-

Posts

695 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by The McGlashan

-

-

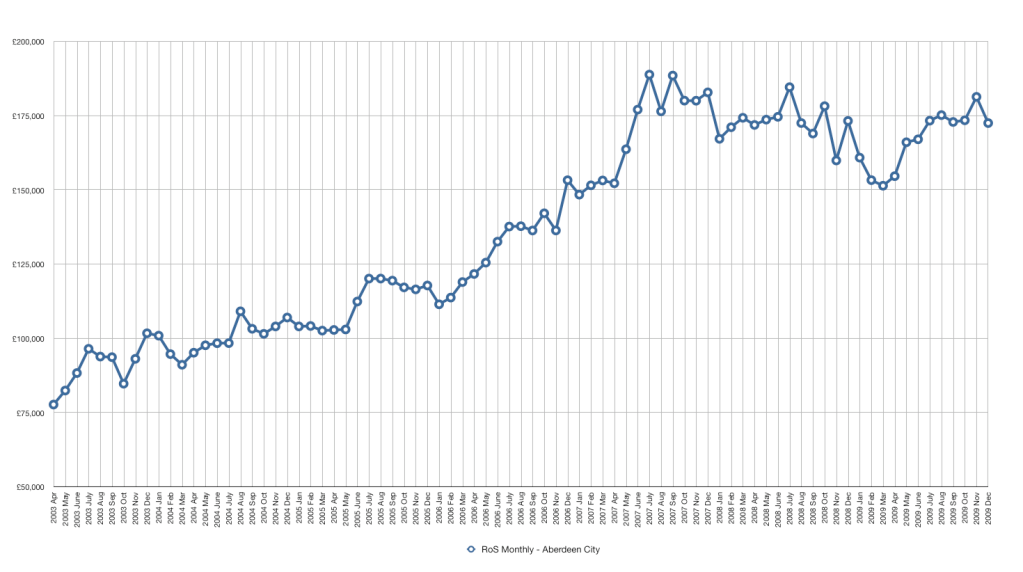

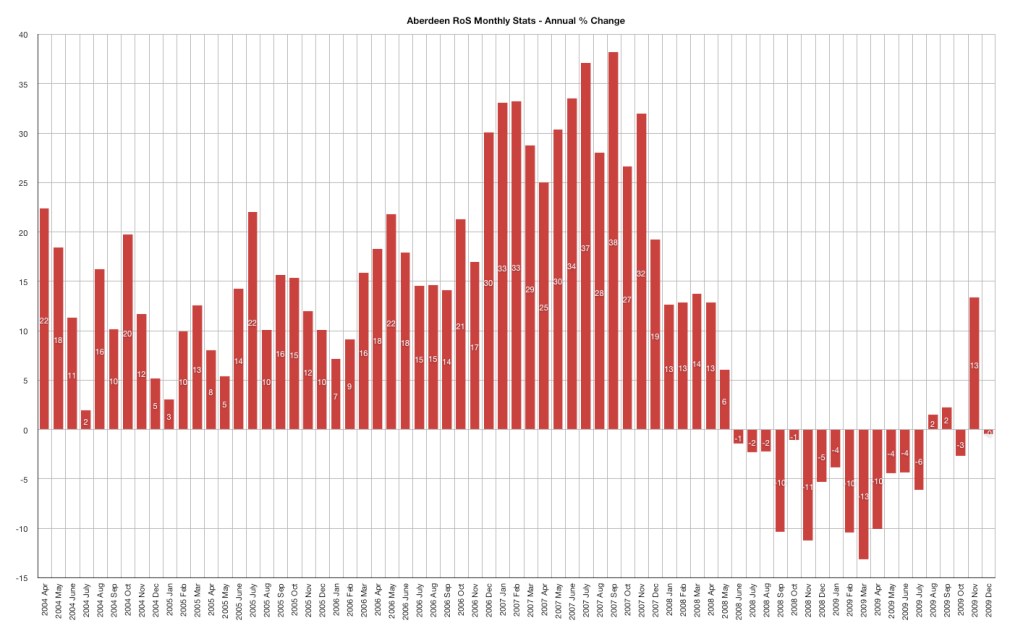

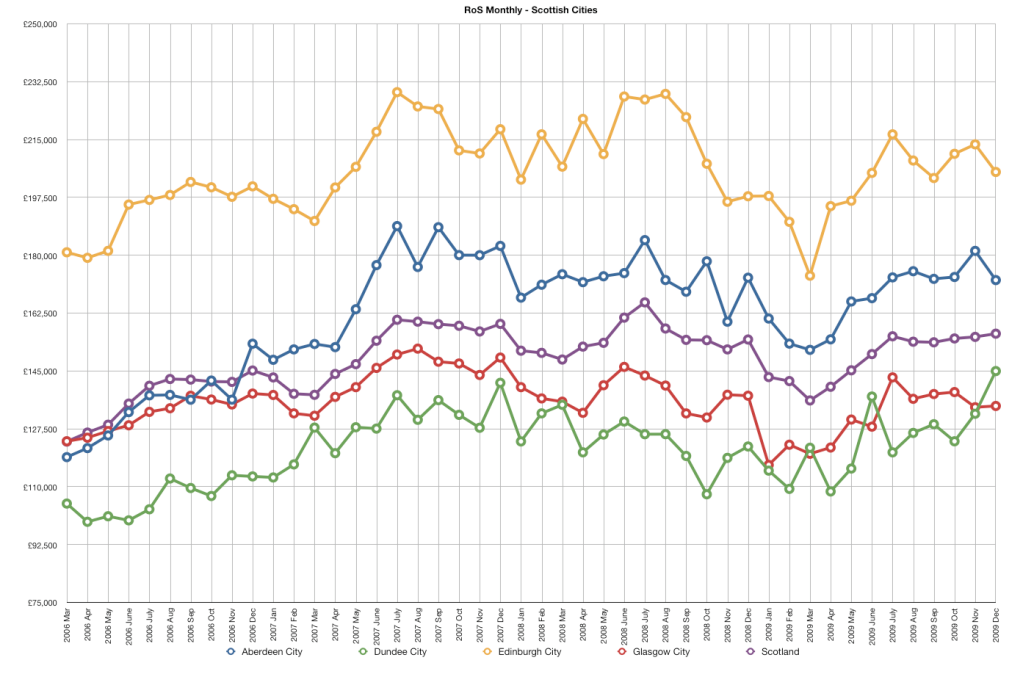

Aberdeen monthly figures from RoS

http://www.ros.gov.uk/pdfs/local%20authorities%20dec%202009.pdf

Down -5% MoM

Down -0.5% YoY

Volume still depressed; down -60% from the peak volume of Aug 06 and down -49% from the price peak of July 07

-

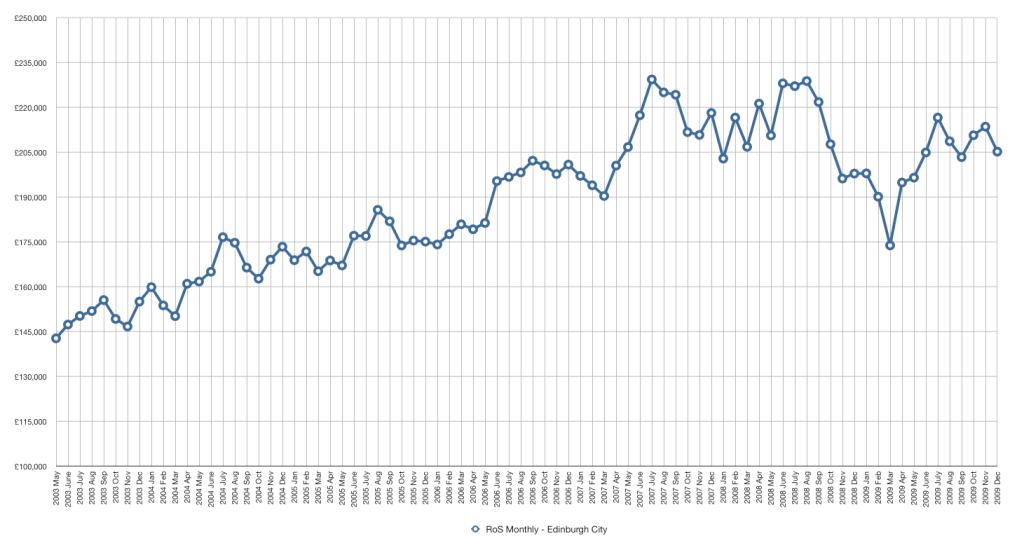

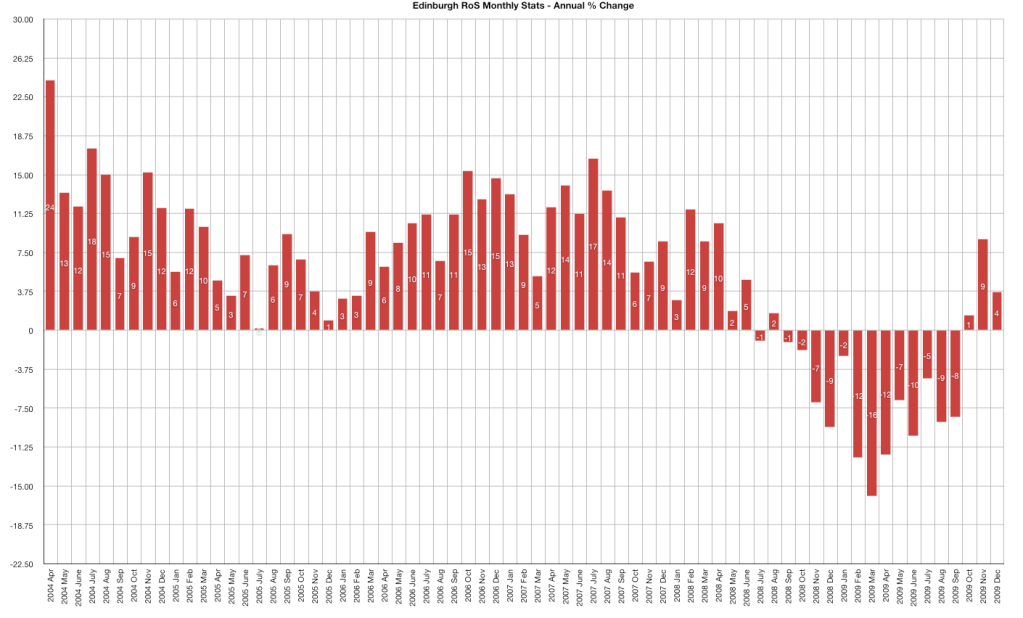

RoS figures for Embra.

http://www.ros.gov.uk/pdfs/local%20authorities%20dec%202009.pdf

Down -4% MoM on highest volume since July 2008

Up +3.7% YoY

-

RoS Monthly figures for December:

http://www.ros.gov.uk/pdfs/local%20authorities%20dec%202009.pdf

Aberdeen down sharply reversing last months gains.

Edinburgh down sharply

Glasgow stable

Scotland Stable.

Dundee BOOM! Dundee average house price now at an all-time high. Unbelievable! (I'd better stop ramping the place!)

-

http://www.ros.gov.uk/pdfs/Statistical%20Publication%20(Oct%20-%20Dec%202009)%20issued%20Feb%202010%20Final.pdf

Scottish prices up 1.3% YoY.

Inflation @ ~3%

=> Scottish House Prices DOWN!

-

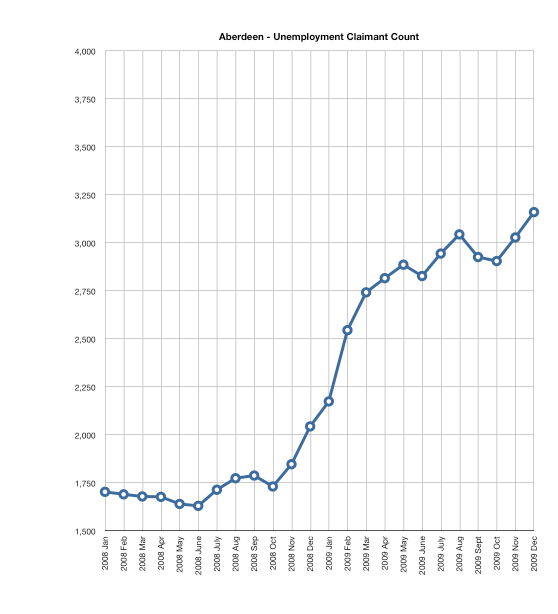

Rental yields dropping in Aberdeen - Strong indication that sales prices are detached from fundamentals

Rental yields falling below average indicates that sale prices are out of line with 'fair value'. Price/rent ratios are a common way to evaluate housing market fundamentals; rents incorporate fundamental influences on housing demand and supply. People need to live somewhere – the choice is between buying your own home or renting, not between spending money on housing or retaining income for other purposes. Moreover, rental expenditure is not subject to the market distortions which plague the house purchase market. We can therefore use yield fluctuations to determine the extent of those distortions.

We've heard time and again that Aberdeen is the BTL paradise where rental yields of 7% are common. On the Aberdeen threads we've had landlords boasting of 12% and 8% yields. (Though these claims were subject to heated debate.)

Not any more. A quick look at comparable properties for sale and let on ASPC indicates that yields like that are a thing of the past.

If we take the 'common' 7% yield to indicate a fair value equilibrium, we can put a rule of thumb on asking prices to work out how far detached from fundamentals the price is. Actually, let's be conservative and call net 6% yield a fair-value price for Aberdeen. (The long-run UK average is 6.4%, rising to 7.9% in 'top university towns' according to Propertywire.)

(Comparable properties - comparable or same areas)

__________________________________________________________________________________________

FTB-type one-bet flats

Rosebank Place, Ferryhill

http://www-q.aspc.co.uk/cgi-bin/public/LiveProperty/276626?ID=FGLFGAAK#picture

O/o £115k

http://www-p.aspc.co.uk/cgi-bin/public/LiveProperty/273620?ID=FGLFGAAK#picture

Rent £500 pcm

Yield (net) = 4.7%

=> asking price is 28% higher than fundamentals would dictate.

Fair value asking price for this type of property in this sub-area would be £90k

__________________________________________________________________________________________

'Aspirational' new-build 2-bed flats

Grandholm Mills

http://www-q.aspc.co.uk/cgi-bin/public/LiveProperty/276304?ID=FGLFGAAK#picture

O/o £165k

http://www-p.aspc.co.uk/cgi-bin/public/LiveProperty/276443?ID=FGLFGAAK#picture

Rent £800 pcm

Yield = 5.2%

=> asking price is 15% higher than fundamentals would dictate.

Fair value asking price for this type of property in this sub-area would be £143k

__________________________________________________________________________________________

3-bed semi's

Broomhill

http://www-q.aspc.co.uk/cgi-bin/public/LiveProperty/274635?ID=FGLFGAAK#picture

O/o £360k

http://www-p.aspc.co.uk/cgi-bin/public/LiveProperty/276689?ID=FGLFGAAK#picture

Rent £990 pcm

Yield = 2.97%

=> asking price is 100% higher than fundamentals would dictate! By the profit's beard!

Fair value asking price for this type of property in this sub-area would be £180k

__________________________________________________________________________________________

4-bed detached

West end Cragiebuckler

http://www-q.aspc.co.uk/cgi-bin/public/LiveProperty/261098?ID=FGLFGAAK#picture

O/o £425k

West end Mannofield

http://www-p.aspc.co.uk/cgi-bin/public/LiveProperty/276316?ID=FGLFGAAK#picture

Rent £1350 pcm

Yield = 3.4%

=> asking price is 76% higher than fundamentals would dictate!

Fair value asking price for this type of property in this sub-area would be £241k

__________________________________________________________________________________________

What factors are at play here? What will bring the market back to fundamental equilibrium? What's the situation in other Scottish towns?

Originally posted in 'Aberdeen - ASPC stats' thread.

-

Rental yields dropping in Aberdeen - Strong indication that sales prices are detached from fundamentals

Rental yields falling below average indicates that sale prices are out of line with 'fair value'. Price/rent ratios are a common way to evaluate housing market fundamentals; rents incorporate fundamental influences on housing demand and supply. People need to live somewhere – the choice is between buying your own home or renting, not between spending money on housing or retaining income for other purposes. Moreover, rental expenditure is not subject to the market distortions which plague the house purchase market. We can therefore use yield fluctuations to determine the extent of those distortions.

We've heard time and again that Aberdeen is the BTL paradise where rental yields of 7% are common. On this very thread we've had landlords boasting of 12% and 8% yields. (Though these claims were subject to heated debate.)

Not any more. A quick look at comparable properties for sale and let on ASPC indicates that yields like that are a thing of the past.

If we take the 'common' 7% yield to indicate a fair value equilibrium, we can put a rule of thumb on asking prices to work out how far detached from fundamentals the price is. Actually, let's be conservative and call net 6% yield a fair-value price for Aberdeen. (The long-run UK average is 6.4%, rising to 7.9% in 'top university towns' according to Propertywire.)

(Comparable properties - comparable or same areas)

__________________________________________________________________________________________

FTB-type one-bet flats

Rosebank Place, Ferryhill

http://www-q.aspc.co.uk/cgi-bin/public/LiveProperty/276626?ID=FGLFGAAK#picture

O/o £115k

http://www-p.aspc.co.uk/cgi-bin/public/LiveProperty/273620?ID=FGLFGAAK#picture

Rent £500 pcm

Yield (net) = 4.7%

=> asking price is 28% higher than fundamentals would dictate.

Fair value asking price for this type of property in this sub-area would be £90k

__________________________________________________________________________________________

'Aspirational' new-build 2-bed flats

Grandholm Mills

http://www-q.aspc.co.uk/cgi-bin/public/LiveProperty/276304?ID=FGLFGAAK#picture

O/o £165k

http://www-p.aspc.co.uk/cgi-bin/public/LiveProperty/276443?ID=FGLFGAAK#picture

Rent £800 pcm

Yield = 5.2%

=> asking price is 15% higher than fundamentals would dictate.

Fair value asking price for this type of property in this sub-area would be £143k

__________________________________________________________________________________________

3-bed semi's

Broomhill

http://www-q.aspc.co.uk/cgi-bin/public/LiveProperty/274635?ID=FGLFGAAK#picture

O/o £360k

http://www-p.aspc.co.uk/cgi-bin/public/LiveProperty/276689?ID=FGLFGAAK#picture

Rent £990 pcm

Yield = 2.97%

=> asking price is 100% higher than fundamentals would dictate! By the profit's beard!

Fair value asking price for this type of property in this sub-area would be £180k

__________________________________________________________________________________________

4-bed detached

West end Cragiebuckler

http://www-q.aspc.co.uk/cgi-bin/public/LiveProperty/261098?ID=FGLFGAAK#picture

O/o £425k

West end Mannofield

http://www-p.aspc.co.uk/cgi-bin/public/LiveProperty/276316?ID=FGLFGAAK#picture

Rent £1350 pcm

Yield = 3.4%

=> asking price is 76% higher than fundamentals would dictate!

Fair value asking price for this type of property in this sub-area would be £241k

__________________________________________________________________________________________

What factors are at play here? What will bring the market back to fundamental equilibrium? What's the situation in other Scottish towns?

Copied to "Is Scottish Property most overpriced in UK?" thread.

-

Hiya Pele,

I tend to look at the Registers of Scotland data which is here:

http://www.ros.gov.uk/professional/eservices/land_property_data/lpd_stats.html

However, it goes by Local Authority, not city or constituency, so data which includes Inverness will also include whole of Highland.

You might try looking at Zoopla

http://www.zoopla.co.uk/house-prices/inverness/

All the best,

McG

-

I'll go for Cork and the houses are getting cheaper by the day.

Cork y'say?

Do you know the place? Tell us what you think of it compared to Aberdeen.

-

Inverness? You mean Tesco town?

This is what a proper city centre looks like, complete with indoor market:

That all looks really nice - where's that? And how much are the houses?

-

So many beautiful buildings neglected - who would believe we were / are (?) the "Oil Capital of Europe"

It's a disaster. Yet entirely predictable - this blight is the forseeable consequence of oversupply in the commercial property sector.

Overdevelopment overcapacity malinvestment misallocation-of-capital a go-go!

Union Plaza - behind Gilcomston Church on Union Row. (Not a bad building on a former industrial gap-site)

Union Sq and Jury's Inn, Guild St (Overdevelopment brutalises Guild St)

Aberdeen Gateway & Axcess, Cove (Requires AWPR to make any sort of sense)

City Wharf and Hotel Ibis on Aberdeen's 'Historic'(?!) Shiprow (an unmitigated disaster of out of scale overdevelopment of a historic site)

IQ Justice Mill Lane (It's huge!)

-

-

Photos on and around Holburn St, Union St and Bridge St.

-

-

Some ASPC Stats!

It's ASPC quarterly bulletin time.

http://www.aberdeencity.gov.uk/nmsruntime/saveasdialog.asp?lID=27660&sID=332

City centre:

Quarterly change +2.3%

Annual change +8.2%

Change from Peak (Q3 07) -5.7%

Bridge of Don/Danestone:

Quarterly change +13.9%

Annual change +19.7%

Change from Peak (Q2 08) +0.8%

Bucksburn:

Quarterly change -1.5%

Annual change -1%

Change from Peak (Q2 07) -21.4%

Lower Deeside:

Quarterly change +1.7%

Annual change -23.9%

Change from Peak (Q4 08) -23.9%

Nigg/Cove:

Quarterly change +13.4%

Annual change +2%

Change from Peak (Q2 07) -8.7%

Kingswells:

Quarterly change -0.9%

Annual change +9.3%

Change from Peak (Q4 07) -18.5%

Dyce:

Quarterly change +13%

Annual change +7.8%

Change from Peak (Q3 07) -1.7%

Westhill/Kintore/Blackburn/Kemnay:

Quarterly change -0.6%

Annual change -1.0%

Change from Peak (Q2 08) -10.2%

Ellon/Newburgh/Balmedie:

Quarterly change -6.4%

Annual change +3.6%

Change from Peak (Q2 07) -10.0%

Inverurie/Oldmeldrum/Pitmedden:

Quarterly change +4.5%

Annual change -4.9%

Change from Peak (Q2 07) -8.6%

Newmachar:

Quarterly change +19.7%

Annual change +8.2%

Change from Peak (Q3 08) -8.1%

Banchory/Durris/Drumoak:

Quarterly change -24.5%

Annual change -7.8%

Change from Peak (Q3 08) -20.5%

Stonehaven/Portlethen/Newtonhill:

Quarterly change -1.1%

Annual change +8.2%

Change from Peak (Q1 08) -8.2%

Total Abdn Housing Area

Quarterly change +0.7%

Annual change +6.0%

Change from Peak (Q1 08) -3.0%

-

problem with aberdeen, by the time prices fall it will be alot less desirable to live there.

I disagree entirely. More affordable housing in Aberdeen would lead to a far nicer class of people populating the city.

the quality of your house has nothing to do with your job or skill but when you bought it.... how long ago it was built

Fixed.

-

Ah, the ABC Bowling. I worked in their greasy spoon on a Saturday when I was at school. Somehow I can't envisage a boutique hotel and luxury flats there - but I'll check it out next time I'm back in ABZ.

That's the one! What was the name of the larger-than-life foul-mouthed mother-figure who ran the greasy spoon there? She was quite a character.

The lounge bar was also an 'interesting' spot.

-

McGlashan

I can't figure out where the St Andrew's St development (with "boutique" hotel - ha ha ) is going to happen.

Q

Hiya Quine,

Its the former 'Bowl' bowling alley and its car-park. It's very nearly finished and it actually (in my opinion) looks quite good. I'm not usually a big fan of 'contemporary modern', particularly when the style is deployed without thought, but the hotel frontage is onto St-Andrew's St and sits on the site of the former car-park, which, for the whole of my life has been a scrappy gap-site. The new frontage is a great improvement.

Decent building or not, tho', it's still part of a drastic over-supply in the sector which is coming soon to Aberdeen.

-

Aberdeen Hotel Bubble.

It's long been a source of complaint and puzzlement that Aberdeen has a shortage of hotel rooms. That shortage is about to turn into a glut.

Suddenly, there is lots and lots of new-build hotel accommodation at various stages of completion:

1. Jury's Inn at Union Square

Recently opened - 203 rooms.

http://aberdeenhotels.jurysinns.com/

2. Park Inn at Justice Mill (Now Travelodge - ugh)

Nearing completion - 185 rooms.

http://www.richardmurphyarchitects.com/projects/429/

3. Hotel Ibis at City Wharf

Nearing Completion - 107 rooms

http://www.aberdeencitywharf.co.uk/pdfs/leisure_and_retail.pdf

4. Radisson Edwardian at AECC

Open soon? - 222 rooms

http://www.aecc.co.uk/aecchoteltobearadissonedwardian.aspx

5. Unnamed Boutique Hotel, St Andrews St

Nearing completion, 100 rooms 4 star

Part of St Andrews Square Development

http://www.bancon.co.uk/eng/homes/standrews.pdf

6. Unnamed Hotel, E&M site, Union St

Consent granted, 100 rooms

http://www.worldarchitecturenews.com/index.php?fuseaction=wanappln.projectview&upload_id=10912

7. Bells Hotel - Justice Mill Lane side

Consent granted for 10-story 217 room extension

http://news.stv.tv/scotland/north/94078-aberdeen-hotel-expansion-plans-approved/

Have I missed any?

I make that about 1200 brand-new hotel rooms in Aberdeen, not counting smaller developments (the likes of the new Bauhaus and Gt Western renovation) - I've never seen anything like it! I'm tempted to grump at the 'crapitecture' but some of them are actually quite good - for instance, the St Andrews development destroys nothing and actually appears to have some architectural merit. Similarly the Justice Mill development replaces only ugly redundant industrial buildings which have been a derelict eyesore for decades. So far, so good.

The question is...

Is this amount of development all at once a good idea? Can they all survive? Will they all be completed?

We might expect the E&M development to be delayed (and the building to become a source of blight). We might, similarly, expect the Bell's Hotel development to be deferred (but at least the plan refers to a gap site). I've heard that the development company (Kenmore) at the Ibis City Wharf needed a bail-out from Lloyds in November and is now in administration. Travelodge took over the ailing (formerly 4-star) Jury's Inn development at Justice Mill. Will other developments go similarly downmarket?

What effect will 1200 new rooms have on the B&B sector in the city? Surely that's the equivalent of about 100 guest houses.

IMHO it would be great to see an amount of townhouses and villas across Ferryhill and the West End come back into domestic use, but I do feel for the B&B proprietors (some of whom I know.)

-

Here are the ESPC stats for the four central Edinburgh areas - Marchmont/Bruntsfield, City Centre, Leith Walk, Stockbridge, from 1996, updated for the Q4 2009 figures.

Three graphs: 1) absolute prices, 2) YoY and quarterly changes, 3) change from peak in Q2/2008.

There was a 1.1% increase YoY and prices are now at 87.5% of their peak value.

It seems ESPC are no longer publishing details on number of sales, but the total number of sales was very similar to Q3 (~1,300).

Good stuff Frisian!

Those trend lines certainly calm the nerves!

-

I agree with every word you say. An insane thing for people to do.

OTOH the pedant in me notes this survey is PR presented by a VI,

Quoted elesewhere to be 2022 respondents across the country as a whole (not sure whether GB or UK)

That means fewer than185 respondents in Scotland (assuming the best case of GB rather than UK for the whole survey)

So the 8% mentioned in the Scotsman is only 15 people.

Given we quibble about data for house price indices being too small a sample to be valid I think its fair to say the paper on which this article is printed is only fit to be cut into squares and hung on a hook in the outdoor privy.

Reputable market research companies tend to require that PR quoting their figures is cleared by their statisticians before publication - and none would allow this stuff in the Scotsman.

Neither the Scotsman or the BBC quote the source of the research, which they would usually do, so I assume shelter did their own, or suppressed the name of the research company when said company refused to allow their name to be put to dodgy figures.

An online survey of that size would cost Shelter a couple of hundred quid. Cheap for a bit of PR. Everyone ends up talking about the topic and nobody bothers to check whether the data is valid. An urban myth gets born.

It really annoys me that charities get away with behaving like this. There may come a time when something important means they need a reputation for integrity, and they've lost it.

Thanks for your informed perspective, most enlightening and much appreciated.

Indeed, a tiny sample size to spawn an urban myth and, as such, a bit of a non-story. However, those of us who wish to see a return to affordability in family housing should embrace the power of myths. I believe that this type of report, along with others current in the press this weekend, may mark a tipping-point in public sentiment (whether true or not).

Reports like this one from unbiased.co.uk (Yeah, right):

Karen Barrett, Chief Executive of Unbiased.co.uk comments, “While there are mixed messages as to whether house prices are now starting to rise again, it is clear that the property market crash has had a profound effect on the way people view their homes. For many who own their own home, the worry and stress of this through the property market volatility has caused them to re-think about whether long-term renting is a viable option for them.“It has also caused renters to think about their long-term options, and while some still want to get on the property ladder despite the recent crash, many have now decided that the British status symbol of owning your own home no longer has the same importance."

Money is to be made in determining what the next 'status symbol' will be.

-

http://thescotsman.scotsman.com/scotland/128500-39desperate39-Scots-use-credit.5970324.jp

If people are already struggling to the extent that they fear losing their home, increasing credit card debt cannot be the answer.It'll end in tears, sleepless nights and worse.

Imagine, paying 16% (ish) plus 2.5% cash advance fee to repay a 6% (probably) interest debt.

-

Mcglashan

I stand corrected, if you were in Management in the industry your more than qualified to know what your talking about, and more qualified to discuss the subject than myself, which is clear to see in your precise and well structured response

I myself wok in the industry, not quite management level, but do alright cash wise as do most people in this industry

I have been in it for 7 years, when I first moved up here I had visions of settling down in a nice house etc, bearing in mind the starting salary in 2003 was above the average.

The wages Im getting now are well above the average, however even with these high wages I am unwilling to mortgage myself up to the tune of £300k, bearing in mind the repayments I would guess would work out roughly £2000 a month? Who can pay that amount?

£300k I would be wanting a hotel, not just a bog standard house, which in 2001 cost £130k

Thanks for the response, as you can see from my very basic post Im not fully aware of all the intricate detailed points brought up on this site, I just thought your previous post was a bit alarmist, however I can see you were being humorous more than anything

I will continue to work in this industry while the jobs are going, Ill do well money wise, but what good is big wages when even modest properties are priced at an unfair £300k or so? Im not willing to fill another persons pockets with over £1/4 Million+ for a bungalow in Cults / Stonehaven when the same properties were for sale around the £130k mark only 8 years ago or so

£150k (the extra cost on top of the true value of the properties) is the equivalent to 20 years savings!!!

Instead of going to Uni from 1999-2003, I would have been better training as a joiner or whatever, buying a house at a modest £130k in 2000, now id be sitting on a nice £150k profit, with no need to go into the North sea as a fully qualified proffessional

It used to be you got a house through hard work and earning high wages

Now its down to what year you bought your house which defies the size and quality of your house, nothing to do with how successful you have become or how hard you have worked

Ill continue building up the considerable cash sum I have at the moment in the hope that prices may come down in the future, not thinking this year but hope to see drops next year in and around Aberdeen and across UK

Surely If the interest rates went up to say 7% or so, this would ensure the banks would start lending mortgages again at a more realistic level? bringing down the prices in the process?

Hi Rookie,

Thanks for your reply. I can't offer any particular advice. It is frustrating, isn't it? The best advice I can offer anyone is to be diverse and flexible, both in skills and investments.

-

Potential Edinburgh buyers should head for their Boom-proof shelters:

RoS Nov

http://www.ros.gov.uk/pdfs/la_nov09.pdf

Edinburgh up 1.5% MoM. Up an eye-watering 9% YoY.

Volume up 10% YoY.

Still down 7% from July 07 peak. Volume down 60% from that time.

-

Potential Aberdeen buyers should head for their Boom-proof shelters:

RoS Nov

http://www.ros.gov.uk/pdfs/la_nov09.pdf

Aberdeen up 4.5% MoM. Up a scarcely-believable 13% YoY.

Volume up 20% YoY.

Still down (just) 4% from July 07 peak. Volume down 44% from that time.

Ugh.

Aberdeen - That's A Big Drop!

in Scotland

Posted

Gosh!

Down 10% in 28 days.

From this page.

http://www.ros.gov.uk/public/news/latest_house_prices.html#