example: Mortgage amount term- years annual repayment at 5% annual repayment at 6% diff (£) percentage increase 100,000 15 9,634 10,296 662 6.9% 148,101 30 9,634 10,759 1,125 11.7% Concerning the US, where the standard mortgage term is 30 years, the vast majority of mortgage loans are at fixed rates - with no penalty for pre-payment. i.e. even if a loan is taken out now at 6%, in a couple of years, if rates are lower, the borrower can refinance at the new lower rate without penalty.

-

I am not persuaded that 'offset' is anything other than a scam - made to enable greenwashing and generate jobs for the firms issuing certificates. Grauniad reports more than 90% of projects provide no real benefit (https://www.theguardian.com/environment/2023/jan/18/revealed-forest-carbon-offsets-biggest-provider-worthless-verra-aoe) paying extra for using fuel produced from renewable resources does seem a valid approach.

-

The Bubbly Bitcoin Thread -- Merged Threads

bearishonhouses replied to NatterJackToad's topic in House prices and the economy

Is it not the case that absolute stability does not and cannot exist when discussing bitcoin and fiat currencies? It only makes sense to talk about stability of an asset value relative to the value of another resource. Yes, GBP has lost value against USD; and USD has lost value against the value of labor and many consumer goods. But arguably has gained value against other, technology related, goods. Strip out 'inflation' then - but measured how? CPI, RPI, GDP deflator. There are problems with all of these. It seems to me that the characteristics of something to function as 'money' needs to be is a medium of exchange and a store of value are often contradictory. Fiat currencies work well as mediums of exchange - less well as stores of value; BTC has problems on both dimensions; artwork, real estate, equity investments are definitely lousy as mediums of exchange, and although in general they may work as stores of value, even there fashions change and reduce their effectiveness on that dimension. In short, in case we had not yet realized, life requires compromises and tradeoffs. -

Why are house prices so high in the UK?

bearishonhouses replied to myusernameistaken's topic in House prices and the economy

This article has some interesting tidbits, but the main overall conclusion is not at all clear. Regarding the growth in value of house prices and an investment in equities, the article says: "House prices have tended to rise over time, so it is not hard to understand why people say this. £100,000 worth of UK property 25 years ago would be worth an average of around £451,000 today. ......... These figures exclude any costs of ownership such as maintenance, repairs, insurance or taxes; any income generated by the property (not relevant for primary residence, only buy-to-let); and the impact of leverage/mortgage finance. However, that same £100,000 invested in the global stock market (again, excluding any costs) would have grown even more, to around £727,000. This is 10% more than in even the best performing regional property market, London. Furthermore, it doesn’t matter whether you look at this over 5, 10, 15, 20, 25 or 30 year horizons. The stock market would always have resulted in a bigger increase in your £100,000 compared with UK residential property." But the returns on the stock market (average 8.3% annually) are stated AFTER including the value of reinvested dividends ; the returns on property (average 6.2% annually) exclude the net annual benefit (rental income less costs of maintenance etc). Although running yields have been very low in recent years (approx 2% because house prices are so ludicrously high), prior to 2006 they were running at approximately 6%. Therefore, total returns, including income, on residential property would have been in excess of 10% over the past 25 years. I firmly believe that financial returns on UK residential property will not perform as well as equities over the next 25 years - nor that they have done over any 25 period that ends prior to 2000. But to assert that equities were also the winner over the last 25 years is simply not supported by the facts. Jeez, we recognize the bias of vested interests encouraging folks to buy houses. We should be equally wary of the bias of those with vested interests in encouraging people to buy equities -

I knew a couple who used to (maybe still do) worked in broadcasting. She was a fairly senior producer in tv - salary about 30k in the early 90's. He was a freelance sound recordist - working on dramas, documentaries etc. The amount of overtime payments, and per diems etc brought his earnings to more than 100k in the early 90's - for what is a fairly straightforward technician's job. And they subsequently bought a bunch of flats - though I suspect with cash outright rather than IO mortgages. I do not know current rates of pay, but I'll wager it's comparable in real terms. (100k in 1993 is equivalent to 200k in 2022 based on prices.

-

If you want to get an estimate of what proportion of salary is required to fund a pension see explanation below: You can alter the model to put in your own assumptions about life expectancy; desired pension as percentage of salary; real rate of return on investments (pension assets), age of retirement; age at which you start saving.

-

I have a nephew and niece (sort of - children of old friends), both very early 30s. Nephew has a PhD in chemistry but after a few years post doc became a chartered accountant and is married to a lawyer in a top ranked firm in London. Niece works in forestry management in the west country (and I think her husband is similarly not highly paid). Just recently, comparing notes, they realized that the standard of living the 'rich' couple have (now with child) does not come close to the way the 'poor' couple live. And the London couple, I think, live in a small ex-slum house, not half the size of what the west country couple can afford. It is not clear how long London can survive in this way.

-

Savings rates nudging up

bearishonhouses replied to rantnrave's topic in House prices and the economy

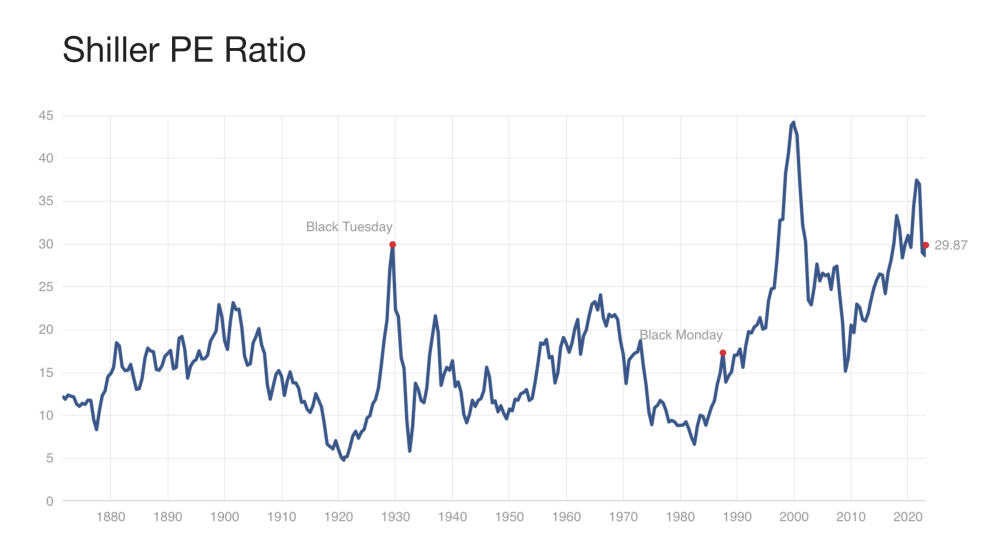

I recommend that rather than look at the straight P/E ratio of the S&P500, it is better to look at the 10 year average - Shiller P/E ratio. It is still high - but certainly not an 'all time' high. see https://www.multpl.com/shiller-pe But the PE ratio is not outrageous either.: -

Examples of big & multiple drops

bearishonhouses replied to user not found's topic in House prices and the economy

I like this house. Gorgeously designed, south facing, spacious, enough bathrooms, privacy from neighbours, . BUT, it is probably a bear to keep warm, and it looks as though electric outlet are minimal. And I don't want to live in Barmouth. OTOH, for someone who does, ...... -

There are 12 non-recourse states - mainly in the west (including California, Oregon and Washington) but also Connecticut. However, even in non-recourse jurisdictions, the likelihood of a borrower in negative equity having any other assets worth pursuing is low; in practice, there is not much difference between in outcomes if a borrower hands back the keys to the bank.

-

Examples of big & multiple drops

bearishonhouses replied to user not found's topic in House prices and the economy

-

I wonder if it is possible that transfer of ownership could be restricted for houses that do not comply with minimum EPC standards. If so, that would probably not depress prices but would at least improve the quality of the housing stock. Personally, I do do not think it is at all likely in the UK but I know that in some jurisdiction in the US (e.g. Atlanta) transfer of ownership is not possible while toilets that are not low-flush are installed.

-

Anybody starting to doubt HPC next year?

bearishonhouses replied to Orb's topic in House prices and the economy

IMHO the talk about house prices 'in real terms' is not really relevant. I am not sure folks choose to spend on housing in proportion to what they spend on other things. Rather, they choose to spend on housing 'what they can afford' which is a mixture of interest rates and income. And for the vast majority of the adult population, income is principally made up of earnings. So what really matters is the price of housing in terms of earnings. And so we come back to the graph we know and love showing that the ratio of median house prices to median earnings has increased unsustainably in the last couple of decades. At normal interest rates (say, expected inflation plus 2.5%) I cannot see a long run equilibrium with housing priced at 10 x earnings. Holding interest rates constant, what happens to house prices in the medium-long run will be determined by earnings - albeit those earnings partially reflect general price inflation. -

The Bubbly Bitcoin Thread -- Merged Threads

bearishonhouses replied to NatterJackToad's topic in House prices and the economy

Can you not trade crypto derivatives on the Chicago Merc? I would trust them to honor contracts at expiry. -

Agreed - not easy. Batteries could be transported between the vehicle-swap station to charging station- needs fewer charging stations - but they would have to be huge - maybe attached to a power plant. And transport would not be energy free. The issue of course is the difference in energy density between batteries and petrol. "the Tesla Model S (85 kWh) requires a battery pack weighing about 540 kg to achieve a 400 km range, but a similarly sized gasoline vehicle achieves the same range with 25 kg of petrol," and a fuel cell electric vehicle requires 5 kg of hydrogen. see: https://georgejetson.org/why-is-the-energy-density-of-hydrogen-so-much-higher-than-batteries/ But, it looks to me as if the figures for hydrogen and petrol exclude the mass of the containment vessel - significant for hydrogen, very small for petrol. Taking that into account, hydrogen and petrol are the same order of magnitude. https://www.batterypowertips.com/comparing-ev-battery-and-fuel-cell-energy-density-faq/

-

FYI, this site is really cool (I think) for showing where electricity is being generated at any time. https://grid.iamkate.com/ It is neither very windy nor sunny at the moment, so wind/solar account for only 15% of supply, but according to that site, fossil fuels account for only 44% of UK electricity supplied over the past year. Carrying a battery around is indeed wasteful. If/when green hydrogen becomes available, that will be a better solution. Hydrogen fueled electric planes are already at the prototype stage.

-

Sorry - I do not understand the point of this remark. As others have already suggested, a battery replaceable by a robot in a few minutes would mitigate the concern that many drivers have about taking a long trip and having to spend 30 mins every 5 hours recharging. Compared with 5 minutes at a petrol station. Is this view contentious?

-

Too true. I have met Indians who speak and write English considerably better than many Brits. Although, tbh, these were generally well educated and highly qualified individuals, I guess Brahmins. Don't know how willing they would be to work for peanuts for a UK based outfit. Regarding time zones - it can be advantageous to have other members of a team working in a different time zone. e.g. folks in Taiwan work on the project, at end of their work day, pass it to UK, who at end of their work day, pass it to California team who work until 6 pm Pacific time when it is next morning in Taiwan.

-

House price stats vs getting less for your money

bearishonhouses replied to athom's topic in House prices and the economy

My understanding is that the Land Registry price indeces are computed in the 'best' way; i.e. they compare changes in 'sold' prices for each individual house and compute an average. The best description I can find for how it is computed is at: https://www.gov.uk/government/publications/about-the-uk-house-price-index/about-the-uk-house-price-index at the section: '3 Property Attributes Data' See also: https://www.gov.uk/government/publications/about-the-uk-house-price-index/quality-and-methodology Reading this makes me think LR computes the index in the same way as the Case-Shiller index for US house prices. In particular, in computing the index, less weight is placed on properties where the chang in price is atypical compared with others. The unusual change is taken as a signal that something significant may have been done to it - e.g. extended, and therefore the previous purchase price is not representative of the cost of the property. I do not know how they deal with properties where the first recorded sale on LR is pre-1995. I do not know how they weight the price changes indicated by different properties - are they equally weighted? value weighted? Detailed documentation of the computation of the Case-Shiller index is at: https://www.spglobal.com/spdji/en/indices/indicators/sp-corelogic-case-shiller-10-city-composite-home-price-nsa-index/#overview (look for Documents:Methodolgy) . A few years ago, I tried to work out how to apply this methodology to UK data - but gave up because it was too difficult for me! methodology-sp-corelogic-cs-home-price-indices.pdf -

It is correct that the Thatcher administration introduced MIRAS in 1983 but it is not clear that it made a big difference to mortgage affordability. Prior to that date - and probably going back to at least the 1960's if not earlier, I think - mortgage interest was tax deductible, but relief was given through an individual's PAYE tax code. Or, for the self employed, by a reduction in tax payable at the end of the year.