bluegnu

Members-

Posts

123 -

Joined

-

Last visited

About bluegnu

-

Rank

Newbie

Recent Profile Visitors

964 profile views

-

Yields Crumbling as rate cuts priced in

bluegnu replied to Stewy's topic in House prices and the economy

Wolf Richter has an interesting take on the recent drop in yields, "And by October 31, the net short-positions in Treasury futures had reached the highest level ever" https://wolfstreet.com/2023/11/06/highest-ever-treasury-short-positioning-by-hedge-funds-into-last-week-was-accident-waiting-to-happen-massive-short-covering-ensued-pushed-down-yields-the-basis-trade-is-at-it/ -

The 5yr gilt seems to have stabilized at around 4.4% over the past 3 weeks or so and volatility has reduced so I reckon the banks can start pricing 5yr fixes at the usual gilt yield + 0.5% to 1% higher. If Halifax was pricing at 6.1% then they were way above the cheapest deals out these, watching the comparison sites 5yr fixes have been around 5.2% - 5.5% for a while now.

-

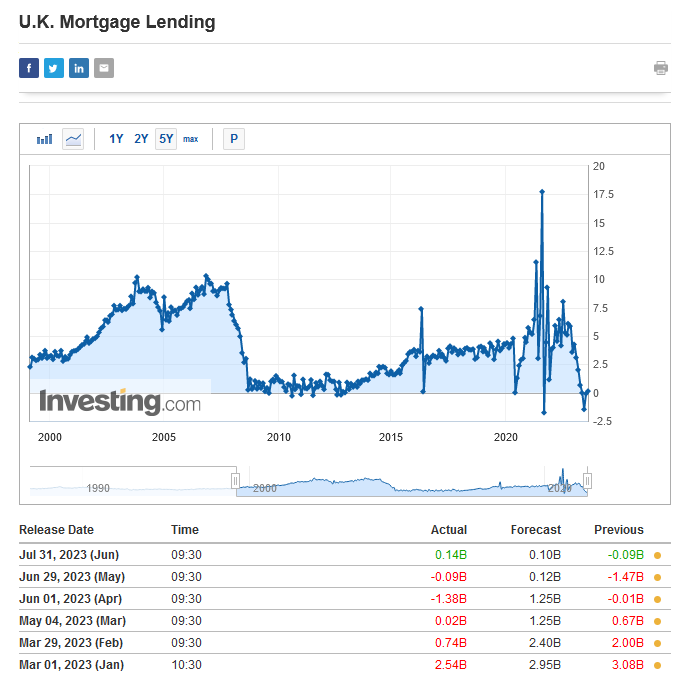

There's some interesting points about the approval data on the BOE website (my highlighting)... https://www.bankofengland.co.uk/statistics/details/further-details-about-total-lending-to-individuals-data So in theory two existing homeowners could sell each other their houses both covered by existing mortgages but this would trigger 2 'House purchase approvals' even though nothing has really changed. Also, remortgaging is only recorded when a borrower moves to another bank; with the rapid rise and volatility in mortgage rates in recent months it reasonable to assume folks would be shopping around for the cheapest deals when they need to remortgage and so increase the number of recorded remortgages. Here's the approvals data with some history for context... https://uk.investing.com/economic-calendar/mortgage-approvals-211 Net mortgage lending is still incredibly low, only just above 0. Perhaps this could go some way in supporting the idea of existing homeowners just swapping houses alongside low numbers of ftb's entering the market. https://uk.investing.com/economic-calendar/mortgage-lending-664

-

Mortgage approvals fall again

bluegnu replied to henry the king's topic in House prices and the economy

Net lending went negative too and as we can see - this is historic! ... Just under £1.4B was paid off mortgages than taken out. Even in the depths of the 2008 crash it only just touched negative by a few tenths of a billion(the lowest was -0.28B). Also, with last months figure revised down to -0.01B we now have had 2 consecutive negative months (granted - only just!), this hasn't happened in the above data (starts late 1986). -

There's a bit more detail in todays press release... https://www.bankofengland.co.uk/statistics/money-and-credit/2023/march-2023 You can also have a poke around in the BoE data base though personally I can find it tricky to find exactly what I'm looking for, there's a LOT of data in there and I don't understand all of the terminology... https://www.bankofengland.co.uk/boeapps/database/default.asp Here's the Topic list for Money and Lending, there are a few entries for Secured Lending on Dwellings etc... https://www.bankofengland.co.uk/boeapps/database/index.asp?first=yes&SectionRequired=A&HideNums=-1&ExtraInfo=false&Travel=NIxSTx

-

Thursday's BoE meeting - what's your prediction?

bluegnu replied to Orb's topic in House prices and the economy

I'm not getting too excited yet, bond yields are kerplunging. The 5 and 10yr are both down two tenths today. -

LR Data Nov '22 -0.3% MoM +10.3% YoY

bluegnu replied to Data Dave's topic in House prices and the economy

Here's the RICS survey data going back to 1978. Just casting my eye over it it looks like we're getting the steepest fall since it began... -

BOE cracks down on BTL !!!!!!!!!!!!!!!!!!!!!!!!!!!!!

bluegnu replied to Maghull Mike's topic in House prices and the economy

I think most 'amateur' (yeah, I know) BTL mortgages are secured against the landlords own residence. Which raises an interesting scenario. Could we see a situation where the rental properties are falling in value possibly triggering a margin call on the debt, and the collateral for the mortgages, the landlords own house, is also falling in value? A double margin call...? Oh my! -

-2.1% Rightmove asking price index November / December

bluegnu replied to mynamehere's topic in House prices and the economy

I remember the Rightmove index being described as the Delusion index. It seems that reality is ever so slowly beginning to seep into the market. -

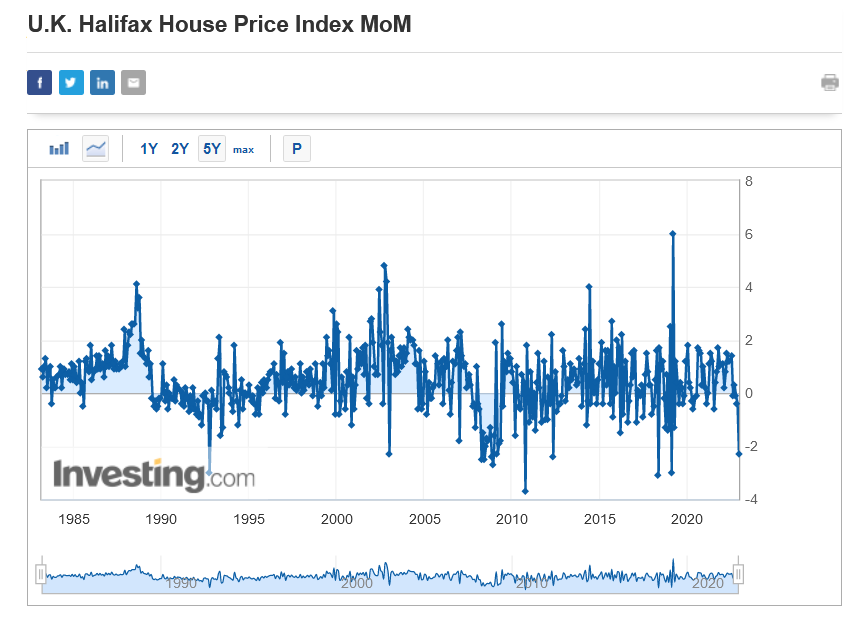

Yeah, I remember a -3.1% pre pandemic though I think Halifax revised their methodology at some point, it used to be one of the most volatile indexes. That chart may show historic data under the new method. Here's what I think is the raw published data...