BelfastVI

-

Posts

3,430 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by BelfastVI

-

-

22 hours ago, 2buyornot2buy said:

Housing benefit uprating at play here. It was uprated by 10.1% in April and feeds into the figure. Housing ass and HE set the floor on rents and rent increases.

Private rent increase will only ever meet wage inflation longterm. You can't borrow to pay the rent.

I believe NIHE benefit increase was a reaction to increasing rents rather than them getting out in front and driving the increase.

Demand and supply is the major factor. too many people chasing too few properties. I hear from agents that they are getting 100's of enquiries about rental listings. That's what drives rents.

-

The attached article is ROI but interesting that they say a normal function market should have 3% of existing stock on the market.

"The number of second-hand properties listed for sale in the Republic has fallen to a new low, according to Sherry FitzGerald. The company said there were just 13,750 used properties – excluding newly-built homes – available to buy across the State in July, the lowest since it started keeping records in 2009.

The figure represents just 0.7 per cent of the private housing stock here. In a normal functioning market experts say approximately 3 per cent of the existing stock should be in a state of churn."

-

On 11/08/2023 at 15:21, 2buyornot2buy said:

Very interesting times. Who knows what way it's all going to play out.

Speaking as someone who's had to carry out extensive building work recently, I can testify as to the massive material increases but still there's appears to be a massive difference in sq foot costs between regions (50%+). Obviously down to a number of factors, land conditions, spec etc. But also obviously land prices. There's going to be movement somewhere because there's only so much extending terms in a "high" rate environment can do and it isn't much.

I also hate to be pedantic but rents are soaring BVI. They haven't even kept pace with inflation.

I don't know if 'soaring' was teh correct word as it is subjective. The alternative to buying has always been renting and I believe it is fair to say average rents have increased substantially.

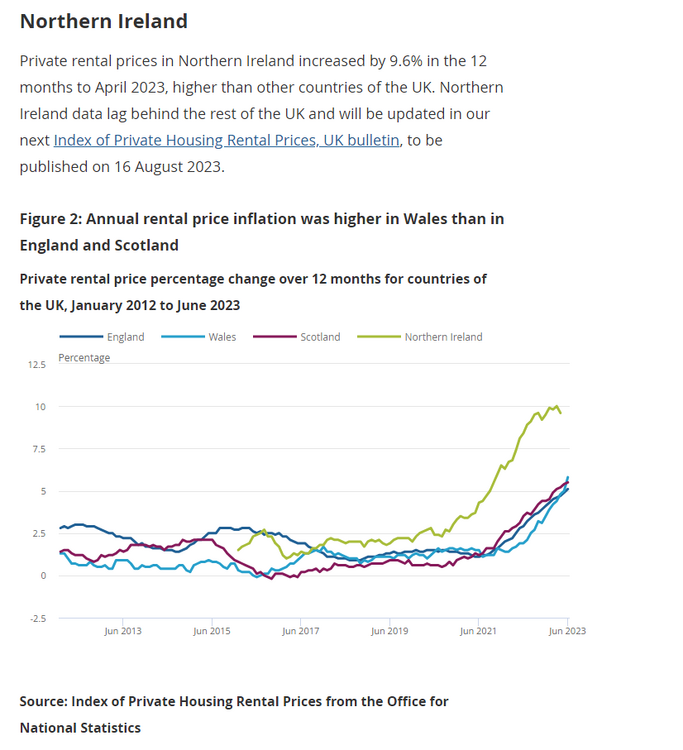

I will leave this here.

-

2 hours ago, 2buyornot2buy said:

If any region knows the power of sentiment it's NI. Think positive will be the general message, plus there's going to be an element of selection bias. Disregard the 5 houses you sold 10k under asking with no competing bidders and focus on the 1 that went 20k over. I keep an eye on my old market, just because some trophy new builds are selling doesn't mean the general market isn't highly depressed. This should be the busiest time for house sales... it doesn't feel like that.

It is interesting times. Due to the higher interest rates (to what people have been used to for that last 10 years or so) many of the First Time Buyers who would have been looking 90%+ mortgages are not there. People either moving house or who have a larger deposit are still buying. But overall volumes are down 30% or more. Normally that would trigger a price fall. However, the cost to build has increased by over 30%. Anyone who has had any work done to their house in the last year or so will agree. Therefore new houses can't be delivered cheaper and there is a massive drop in housing starts. In the background rents are soaring.

We have well and truly entered a housing crisis.

-

On 10/04/2023 at 16:00, satsuma said:

I am seeing the same thing, I wonder what's happening

Lack of housing supply

-

Q4 2022 NIRPPI REPORT

Quarter Change -0.5%

Annual Change +10.2%

Provisional Number of Sales 6,142

-

On 03/02/2023 at 14:21, 2buyornot2buy said:

Also where are you seeing the cost pressures now? I'm going through a big renovation and I've found timber is way way down. Labour is up. Not your area but lime based mortars are way way up too.

Timber was one of the first products to sky rocket at the start and timber has come down again. you may not see it in B7Q but wholesale prices are well down.

Products that went up massively in the last 6-12 months are anything that goes into an oven. Bricks, concrete floor & wall tiles etc have all had 30% to 40% increases (last 18 mths). whilst I am told wholesale gas prices are away down due to their usage of forward buying many of the manufactures claim to be still paying high prices and we are still getting letters advising of further increases.

As noted above construction has slowed massively and hopefully this drop in demand for products will help to bring them down.

-

On 01/02/2023 at 10:24, 2buyornot2buy said:

Not much activity on the NI forum but hey ho.

Was listening to Radio Ulster in the car yesterday morning. Not a Nolan fan but there was an interview with Sam McBride the BelTel editor on out obsession with increased house prices. We'll worth a listen.

He even managed to have a good swipe at estate agents and other VI. Had a go at Templeton Robinson saying they said they can't see houses falling in 2007 and the bottom was here in 2009. Both spectacularly wrong on.

It is no secret the market was cooling from about Aug and then Truss put the tin hat on it. Very little activity between that and the end of the year as buyers took a step back to assess what was happening with mortgage rates and the ongoing cost of living crisis. However, since the return from the break the interest and foot fall has been away up and for us the bookings are now coming through.

Build costs still going up whilst selling prices are static at best. People who increased prices June/July (which we did) have to take that back off again.

I don't know if the increase in bookings will continue for us but the light has certainly been switched back on.

-

Q3 2022 NIRPPI REPORT

Quarter Change +4.1%(Last time we will see that for a while)

Annual Change +10.7%

Provisional Number of Sales 6,402

-

Q2 2022 NIRPPI REPORT

Quarter Change +3.2%

Annual Change +9.6%

Provisional Number of Sales 5,798, down 27% on Q1 2021

-

16 hours ago, JoeDavola said:

I'd assumed that there would be a big increase in the number of houses coming on this Spring seing as the pandemic is 'over', but it doesn't seem to have happened.

I know someone who has sold (for much more than they bought 8 years ago obv), but it's kind of irrelevant as they're seeing nowhere worth moving to. The quality of what is coming on the market is often quite low; i.e. places needing renovation but still asking big money so will be of limited appeal to many buyers.

I do wonder whether low inventory is indicitive of a highly disfunctional market where most people can't afford to move, or don't see it as being worthwhile taking on so much extra debt for just a little extra space, so are just staying put.

Which means most people looking to buy will be FTB, folk who have gotten divorced, and older folk who are forced to downsize?

Who knows maybe inventory numbers will pick up over the summer, but I have a feeling they wont. Of course low numbers coming on does help to keep prices high, even in an environment where the cost of everything including borrowing is going up.

I can't explain the low inventory. its baffled me for a while. I know new build has been unable to provide what it should be due to no zoned land, slow planning and NI Water issues but, at best new build is 20% of the market.

-

On 08/06/2022 at 11:40, PeanutButter said:

Surely, waiting for other places to buy? Can't move if there's nowhere to go.

true

-

On 02/06/2022 at 19:24, Canyon78 said:

Its up to 875 today.

Yes hearing agents saying people finally starting to put their houses on the market. don't know what they were waiting for.

-

Q1 2022 NIRPPI REPORT

Quarter Change +3.4%

Annual Change +10.4%

Provisional Number of Sales 5,436, down 28% on Q1 2021

-

Q4 2021 NIRPPI REPORT

Quarter Change +0.1%

Annual Change +7.9%

Provisional Number of Sales 6,150 for quarter 29,769 for year (highest since 2006)

-

On 25/01/2022 at 18:45, Noah said:

I've already bought a new house, that could be good or bad. I think I got a reasonable deal, but there haven't been too many bargains recently. If prices continue to go up I'll get a good price for my old house, but if the market turns down I'll have bought high and sold low which is exactly what you're not supposed to do! Spoke to the estate agent recently and she told me not to delay, kinda wondering does she know something I don't. Maybe the word is with the US stock market teetering on the edge of a fall it won't be too long before the knock on effect is first a US housing down turn then a UK one, or maybe I'm reading too much into the EA's comments!

I expect he is just crying out for stock. My advice is never to listen to either car sales men or estate agents.

-

NI House prices have gained aprox £61k in the past 7 years since the bottom in 2013. However, current average prices are still aprox £65k below what they were at the height of the boom in 2007. Therefore, even if house prices were to continue on this path, which almost certain not to happen, it would not be until 2028 until we reached the peek prices again, some 21 years later.

For the record I don't believe that will happen unless general inflation (including wages) takes over.

-

-

We have next to no area plans and most zoned land is exhausted. there has been constraint on supply for years. of course it will have an impact.

-

-

16 hours ago, coypondboy said:

reminds me of the last boom people have not learnt just talk to any ftb who bought in 2006/7 and still in serous negative equity. My brother in law lives in cookstown and his 2 bed flat he bought for 30k in 2002 went up to 130k at the peak (his neighbour bought idential flat) around that time.

Today his neighbour had the flat repossessed in 2012 and sold at auction for 30k now worth 130k again. He buggered off to Australia with no forwarding address and I think it was his cousin who bought it at auction for that price.

History repeating itself?

The 2007 crash was fueled by a credit boom with the banks pushing out debt with few questions asked with valuers egar to rubber stamp this. The price of property had little connection to the cost of construction.

The banks are certainly not doing that now and NI houseprices (thankfully) are no where near 2007 prices.

Prices today would have to grow by over 50% to reach 2007 levels.

What we have is a massive shortage of supply coupled with a boom in demand caused mainly by a change in lifestyle choices as a result of lockdown (my opinion). Low interest rates (10y fixed repayment at sub 4%) means the cost of ownership is much less than the cost of renting in many cases and this fuels decisions.

We are also seeing a massive increase in cost of construction. I am hoping some of this will ease but it will never return to where it was with the cost to construct increasing by around 10%.

-

On 22/07/2021 at 00:35, getdoon_weebobby said:

If I paid to resubmit the developers house plans and I added a garage to the application. Let’s say those plans were approved BUT I ran out of time to get my own design planned and approved. Would the foundations of a garage be enough to secure planning ? That way I would have time to try and secure planning for our design but without committing to the foundations of the builders design.

Yes, if the garage is part of the approved planning permission. Provided you first comply with any pre-commencement conditions such as forming sightlines, submitting and obtaining approval of land scaping etc. Any clause that states "before commencement of.." needs to be sorted before you excavate the foundations.

You can then apply for a Commencement of Legal Development Certificate (may be slightly different wording, where Planning Service, for a fee will confirm that the Planning Approval has been legally commenced.

-

On 04/07/2021 at 00:05, gruffydd said:

The current rise was caused by politicians... politics, for goodness sake.

The only impact local politicians have had on house prices in NI is their continuous practice limiting supply via no area plans and the slowest planning system in these islands. At a national level the only decision to have any impact in the Covit era was the STAMP holiday which had little impact here as it was free up to £125k in any event.

-

On 04/07/2021 at 00:04, gruffydd said:

Government intervention simply changed the trajectory... now they're out of powder it'll be interesting to see what happens next.

"At another level, there is a deeper, more philosophical debate waging. It centres on the core inconsistency embedded in what we might call the “promise of property”. The inconsistency is the promise that property will make you wealthy once you own it and sell it on, allied with the promise that the first-time buyer can buy an affordable house. You can only have both of these aspirations for a number of generations because eventually, the society runs out of buyers. We are here now. If we promise homeowners the option to sell on eventually, cashing in at much higher prices than they originally bought the property for, then we need to create a buying class with limitless income. Societies that get lucky economically can probably get away with this, in a fast-growing economy, for at most two generations, then we run out of buyers rich enough to play the game."

The Ponzi scheme is about to unwind. http://www.davidmcwilliams.ie/we-are-at-the-end-of-a-slow-moving-housing-ponzi-scheme/I am a big fan of McWilliams but he is talking about house prices in Dublin which are on a different planet They have the surrounding areas busy de-zoning land. what could possibly go wrong.

Dublin has a major housing crisis. Rents are falling with people being able to work from home but to rent a bedroom in a house was €2,400 per month and multi-national funds, who had been given major tax breaks, are buying up all the newbuild in the city.

The average price in Dublin is €380,000 (£325,000), Belfast is £142,000 (43% of Dublin Prices).

Is a price crash/ major correction coming

in Northern Ireland

Posted

It's difficult to draw a conclusion. Generally low availability points to higher prices whilst a glut of properties for sale generally lowers prices.

My gut feeling - Prices have to increase.

Firstly: The cost to build has spiralled and new building control regulations will drive that further. Anyone who has carried out any work to their house over the last year or so will know.

Secondly: Rents (the alternative to buying) for decent houses have sky rocketed.

Thirdly: Mortgage rates have been coming down.

And finally, don't underestimate the 'feel good' sentiment generated by our government getting back together 'again'. Not that they make much difference when in role but there is a lot of inward investment waiting on this settlement.