Patient London FTB

-

Posts

1,194 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by Patient London FTB

-

-

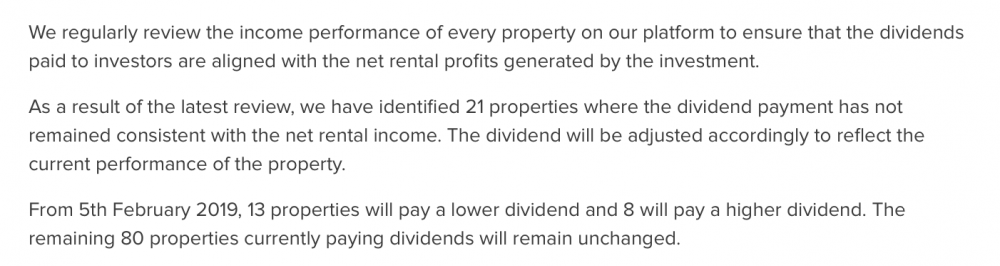

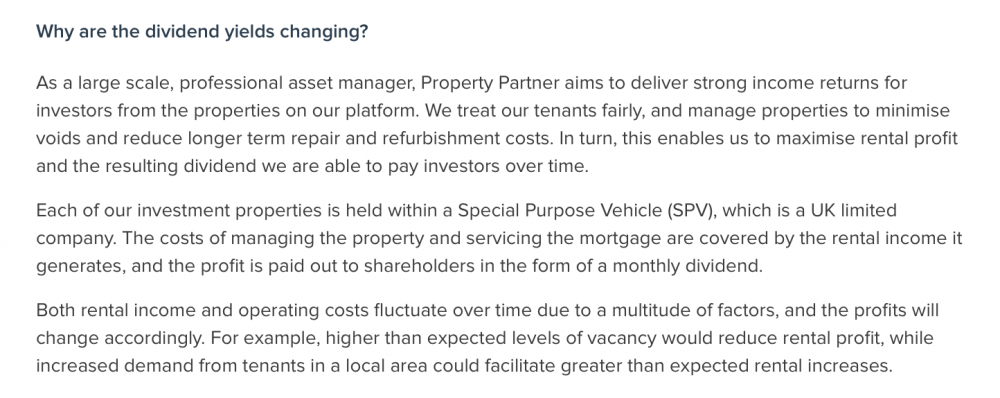

2 minutes ago, Ah-so said:

"The overall impact across the portfolio is that the weighted average dividend yield has decreased from 4.09% to 4.01%."

No big deal if you have a stake in the entire portfolio, but it doesn't work like that. Investors buy stakes in the individual properties, so there will be a few unlucky ones who picked some of the dogs.

-

-

-

On 17/01/2019 at 09:46, Freki said:

View from a London-watcher is that 5-15% drops in rents would be the most you could realistically hope for over the next two years, but the important thing is not how that changes your rent/buy calculations but how it changes the hold/sell calculations made by the landlords and their lenders.

The landlord mindset is going to completely change as it becomes clearer that the immediate future means choosing between between eating voids and dropping rents, while their tax payments rise and their capital values fall.

Sit tight for a couple of years, wait til you see the whites of their eyes.

-

30 minutes ago, warrior88 said:

64.6

Any predictions on how low it can go?

57?

-

Still here, hope you keep posting DB

-

1 hour ago, ebull said:

London 70-90 days on market. LOL.

Don't believe that.

They only count the houses that actually sell!

-

1 hour ago, the_duke_of_hazzard said:

Stock rising also. Up over 50% in a year in my part of SE London.

Ditto in SE1. Stock of unsold one bed flats up 66% in a year.

-

4 minutes ago, The Crow said:

Where do we get time on market stats get published? Is it RICS report?

Houses in my neck of the woods have suddenly stopped going SSTC. I'm looking at 3 bed semi so flats and top of the market may still be shifting.

Anyone else seeing this?

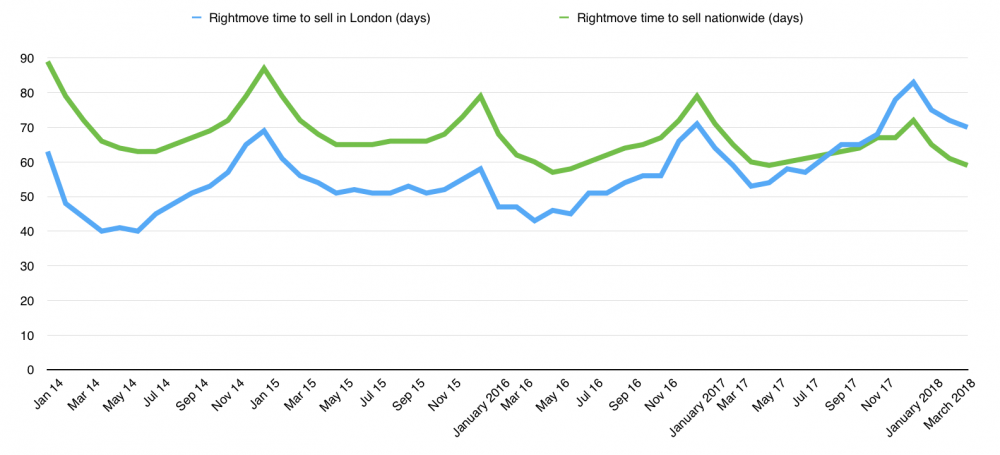

It's Rightmove, they do it for London and for Britain. London's been slowing for ages but the rest of the country has been speeding up.

Areas near London could be slowing too due to the ripple, but you can't prove that with Rightmove data. RICS is worth a look in that it will show whether sales volume expecting to rise or fall in different regions though.

-

-

17 hours ago, AdamoMucci said:

I am not going to hunt for the original source data, but what is mentioned in the article is not compelling and is intentionally or otherwise presented in a way to create a certain narrative. I would not read anything into that useless article. The only thing mildly interesting and meaningful may be the number of properties under management per branch. But that could just be due to an increase in the number of branches.

As for the rest of it, need the source data. ARLA propagandist in chief, Mr Cox, does not understand stats, or does not want you to understand them.

True that ARLA's adventures in stats are an absolute joke

-

38 minutes ago, mrtickle said:

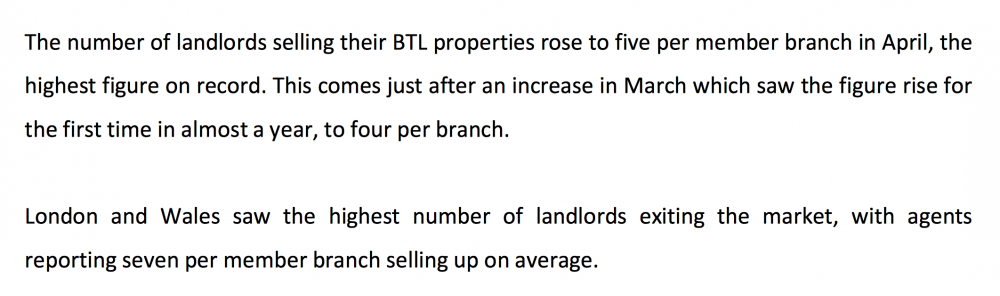

Thanks to the team of Axe the Tenant Tax for signposting this for us.

https://www.mortgageintroducer.com/record-number-landlords-selling-buy-let-properties/

Bonus excerpt from the ARLA report:

London and Wales - boom!

-

-

On 26/05/2018 at 09:00, durhamborn said:

Im very tempted to start shorting some of the housebuilders now as i think UK housing has already entered a bear market.Higher priced sales on new build estates are sticking and seeing price falls.Looking back at my old charts this sort of action marked tops in house builders in the past.The only fly in the ointment is HTB now.

Looks like Berkeley is about to roll over

-

15 minutes ago, jiltedjen said:

whats the news to drive that fall? strengthening pound at a guess?

my guess is this http://www.propertyindustryeye.com/eye-newsflash-tepilo-and-emoov-in-100m-merger-with-third-online-agent/

-

14 minutes ago, Beary McBearface said:

If you like maturity transformation, you're going to love Hodge Lifetime.

Source: Hodge Lifetime announces retirement interest-only loan with no end date, Mortgage Solutions 30 May 2018

Relatively small lender (2017 financial statements showed about £1bn worth of loans). If there is no change in their funding arrangements then they'll be funding their 'until death, or residential care, do us part' open-ended lending with customer deposits, 75% of which are repayable within 12 months (link).

Borrow short, lend wrong

-

40 minutes ago, Beary McBearface said:

For my money the value of pieces like is how they inform sentiment. Daft to imagine anyone can anticipate where prices will be in three years, just nice to see DOWN slipping in through the Overton window.

Just posted this in the Sentiment thread

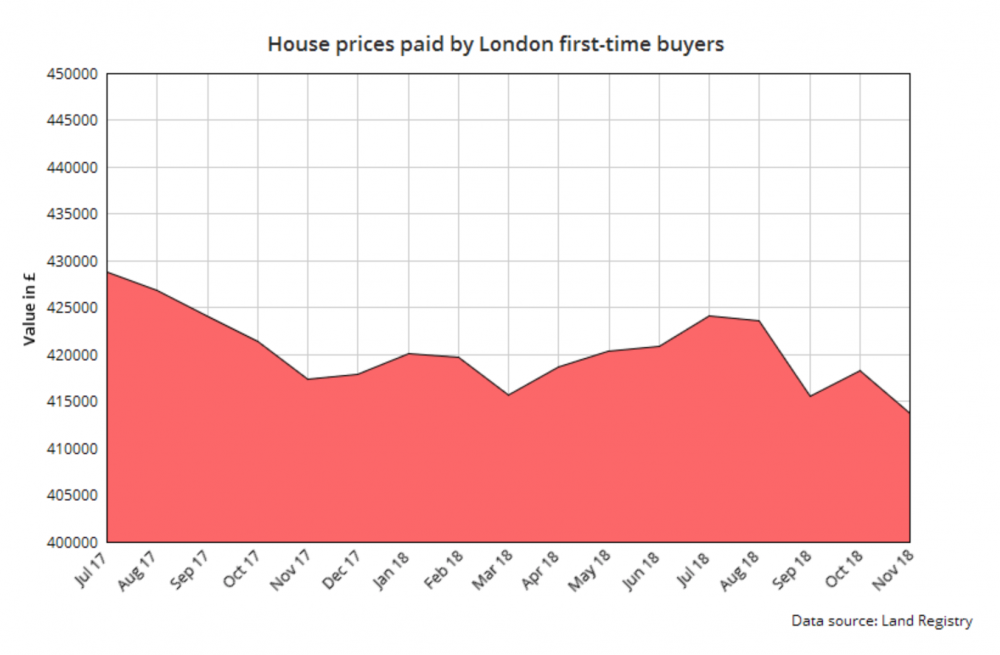

What’s telling for me in London is the data shows the Autumn Budget stamp duty cut for FTBs has made absolutely zero difference to prices and transactions. It’s as if it never happened.

-

2 hours ago, Jack Kada said:

I m suprised no one has mentioned the word SENTIMENT.

What’s telling for me in London is the data shows the Autumn Budget stamp duty cut for FTBs has made absolutely zero difference to prices and transactions. It’s as if it never happened.

-

8 minutes ago, Beary McBearface said:

Witless twigged. Available now at all good bookshops

Coming soon: Fergus Sucked

-

3 minutes ago, Beary McBearface said:

Looks to me as if Atlas needs to do some shrugging.

As our boy Atlas is none too bright he’s got his head full with the twigging process at the moment

-

8 minutes ago, deadlyavenger said:

Apologies if already posted, thought this was much lolz, yet "more" pressure on Landlords (probably a bit late mind).

"London boroughs sign up to 'name and shame' renting database"

Talking of lolz, has everyone seen how the Telegraph has illustrated the concept of pressure on those noble, selfless beings who we call landlords?

-

And another 'no bids' on lot 90, with the previous nine lots all unsold. Carnage.

-

2 minutes ago, Sancho Panza said:

Lot 16,flat in Greenwixch,guide £655k err no bids.

Never seen 'no bids' before!

-

56 minutes ago, fru-gal said:

Where did you get that figure from?

53 minutes ago, Houdini said:It's the top line of the 118 post

For a less garbled report than on 118 see https://www.landlordtoday.co.uk/breaking-news/2018/5/rental-supply-set-to-fall-as-landlords-look-to-quit-sector

Letting fees ban is good news for tenants – but beware a backlash

in House prices and the economy

Posted

Can’t see this underpinning rents, but what has been doing so is the slowdown in sales of newbuilds to landlords. Unless they’re bought by owner occupiers then they stay empty and don’t hit the rental market. But recent signs are that big overseas investors are buying flats in bulk off anxious London developers, so expect rents to fall again this year.