-

Posts

392 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Minderbinder

-

-

http://www.housepricecrash.co.uk/forum/index.php?showtopic=174369&st=15

See discussion from FreeTrader post onwards.

Wow .. Krugman reads Hpc!

-

the ongoing slump in Britain is now longer and deeper than the slump in the 1930s

-

Of course, if one is waiting patiently in line at a Dexia ATM machine, one is forgiven.

Dexia's midnight runners?

I'll get me coat.

-

It's just been published and it's 400 pages long. I'll get back to you in a month or two.

-

If "Extreme QE" is likely to happen then why have bond prices risen?

"Extreme QE" is being considered because government bond prices have risen.

-

In an innoucuous sounding article, 'Are UK and US turning Japanese?' pesto drops this:

http://www.bbc.co.uk/news/business-14589325

But what if the worst happens? Is there nothing that the UK authorities can do?

Well there is an extreme remedy, which policy-makers have muttered about to me.

I should say at this point - because it is the sort of remedy which will upset lots of people - that I am not saying this will happen.

But you probably need to know what theoretical treatments are left in the armoury if the patient - the British economy - were to go on the critical list.

The Bank of England could engage in an extreme form of quantitative easing.

It could purchase a sizeable amount of British government debt and then announce that the debt was being cancelled, that it never needed to be repaid.

It would therefore be dropping cash into the economy, it would be pure helicopter money, to use the phrase beloved of economists.

-

Yup and then we will have a less inequality and more balance. Having the vast majority struggling with loads of debt, while the government props up the super rich is pretty disgusting imo.

Another well-known left-wing economist, Robert Reich agrees with you:

-

For a mere 12.73 quid Howard Davies, director of the London School of Economics and founding chairman of the Financial Services Authority will tell you the answers:

http://www.amazon.co.uk/Financial-Crisis-Who-blame/dp/074565164X

Apparently there were 38 causes.

Nod to Peston for pointing this out:

http://www.bbc.co.uk/blogs/thereporters/robertpeston/2010/09/cause_39_of_the_banking_crisis.html

-

He's suggesting the BoE's QE program as the best route away from deflation so for; a better approach than US, Japan etc efforts at QE.

It'll be interesting to see if he can reverse Hull's deflationary spiral when the season starts.

-

Interesting post from Krugman who is now strongly advocating protectionism against China:

Here’s how the initial phases of a confrontation would play out – this is actually Fred Bergsten’s scenario, and I think he’s right. First, the United States declares that China is a currency manipulator, and demands that China stop its massive intervention. If China refuses, the United States imposes a countervailing duty on Chinese exports, say 25 percent. The EU quickly follows suit, arguing that if it doesn’t, China’s surplus will be diverted to Europe. I don’t know what Japan does.Suppose that China then digs in its heels, and refuses to budge. From the US-EU point of view, that’s OK! The problem is China’s surplus, not the value of the renminbi per se – and countervailing duties will do much of the job of eliminating that surplus, even if China refuses to move the exchange rate.

And precisely because the United States can get what it wants whatever China does, the odds are that China would soon give in.

Look, I know that many economists have a visceral dislike for this kind of confrontational policy. But you have to bear in mind that the really outlandish actor here is China: never before in history has a nation followed this drastic a mercantilist policy. And for those who counsel patience, arguing that China can eventually be brought around: the acute damage from China’s currency policy is happening now, while the world is still in a liquidity trap.

-

Do we know to what extent Merv and da boys are 'money stock' or 'money flow' proponents? Do they know themselves?

Asset prices (equity and house) have risen so they know it has had a significant effect, but do they understand how and whether it is the stock of the flow argument?

Edit: Title should be QE: A stock or flow concept. Can't edit it.

As of the middle of last year, Stephanie Flanders was of the opinion that the BoE were money stock proponents:

http://www.bbc.co.uk/blogs/thereporters/stephanieflanders/2009/07/does_size_matter.html

If QE is a "topping up" exercise to bring nominal GDP - and the amount of money flowing the economy - back to normal levels, then what matters for the policy is how much you've put in.

If, on the other hand, you think of QE as an ongoing stimulus, you might be less interested in the size of the injection than in how it's being injected - and how long for.

You will find supporters of QE in both camps. But the minutes of last month's MPC meeting, published today, suggest that the Bank's policy-makers had a very clear view:

"The key question for the committee at the current meeting was whether it needed to make an immediate change to the total of planned asset purchases. It was important to recognise that the degree of monetary stimulus associated with the asset purchase programme was determined by the stock of the assets purchased rather than by the flow of purchases. Decisions on the appropriate degree of monetary stimulus would depend on the outlook for nominal demand and inflation."

So, size matters. QE is about how much money you inject into the economy - and how many assets you buy for that money - not how long you spend it for.

-

Good thread. I've been thinking along fairly similar lines lately, but with a slightly less dark and conspiratorial perspective.

I found my way to this via Dr Bubb at the other place:

http://financialsense.com/fsu/editorials/2005/1003.html

The relevent bit is the diagram of 'Greenspan's money machine'.

No doubt this basic mechanism is well known and well documented. But its obvious what's wrong: the west grows its debt as China grows its reserves. Or China gets richer at the west's expense. But otherwise its a virtuous circle. Employment increases in China, living standards improve there; the west benefits from re-investment from China as well as lower priced manufactured goods produced there - so living standards increase on both sides.

The trouble is it looks unsustainable. Surely the west's debt can only grow so far (i.e. slightly beyond its ability to repay) before something breaks? I still think so, but now I'm not so sure.

I wonder if it just doesn't work that way any more. If near-zero interest rates can be maintained for a long, long time then it could go on for a long, long time? If in the west can just continue to pile on the debt because we only have to be able to service it and roll it over, and with ZIRP that's easy.

And the big game in reality is improved living standards on both sides.

No doubt it breaks down eventually, but when? 200 years from now? It just has to keep going until living standards are equivalent all over.

-

There was not much inflation about in 1931 but that did not stop a collapse in the government bond market.

Good point.

-

Well, I'm an STR who got out at the very peak and stuck the lot in bonds and savings but obviously I want to buy again because living in your own place is always more satisfying than living in the landlord's place.

Not so liberating that I would buy while prices are still falling though...

I provisionally reckon around this time next year will be the time to buy again, but of course it will always depend on prevailing market conditions.

So, just for STR's, when do you think it will be time to buy again?

I'm ready to buy in a hurry if the economic landscape changes suddenly, or defer for longer if it looks like heavy house price falls will continue longer than most expect. But I think I'll most likely buy around 18 months from now.

-

ParticleMan (an FX dealer, I think) has suggested on other threads that it is extremely risky to put your savings into another currency, and it is an uneccessary risk. I'll post a link when I can find it.

Here you go ...

*** The only currency you should be holding at present is the currency in which you need to fund your next asset purchase ***And you should be holding it as a risk-free income bearing security (so Gilts, Treasuries, and "I can't believe they're not Treasuries" - investment grade debt where a sovereign issuer bears first loss).

Not cash.

If you can't answer the implicit question "um what do I want to actually buy with this" then anything you do (including nothing) is naked speculation.

The least costly kind of speculation is to sit in the currency of the country where you plan to live (because odds are your future asset purchases will also be in this currency).

Gottit?

Message ends.

-

Bit embarrassed to ask, but as a saver I don't really know what is the most efficient way to transfer X% from Sterling into US Dollars or Euros?

Any step by step guides, fildi101 or anyone?

ParticleMan (an FX dealer, I think) has suggested on other threads that it is extremely risky to put your savings into another currency, and it is an uneccessary risk. I'll post a link when I can find it.

-

I don’t think we can offer the prospect that problems that were created over a very long time period,” will be fixed in “a matter of months,” Lawrence Summers, director of the White House’s National Economic Council, said in an interview today. Still, he said the stimulus will help ensure the unemployment rate doesn’t hit 10 percent.

http://www.bloomberg.com/apps/news?pid=206...&refer=home

So the US government is openly admitting that their massive intervention is only an attempt to keep the unemployment rate in single figures. Yikes.

-

For those who don't know, the Bond Vigilantes were the earlier 1980s Bond traders who had an almost pavlovian response to the threat of inflation. Essentially one wiff of inflation and they'd sell bonds triggering a collapse in bond prices. The effect of which is to drive yields and interest rates up.

But there is no whiff of inflation. They see a deflating economy. So they buy goverment bonds for safety.

How long do you think bond holders are going to sit holding bond that are losing them money?Until we return to an inflationary environment. In a deflationary environment there is nowhere else for them to put there money and get a decent return. Its all too risky. They will stick with government bonds. They will continue to buy a government's bonds unless they decide that particular government is in imminent danger of default.

-

Interesting snippet from acrossthecurve:

Here is an interesting excerpt from a dealer research piece. The dealer must remain nameless but it is a good sized firm.* Banks risk contagion to Government credit *

In fact, this transfer of risk from European banks to their governments we have repeatedly mentioned has also been the main driver of the massive widening in peripheral spreads (and CDS) this week, with 10y bond spreads widening by 40bp in Greece, 35bp in Ireland and 28bp in PGBs. A similar widening has taken place in the CDS market with Ireland 5y CDS opening 40bp wider this morning with Austria, Greece and the UK widened by c.15bp while Italy, Spain, Belgium and Portugal between 10bp and 13bp.

Probably the most interesting aspect, the fact that while some of the lower rated countries’ CDS such as Greece, Italy or Spain are still trading below their previous highs, it is the highly-rated countries such as Germany the ones reaching their all time highs in terms of credit risk protection (see Chart, with yesterday’s closing levels). In fact, assuming a 40% recovery rate, the market is currently pricing in a higher than 5% probability of Germany defaulting on its debt while this probability is currently above 20% for Ireland and Greece and above 10% for Austria, Spain, Portugal and Belgium (5y).

-

However, in desperation, Panasonic has hit on the perfect counter-attack against the consumer slump: it has ordered every member of staff to go out and buy £1,000 of Panasonic products.

Innovation in self-immolation.

-

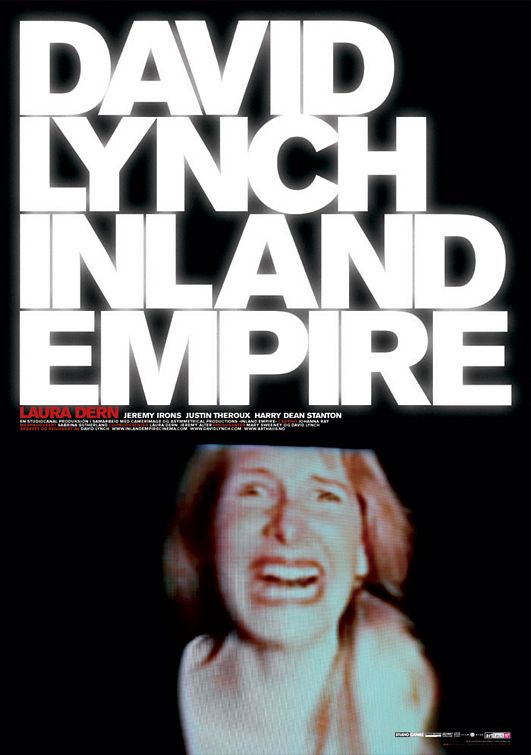

The area is called "Inland Empire" and is in Riverside/San Bernadino counties in SoCal.

-

Way back in the 19th century state spending was a couple of percent of GDP rather than half of GDP.

I don't think people generally equate the Victorian era with anarchic chaos...

But far more people lived in abject poverty, without healthcare, infant mortality was high and life expectancy low.

Randomly googled article: http://www.geocities.com/victorianmedicine/healthtrends.html

In the upper-class areas Liverpool England, 1899, 136 newborns out of 1000 would die before they reached the age of one. Working class districts maintained a rate of 274 infant deaths per 1000 births, and impoverished slums had a horrifying 509 infant deaths per 1000. Even as these rates improve towards the end of the Victorian Age, infant mortality remained at over ten times the current rates in industrialized nations. Alexander Finlaison reported that one half of all children of farmers, laborers, artisans, and servants dies before reaching their fifth birthday, compared to one in eleven children of the land owning gentry....

The average life span in 1840, in the Whitechapel district of London, was 45 years for the upper class and 27 years for tradesman. Laborers and servants lived only 22 years on average.

-

Terry Freeman, 60, a foreign exchange trader, was arrested at his home in Buckhurst Hill, Essex, on Monday by detectives from the City of London Police Economic Crime Department.

Hope that's not ParticleMan.

-

Pesto's reporting that Jamie Dimon at Davos argued against a central clearing system for inter-bank transactions

he warned against placing too much faith in the possible creation of a central clearing system for financial transactions between banks.The proponents of such a system believe that it would restore confidence to inter-bank lending - which has been sadly lacking for most of the past 18 months and has been a massive contributor to the implosion of the global machine for creating credit.

The reason it could restore confidence is that it would involve the establishment of what's known as a central counterparty, which would in effect insure banks against loss if another bank was unable to honour commitments.

...

Except that Dimon posed the question whether it would really be sensible to reduce the requirement for bankers to think long and hard about who they're lending to and why.

http://www.bbc.co.uk/blogs/thereporters/ro...onsibility.html

I don't get it. I thought the point of a central clearing system was that it would have a complete picture of who was exposed to who, and so would be more able to see risks? Individual banks can't see what other exposures their counter-parties have so can't do that, i.e. the can "think long and hard about who they're lending to and why" but can't come up with the right answer.

Am I talking b***ocks? Or is Dimon's argument b***ocks? Or is the article b***ocks?

The Austerity Debacle - Krugman

in House prices and the economy

Posted

Generally, Krugman's objectives (as its his article we're posting about) are: restoring a stable economy with full employment.

Of the many who disagree with his prescriptions I imagine the majority are less concerned than he is about full employment. Also, he reckons near full-employment is part of the Fed's remit and just as important an objective as their others. He's largely critising people (Fed, Obama, Republicans, whoever) for either not doing what's required(*) to restore full employment or for not caring about it.

* Of course, many may argue about whether or not his prescriptions will restore full-employment, but I reckon that's a secondary issue.