-

Posts

16,129 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by Mikhail Liebenstein

-

Ground rent to be capped at £250

Mikhail Liebenstein replied to fellow's topic in House prices and the economy

Doesn't seem unreasonable though, given the tightening thumbscrews of ground rents. Ground rents compounding annually is another financial scam; wipe out the pension funds and insurers who were complicit in the financialisation process. -

GPs to lose the power to hand out sick notes

Mikhail Liebenstein replied to fellow's topic in House prices and the economy

Sunak wants to abolish benefits for those out of work for 12 months or more: https://www.dailymail.co.uk/news/article-13330045/Benefits-axed-year-stop-lifestyle-choice-Prime-Minister.html -

Yes, Government has messed up big style here. I think they were lulled into buying cloud by arguments such as "leave it to the experts" "you don't need to build a new datacentre" "it's hard to recruit technical staff" You then also had incompetent managers using phrases like "cloud first" to justify not having to deal directly with staff managing infrastructure or indeed Software as is shown by the uptake of SaaS. Now the Government is locked in, doesn't have the datacentre capability, can't repatriate the data, and has crappy silos of SaaS that can't talk to each other.

-

Energy new record - economy healing 🌱

Mikhail Liebenstein replied to Stewy's topic in House prices and the economy

Governments should start raiding Crypto mining operations and shutting them down. Total waste of energy. -

Yes, just been reading that in El Reg: https://www.theregister.com/2024/04/04/uk_cddo_admits_cloud_spending_lock_issues_exclusive/?td=rt-3a I've zero confidence in AWS or Azure. Just read this report into the MSFT summer 2023 Exchange hack, total incompetence: https://www.cisa.gov/sites/default/files/2024-04/CSRB_Review_of_the_Summer_2023_MEO_Intrusion_Final_508c.pdf

-

The middle class is dying in the UK

Mikhail Liebenstein replied to debtlessmanc's topic in House prices and the economy

Professors should be paid more in my opinion. Certainly more than MPs - and allowed to do side gigs. I was often asked why I didn't go into academia, the answer is pretty obvious. That Professor's average salary is less than my US Tech Vendor Salary from the year 2000. Professors are definitely underpaid. -

The middle class is dying in the UK

Mikhail Liebenstein replied to debtlessmanc's topic in House prices and the economy

100% agree, I definitely grew up working class, though did well at school and got into a top University, and consequently got well paying jobs. I was thus then able to squirrel away plenty of cash to invest early on, and have now got to the point where my annual portfolio growth is close to my salary. If you're not born into it, you need to save and invest, and start early. -

Technically we need three beds, but we have 3500 Square feet.

-

We are very similar to the above, though we have always had higher incomes than the example. We paid £750k for our house 14 years ago, the mortgage is now pretty small and of course the equity is up. Probably £1.2m of equity, if being conservative.

-

The CEO of BlackRock doesn’t want to die

Mikhail Liebenstein replied to NoHPCinTheUK's topic in House prices and the economy

There has been a long running theme in healthcare of trying to save every life however hopeless the chances, or however costly. The current explosion in cancer in the under 40s is partly being blamed on the NHS saving people with inherited conditions/susceptibilities. Personally, I'd prefer them to focus on population health by a bit of natural selection. Stop wasting Billions on rare genetic disorders that affect a handful of people. -

How much would you borrow?

Mikhail Liebenstein replied to Pmax2020's topic in House prices and the economy

My mortgage is pretty old now, 15 years into a 25 year repayment. At the time, we borrowed £525k on low interest rates, which then became super low. At the time the mortgage was less than 3x income. I was on about £130k and the wife was on £70k. The mortgage is down to about £260k now, which is less than a year's pre-tax combined income. I'm sure we could have paid it off by now, except that we have school fees still and to be honest, I've mainly focused on stuffing my pension. Right now our monthly repayment is about £2600 and our renewal went from 1.8% to 4.6%, but that only increased the repayment by £400. This is because given there are just 10 years to run, the actual interest each month will fall quite quickly, so the proportion of repayment rises. In 5 years, the outstanding will be down to something like £160,000 unless I repay early. ------ I think sticking to 3x is a good safe rule of thumb. At the time we could have borrowed big, but then the outstanding mortgage would still be huge. -

Boomers have their hand out again!!!

Mikhail Liebenstein replied to hughjass's topic in House prices and the economy

Brilliant post. I agree 100%. The boomers are dragging everything down and playing the i pAiD mY sTaMp card, which is utter bowlocks. The triple lock needs to go, and really the state pension should be cut by 1/3. -

Boomers have their hand out again!!!

Mikhail Liebenstein replied to hughjass's topic in House prices and the economy

That is irrelevant versus tax rate changes. Who earns £10k ffs. -

Boomers have their hand out again!!!

Mikhail Liebenstein replied to hughjass's topic in House prices and the economy

Can't they just die. Seriously, Covid was nature's way of dealing with net takers from the system. -

Is there a 2008-2010 Vibe in the air?

Mikhail Liebenstein replied to Pmax2020's topic in House prices and the economy

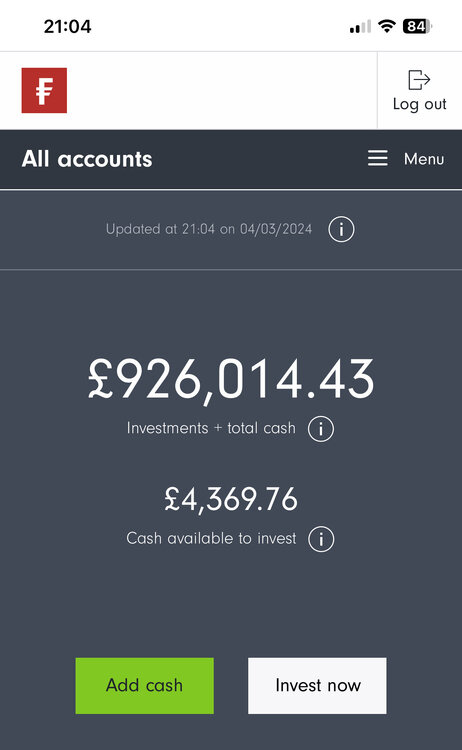

-

Is there a 2008-2010 Vibe in the air?

Mikhail Liebenstein replied to Pmax2020's topic in House prices and the economy

I had STRed by then (mid 2008). The house I eventually bought late 2009, had been on for £900k 18 months earlier, but with cash in the bank, I was able to beat the developer who had taken it in part exchange down to £750k. housepricecrash.co.uk saved me £150k on the day, and probably double that on mortgage payments. That said, it pales into insignificance in comparison with my Covid led investing gains. If you read the thread, I was debating this in Feb 2020. I was persuaded to buy back into the market on the 18th March 2020 by a colleague across the pond who was bullish. My pension fund shot up £250k in a few months, somehow buying back at the absolute market bottom. The only downside is, I miss accessing the fund at age 55 by about 3 months. Though frankly that probably isn't wise as I am still 100% fit at 50 with relatives who touched 100.